Nearly Half of Americans Are Considering a Move to Reduce Living Expenses

The COVID-19 pandemic has been a mainstay for the better part of 2020, affecting nearly every aspect of daily life as we know it. Our housing choices are no different.

Record-breaking unemployment — with more than 11 million Americans still jobless — along with an exodus from major cities with dense populations, such as New York, and a desire for more living space are all factors motivating Americans to reevaluate priorities for their next home purchase or lease.

A new LendingTree survey finds that close to half of Americans have a move on their minds in the not-too-distant future. The results, based on the responses of more than 2,000 participants, offer some insights into what could motivate consumers to pack up and relocate.

Key findings

- Overall, 46% of survey respondents are thinking about relocating within the next year. This includes those considering a new place in their current area (27%), in another city in their state (12%) or a new state entirely (8%).

- Nearly two-thirds (64%) of remote workers are mulling over a move, while just 31% of commuters report the same. Additionally, homeowners are less likely than renters — 39% versus 56%, respectively — to consider relocating in the next 12 months.

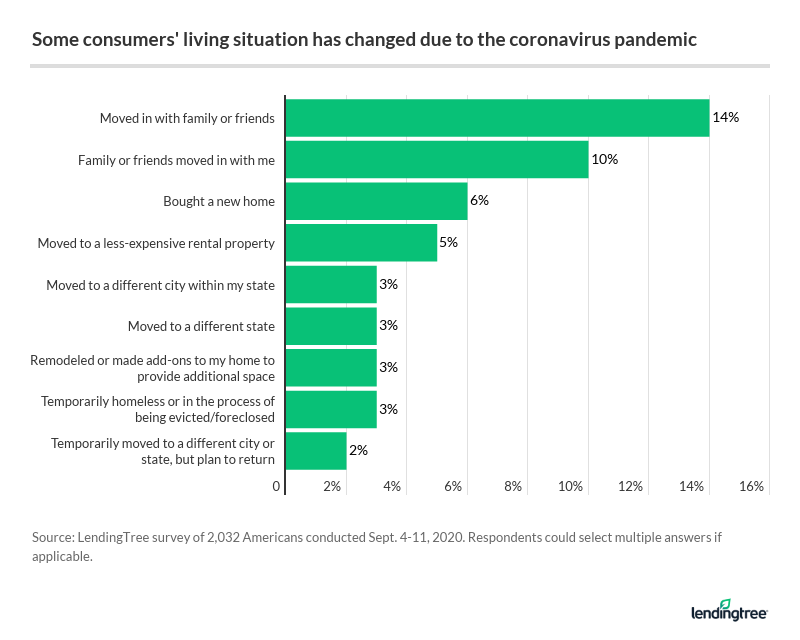

- More than a third (38%) of consumers report that the coronavirus pandemic has changed their living situation. The most common change was moving in with family or friends (14%), followed by having family or friends moving in with them (10%) and buying a new home (6%).

