Nearly 40% of Americans Will Spend Less on Football This Season Due to Economy

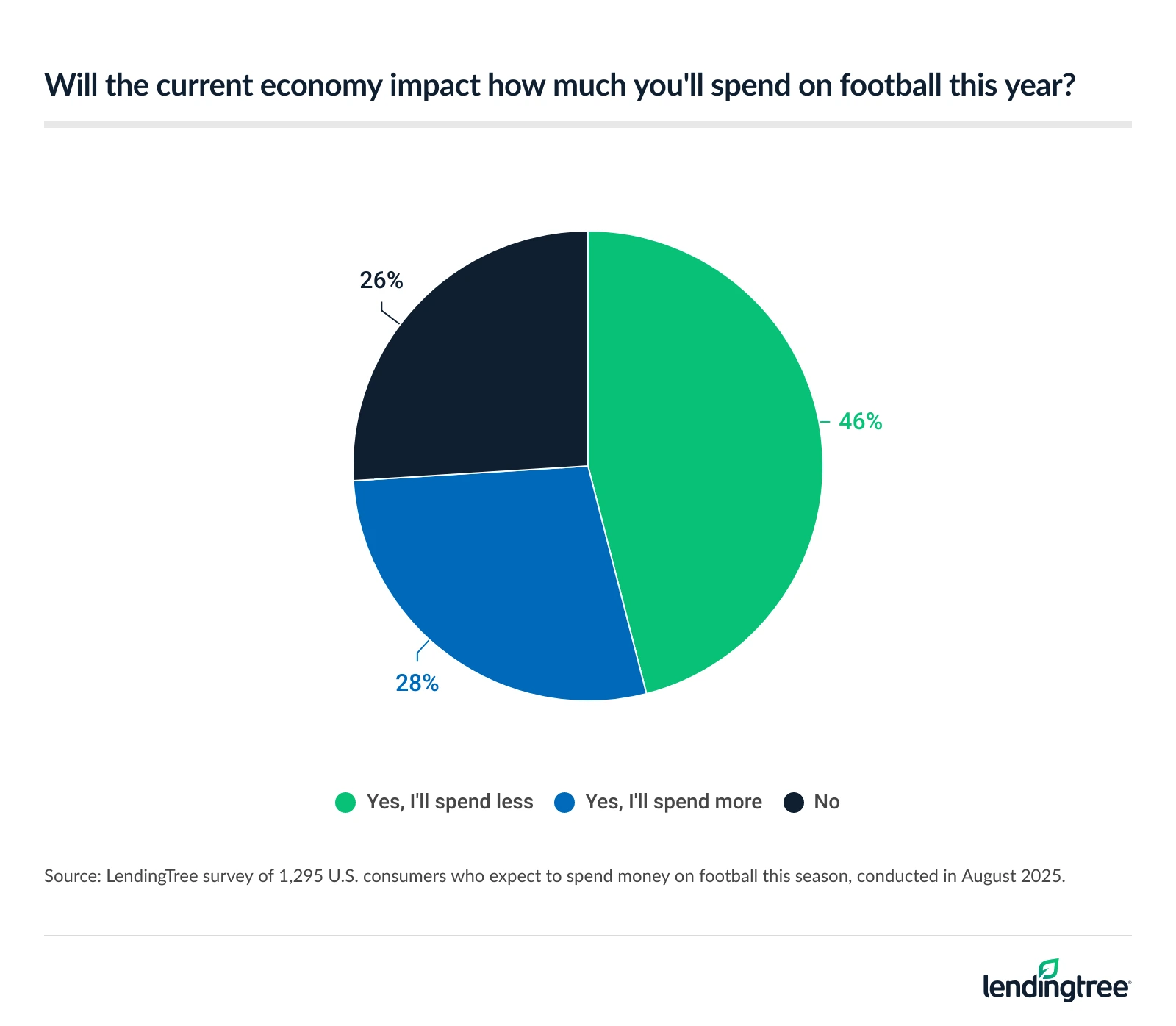

Nearly 4 in 10 Americans say they’ll spend less money on football this year because of the economy.

LendingTree asked 2,000 Americans about their spending plans this football season. While about two-thirds of Americans say they’ll spend money on our nation’s favorite game, it’s clear that economic uncertainty is impacting plans, leaving many people expecting to take on debt along the way.

Here’s what we found.

