On this page

- Our top picks

- What is a credit card extended warranty?

- How does extended warranty work?

- Who provides extended warranty?

- What does extended warranty cover?

- What does extended warranty not cover?

- Is credit card extended warranty enough?

- How to file an extended warranty claim

- Tips on maximizing your coverage

- FAQs

Best Extended Warranty Credit Cards in 2026: Extra Protection for Purchases

Winner: Best extended warranty credit card

Winner: Best extended warranty credit card

Citi Strata Premier® Card

The Citi Strata Premier® Card is the best credit card for extended warranty because it extends the original warranty by 24 months with a coverage limit up to seven years from the purchase date, which is longer than what most other cards provide.

Key takeaways

- Credit card extended warranty typically automatically extends a manufacturer’s warranty by one to two years.

- Coverage depends on the credit card issuer, but many cards provide up to $10,000 per claim and a total of $50,000 per account annually. Extended warranty benefits typically apply to items with original warranties of three to five years or less.

- Credit card extended warranties come with exclusions, and not all cards include this benefit, so it’s important to check with your issuer before depending on it.

Your new dishwasher stopped working right after the manufacturer’s warranty ran out, you have a pile of dishes to wash and you’re not sure you have the funds for a repair. Bad timing, right? Not necessarily. If you used a credit card with extended warranty, you could still be covered. Many credit cards add an extra year or more to eligible manufacturer warranties, potentially saving you hundreds (or even thousands) on repairs or a replacement.

Extended warranty automatically extends the manufacturer warranty on eligible purchases, so it’s smart to use a credit card with extended warranty on big-ticket items like electronics or appliances. However, not all credit cards come with this benefit. To see if your credit card comes with extended warranty, check your credit card benefits guide or call the number on the back of your card.

- Winner: Best extended warranty credit card: Citi Strata Premier® Card

- Best premium Citi credit card for extended warranty: Citi Strata Elite℠ Card

- Best card for purchase protection and extended warranty: American Express® Gold Card1

- American Express card extended warranty and luxury travel perks: American Express Platinum Card®1

- American Express credit card extended warranty and cash back* rewards: Blue Cash Preferred® Card from American Express1

- Best for Chase credit card extended warranty and cash back rewards: Chase Freedom Unlimited®

- Best for Chase credit card extended warranty and travel rewards: Chase Sapphire Preferred® Card

- Best for Chase credit card extended warranty and luxury travel perks: Chase Sapphire Reserve®

- Best for Amazon credit card extended warranty: Prime Visa

- Best Capital One credit card extended warranty: Capital One Venture X Rewards Credit Card

- Best for Navy Federal credit card extended warranty: Navy Federal Platinum Credit Card

- Best U.S. Bank credit card with extended warranty and shopping perks: U.S. Bank Shopper Cash Rewards™ Visa Signature® Credit Card

- Best for Bank of America credit card extended warranty: Bank of America® Premium Rewards® credit card

13 Best extended warranty credit cards

| Credit Cards | Our Ratings | Annual Fee | Welcome Offer | Rewards Rate | |

|---|---|---|---|---|---|

Citi Strata Premier® Card

on Citibank's secure site Rates & Fees |

Winner

|

$95 | 60,000 points

Earn 60,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com.

| 1X - 10X points

|

on Citibank's secure site Rates & Fees |

Citi Strata Elite℠ Card

on Citibank's secure site Rates & Fees |

Premium Citi card

|

$595 | 75,000 points

Earn 75,000 bonus Points after spending $6,000 in the first 3 months of account opening.

| 1.5X - 12X points

|

on Citibank's secure site Rates & Fees |

American Express® Gold Card

|

Purchase protection + extended warranty

|

$325 | As high as 100,000 points

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.

| 1X - 4X points

| |

American Express Platinum Card®

|

American Express + luxury travel perks

|

$895 | As high as 175,000 points

You may be eligible for as high as 175,000 Membership Rewards® Points after spending $12,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.

| 5X points

| |

Blue Cash Preferred® Card from American Express

|

American Express + cash back* rewards

|

$0 intro annual fee for the first year, then $95. | $250 statement credit

Earn a $250 statement credit after you spend $3,000 in eligible purchases on your new Card within the first 6 months.

| 1% - 6% cash back

| |

Chase Freedom Unlimited®

on Chase's secure site Rates & Fees |

Chase + cash back rewards

|

$0 | $200 cash back

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

| 1.5% - 5% cash back

|

on Chase's secure site Rates & Fees |

Chase Sapphire Preferred® Card

on Chase's secure site Rates & Fees |

Chase + travel rewards

|

$95 | 75,000 points

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

| 1X - 5X points

|

on Chase's secure site Rates & Fees |

Chase Sapphire Reserve®*

|

Chase + luxury travel perks

|

$795 | 125,000 points

Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

| 1X - 8X points

| |

Prime Visa*

|

Amazon

|

$0 | $150 Amazon gift card

Get a $150 Amazon Gift Card instantly upon approval exclusively for Prime members

| 1% - 5% cash back

| |

Capital One Venture X Rewards Credit Card

|

Capital One

|

$395 | 75,000 miles

Earn 75,000 Miles when you spend $4,000 on purchases in the first 3 months from account opening

| 2X - 10X miles

| |

Navy Federal Platinum Credit Card*

|

Navy Federal

|

$0 | N/A | N/A | |

U.S. Bank Shopper Cash Rewards™ Visa Signature® Credit Card*

|

3.6

U.S. Bank + shopping perks

|

$0 for 12 months, then $95 | $250 cash bonus

$250 bonus after you spend $2,000 in eligible purchases within the first 120 days of account opening.