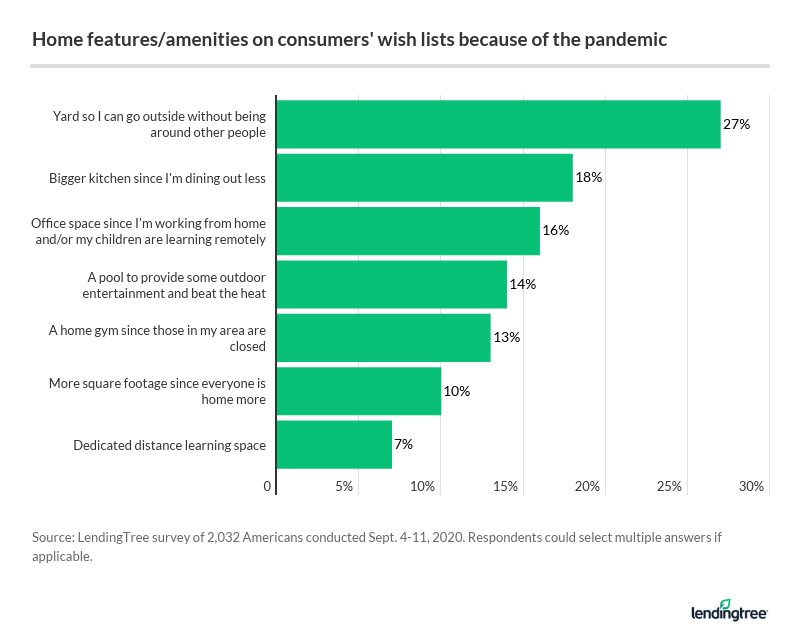

- Two-thirds (67%) of consumers now desire home amenities and features they didn’t previously consider. The three most cited are: A yard (27%) to enjoy more time outdoors without being in a shared space with others; a bigger kitchen (18%) to accommodate a shift away from dining out; and an office space (16%) for remote working or distance learning.

Nearly half of Americans are considering a move to a new home

LendingTree’s survey found that 46% of consumers are thinking about moving into a new home within the next year.

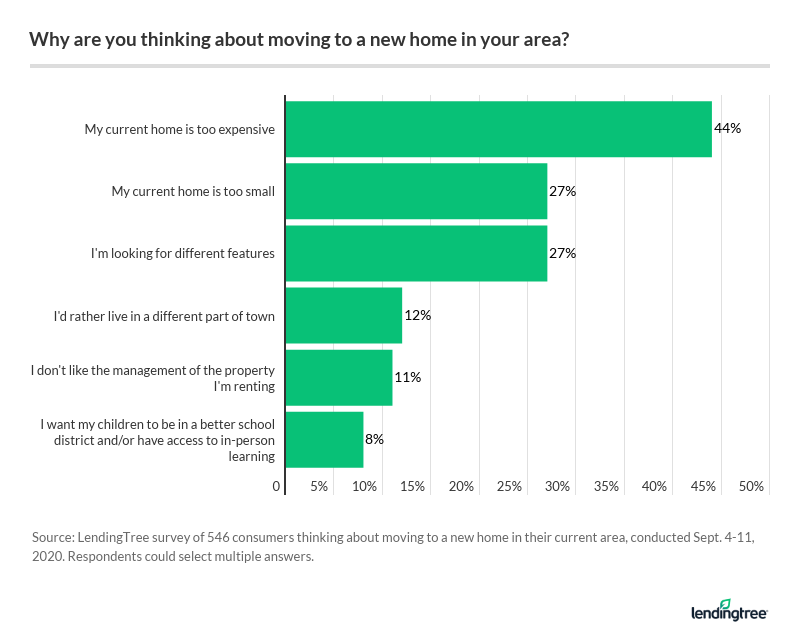

Of those considering a move, more than 1 in 4 (27%) want to stay within their current area. The main driver behind this sentiment is a desire to reduce living expenses, which is true for 44% of respondents.

Rounding out the top five reasons behind a potential move are:

- “My current home is too small” (27%)

- “I’m looking for different features” (27%)

- “I’d rather live in a different part of town” (12%)

- “I don’t like the management of the property I’m renting” (11%)

“The economic crisis has adversely affected the finances of many Americans,” said Tendayi Kapfidze, LendingTree’s chief economist. “Even those who have kept their jobs and added to savings, via stimulus and spending less due to staying home, are likely worried about the stability of their financial position.”

