Average Credit Score in US: FICO and VantageScore Breakdowns

Americans are in better credit score shape than in the past few years, and that’s the case for the two main scoring models — FICO and VantageScore.

LendingTree analyzed FICO and VantageScore credit score data on a national, state and demographic level to get a glimpse into American consumers’ credit health. Among the major findings: The average FICO Score was 715 in the third quarter of 2023, while the average VantageScore was 702 in March 2024 — both in the good range.

Learn which groups of people have the best and worst credit scores in the nation, the role credit utilization plays and tips for improving your score.

Key FICO Score findings

- The average FICO credit score in the U.S. was 715 (good) in the third quarter of 2023. That’s up 26 points from 689 (also good) in the third quarter of 2010.

- 71.3% of Americans have a FICO Score of 670 (good) or better. 21.2% have an exceptional FICO credit score of 800 or above.

- FICO credit scores generally increase with age, with older generations having higher averages. As of the third quarter of 2023, members of the silent generation have an average FICO Score of 760 (very good), while Gen Zers have an average of 680 (good).

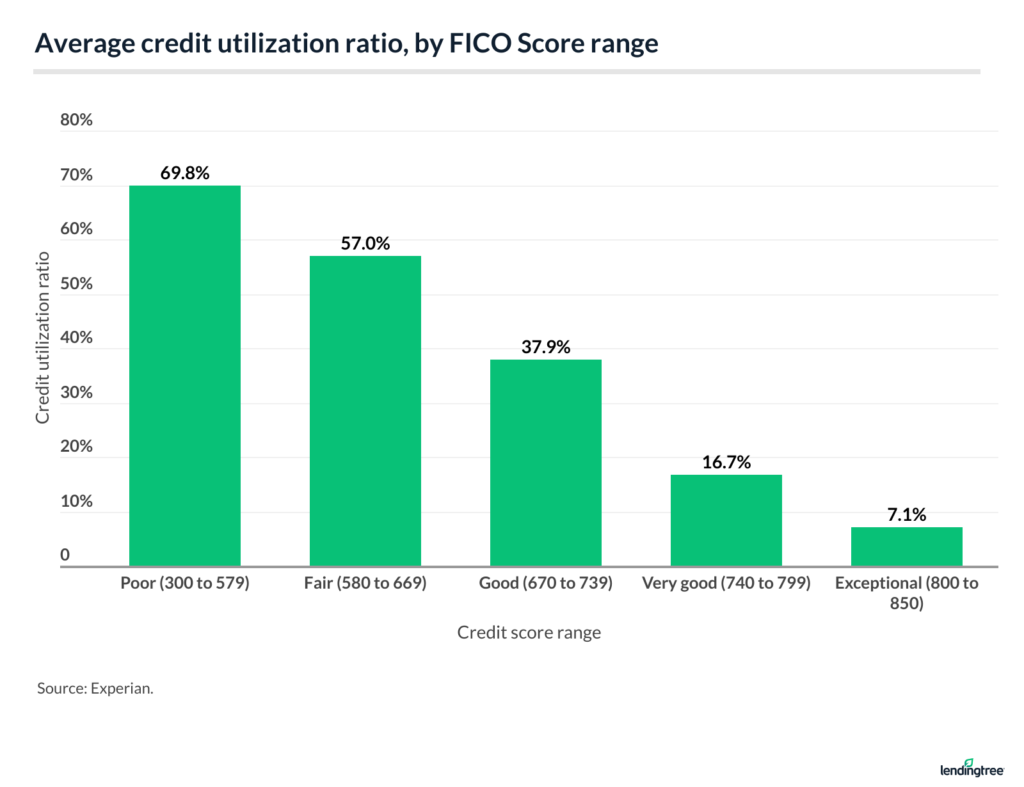

- Similarly, credit utilization ratios generally decrease as FICO Scores improve. Consumers with a poor (300 to 579) FICO Score have the highest utilization ratio, averaging 69.8%. That compares with consumers with an exceptional score of 800 or above, with an average utilization ratio of 7.1%.

- Men’s and women’s average FICO Scores are nearly identical. According to second-quarter 2019 data (the latest available), men’s average (705) is only one point higher than women’s average (704).