Key findings

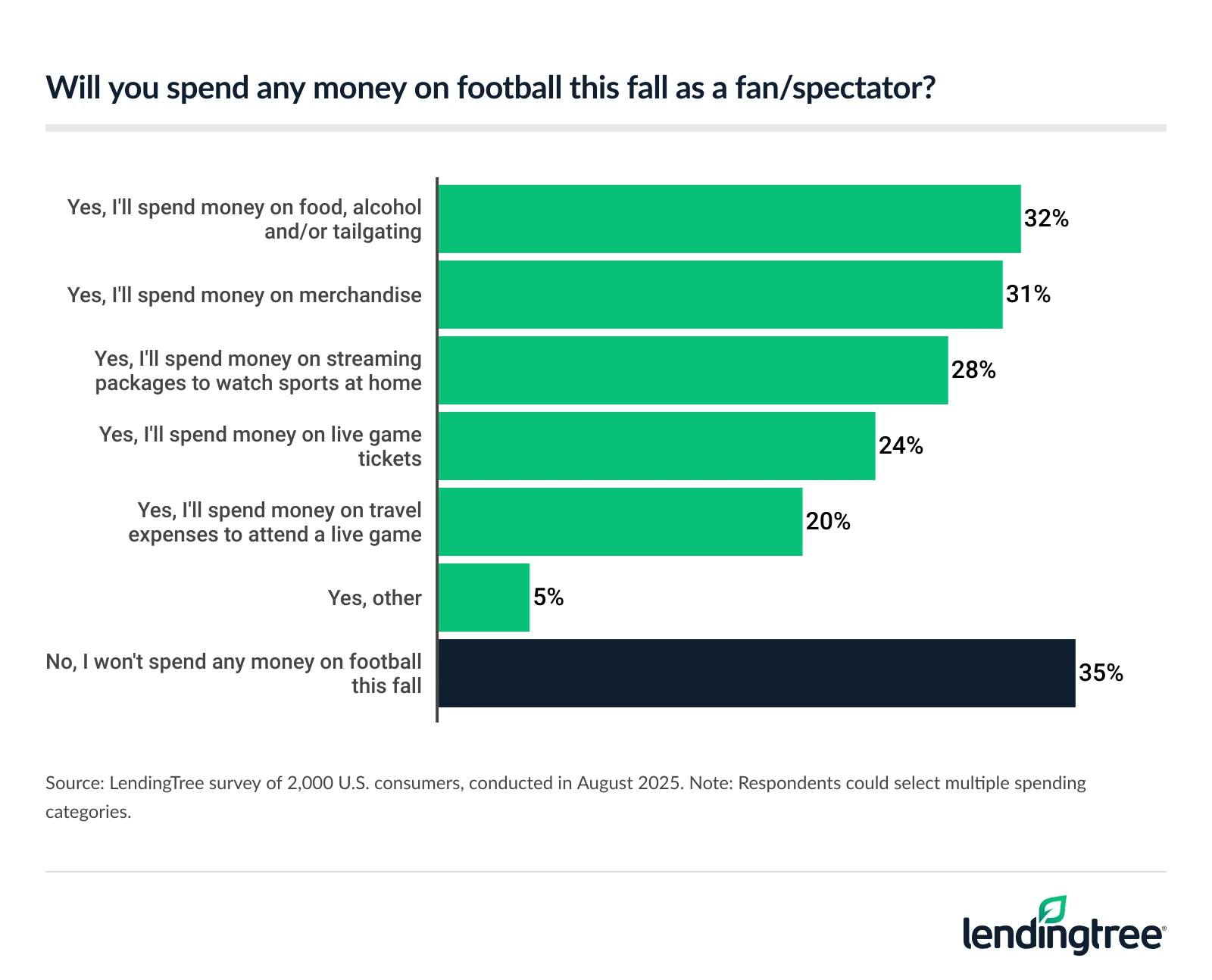

- Nearly two-thirds of Americans plan to spend money on football this season. 65% expect to shell out money, specifically on food, alcohol or tailgating (32%), merchandise (31%), streaming packages (28%), live game tickets (24%) and travel (20%). And 37% expect to spend four hours or longer weekly engaging with football content.