| 1.5% - 6% cash back

| |

Bank of America® Premium Rewards® credit card

on Bank Of America's secure site |

Bank of America

|

$95 | 60,000 points

60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening.

| 1.5X - 2X points

|

on Bank Of America's secure site |

How we chose the best credit cards for extended warranty

We take a comprehensive, data-driven approach to identify the best credit cards with extended warranty. We use an objective rating and ranking system that evaluates over 200 credit cards from more than 50 issuers. All recommendations are made by LendingTree’s editorial team, completely independent of affiliate partnerships or compensation. Every card is selected based on its merit and ability to help people achieve their financial goals. We use the following criteria to make our picks:

We calculate the cash back earned for the average cardholder using Bureau of Labor Statistics data and an annual spend of $20,000, minus the annual fee. This value includes sign-up and annual bonuses. We look at the average rewards earned over two years to balance out a card’s ongoing value with its first-year value.

We consider how easy the rewards are to use, looking at factors like expiration dates and minimum thresholds to redeem.

We also compare a card’s benefits, such as purchase and travel protections, against benefits from other cards.

Note that our ratings are a starting point for comparing and choosing the best credit cards with extended warranty. However, your needs may be different from the average cardholder. You should consider the amount you’re likely to spend in a card’s bonus categories and which benefits you value to choose the best card for you.

Winner: Best extended warranty credit card

Citi Strata Premier® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: 24 months added to the original manufacturer’s warranty, not to exceed seven years from the original purchase date.

- Earn 10x on Hotels, Car Rentals, and Attractions booked through CitiTravel.com. Earn 3 Points per $1 spent on Air Travel and Other Hotel Purchases.

- Earn 3 Points per $1 spent on Restaurants.

- Earn 3 Points per $1 spent on Supermarkets.

- Earn 3 Points per $1 spent on Gas and EV Charging Stations.

- Earn 1 Point per $1 spent on All Other Purchases

- Earn a $100 Annual Hotel Benefit: Once per calendar year, enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com. Benefit applied instantly at time of booking.

- Travel insurance protection: Trip Cancellation and Trip Interruption (Common Carrier), Trip Delay, Lost or Damaged Luggage, MasterRental Coverage (Car Rental).

- Generous sign-up bonus

- Accelerated rewards on travel and everyday purchases

- Ability to transfer points 1:1 to more than 15 travel partners

- Solid travel protections

- $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com

- 0% foreign transaction fee

- $95 annual fee

- No intro APR on purchases or balance transfers

- Limited travel benefits

The Citi Strata Premier® Card is the best credit card with extended warranty because it offers one of the longest warranties available. It adds up to two additional years to most original manufacturer warranties — twice as long as the one-year extension typically offered by other cards. Additionally, coverage lasts for up to seven years from the purchase date, which is longer than what most cards offer. This card makes sense to use for high-ticket tech or appliance purchases with longer warranties.

Plus, you can earn elevated rewards across several everyday spending categories, and you can redeem Citi ThankYou® Points in a variety of ways, including transfers to more than 15 airline and hotel loyalty programs.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: Not specified

- Click APPLY NOW to apply online.

- Earn 60,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com.

- Earn 10 Points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.

- Earn 3 Points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas and EV Charging Stations.

- Earn 1 Point per $1 spent on all other purchases

- $100 Annual Hotel Benefit: Once per calendar year, enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com. Benefit applied instantly at time of booking.

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

- Rates & Fees

Best premium Citi credit card for extended warranty

Citi Strata Elite℠ Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: 24 months added to the original manufacturer’s warranty, not to exceed seven years from the original purchase date.

- Earn 12 Points per $1 spent on Hotels, Car Rentals, and Attractions booked on cititravel.com

- Earn 6 Points per $1 spent on Air Travel booked on cititravel.com

- Earn 6 Points per $1 spent at Restaurants including Restaurant Delivery Services on CitiNights℠ purchases, every Friday and Saturday from 6 PM to 6 AM ET; earn 3 Points per $1 spent any other time

- Earn 1.5 Points per $1 spent on All Other Purchases

- Premium lounge access, including Priority Pass™ and Admirals Club® passes

- Strong rewards on everyday spending and Citi Travel® bookings

- Over $1,000 in annual credits

- Strong airline and hotel transfer partners (including AAdvantage®)

- 0% foreign transaction fee

- High $595 annual fee

- Top earning rates require booking through Citi Travel®

Similar to the Citi Strata Premier® Card, the Citi Strata Elite℠ Card offers one of the longest extended warranties available, adding up to two years to most original manufacturer warranties. It also ranks among the top premium travel credit cards thanks to its suite of travel benefits, including extensive airport lounge access, valuable travel protections and elevated rewards on travel purchases.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: Not specified

- Click APPLY NOW to apply online.