- Residents in Minnesota (742) and Vermont and Wisconsin (both 737) have the highest average FICO credit scores. Conversely, those in Mississippi (680), Louisiana (690) and Alabama (692) have the lowest average FICO Scores.

- Only 1.7% of the U.S. scorable population had a perfect 850 FICO credit score as of April 2023 — up more than double from 0.8% in April 2013. By state and metro, Hawaii (2.6%) and San Francisco (3.0%) had the highest percentage of the population with a perfect FICO Score in April 2023.

Key VantageScore findings

- The average VantageScore in the U.S. was 702 (good) in March 2024. The average VantageScore improved by 16 points (from 686, also good) between March 2020 and March 2024.

- A lower rate of Americans have at least a good VantageScore (661 or better) — 61% — than a good FICO Score. The percentage with an excellent score — 23% — is higher than those with an exceptional FICO Score, though the score range is wider.

- Baby boomers have an average VantageScore of 740 — two points higher than members of the silent generation (738). Baby boomers’ average is 77 points higher than Gen Zers’ average of 663.

- The median credit score in majority white communities is 100 points higher than in majority Black communities — 727 versus 627. According to the August 2021 data, majority Hispanic communities are in the middle, averaging 667, while majority Native American communities are at the bottom, averaging 612.

- Like with FICO Scores, Minnesota residents have the highest average VantageScore, at 728. It’s followed by New Hampshire (726) and Vermont (724). All 10 states with the lowest average VantageScores are in the South, with Mississippi (668), Louisiana (675) and Alabama (679) at the bottom.

Average credit score: FICO Score

FICO says its credit score model is used by 90% of top lenders. FICO Scores range from 300 to 850, broken up into various tiers of creditworthiness.

FICO Score ranges

| Category | Score |

|---|---|

| Poor | 300 to 579 |

| Fair | 580 to 669 |

| Good | 670 to 739 |

| Very good | 740 to 799 |

| Exceptional | 800 to 850 |

As of the third quarter of 2023, 71.3% of Americans have a FICO Score of 670 (good) or better. Considering that conventional home loans usually require a minimum credit score of 620, that means more than 7 in 10 people have scores high enough to meet the credit requirement for buying a home. Even better, just over 1 in 5 people (21.2%) have an exceptional FICO credit score of 800 or above, all but guaranteeing access to the best products and interest rates.

That still leaves the other 28.7% of people who struggle with credit — 16.6% have a fair score and 12.1% are in the poor score range. A low credit score from a lender’s perspective means those borrowers are more likely to default on their debt obligations. This is why people with poor or fair credit are less likely to qualify for new loans, credit cards or mortgages. Even when they do, they’ll most likely pay higher interest rates and be offered less favorable terms than those with stronger credit profiles.

Nationally, however, the credit score news is positive: The average FICO Score in the U.S. was 715 in the third quarter of 2023, which is the higher end of the good credit score range. What’s more, there has been a significant climb in the average score since the third quarter of 2010, when it was 689 (the lower end of the good range).

What has helped drive the incremental rise in credit scores over the past 14 years? “People have become much more aware of credit and how it works,” says Matt Schulz, LendingTree chief consumer finance analyst. “The amount of information about credit scoring is infinitely greater than in 2010, so people are becoming savvier and more cognizant of its importance.”

Another contributing factor could be credit bureaus’ big leaps in integrating so-called alternative data in the past decade, says Schulz, author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.” There are more opportunities to factor in things like rent payments and cellphone or utility bills into credit scoring. “Tools like Experian Boost have made it far easier to include these bits of data, which generally has had a positive influence,” he says.

Average FICO Score since 2010

| Year | Avg. FICO Score |

|---|---|

| 2023 | 715 |

| 2022 | 714 |

| 2021 | 714 |

| 2020 | 711 |

| 2019 | 703 |

| 2018 | 701 |

| 2017 | 699 |

| 2016 | 699 |

| 2015 | 695 |

| 2014 | 693 |

| 2013 | 691 |

| 2012 | 693 |

| 2011 | 689 |

| 2010 | 689 |

The FICO Score, regarded as the first credit score, was introduced in 1989 by Fair, Isaac and Co. (Today, there are multiple credit scoring models.) FICO generates multiple versions, utilizing information from the three main credit-reporting bureaus: Experian, Equifax and TransUnion. Some lenders and creditors only report to one credit bureau, so your reports will likely vary.

