Achieve Personal Loan Review

- APR

- 8.99% – 29.99%

- Eligibility and access: 4.5/5

- Cost to borrow: 4.1/5

- Loan terms and options: 4.6/5

- Repayment support and tools: 5/5

Achieve offers online personal loans ranging from $5,000 – $50,000. Along with personal loans, it also offers home equity loans (HELOCs) and debt relief options. This review focuses primarily on personal loans.

- Personalized customer support: Achieve can assign you a dedicated loan consultant to walk you through the application process online or over the phone.

- Three rate discounts: Achieve offers a co-borrower discount, a direct pay discount and a retirement asset discount.

- All loans have an origination fee: Achieve loans come with a mandatory origination fee between 1.99% - 9.99%.

- Accepts fair credit: Achieve’s minimum credit score requirement is 640, so you can still qualify with fair credit.

- Fast funding: You could get your money as soon as one business day after approval.

- Best for joint loans and personalized assistance: Achieve’s unique co-borrower discount could be perfect if you’re planning on getting a loan with another person. Achieve’s personal loan consultants are also available seven days a week to help, if needed.

Achieve pros and cons

Shopping for a personal loan can be overwhelming. Each company has its own benefits and drawbacks to consider — here are Achieve’s.

Pros

- Offers three rate discounts, more than most personal loan lenders

- Competitive rates

- Can work with the same loan consultant throughout the process

- Offers financial hardship options if you’re having trouble paying

Cons

- Must pay an origination fee of 1.99% - 9.99%, regardless of your score

- Can’t borrow less than $5,000

- Accepts fair but not bad credit

Some lenders might offer one or two discounts, but Achieve offers three ways to save.

You could get a discount for getting a joint loan. So if you’re already planning on borrowing with another person, Achieve may be worth checking out. You could also save by letting Achieve pay your creditors directly if you’re consolidating debt or by showing proof of sufficient retirement savings.

Achieve also makes getting a loan easier by assigning borrowers a personal loan consultant. That means you won’t have to re-explain your situation if you need to call or chat multiple times throughout the process.

However, some lenders waive origination fees for all or some of their applicants — Achieve charges a fee of 1.99% - 9.99% on every loan.

This origination fee won’t come out of your pocket. Instead, Achieve will keep part of your loan before sending it to you. Origination fees make loans more expensive, and you may need to borrow more than you thought to make up for the fee.

Achieve requirements

Other than its minimum credit score, Achieve doesn’t offer a lot of insight into its specific borrower requirements.

| Minimum credit score | 640 |

| Required documents |

|

| Residency requirements | Not available in Colorado, Connecticut, Hawaii, Iowa, Kansas, Maine, North Dakota, Vermont, Washington, Wisconsin, West Virginia or Wyoming |

If Achieve’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that can offer you the best-fitting rates, terms and amounts and, ultimately, help you meet your financial goals.

How to get a personal loan with Achieve

Achieve’s online personal loan application process is straightforward and simple. You can find out whether you’re approved for a loan the same day you apply.

Check whether you prequalify

Achieve allows applicants to prequalify for a loan — this lets you check rates without hurting your credit. Here, you’ll need to provide your personal information and specify how you plan to use the loan.

Formally apply for the loan

After you pass the soft credit check, you can formally apply for a loan. You may need to confirm some details and provide documents, like a copy of your ID and/or proof of income.

After Achieve confirms your information, the lender will run a hard credit pull. Unlike with prequalification, this can cause your credit score to drop by a few points. However, the effect is temporary and typically only causes a drop of five points or less.

Finalize your loan

If Achieve approves your application, you’ll need to sign your loan agreement electronically to finalize the process. Once all the paperwork is signed, you should get your money within one to three business days.