- Earn 75,000 bonus Points after spending $6,000 in the first 3 months of account opening.

- Earn 12 Points per $1 spent on Hotels, Car Rentals, and Attractions booked on cititravel.com and 6 Points per $1 spent on Air Travel booked on cititravel.com

- Earn 6 Points per $1 spent at Restaurants including Restaurant Delivery Services on CitiNights℠ purchases, every Friday and Saturday from 6 PM to 6 AM ET. Earn 3 Points per $1 spent any other time

- Earn 1.5 Points per $1 spent on All Other Purchases

- Up to $300 Annual Hotel Benefit: Each calendar year, enjoy up to $300 off a hotel stay of two nights or more when booked through cititravel.com.

- No Foreign Transaction Fees

- Rates & Fees

Best card for purchase protection and extended warranty

American Express® Gold Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: Up to one extra year added to the original U.S. manufacturer’s warranty. Applies to warranties of five years or less.1

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- Terms apply.

- High earning rate on food purchases

- Generous welcome offer

- More than $400 worth of credits (enrollment required for some)

- Transfer points 1:1 to 20 travel partners

- Foreign transaction fee: None

- $325 annual fee

- Can’t carry a balance on some purchases

- Statement credits can be difficult to use

- Limited travel benefits

The American Express® Gold Card offers longer-than-average warranty coverage1. It extends eligible manufacturer warranties by up to one additional year on warranties of five years or less — most cards only cover warranties up to three years. In addition to extended warranty coverage, it also offers strong purchase protection2, making it a dependable choice for both everyday and high-value purchases.

This card also stands out as a top choice for dining worldwide and U.S. supermarket purchases, thanks to its impressive rewards rate.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: $50,000

- Click APPLY NOW to apply online.

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

- Rates & Fees

American Express card extended warranty and luxury travel perks

American Express Platinum Card®

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: Up to one extra year added to the original U.S. manufacturer’s warranty. Applies to warranties of five years or less.1

- Earn 5X Membership Rewards® points on flights booked directly with airlines or with American Express Travel® on up to $500,000 on these purchases per calendar year

- Earn 5X Membership Rewards® points on prepaid hotels booked with American Express Travel®.

- Terms apply.

- Complimentary access to the Global Lounge Collection®

- Generous welcome offer

- $2,000+ worth of travel and shopping credits

- Up to $120 Global Entry/TSA PreCheck® credit (enrollment required)

- $895 annual fee

- High welcome offer spend requirement

Like many American Express cards, the American Express Platinum Card® extends eligible manufacturer warranties by up to one additional year on warranties of five years or less1 — longer than the three-year limit offered by many other cards. It’s also considered the top credit card for lounge access, thanks to its unmatched global lounge network, and includes a wide range of travel perks and valuable statement credits.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: $50,000

- Click APPLY NOW to apply online.

- You may be eligible for as high as 175,000 Membership Rewards® points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings. You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

- With over 1,550 airport lounges - more than any other credit card company on the market* - enjoy the benefits of the Global Lounge Collection®, over $850 of annual value, with access to Centurion Lounges, 10 complimentary Delta Sky Club® visits when flying on an eligible Delta flight (subject to visit limitations), Priority Pass Select membership (enrollment required), and other select partner lounges.* As of 07/2025.

- $200 Uber Cash + $120 Uber One Credit: With the Platinum Card® you can receive $15 in Uber Cash each month plus a bonus $20 in December when you add your Platinum Card® to your Uber account to use on rides and orders in the U.S when you select an Amex Card for your transaction. Plus, when you use the Platinum Card® to pay for an auto-renewing Uber One membership, you can get up to $120 in statement credits each calendar year. Terms apply.

- $300 Digital Entertainment Credit: Experience the latest shows, news and recipes. Get up to $25 in statement credits each month when you use your Platinum Card® for eligible purchases on Disney+, a Disney+ bundle, ESPN streaming services, Hulu, The New York Times, Paramount+, Peacock, The Wall Street Journal, YouTube Premium, and YouTube TV when you purchase directly from one or more of the providers. Enrollment required.

- $600 Hotel Credit: Get up to $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts® or The Hotel Collection* bookings through American Express Travel® using the Platinum Card®. *The Hotel Collection requires a minimum two-night stay.

- $400 Resy Credit + Platinum Nights by Resy: Get up to $100 in statement credits each quarter when you use the Platinum Card® to make eligible purchases with Resy, including dining purchases at U.S. Resy restaurants. Enrollment required. Plus, with Platinum Nights by Resy, you can get special access to reservations on select nights at participating in demand Resy restaurants with the Platinum Card®. Simply add your eligible Card to your Resy profile to book and discover Platinum Nights reservations near you.

