Two-Thirds of Newlyweds Went Into Debt for Their Wedding, and a Third Felt Pressured to Overspend

For generations, “something borrowed” has symbolized shared happiness on a couple’s special day. For the majority of today’s brides and grooms, this phrase takes on a different meaning — financial debt.

Of the newlyweds we surveyed, 67% say they went into debt to pay for their wedding. Around a third went over their budget. Learn what couples spent, where they spent it and what they wish they had done differently in LendingTree’s survey.

Key findings

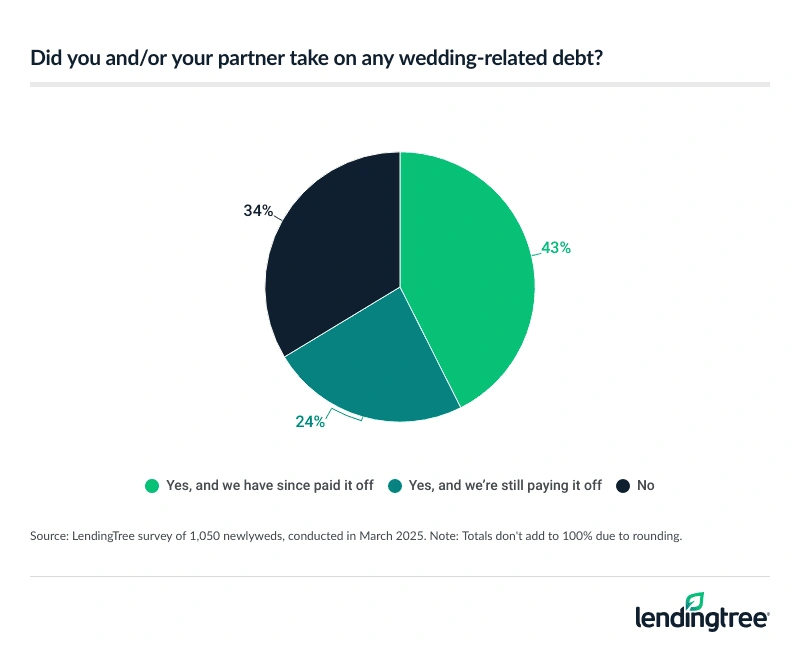

- Tying the knot leaves many newlyweds tied up in debt. To pay for their big day, 67% of newlyweds say they took on wedding-related debt, with 24% borrowing and still paying it off. Of those still in the hole, 41% say it’ll take them at least a year to finish paying. Nearly half (46%) of newlyweds say they primarily paid for their wedding with their savings, with another 24% saying credit cards and 16% saying help from parents or relatives.

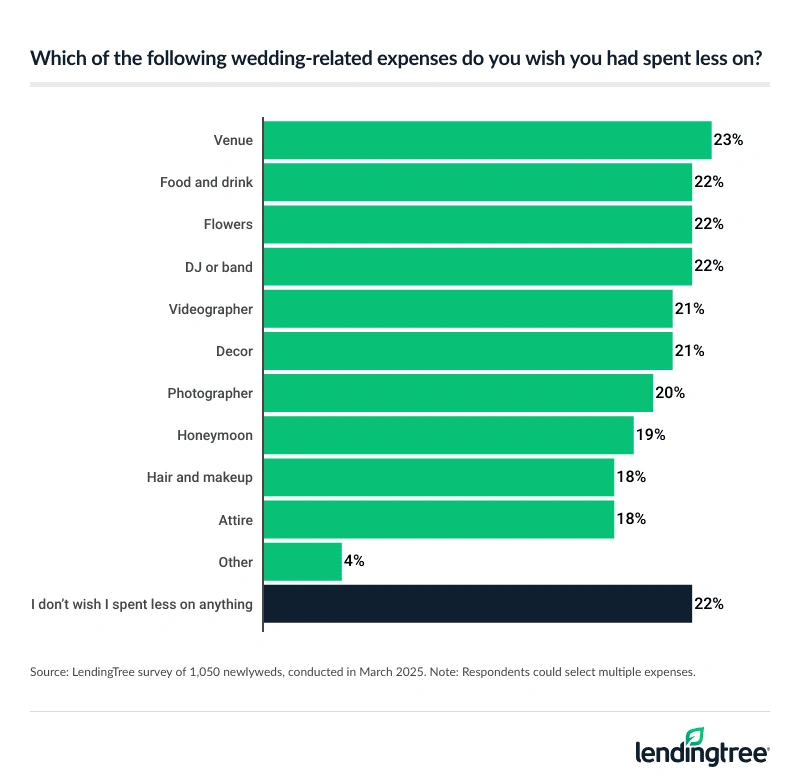

- Many overspent to impress their guests. A third (34%) of newlyweds say they felt pressured to spend beyond their means to impress their wedding guests, which may be why 32% say they blew past their wedding budget. With hindsight being 20/20, many newlyweds say they wish they had spent less on the venue, catering, flowers and the DJ/band.

