42% of Americans Were Denied a Financial Product — Like a Credit Card or Personal Loan — in the Past Year Because of Their Credit Score

Whether you believe your credit score reflects your financial responsibility, it plays an undeniable role in your financial health, and lenders do look at it closely. In fact, many Americans — particularly those with poor scores — say their credit score has prevented them from obtaining a financial product in the past year.

In this survey, LendingTree asked more than 1,000 U.S. consumers about their credit scores and experiences applying for financial products. Keep reading to learn how many consumers think their scores accurately reflect their financial responsibility, which habits have most impacted their credit scores and what our expert says are the three fundamentals for improving your credit score.

Key findings

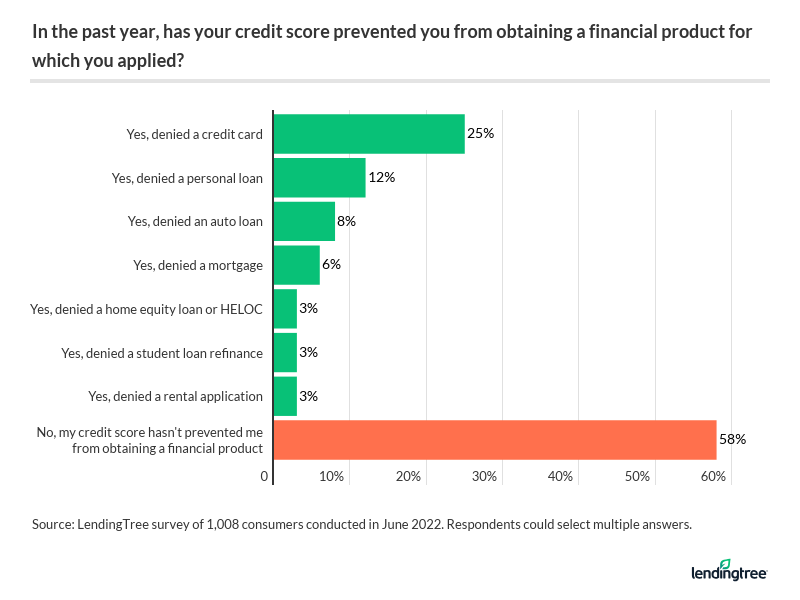

- 42% of Americans say their credit scores prevented them from obtaining a financial product in the past year, rising to 74% among those with poor credit. Credit cards (25%) and personal loans (12%) are the top products consumers say they were denied due to their credit.

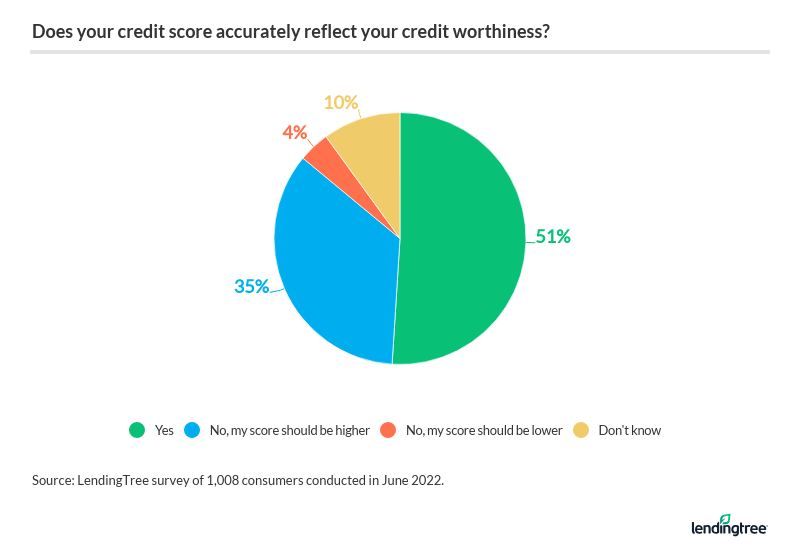

- 40% of Americans don’t think their credit scores accurately reflect their financial responsibility. This is especially true for those with poor credit (60%), millennials (47%) and women (44%).