- $209 CLEAR+ Credit: CLEAR+ helps get you to your gate faster by using your face to verify you are you at 55+ airports nationwide. You can cover the cost of a CLEAR+ Membership* with up to $209 in statement credits per calendar year after you pay for CLEAR+ with your Platinum Card®. *Excluding any applicable taxes and fees. Subject to auto-renewal.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to the Platinum Card® Account. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details.

- Start your vacation sooner, and keep it going longer. When you book Fine Hotels + Resorts® through American Express Travel®, enjoy noon check-in, when available, and guaranteed 4PM check-out.

- $300 lululemon Credit: Enjoy up to $75 in statement credits each quarter when you use the Platinum Card® for eligible purchases at U.S. lululemon retail stores (excluding outlets) and lululemon.com. That’s up to $300 in statement credits each calendar year. Enrollment required.

- $155 Walmart+ Credit: Receive a statement credit* for one monthly Walmart+ membership (subject to auto-renewal) after you pay for Walmart+ each month with the Platinum Card®.* Up to $12.95 plus applicable local sales tax. Plus Ups not eligible.

- Whenever you need us, we're here. Our Member Services team will ensure you are taken care of. From lost Card replacement to statement questions, we are available to help 24/7.

- $895 annual fee.

- Terms Apply.

- Rates & Fees

American Express credit card extended warranty and cash back* rewards

Blue Cash Preferred® Card from American Express

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: Up to one extra year added to the original U.S. manufacturer’s warranty. Applies to warranties of five years or less1.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year in eligible purchases (then 1%)

- Earn 6% cash back on select U.S. streaming subscriptions

- Earn 3% cash back at eligible U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more) purchases

- Earn 1% cash back on other purchases

- Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout

- High earning rate in popular spending categories

- One of the most rewarding cards for U.S. supermarket purchases

- Valuable welcome offer

- Intro APR on purchases and balance transfers

- $0 intro annual fee for the first year, then $95.

- Spending cap on highest earning category

- Foreign transaction fee (2.7% of each transaction after conversion to US dollars.)

The Blue Cash Preferred® Card from American Express also has an extended warranty of up to one extra year on warranties of five years or less1. But unlike the other two American Express cards mentioned, it earns cash back* and has a lower $0 intro annual fee for the first year, then $95. Because of its generous earning rate at U.S. supermarkets, it’s the top grocery credit card.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: $50,000

- Click APPLY NOW to apply online.

- Earn a $250 statement credit after you spend $3,000 in eligible purchases on your new Card within the first 6 months.

- $0 intro annual fee for the first year, then $95.

- Low Intro APR: 0% intro APR on purchases and balance transfers for 12 months from the date of account opening. After that, your APR will be a variable APR of 19.49% - 28.49%.

- Plan It®: Buy now, pay later with Plan It. Split purchases of $100 or more into equal monthly installments with a fixed fee so you don’t have the pressure of paying all at once. Simply select the purchase in your online account or the American Express® App to see your plan options. Plus, you’ll still earn rewards on purchases the way you usually do.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year in eligible purchases (then 1%), 6% cash back on select U.S. streaming subscriptions, 3% cash back at eligible U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more) purchases and 1% cash back on other purchases. Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

- Get up to a $10 monthly statement credit after using your enrolled Blue Cash Preferred® Card for a subscription purchase, including a bundle subscription purchase, at disneyplus.com, Hulu.com, or Plus.espn.com U.S. websites. Subject to auto-renewal.

- Apply with confidence. Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- Terms Apply.

- Rates & Fees

Best for Chase credit card extended warranty and cash back rewards

Chase Freedom Unlimited®

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: Up to one extra year added to the original U.S. manufacturer’s warranty. Applies to warranties of three years or less.

- Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- Earn 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service

- Earn 1.5% on all other purchases

- $0 annual fee

- Long intro APR on purchases and balance transfers

- Easy-to-earn sign-up bonus

- Points are flexible and easy to redeem

- Transfer points to other Chase Ultimate Rewards® cards

- Foreign transaction fees (3% of each transaction in U.S. dollars)

Like most Chase credit cards, the Chase Freedom Unlimited® adds an additional year to manufacturer warranties of three years or less, for a coverage period of up to four years from the purchase date.

This card is also a great choice for a cash back credit card because you can earn flat-rate cash back on purchases, elevated rewards on limited bonus categories and pay a $0 annual fee. Additionally, you can transfer points to other Chase Ultimate Rewards® cards to boost their value.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: $50,000

- Click APPLY NOW to apply online.

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

- Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 18.24% - 27.74%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

- Rates & Fees

Best for Chase credit card extended warranty and travel rewards

Chase Sapphire Preferred® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: Up to one extra year added to the original U.S. manufacturer’s warranty. Applies to warranties of three years or less.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠

- Earn 3x on dining, select streaming services and online groceries

- Earn 2x on all other travel purchases

- Earn 1x on all other purchases

- Large sign-up bonus

- Excellent rewards on travel, dining and select streaming services

- Up to 75% bonus on travel portal redemptions

- Transfer points 1:1 to 10+ airline and hotel partners

- Great travel and purchase protections

- $95 annual fee

- Doesn’t offer luxury travel benefits like lounge access or Global Entry/TSA PreCheck

The Chase Sapphire Preferred® Card is another Chase card that extends eligible manufacturer warranties by one year on warranties of three years or less. It stands out as a strong travel credit card with a modest $95 annual fee. It offers great rewards on everyday spending like travel, dining and select streaming services, along with valuable travel protection benefits.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: $50,000

- Click APPLY NOW to apply online.

- Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases

- Earn up to $50 in statement credits each account anniversary year for hotel stays through Chase Travel℠

- 10% anniversary points boost - each account anniversary you'll earn bonus points equal to 10% of your total purchases made the previous year.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

- Member FDIC

- Rates & Fees

Best for Chase credit card extended warranty and luxury travel perks

Chase Sapphire Reserve®*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: Up to one extra year added to the original U.S. manufacturer’s warranty. Applies to warranties of three years or less.

- Earn 8x points on all purchases through Chase Travel℠, including The Edit℠

- Earn 4x points on flights and hotels booked direct

- Earn 3x points on dining worldwide

- Earn 1x points on all other purchases

- Huge sign-up bonus

- High earning rate on travel and dining

- $300 annual travel credit

- Up to $120 Global Entry/TSA PreCheck/NEXUS fee credit

- Priority Pass lounge access

- Top-notch travel insurance and purchase protections

- $795 annual fee

- $195 authorized user fee

Like other Chase credit cards, the Chase Sapphire Reserve® offers extended warranty coverage that adds up to one year to eligible warranties of three years or less. It’s also widely recognized as one of the best credit cards for luxury travel, offering premium perks like lounge access and top-tier travel insurance. You’ll also earn flexible points that you can transfer to more than 10 travel programs, in addition to strong travel and purchase protections.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: $50,000

- Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

- Get more than $2,700 in annual value with Sapphire Reserve.

- Earn 8x points on all purchases through Chase Travel℠, including The Edit℠ and 4x points on flights and hotels booked direct. Plus, earn 3x points on dining worldwide & 1x points on all other purchases

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Access over 1,300 airport lounges worldwide with a complimentary Priority Pass™ Select membership, plus every Chase Sapphire Lounge® by The Club with two guests. Plus, up to $120 towards Global Entry, NEXUS, or TSA PreCheck® every 4 years

- Get up to $150 in statement credits every six months for a maximum of $300 annually for dining at restaurants that are part of Sapphire Reserve Exclusive Tables.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Coverage, Lost Luggage Insurance, no foreign transaction fees, and more.

- Get complimentary Apple TV+, the exclusive streaming home of Apple Originals. Plus Apple Music — all the music you love, across all your devices. Subscriptions run through 6/22/27 — a value of $250 annually

- Member FDIC

Best for Amazon credit card extended warranty

Prime Visa*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: Up to one extra year added to the original U.S. manufacturer’s warranty. Applies to warranties of three years or less.

- Earn unlimited 5% back at Amazon.com, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases with an eligible Prime membership

- Earn unlimited 2% back at gas stations, restaurants, and on local transit and commuting (including rideshare)

- Earn unlimited 1% on all other purchases

- $0 annual fee

- Generous cash back rate

- Amazon Gift Card upon approval

- Cash back is easy to redeem

- Foreign transaction fee: $0

- Must have an Amazon Prime membership

Similar to other Chase-issued cards, the Prime Visa extends manufacturer warranties by one additional year for warranties of three years or less, up to four years from the purchase date.

Additionally, this card earns a high cash back rate on Amazon purchases, making it a smart choice for major Amazon Prime purchases, especially when combined with the added warranty protection.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: $50,000

- Get a $150 Amazon Gift Card instantly upon approval exclusively for Prime members

- Earn unlimited 5% back at Amazon.com, Amazon Fresh, Whole Foods Market and on Chase Travel purchases with an eligible Prime membership

- Prime Card Bonus: Earn 10% back or more on a rotating selection of items and categories on Amazon.com with an eligible Prime membership

- Earn unlimited 2% back at gas stations, restaurants, and on local transit and commuting (including rideshare)

- Earn unlimited 1% back on all other purchases

- No annual credit card fee

- No more waiting. Redeem daily rewards at Amazon.com as soon as the next day

- Member FDIC

Best Capital One credit card extended warranty

Capital One Venture X Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: Up to one extra year added to the original U.S. manufacturer’s warranty. Applies to warranties of three years or less.

- Earn 2 Miles per dollar on every purchase, every day

- Earn 10 Miles per dollar on hotels and rental cars booked through Capital One Travel

- Earn 5X Miles per dollar on flights booked through Capital One Travel

- Earn a valuable sign-up bonus

- Top rewards rate on travel

- Lounge access

- Up to $300 annual travel credit through Capital One’s travel booking site

- 10,000 bonus miles every account anniversary

- Up to $120 Global Entry/TSA PreCheck® credit

- Transfer miles to 20+ travel loyalty programs

- $395 annual fee

- No major U.S. airline partners

The Capital One Venture X Rewards Credit Card offers extended warranty coverage that adds up to one year to eligible warranties of three years or less, which is similar to what many of the top cards on our list offer.