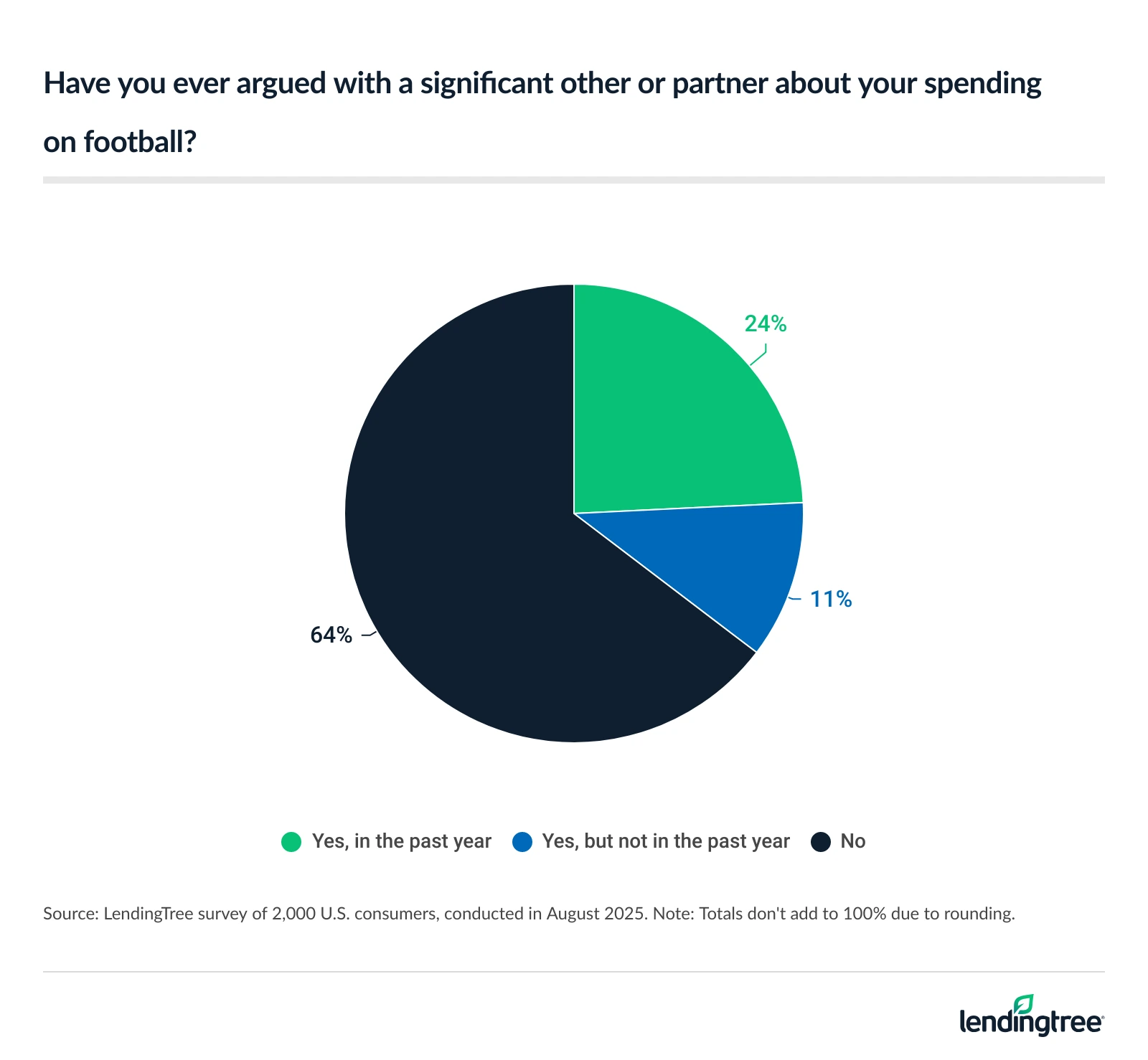

- The economy is reshaping football fans’ spending plans. 37% of Americans say they’ll spend less on football this season because of the economy. Among those who say they’ll spend on football this year, that figure rises to 46%. Additionally, 36% of Americans admit to arguing with a partner about their spending on football, with 45% of men citing this heat (versus 27% of women).

- Half of football spenders could take on related debt. 26% say they will, and 25% say they might. 15% of spenders plan to use buy now, pay later (BNPL) for football expenses, led generationally by Gen Zers (24%) and millennials (17%). 45% of Americans say they’re concerned with the number of streaming platforms they’ll need to watch every game they want to this season.