There are also slightly different FICO formulas used for different industries like credit cards, mortgage lending or auto loans. These scores may be more customized based on what is most important to those niche lenders and are usually different from the scores you see on the consumer side.

However, consumers don’t need to get too into the weeds when it comes to credit scores. “At a basic level, all credit scoring is the same,” Schulz says. “It’s ultimately about paying your bills on time every time, keeping your balances as low as possible and not applying for too much credit too often. Do these three things over and over for years, and your credit is going to be fine.”

Average, by age, credit utilization ratio and gender

FICO Scores generally increase as people age, which is why older generations tend to have higher average scores. As of the third quarter of 2023, silent generation members ages 78 to 95 have an average FICO Score of 760 (very good), while Gen Zers ages 18 to 26 have an average of 680 (good).

Average FICO Score, by age

| Generation | Avg. FICO Score, 2022 | Avg. FICO Score, 2023 | YoY point change |

|---|---|---|---|

| Silent generation (78 to 95) | 760 | 760 | 0 |

| Baby boomer (59 to 77) | 743 | 745 | 2 |

| Generation X (43 to 58) | 707 | 709 | 2 |

| Millennial (27 to 42) | 687 | 690 | 3 |

| Generation Z (18 to 26) | 679 | 680 | 1 |

“It’s easier for an older person to have a high credit score than it is for a younger person,” Schulz says. “That’s because credit is a marathon rather than a sprint,” He compares it to a teen borrowing the car from Mom or Dad. The first time they borrow it, Mom and Dad are going to be nervous and set a bunch of ground rules and restrictions. After a few incident-free times, parents loosen up and give you more responsibility. Then, eventually, they’re willing to give you the car anytime you’d like, he says.

“It’s essentially the same with lenders,” Schulz says. “They want to know you can handle your business before they trust you with a bunch of money.” In fact, length of credit (which includes the age of your oldest account, the age of your newest account and the average age of all your accounts) is one of the key components of a FICO Score, representing 15% of it.

But age also has an indirect impact on credit scores for other reasons. The most important one is that older people usually have more available credit, which can help them maximize another major credit score factor, amounts owed. The FICO scoring algorithm considers amounts owed — including credit utilization — the second most important component (30%), right behind payment history. The lower the utilization, the better the score.

Utilization refers to the amounts you owe compared to your total credit limit. If you have a $1,000 credit limit and owe $750 on your card, you’re utilizing 75.0% of your credit line. If your credit limit is $10,000 and you owe the same $750, your utilization is just 7.5%. Lower credit lines make it harder to keep utilization in check.

As such, it’s no surprise that consumers with a poor (300 to 579) FICO Score have the highest utilization ratio, averaging 69.8%. Conversely, consumers with an exceptional score of 800 or above have an average utilization ratio of 7.1%.

We also looked at how men’s and women’s FICO Scores compare. Despite differences in how men and women generally approach their finances, their average FICO Scores are nearly identical. According to second-quarter 2019 data (the latest available), men’s average FICO Score is 705, while women have an average of 704. That’s pretty remarkable considering that women weren’t even allowed to have credit in their own name just 50 years ago (before 1974) unless a man cosigned with them.

Average, by state

Geographically, Minnesota (742) and Vermont and Wisconsin (both 737) lead the nation with the highest average FICO credit scores. At the bottom of the list are Mississippi (680), Louisiana (690) and Alabama (692). Notably, the score difference between the top and bottom states is only 62 points, which is an achievable credit score gap with strong credit behavior.

The reason for the differences is likely related to other economic factors. “The states with the lowest scores are also among the lowest income states in the country,” Schulz says.

For instance, median household incomes in Mississippi, Louisiana and Alabama are $52,985, $57,852 and $59,609, respectively, compared with the U.S. median of $75,149. As for Minnesota — the state leader for FICO Scores — the median household income is $84,313.