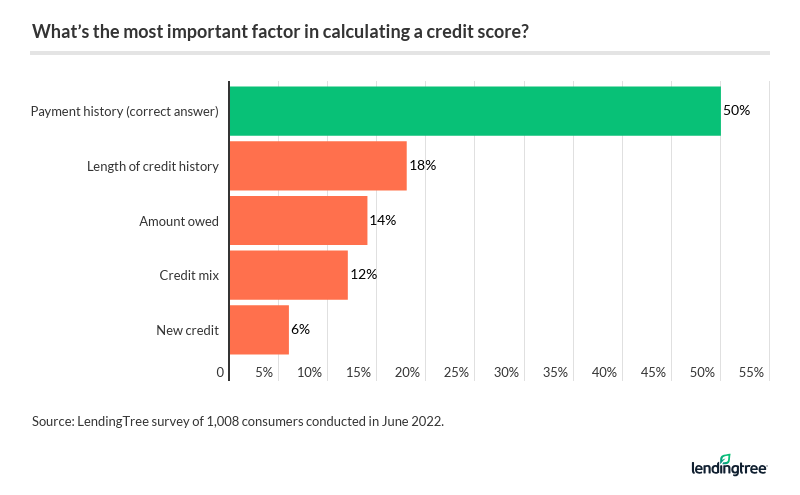

- Payment history is the most important factor in calculating a credit score, but 50% of Americans don’t know that. Gen Zers (61%) and millennials (60%) are the most likely to incorrectly answer this question. However, only 39% of Gen Zers say payment history should be the most important factor, the lowest among the generations.

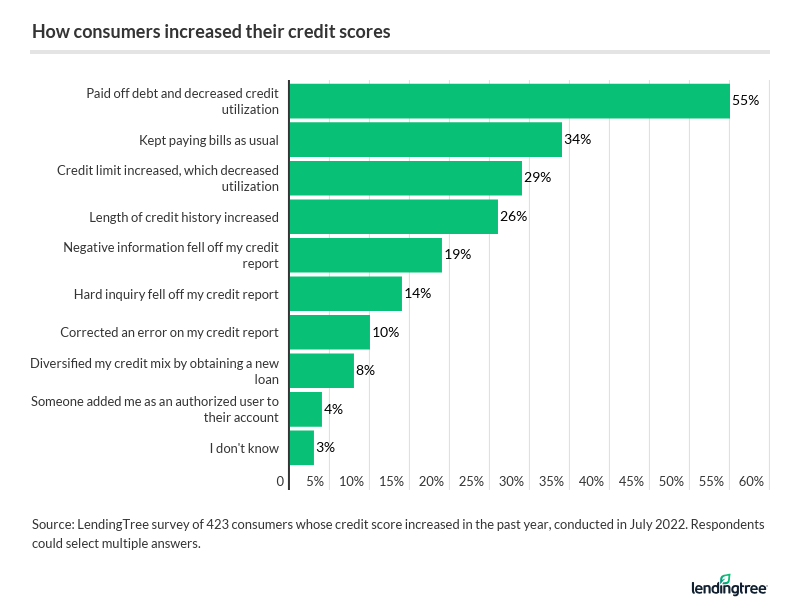

- Paying off debt is the No. 1 way consumers increased their credit score in the past year, while late payments were the primary reason some Americans saw their scores drop. Overall, 42% increased their credit score over the past year, while 14% say their score dropped.

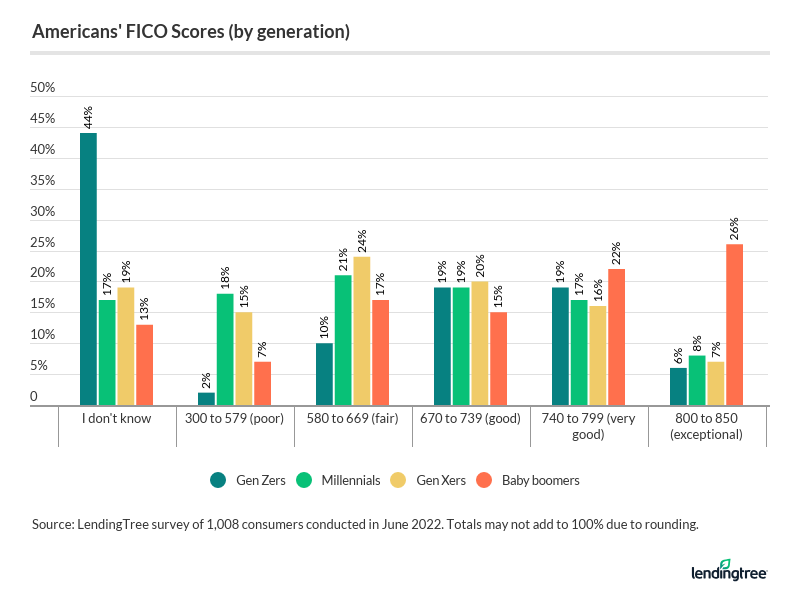

- 44% of Gen Zers don’t know their credit scores, while 25% say they don’t know how to find out. Overall, 19% of Americans say they don’t know their credit scores — and 12% don’t know how to check it.