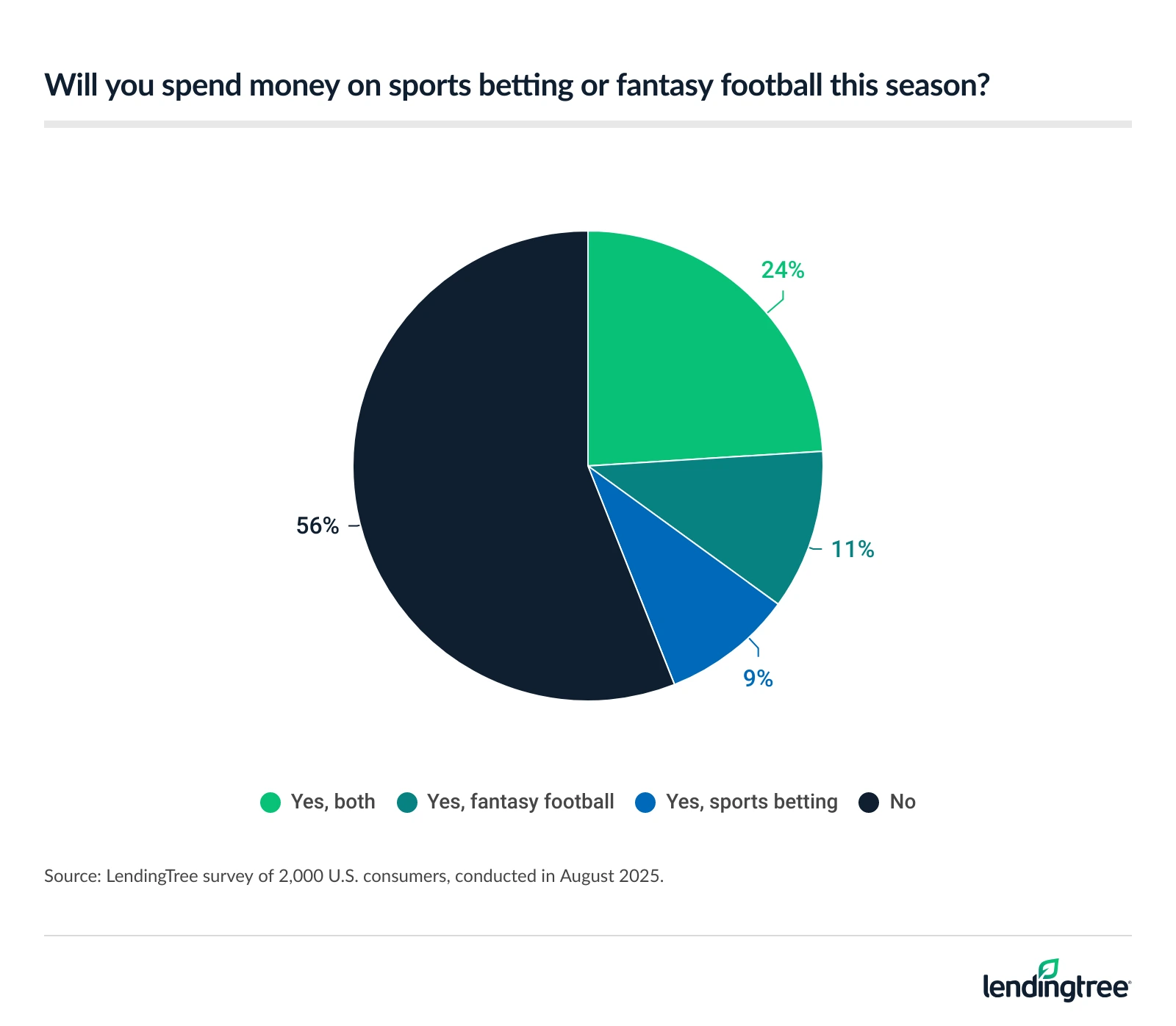

- Betting and fantasy eclipse team support in many budgets. 44% will spend on sports betting and/or fantasy, with 77% of them spending more on it than supporting their favorite team. 40% of sports bettors or fantasy players admit they’re willing to lose $500 or more, and an overwhelming 91% feel confident they can manage gambling responsibly.

Nearly two-thirds of Americans plan to spend money on football this season

Few things unite us like our love of football. About 2 in 3 Americans (65%) say they’ll spend money on the game this fall. That figure soars to 83% among parents of young kids and people earning $100,000 or more a year, 79% among Gen Zers ages 18 to 28 and 74% among men.

The most common expenditure is food and alcohol for tailgates, live games and/or watch parties. About 1 in 3 Americans (32%) say they’ll spend on that this season, slightly more than the 31% who say they’ll spend on merchandise and the 28% who plan to spend on streaming packages to watch games at home. Spending on game tickets (24%) and travel expenses for live games (20%) aren’t far behind.

The most common expense among men planning to spend on football is food and alcohol (36%), while the most common expense among women is merchandise (29%).

Money isn’t the only thing people are spending on football either. They’re spending a lot of time, too, with 37% expecting to spend four hours or longer each week engaging with football content. That includes 7% who’ll devote more than 10 hours a week to the game they love.

Economy reshaping football fans’ spending plans

Challenging economic times often force sacrifice, and almighty football isn’t immune.

Nearly 4 in 10 Americans (37%) say they’ll spend less on football this season because of the economy. If you include only those who say they’ll spend on football this year, that figure shoots higher to 46%, while 28% say they’ll spend more.