“Lower income can mean that if you’re able to get a credit card, for example, it may have a smaller limit than others might receive,” Schulz says. “That can make it far easier to max out a credit card, which can do real damage to your credit.”

Average FICO Score, by state

| Rank | State | Avg. FICO Score, 2022 | Avg. FICO Score, 2023 | YoY point change |

|---|---|---|---|---|

| 1 | Minnesota | 742 | 742 | 0 |

| 2 | Vermont | 736 | 737 | 1 |

| 2 | Wisconsin | 735 | 737 | 2 |

| 4 | New Hampshire | 734 | 736 | 2 |

| 5 | Washington | 735 | 735 | 0 |

| 6 | South Dakota | 734 | 734 | 0 |

| 7 | North Dakota | 733 | 733 | 0 |

| 8 | Hawaii | 732 | 732 | 0 |

| 8 | Massachusetts | 732 | 732 | 0 |

| 8 | Oregon | 732 | 732 | 0 |

| 8 | Montana | 731 | 732 | 1 |

| 12 | Nebraska | 731 | 731 | 0 |

| 12 | Colorado | 730 | 731 | 1 |

| 12 | Utah | 730 | 731 | 1 |

| 12 | Maine | 728 | 731 | 3 |

| 16 | Iowa | 729 | 730 | 1 |

| 17 | Idaho | 727 | 729 | 2 |

| 18 | Connecticut | 725 | 726 | 1 |

| 19 | New Jersey | 724 | 725 | 1 |

| 20 | Wyoming | 723 | 724 | 1 |

| 21 | Pennsylvania | 723 | 723 | 0 |

| 21 | Kansas | 721 | 723 | 2 |

| 23 | Alaska | 723 | 722 | -1 |

| 23 | Rhode Island | 723 | 722 | -1 |

| 23 | California | 721 | 722 | 1 |

| 23 | Virginia | 721 | 722 | 1 |

| 27 | New York | 721 | 721 | 0 |

| 28 | Illinois | 719 | 720 | 1 |

| 29 | Michigan | 718 | 719 | 1 |

| 30 | Maryland | 716 | 716 | 0 |

| 30 | Ohio | 715 | 716 | 1 |

| 32 | District of Columbia | 716 | 715 | -1 |

| 32 | Delaware | 714 | 715 | 1 |

| 34 | Missouri | 712 | 714 | 2 |

| 35 | Arizona | 712 | 713 | 1 |

| 35 | Indiana | 712 | 713 | 1 |

| 37 | North Carolina | 707 | 709 | 2 |

| 38 | Florida | 707 | 708 | 1 |

| 39 | Kentucky | 702 | 705 | 3 |

| 39 | Tennessee | 702 | 705 | 3 |

| 41 | West Virginia | 700 | 703 | 3 |

| 42 | Nevada | 702 | 702 | 0 |

| 42 | New Mexico | 699 | 702 | 3 |

| 44 | South Carolina | 696 | 699 | 3 |

| 45 | Arkansas | 694 | 696 | 2 |

| 45 | Oklahoma | 693 | 696 | 3 |

| 47 | Georgia | 694 | 695 | 1 |

| 47 | Texas | 693 | 695 | 2 |

| 49 | Alabama | 691 | 692 | 1 |

| 50 | Louisiana | 689 | 690 | 1 |

| 51 | Mississippi | 680 | 680 | 0 |

Perfect 850 FICO Score

Believe it or not, some consumers have a perfect 850 FICO Score, representing just 1.7% of the U.S. population (as of April 2023). Then again, that’s more than double the percentage who reached perfection in April 2013 (0.8%), so it’s a milestone that more people are reaching.

The state and metro with the highest percentage of perfect score holders in their population are Hawaii (2.6%) and San Francisco (3.0%). Two key attributes of the top credit scorers: Their average revolving credit utilization is 4.1%, while the average age of their oldest account is 30 years old. This goes with the theme of people with access to higher amounts of credit (and low balances) and many years of positive credit history (and therefore older) having the best chance of reaching the top credit tier.

