OppLoans Personal Loan Review

- APR

- 99.00% – 195.00%

- Eligibility and access: 5/5

- Cost to borrow: 1.8/5

- Loan terms and options: 3.3/5

- Repayment support and tools: 3.5/5

OppLoans offers small, short-term installment loans for people who don’t qualify for loans from traditional banks and online lenders. Here’s what you need to know.

- Expensive rates: Traditional lenders generally cap their rates at just under 36% APR, but OppLoans’ APRs are more than three times higher (99.00% to 195.00%). Your monthly payments and total loan cost will be significantly higher than they would with the best bad credit loans.

- Same-day funding: If you need a quick loan, you’re in luck — you could get your money from OppLoans as soon as the same day.

- No origination fee: OppLoans’ rates are expensive, but they do skip one common personal loan fee called an origination fee. This is a one-time administrative fee that lenders typically take from your loan money before sending it to you.

- No credit check: Unlike most lenders, OppLoans doesn’t do a hard credit check when you apply for a loan. Instead, they’ll do a soft credit check, which will let them peek at your credit without the damage to your score that comes with a hard pull.

- Smaller loans only: Consider other personal loan lenders if you need to borrow more than $5,000, which is OppLoans’ limit.

- Short repayment terms: You’ll only have 9 to 18 months to repay a loan from OppLoans, which is short compared to the typical personal loan term of 24 to 60 months. Short-term loans come with higher monthly payments.

- Build credit with on-time payments: Since OppLoans reports payments to all three credit bureaus, you could build credit as you pay off your loan.

- Best for people with bad credit who don’t qualify elsewhere: OppLoans could give you money when other lenders won’t, but you’ll make steep monthly payments in exchange. If you get a loan from OppLoans, pay it off early to avoid overpaying on interest.

OppLoans pros and cons

OppLoans offers fast installment loans for bad credit, but these loans are expensive and come with limitations that could make them difficult to pay back.

Pros

- Same-day funding possible

- Bad credit OK

- No origination fees, late fees or prepayment penalties

- No credit check

Cons

- High rates (99.00% to 195.00% APR)

- Only offers small loans ($500 to $5,000)

- Short repayment terms (9 to 18 months)

When you have bad credit and are strapped for cash, it makes sense that you’d turn to a lender like OppLoans. OppLoans offers fast, small installment loans to borrowers who don’t qualify with traditional personal lenders.

But before you sign your loan agreement, use a personal loan calculator to estimate your monthly payments and total cost of interest. OppLoans charges expensive rates, and its short repayment terms will make your monthly payments even higher.

Whenever possible, we recommend avoiding loans with APRs above 36%. But if you do get a loan from OppLoans, create an aggressive budget to pay off your debt to save money on interest. You can also take some financial power back by improving your credit score. This will help you qualify for cheaper loans in the future.

OppLoans requirements

To get an OppLoans installment loan, you’ll need to be at least 18 years old and meet the following criteria:

| Minimum credit score | No minimum |

| Minimum annual income | $18,000 |

| Other requirements |

|

If OppLoans’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that helps you meet your financial goals and can offer you the best-fitting rates, terms and amounts.

How to get a personal loan with OppLoans

Prequalify

The first step to get a loan from OppLoans is to prequalify. This just means checking your rates with no impact to your credit. Click “Apply Now” on the OppLoans website and provide personal info like your name, address, contact information, date of birth and Social Security number.

Verify your information

OppLoans may ask you to send the following documents to verify your identity, income and employment:

- Social Security card, W-2, 1099 or 1095-C

- Government-issued identification, like a driver’s license, passport, state ID or permanent resident card

- Proof of income, like your most recent pay stub or most recent benefit/award letter

Close on your loan

OppLoans will send you an offer with your rates and terms if you qualify. At this point, you can decide whether to move forward with the loan. If you do want to take out the loan, you’ll sign the loan agreement and OppLoans will send you your money as soon as the same day.