FICO and VantageScore credit scores are calculated based on the information in consumer credit reports. While both rate credit scores on a scale of 300 to 850, FICO Scores are rated differently from VantageScores (ranges in this survey are based on FICO Scores).Here’s a breakdown:

- Poor: 300 to 579

- Fair: 580 to 669

- Good: 670 to 739

- Very good: 740 to 799

- Exceptional: 800 to 850

Americans denied credit cards, loans and more due to their credit scores

Overall, 42% of Americans say their credit scores prevented them from obtaining a financial product in the past year. Those with poor credit scores were especially likely to have trouble — in fact, three-quarters (74%) of those with credit scores between 300 to 579 were denied a financial product.

Younger Americans also struggled more than their older counterparts with obtaining financial products because of their credit score. But although this is true for Gen Zers (ages 18 to 25) (48%), millennials (ages 26 to 41) were the most likely generation to say their credit score prevented them from obtaining financial products (57%.) In comparison, just 21% of baby boomers (ages 57 to 76) say similarly.

But what financial products were considered, and which ones were Americans denied most often? While anything ranging from rental applications to mortgages were considered, consumers were most likely to be denied credit cards and personal loans. Take a look at this graphic for further insight:

While a quarter (25%) of Americans overall were denied credit cards, this also happened to 53% of those with poor credit scores between 300 and 579, as well as 36% of millennials. Similarly, 12% of Americans were denied personal loans, which rose to 36% for those with poor credit scores.

Major credit bureau Equifax has come under fire for sending inaccurate credit scores to lenders for millions of customers applying for home loans, auto loans and credit cards over three weeks earlier in 2022. The error, which reportedly occurred due to a coding issue, changed scores by as much as 20 points in either direction — enough for some prospective borrowers to be rejected for a loan, and altering interest rates for others. This issue was elevated by the Wall Street Journal after first being reported by National Mortgage Professional, a trade publication.

Do credit scores reflect financial responsibility?

Regardless of whether they’ve been denied a financial product and whether their credit score ultimately played a role, many Americans believe their credit scores don’t reflect their financial responsibility. Overall, 4 in 10 (40%) Americans don’t think their credit scores are a good gauge. Those with poor credit scores between 300 and 579 are most likely to believe their credit scores don’t reflect their responsibility at 60%.

Millennials (47%) and women (44%) are also more likely to believe their credit scores aren’t a good indicator of their responsibility. In addition, 20% of millennials believe their scores should be much higher than they are now, making them the most likely age group to feel that their scores drastically undervalued their financial responsibility.

Notably, 9% of Gen Zers believe their credit scores should be lower, making them the most likely group to think their scores overestimate their financial responsibility.

Meanwhile, consumers with better credit scores don’t tend to have an issue with the credit-scoring system. Among those with exceptional credit scores ranging from 800 to 850, 88% believe their credit scores accurately reflect their financial responsibility. For those with very good scores ranging from 740 to 799, that percentage sits at 69%. Baby boomers and six-figure earners also agree at 63% and 60%, respectively.

Consumers undervalue the importance of payment history

FICO Scores are calculated based on the information in consumer credit reports, but different factors carry more weight than others. Here’s a breakdown of which factors play a role and how much it influences your credit score:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit (10%)

Although payment history is the most important factor in calculating a FICO Score, 50% of Americans don’t know that. Younger consumers are most likely to undervalue the importance of payment history, with 61% of Gen Zers and 60% of millennials incorrectly identifying a different factor as more important. Both are also more likely than any other age group to think that their length of credit history is the most important factor, at 22% for millennials and 18% for Gen Zers.

Gen Zers are the least to believe payment history should be the most important factor at 39%. Despite being the youngest age group, they’re also the most likely to think the length of their credit history should be the most important factor.