Average credit score: VantageScore

While the FICO Score was the undisputed gold standard for many years, VantageScore has made major strides in the past decade-plus, Schulz says. VantageScore is similar to FICO in some ways, but there are distinctions. For starters, the credit score range is also 300 to 850, but the tiers look different:

VantageScore ranges

| Category | Score |

|---|---|

| Very poor | 300 to 499 |

| Poor | 500 to 600 |

| Fair | 601 to 660 |

| Good | 661 to 780 |

| Excellent | 781 to 850 |

Another key difference is that while FICO has separate scores for each of the credit bureaus (Experian, Equifax and TransUnion), VantageScore is calculated using data from all three credit reports. In fact, VantageScore was created as a collaboration between the three bureaus in 2006.

One thing the scores have in common is that the average VantageScore in the U.S. is also in the good range — 702 — as of March 2024. The average VantageScore has also risen in recent years, jumping 16 points (from 686) since March 2020.

Average VantageScore since 2020

| Month/year | Avg. VantageScore |

|---|---|

| March 2024 | 702 |

| March 2023 | 701 |

| March 2022 | 697 |

| March 2021 | 693 |

| March 2020 | 686 |

However, just 61% of Americans have at least a good VantageScore (661 or better), compared with 71.3% with at least a good FICO Score (670 or better). Yet, the percentage with an excellent VantageScore — 23% — is higher than those with an exceptional FICO Score (21.2%). However, you should note that VantageScore has a wider score range at the top.

Average, by age and race

Just as with FICO, time is on your side when it comes to VantageScore, though baby boomers slightly edge out the silent generation, 740 to 738. However, baby boomers’ average is significantly ahead of Gen Zers’ (663), which is just a hair into the good range.

Average VantageScore, by age

| Generation | Avg. VantageScore |

|---|---|

| Baby boomer (59 to 77) | 740 |

| Silent generation (78+) | 738 |

| Generation X (43 to 58) | 705 |

| Millennial (27 to 42) | 683 |

| Generation Z (18 to 26) | 663 |

However, there are bigger VantageScore disparities when it comes to race. According to the Urban Institute, the median credit score in majority white communities is 100 points higher than in majority Black communities — 727 (good) versus 627 (fair). Majority Hispanic communities are in the middle, averaging 667, while majority Native American communities are at the bottom, averaging 612, according to the August 2021 data.

“There are plenty of possible reasons, but lower income levels in the Black community likely play a role,” Schulz says. While income isn’t directly factored into your credit score, he notes that it indirectly affects it. “Income does play into how much credit you are given with that new credit card. The more credit you have access to, the more likely you are to keep your credit utilization low and the more likely you are to have a better credit score. These things matter.”

It can also be a trickle-down effect from generations of systemic economic barriers. According to the Joint Center for Housing Studies at Harvard University, Black Americans are less likely to be homeowners, with a 41.7% homeownership rate nationally — 30 percentage points below white households. Paying rent on time is generally not reported as a positive activity on credit reports (unless you proactively use a rent-reporting service), while paying a home loan gets reported.

Black Americans are also more likely to default on their student loan debt — 50%, versus 29% of white borrowers, according to a 2023 Pew article — which can drag scores down.

Median VantageScore, by race

| Race (majority community) | Median VantageScore |

|---|---|

| White | 727 |

| Hispanic | 667 |

| Black, non-Hispanic | 627 |

| Native American | 612 |

Average, by state

In looking at state VantageScore averages, there was little variation at the top and bottom from the FICO Score findings. Once again, Minnesota residents have the best credit, averaging a 728 VantageScore. No. 2 on the list (and fourth for FICO Score) is New Hampshire (726), while Vermont (724) takes the third spot.

Mississippi (668), Louisiana (675) and Alabama (679) are once again the bottom three, and each of the bottom 10 states for average VantageScores are in the South.