Across all Americans, Gen Xers ages 45 to 60 and parents of young kids (both at 42%) are the most likely groups to say they’ll spend less on football this season. None of the demographics we analyzed saw a larger percentage of people saying they’d spend more this year than saying they’d spend less. Those earning $100,000 or more a year were closest, with 34% expecting to spend less and 33% expecting to spend more.

That spending can be a sore point in relationships. Our survey found that 36% of Americans say they’ve argued with a partner about their own spending on football, including 24% who say it’s happened in the past year.

Men are far more likely than women to have had their football spending spur an argument (45% versus 27%).

Half of football spenders could take on related debt

Among those who say they’ll spend money on football-related expenses this season, 26% say they’ll take on debt and another 25% say they might.

Nearly 4 in 10 parents of young kids (39%) say they’ll take on debt from football spending this season. Perhaps surprisingly, 38% of people making $100,000 or more a year say the same, the highest of any income bracket.

Millennials ages 29 to 44 are the most likely age group to say so, at 34%, while men are significantly more likely than women to say the same (31% versus 19%).

While many football spenders plan to pay for some of their purchases with a debit card (57%) or cash (49%), 46% say they’ll use credit cards for at least some of them and 15% plan to use buy now, pay later (BNPL). Gen Zers (24%) and millennials (17%) are the most likely age groups to lean on BNPL.

Our survey suggests that the proliferation of streaming services is a significant pain point for football fans: 45% of Americans report being concerned about the number of streaming platforms required to watch every game they want to this season. Men are far more likely than women to express this concern (56% versus 34%).

Betting, fantasy often eclipse team support in budgets

More than 4 in 10 Americans (44%) will spend money on sports betting and/or fantasy football this season, including 24% who’ll spend on both.

Nearly two-thirds of Gen Zers (65%) say they’ll spend money on sports betting and/or fantasy football, as will 62% of people earning $100,000 or more a year and 55% of men.

Sports betting and fantasy sports are so big that 77% of those who’ll partake in one or both activities say they’ll spend more on them this season than they will in supporting their favorite real-life football team.

Most sports bettors and fantasy players (57%) say they’ll spend less than $500 this football season on those activities, while 10% say they’ll spend $2,000 or more.

When it comes to what they’d be willing to lose, 60% say less than $500, including 17% who say less than $50. Four in 10 Americans say they’d be willing to lose $500 or more, including 5% who’d be willing to lose $2,500 or more.

Meanwhile, 91% of sports bettors and fantasy players — including 93% of men — say they feel confident they can manage gambling responsibly.

Proceed with caution

Football is our nation’s passion. Whether you prefer high school Fridays, college Saturdays or pro Sundays, it’s OK to spend your money and time pursuing that passion. Just make sure you do it in moderation.

Here are some tips to help.

- Budget for it. I’ve said it a million times: If you’re passionate about something and you spend a significant amount on it — no matter what it is — it belongs in your budget. That’s the best way to ensure you can pursue that passion responsibly.

- Know your limits. Stories about famous athletes and celebrities dropping thousands on a single casino bet or on the golf course are legendary. However, doing something like that would be profoundly irresponsible for most of us — even financially devastating. Taking the time to understand your boundaries on what you’re willing to spend, whether on gambling, merchandise, travel or another aspect of football, is crucial in managing your football spending.

- Communicate. As our survey shows, football-related spending is a real source of friction in many households. However, much of that tension could be defused by open and honest conversations ahead of time. Chances are that your partner doesn’t want to keep you from enjoying what you love. They just don’t want to be in the dark about how much you spend on it, only to be blindsided by a bunch of debt they didn’t know about. Talk to your partner. Listen to their point of view. Share your own. And come to a compromise that everyone can live with.

- Leverage credit card rewards and 0% offers. The right credit card, used wisely, can make a difference in your finances. Whether you’re getting 2% or more cash back on what you buy or you’re cashing in points and miles for free (or almost free) airfare and hotel nights, credit card rewards can extend your football fan budget significantly. Also, many cards come with 0% APR offers on new purchases during a specified intro period. If you know you have big-ticket purchases in your future, it can be worth considering getting a new credit card and taking advantage of that 0% period. It can save you real money. Just make sure you’re confident you can manage those cards responsibly.

And if you feel as if your gambling (or that of someone you know) has gotten out of control, seek help. Groups such as the National Problem Gambling Helpline (1-800-GAMBLER) are available 24 hours a day, seven days a week.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from Aug. 13 to 16, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Get debt consolidation loan offers from up to 5 lenders in minutes