In addition to its extended warranty benefits, the card stands out as a leading travel credit card, thanks to its strong rewards rate on travel and above-average earnings on everyday spending. It also includes a wide range of other travel and purchase protections.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: $50,000

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights and vacation rentals booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Enjoy access to 1,300+ lounges worldwide, including Capital One Lounge locations and Priority Pass™ lounges, after enrollment

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Best for Navy Federal credit card extended warranty

Navy Federal Platinum Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: Doubles the manufacturer’s warranty up to a maximum of one year. Applies to warranties of five years or less.

- $0 annual fee

- $0 foreign transaction fees

- $0 balance transfer fee

- Intro APR on balance transfers

- Low ongoing interest rate

- Credit union membership required

- No rewards program

- No intro on APR purchases

If you or an eligible family member have a military affiliation and can join Navy Federal Credit Union, the Navy Federal Platinum Credit Card is a strong, low-cost choice that includes extended warranty protection of up to one year on warranties of five years or less. The card has few fees and a low ongoing interest rate, though it doesn’t have a rewards program.

Keep in mind, extended warranty coverage is only available with the Mastercard version of the card and not the Visa version.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: Not specified

- 0.99% introductory APR for 12 months for balance transfers requested within 60 days of account opening. Applies to balance transfers requested within 60 days of account opening.

- After the intro period, a 10.49% to 18.00% (variable) APR applies

- No balance transfer fee

- No annual fee

Best U.S. Bank credit card with extended warranty and shopping perks

U.S. Bank Shopper Cash Rewards™ Visa Signature® Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: Adds one additional year to the original manufacturer’s warranty for warranties of three years or less.

- Earn 6% cash back on your first $1,500 in combined eligible purchases each quarter with two retailers you choose

- Earn 3% cash back on your first $1,500 in eligible purchases on your choice of one everyday category (like wholesale clubs, gas and EV charging stations, bills and utilities)

- Earn 1.5% cash back on all other eligible purchases

- Easy-to-earn sign-up bonus

- Excellent cash back rate on shopping purchases

- Annual fee: $0 for 12 months, then $95

- Cap on higher earning rates

- No intro APR on purchases or balance transfers

The U.S. Bank Shopper Cash Rewards™ Visa Signature® Credit Card extends eligible manufacturer warranties by one additional year for warranties of three years or less, which is similar to what many other extended warranty cards provide. In addition to this coverage, it’s also a strong choice for shopping thanks to its high rewards across multiple retail categories.

Extended warranty coverage details

- Maximum coverage per item: $10,000

- Maximum coverage per year: $50,000

- 6% cash back on your first $1,500 in combined eligible purchases each quarter at two retailers you choose

- 3% Cash Back on your first $1,500 in eligible purchases in your choice of one everyday category

- 1.5% Cash Back on all other eligible purchases.

- 5.5% Cash Back on prepaid car and hotel reservations booked directly in the Travel Rewards Center

- Get a $250 bonus after you spend $2,000 in eligible purchases within the first 120 days of account opening

- Enjoy a $0 intro annual fee the first year ($95/year thereafter).

- Divide large purchases into fixed monthly payments with U.S. Bank ExtendPay®Plan. Pay no interest and keep your rewards, all for a small monthly fee.

Best for Bank of America credit card extended warranty

Bank of America® Premium Rewards® credit card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Extended warranty: Doubles the time period of the manufacturer’s warranty, up to one additional year, for eligible items purchased with your card. You can also register your receipt and warranty information, which can be kept on file on warranties of three years or less, when you need them.

- 2 points for every $1 spent on travel and dining purchases.

- 1.5 points for every $1 spent on all other purchases.

- Generous sign-up bonus

- Earns bonus points on travel and dining

- Annual travel credits

- Points-earning bonus for Preferred Rewards members

- Flexible redemption options

- Strong travel and purchase protections

- $95 annual fee

- No intro APR

- No transfer partners

- Lower rewards rate for non-Preferred Rewards members

The Bank of America® Premium Rewards® credit card offers up to one additional year on warranties of three years or less. This isn’t the longest extended warranty coverage available, but it’s consistent with many credit cards that offer extended warranty.

The card also has valuable travel perks for a modest $95 annual fee, with the potential to boost your rewards rate through the Bank of America Preferred Rewards® program. Plus, it has solid travel protections on top of purchase protections.

- Click APPLY NOW to apply online.

- Low $95 annual fee.

- Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don't expire as long as your account remains open.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87 - 2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

What is a credit card extended warranty?

A credit card extended warranty is a benefit offered by some credit cards that adds additional time to the manufacturer’s warranty on eligible purchases. Typically, it extends the original warranty by up to one extra year and applies automatically when you use the credit card to make the purchase, though terms can vary by card issuer.