Average VantageScore, by state

| Rank | State | Avg. VantageScore |

|---|---|---|

| 1 | Minnesota | 728 |

| 2 | New Hampshire | 726 |

| 3 | Vermont | 724 |

| 4 | Washington | 722 |

| 5 | Massachusetts | 721 |

| 5 | Wisconsin | 721 |

| 7 | Hawaii | 720 |

| 8 | Colorado | 719 |

| 8 | South Dakota | 719 |

| 10 | Montana | 718 |

| 10 | North Dakota | 718 |

| 12 | Idaho | 717 |

| 12 | Maine | 717 |

| 12 | Oregon | 717 |

| 12 | Utah | 717 |

| 16 | Nebraska | 715 |

| 17 | Connecticut | 714 |

| 17 | Iowa | 714 |

| 19 | New Jersey | 713 |

| 20 | Alaska | 712 |

| 21 | Virginia | 711 |

| 21 | Wyoming | 711 |

| 23 | Rhode Island | 710 |

| 24 | Pennsylvania | 709 |

| 25 | California | 708 |

| 26 | Illinois | 707 |

| 26 | Kansas | 707 |

| 28 | New York | 706 |

| 29 | Delaware | 705 |

| 29 | Michigan | 705 |

| 31 | Maryland | 704 |

| 32 | Arizona | 701 |

| 32 | Ohio | 701 |

| 34 | Missouri | 700 |

| 35 | Indiana | 699 |

| 36 | Florida | 698 |

| 36 | North Carolina | 698 |

| 38 | Tennessee | 693 |

| 39 | New Mexico | 691 |

| 40 | Nevada | 690 |

| 41 | South Carolina | 688 |

| 42 | Kentucky | 687 |

| 42 | West Virginia | 687 |

| 44 | Georgia | 682 |

| 45 | Arkansas | 681 |

| 45 | Oklahoma | 681 |

| 45 | Texas | 681 |

| 48 | Alabama | 679 |

| 49 | Louisiana | 675 |

| 50 | Mississippi | 668 |

4 tips to improve your credit score

Overall, Americans are doing better than ever when it comes to credit. But even if you’re in the good range like the majority of consumers, getting your credit score up into the excellent or exceptional tier can bring with it a lot of advantages and savings on future borrowing costs. Here are some key strategies to help your score soar.

- Know where you stand. According to a LendingTree survey published in August 2022, 19% of Americans don’t know their credit score — a figure that jumps to 44% among Gen Zers. “We talk a lot about credit scoring, but your credit report is the most important thing,” Schulz says. That’s because your credit score is a numerical grade for what’s on your credit report. Because mistakes happen, often the only way to catch them is to check your credit report from all three major bureaus. You can do it for free once a week at AnnualCreditReport.com, then sign up to monitor your TransUnion credit report and your VantageScore on an ongoing basis at LendingTree. Many credit cards also let you see your credit score for free.

- Pay bills on time. “Nothing matters more than this,” says Schulz, pointing out that it’s the No. 1 credit score factor for both FICO and VantageScore. For a FICO Score, payment history accounts for 35% of the calculation, while VantageScore weighs it even more heavily at 40%. “Autopay can be a huge help,” he adds. “Set it up to pay at least the minimum but ideally much more than that.”

- Watch those balances. Utilization is part of the second most important factor in FICO credit scoring formulas, and it represents 20% of the VantageScore. “Of course, the best way to improve your utilization is to pay off your balances, but you can also impact the other half of the equation by ramping up your credit limit,” Schulz says. Just make sure to leave that newly available credit unused. Otherwise, you risk digging that hole even deeper.

- Use credit. About 26 million U.S. adults don’t have a credit history, making them “credit invisible,” according to a 2015 Consumer Financial Protection Bureau report. “There’s little in life that’s more expensive than having crummy credit, but having no credit isn’t great either,” Schulz says. Your best move is to start building credit early — and responsibly. “Do that with a secured credit card or even being made an authorized user on a trusted friend or relative’s credit card account,” he suggests. The sooner you get started proving your ability to handle credit, the better off you will be when you’re older.

Sources

- Experian

- FICO

- VantageScore

- USA Today

- Urban Institute

Learn more about your credit score

Want to know your credit score? Click here.

Learn more about credit repair companies!

How is my credit score calculated?

Get debt consolidation loan offers from up to 5 lenders in minutes