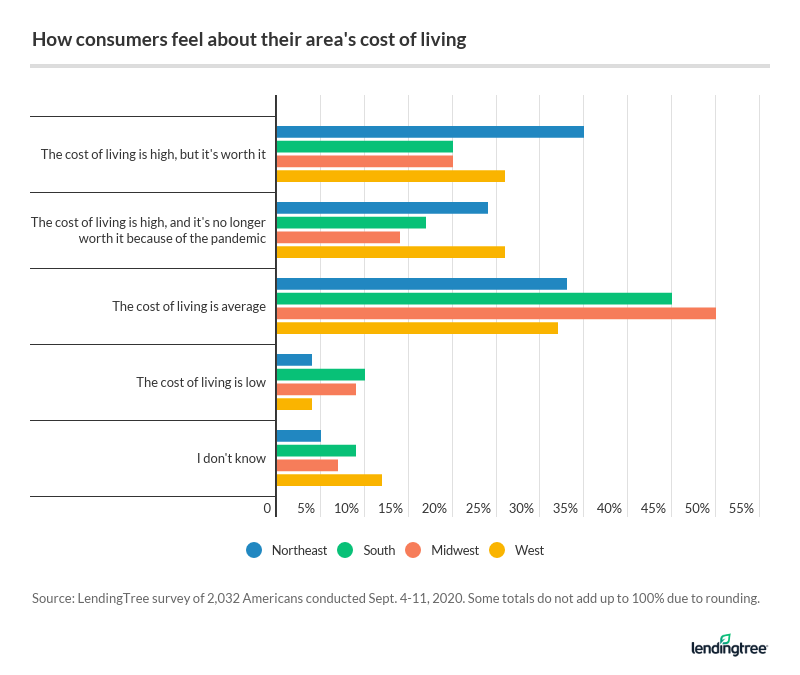

More than 1 in 4 (26%) Westerners and nearly a quarter (24%) of Northeasterners say their local cost of living is high and no longer worth it, due to the coronavirus pandemic. This is underscored by the fact that more than half (53%) of those in the Northeast and more than 4 in 10 (44%) of those in the West are considering a move in the near future.

Recent data makes it clear why consumers in the Northeast and West are looking for a way out. The cost of living in New York is more than twice the national average, according to the most recent Cost of Living Index from the Council for Community and Economic Research.

While home prices have continued to trend upward across the country — increasing nearly 6% year over year, according to the latest S&P CoreLogic Case-Shiller Home Price Index — home values in the West outpace other regions. For example, home prices rose 10% in Phoenix, 9% in Seattle and about 8% in San Diego, when compared with last year.

Remote workers are more likely to consider a move

More than 6 in 10 (64%) of Americans who work remotely are entertaining the thought of relocating in the next 12 months. This is compared with less than a third (31%) of those who commute.

Remote work is unlocking a different type of demand for both homebuyers and renters who wish to move, which is highlighted in a related, breakout survey of remote workers conducted by LendingTree.

The previous survey found that nearly half (47%) of Americans are working from home, with more than a quarter (27%) of them thinking about relocating locally. The primary reason was the need for different in-home features, such as office space or a bigger kitchen.

Additionally, results from LendingTree’s current survey reveal that the No. 3 home amenity or feature on Americans’ wish list — due to the ongoing effects of the pandemic — is a dedicated office space. The survey showed that nearly 1 in 6 consumers favor this choice, which may serve a dual purpose of providing space for working adults and children who are learning remotely. Office space is preceded by a yard (27%) and a bigger kitchen (18%).

Living situations have changed for more than a third of Americans

The COVID-19 crisis has changed living arrangements for 38% of Americans. When comparing men to women, men are more likely to report a change in their living situation than women — 47% versus 28%, respectively.

The most cited changes include:

- “Moved in with family or friends” (14%)

- “Having family or friends move in with me” (10%)

- “Bought a new home” (6%)

- “Moved to a less-expensive rental property” (5%)

“Job losses continue and are migrating from temporary to permanent,” Kapfidze said. “Of all the expenses households face, housing ranks first at 32.8% of expenditures. Thus, lowering housing costs can have the largest impact on a household’s financial position.”

More than half (52%) of Gen Xers report their living situation has changed because of the pandemic. That’s compared with 49% of millennials and just 10% of baby boomers.

Methodology

LendingTree commissioned Qualtrics, an experience management firm, to conduct an online survey of 2,032 Americans, with the sample base proportioned to represent the overall population. The survey was fielded Sept. 4-11, 2020.

We used the following age ranges to define generations:

- Generation Z: 18-23

- Millennials: 24-39

- Generation X: 40-54

- Baby boomers: 55-74

- Silent generation: 75 and older

View mortgage loan offers from up to 5 lenders in minutes