A credit card extended warranty is different from a manufacturer’s warranty or store warranty because it’s a free benefit that adds time to the original manufacturer’s warranty. A manufacturer’s warranty is included with most new products and covers defects in materials or workmanship for a set period of time. A store warranty (or protection plan) is sold by the retailer and may offer broader or longer coverage, but adds an extra cost to your purchase. In many cases, your credit card’s extended warranty might be sufficient.

How does credit card extended warranty work?

If your credit card has extended warranty, the benefit typically activates automatically, with no registration needed. Extended warranty only applies to eligible purchases, which can vary by issuer. Most cards add one year to the manufacturer’s warranty, though terms differ. Coverage is often capped at around $10,000 per item and $50,000 per account.

Example of using a credit card extended warranty

You purchase a new laptop for $1,200 using your Citi Strata Premier® Card. The manufacturer provides a one-year warranty that covers hardware defects. After 14 months, the screen stops working due to a covered internal issue, not from accidental damage.

Since Citi’s extended warranty benefit automatically adds up to two extra years to the original warranty, your laptop is covered for three years under your card’s warranty. You can submit a claim with your receipt, warranty info and proof of purchase. Citi may reimburse you for the repair cost or replace the laptop, saving you hundreds of dollars.

Who provides the extended warranty?

Credit card extended warranty is typically offered through a credit card network like Visa, Mastercard or American Express. Credit card issuers then decide whether to include extended warranty as a benefit for their credit cards and might set varying levels of coverage. So, for example, Visa might have extended warranty available, but a credit card issuer might decline to have that benefit available for your specific credit card.

→ Learn more about Visa vs. Mastercard.

Extended warranty by bank

| Issuer | Extended terms | Maximum coverage per item | Maximum coverage per year |

|---|---|---|---|

| Up to one extra year added to the original U.S. manufacturer’s warranty. Applies to warranties of five years or less. | $10,000 | $50,000 |

| Up to one extra year added to the original U.S. manufacturer’s warranty. Applies to warranties of three years or less. | Not specified | Not specified |

| Automatically doubles the original manufacturer's warranty on eligible purchases. Not offered with all Capital One credit cards. | Not specified | Not specified |

| Up to one extra year added to the original U.S. manufacturer’s warranty. Applies to warranties of three years or less. Not offered with all Chase credit cards. | $10,000 | $50,000 |

| Up to 24 months added to the original manufacturer’s warranty, not to exceed seven years from the original purchase date. Only offered with the Citi Strata Premier® Card. | $10,000 | Not specified |

| Discover no longer offers extended warranties. | None | None |

| Extends the time period of the original manufacturer’s warranty by one year. Applies to warranties of three years or less. Only offered with the U.S. Bank Shield™ Visa® Card and U.S. Bank Shopper Cash Rewards Visa Signature Card. | $10,000 | $50,000 |

| Wells Fargo doesn’t offer extended warranty. | None | None |

What does credit card extended warranty cover?

A credit card’s extended warranty typically mirrors the coverage provided by the original manufacturer’s warranty. For example, if your new laptop comes with a warranty for defects in materials and workmanship, the card’s extended warranty would likely continue that same coverage.

Products that may be covered include:

- Cellphones

- Electronics

- Home appliances

Many credit cards with extended warranties offer coverage up to $10,000 per claim and $50,000 per cardholder, though limits can vary by card. To get the specific details for your card, check your benefits guide or call the number on the back of your card.

What does credit card extended warranty not cover?

Credit card extended warranty doesn’t cover everything. While it generally extends the original manufacturer’s coverage, it excludes many types of damage and certain items. Here’s what it might not cover:

- Cars, boats, motorcycles and other motorized vehicles

- Used items

- Antiques and collectables

- Computer software

- Medical equipment

- Real estate

- Professional services

- Items with product guarantees

Is credit card extended warranty coverage enough?

Credit card extended warranty coverage is often enough for many common purchases, especially electronics or appliances, as it typically mirrors and extends the manufacturer’s warranty. However, it may not be sufficient for more complex or high-value items, or if you want coverage for accidental damage, theft or wear and tear — which extended warranties don’t cover.

If you want broader protection, like accidental damage or longer terms, a retailer’s protection plan or standalone insurance may be worth considering.

How to file an extended warranty claim

- Verify your eligibility.

Check your credit card’s extended warranty terms to verify the item is eligible and that the original purchase date falls within the covered timeframe. - Gather the required documents.

This can typically be found in your credit card benefits guide. Commonly required documents include:

→ A copy of the original purchase receipt

→ A copy of your card statement showing the item was purchased with your card

→ The original manufacturer’s warranty

→ Repair estimate or service diagnosis - Contact your credit card issuer.

Call the number on the back of your card or go to your credit card’s benefits website or claims portal to start the claim process. - File the claim.

Upload or mail in the documentation by the deadline (usually within 60 to 90 days of the issue). Make sure all documents are clear and legible to avoid delays in processing. - Wait for your claim to be reviewed.

If approved, you’ll be reimbursed for repair costs or the item may be replaced. Some policies may directly cover the repair without reimbursement. Check the terms of your extended warranty for details.