Meanwhile, 57% of consumers with fair credit scores between 580 and 669 don’t know that payment history is the most important factor, with 22% of this group incorrectly believing that length of credit history is more important. Meanwhile, those with poor credit scores between 300 and 579 are the most likely to believe that their credit mix should be the most important factor, at 22%.

56% say their credit scores have changed in the past year — here’s how

Americans’ discontent with the credit-scoring system and lack of knowledge of how credit scores are calculated comes as more than half (56%) of consumers say their credit scores have changed in the past year.

Of those who’ve experienced a change in their credit scores, 42% say their credit scores have increased — in particular, consumers who now have good credit scores between 670 and 739 were the most likely to increase their scores (65%). Following that, half (50%) of those with very good credit scores between 740 and 799 also bolstered their credit scores.

When it comes to how Americans increased their credit scores, paying off debt was the most popular method (55%) — particularly for baby boomers (63%), those with good credit scores (63%) and those with very good credit scores (60%). Take a look at the next most popular methods:

Those with poor credit scores between 300 and 579 were the most likely to increase their credit scores after negative information, such as late payments or collections, fell off their reports (37%.) Those with very good credit scores were also more likely than average to bump their score by increasing their credit limit (39% versus 29%).

Generally, most consumers believe making payments is the most important factor in increasing credit scores. Overall, 54% believe paying all bills on time is the best way to bolster credit scores, while 31% believe paying credit card balances in full every month works best.

This comes as those who’ve experienced a credit-score drop say that late payments were the primary reason. Of the 14% who’ve experienced a decrease in their credit score over the past year, 39% say it was because they made a late payment. An additional 32% say they made a large purchase, which raised their credit utilization ratio. Meanwhile:

- 27% struggled with paying their credit card bills in full, which raised their credit utilization ratio

- 19% closed an older credit card, which shortened their length of credit history

- 15% had a hard inquiry added to their report

- 9% paid off a loan, which changed their overall credit profile

- 8% experienced a decrease in one of their credit limits

- 4% experienced identity theft/fraud

Another 7% said that they don’t know what caused their credit scores to decrease.

Out of sight, out of mind: 44% of Gen Zers don’t know their credit scores

Gen Zers are more likely to keep themselves in the dark about their credit scores. Although 19% of Americans say they don’t know their credit score, that jumps to 44% for the youngest group of Americans — and it may not be intentional, either. A quarter of Gen Zers (25%) don’t know how to check their credit scores, compared to the average of 12% across all respondents.

Generally, though, consumers are most likely to have fair credit scores (19%) between 580 and 669. That’s particularly true for those making less than $35,000 annually (24%), those making between $50,000 and $74,999 (23%) and women (21%). Following that, 18% of Americans have very good credit scores between 740 and 799, led by six-figure earners (32%), baby boomers (22%) and men (20%).

Baby boomers and six-figure earners are the most likely to have excellent credit scores at just over a quarter each (26%). Meanwhile, consumers making less than $35,000 annually (19%) and millennials (18%) are the most likely to have poor credit scores.

Regarding credit health, 54% of consumers say they keep track of hard credit inquiries, including limiting credit card applications and completing all their loan applications within a particular time frame. And they’re willing to invest in their credit scores, too: Overall, 44% of Americans say they’d be willing to pay for a credit repair service, including 16% who’ve done so before.

The 3 fundamentals for improving credit scores

While credit can initially seem complicated, LendingTree chief consumer finance analyst Matt Schulz says that most people tend to overthink it.

“The truth is that the basics of credit comes down to three things: paying your bills on time every single time, keeping your balances low and not applying for too much credit too often,” Schulz says. “Yes, they can all be easier said than done, but if you do those three things consistently over the years, your credit is going to be just fine.”

Schulz also warns that many credit reports contain mistakes, which may lower your credit score.

“That’s a big reason why it’s so important to regularly check your credit reports from all three credit bureaus (Equifax, Experian and TransUnion),” Schulz says. “Having a good credit score is hard enough. The last thing you want is for someone else’s goof-up to keep you from having one.”

For those struggling with debt, consider investing in professional services such as debt counseling. Under the guidance of a professional, you can take steps to improve your credit score through debt consolidation or developing a debt management plan.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,008 U.S. consumers, fielded June 17-20, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

While the survey also included consumers from the silent generation (those 77 and older), the sample size was too small to include findings related to that group in the generational breakdowns.

Get personal loan offers from up to 5 lenders in minutes

Recommended Articles