How OppLoans compares to other personal loan companies

Even if you believe OppLoans aligns with what you’re looking for in a loan, it never hurts to shop around and compare other lenders. Here’s how OppLoans stacks up against similar lenders.

| Lender | OppLoans | OneMain Financial | Upstart |

|---|---|---|---|

| LendingTree’s rating | 3.3/5 | 3.5/5 | 4.4/5 |

| Minimum credit score | None | 500 | |

| APRs | 99.00% to 195.00% | 18.00% to 35.99% | 6.50% to 35.99% |

| Loan amounts | $500 to $5,000 | $1,500 to $20,000 | $1,000 to $75,000 |

| Repayment terms | 9 to 18 months | 24 to 60 months | 36 to 60 months |

| Origination fee | None | $25 to $500, or 1.00% – 10.00% | Varies |

| Funding timeline | Get money as soon as the same business day | Get money as soon as the same business day | Get money as soon as the next business day |

| Bottom line | While OppLoans doesn’t charge origination fees, its high APRs and short repayment terms may make it hard to repay your loan. | Although it does charge a one-time origination fee, OneMain Financial offers much lower interest rates, larger loans and longer repayment terms than OppLoans on a similar timeline. | Like OneMain Financial, Upstart also offers much lower rates and longer repayment terms than OppLoans. Consider Upstart if you need a large loan — it offers up to $75,000, which is well above the $5,000 maximum from OppLoans. |

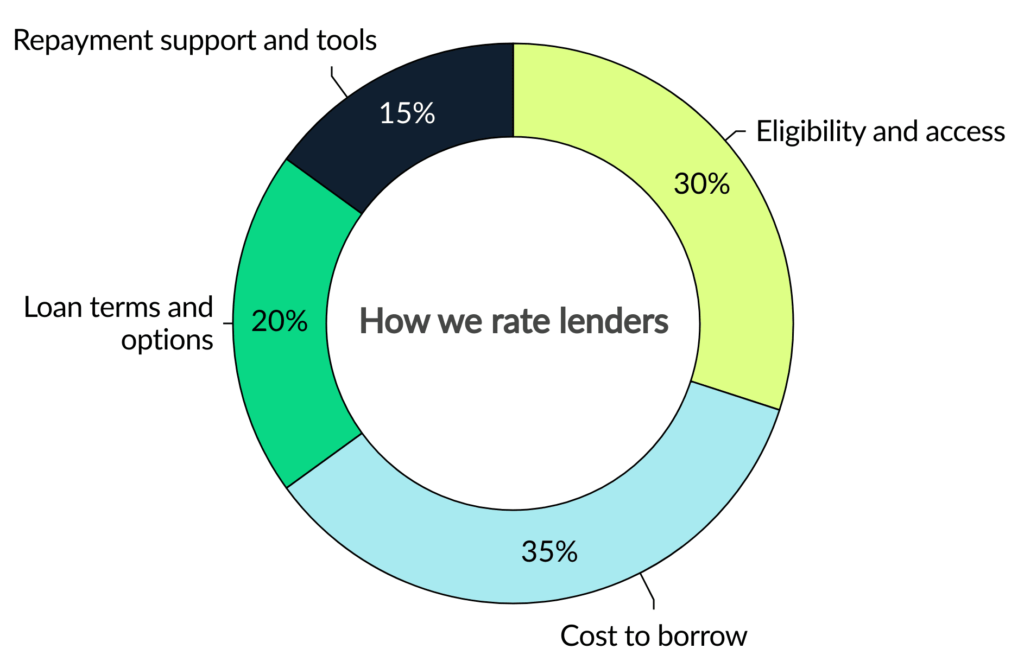

How we rated OppLoans

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

Yes, OppFi (OppLoans’ parent company) and its lending partners are legitimate companies. That said, OppLoans’ rates are expensive, and you can find cheaper loans with other bad credit installment lenders.

OppLoans doesn’t require a certain credit score in order to qualify. But in exchange for easy access to loans, OppLoans charges high rates that make their loans expensive.

OppLoans reports payments to all three credit bureaus, so making on-time payments will likely boost your credit score. But the opposite is also true — if you miss payments or default on your loan, your credit will take a significant hit.

You can only borrow $500 to $5,000 from OppLoans, which is on the low end compared to other personal loans. Lenders typically offer up to $50,000, but some offer up to $100,000 or even $250,000.

Get personal loan offers from up to 5 lenders in minutes