Tips on maximizing your credit card extended warranty coverage

-

Keep receipts and documentation

Keep original receipts, warranty documents and your credit card statement for easy access in case you need to file a claim.

-

Don't buy extended warranties from stores without checking your card first

The extended warranty that comes with your credit card might be sufficient.

-

Use credit cards strategically for big-ticket items

Pay with a card that offers extended warranty, especially for electronics, appliances or other high-cost items.

-

Know the claim limits

Most cards have per-claim and per-account maximums. For example, there might be a maximum of $10,000 per claim and $50,000 each year per account. Factor that in for high-value purchases.

-

Act quickly if something breaks

Extended warranty claims usually have to be filed within a specific timeframe (often 60 to 90 days after the issue occurs).

-

Combine extended warranty with purchase protection

Some credit cards offer purchase protection in addition to extended warranty. You can use both for broader coverage within the first few months.

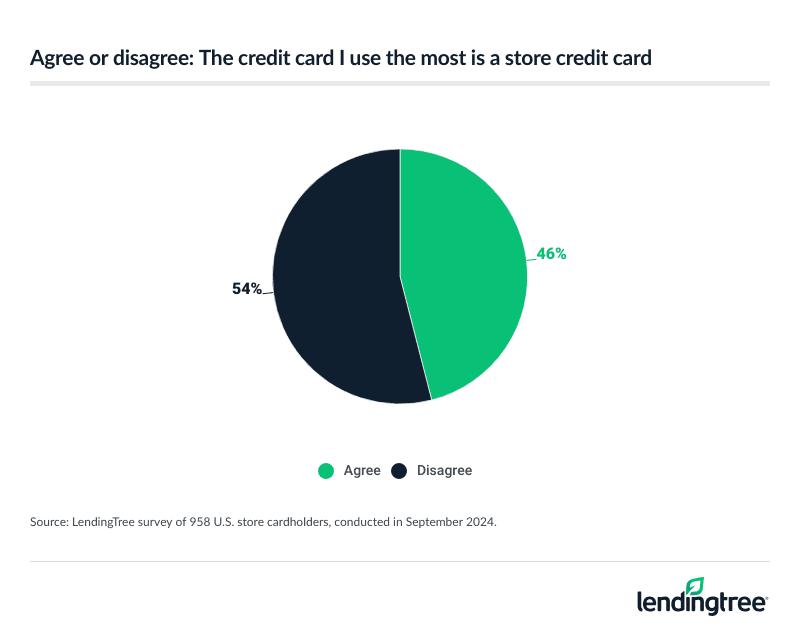

What to know about store credit cards

According to a recent LendingTree survey, 47% of Americans currently have a store credit card, with 46% saying it’s their most used card. Store cards can be helpful in saving money at retailers you shop at frequently, but they often come with higher APRs and some can only be used at the specific retailer. Take a close look at the card’s terms and conditions and make sure it truly fits your needs before feeling pressured to sign up.

An example of a store credit card with extended warranty is the Prime Visa, which outside of earning excellent rewards on Amazon purchases, also offers elevated rewards in other popular categories and comes with access to a number of Chase benefits.

Frequently asked questions

Extended warranty covers you if something breaks after the manufacturer’s warranty period is up. Purchase protection covers you if something is damaged or stolen soon after purchase. Some premium credit cards offer both benefits, but they serve different purposes and timelines.

A good credit card extended warranty typically adds up to one or two extra years to the original manufacturer’s warranty and covers warranties of up to three to five years. You should also check for high coverage limits (like $10,000 per claim), a straightforward claims process and automatic activation when you use your card to make the purchase.

In many cases, the extended warranty from your credit card is a better value than buying one from the store because it’s free and activates automatically when you use the card to make a purchase. Store warranties may offer longer or broader coverage, but they usually cost extra — so unless you need very specific protection, your credit card’s extended warranty may be enough.

To find out if your credit card offers extended warranty protection, check your card’s benefits guide, which you can usually find online through your account or the issuer’s website. You can also call the number on the back of your card and ask a representative to confirm whether extended warranty is included and what the specific terms are.

1. When an American Express® Card Member charges a Covered Purchase to an Eligible Card, Extended Warranty can provide up to one extra year added to the Original Manufacturer’s Warranty. Applies to warranties of five (5) years or less. Coverage is up to the actual amount charged to your Card for the item up to a maximum of $10,000; not to exceed $50,000 per Card Member account per calendar year. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.2. Purchase Protection is an embedded benefit of your Card Membership and requires no enrollment. It can help protect Covered Purchases made on your Eligible Card when they’re accidentally damaged, stolen, or lost, for up to 90 days from the Covered Purchase date. The coverage is limited up to $10,000 per occurrence, up to $50,000 per Card Member account per calendar year. Coverage Limits Apply. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

*Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

- American Express® Gold Card

- American Express Platinum Card®

- Blue Cash Preferred® Card from American Express

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Chase Sapphire Reserve®, Prime Visa, Navy Federal Platinum Credit Card and U.S. Bank Shopper Cash Rewards™ Visa Signature® Credit Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.