How Achieve compares to other personal loan companies

Even if you believe Achieve aligns with what you’re looking for in a personal loan, it never hurts to shop around and compare other lenders. Here’s how Achieve stacks up against similar personal loan lenders.

| Achieve | LendingPoint | Upgrade | |

|---|---|---|---|

| LendingTree’s rating | 4.4/5 | 4/5 | 4.7/5 |

| Minimum credit score | 640 | 660 | 580 |

| APRs | 8.99% to 29.99% | 7.99% to 35.99% | 7.74% to 35.99% (with discounts) |

| Loan amount | $5,000 – $50,000 | $1,000 – $50,000 | $1,000 – $50,000 |

| Repayment terms | 24 to 60 months | 24 to 72 months | 24 to 84 months |

| Origination fee | 1.99% – 9.99% | Up to 10.00% | 1.85% – 9.99% |

| Funding timeline | Get money as soon as one to three business days | Get money as soon as the next business day | Get money as soon as the next business day |

| Bottom line | Of these three lenders, Achieve has the lowest maximum interest rate — but also the highest minimum loan amount. | LendingPoint has a lot of similarities to Achieve, though it has more options for repayment terms and a lower minimum loan amount. However, it has a much lower maximum loan amount, so it’s not a good fit for borrowers who need a large loan. | Of the three, Upgrade has the lowest credit score threshold. This lender also offers long repayment terms, but has a high maximum origination fee. |

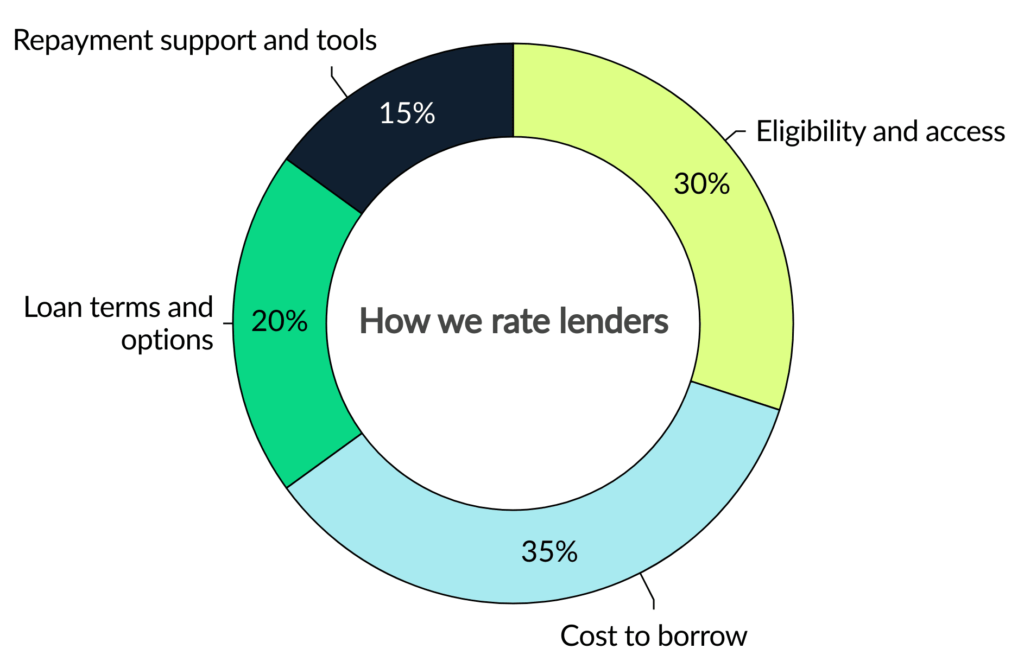

How we rated Achieve

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

Yes, Achieve is a legitimate personal loan lender, and its loans are funded through Cross River Bank. Achieve employs more than 1,400 teammates and has helped more than 1.5 million members since 2002.

Achieve requires a credit score of at least 640 for its personal loans.

Achieve typically gives same-day approval decisions. If approved, you can get your funds within one to three business days.

Get personal loan offers from up to 5 lenders in minutes