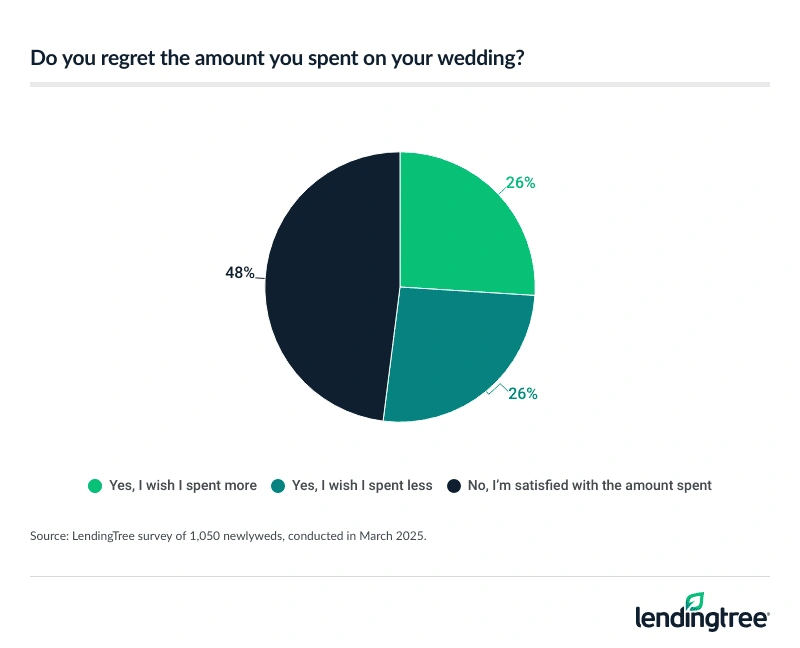

- Most couples have wedding spending regrets, either spending too much or too little. Of the 52% of newlyweds who regret how much they spent on their wedding, half wish they spent less and half wish they spent more. In particular, the top wedding expense newlyweds wish they spent more on was their honeymoon.

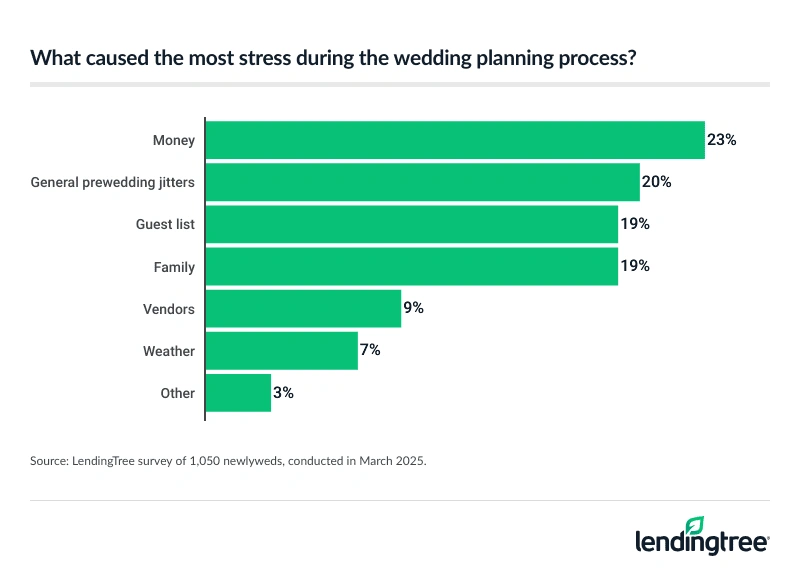

- Financial stress triggers trouble in paradise. Over half (53%) of newlyweds say they had financial arguments with their partner before or after their wedding. Money was the top wedding planning stressor at 23%, ahead of prewedding jitters (20%) and the guest list (19%).

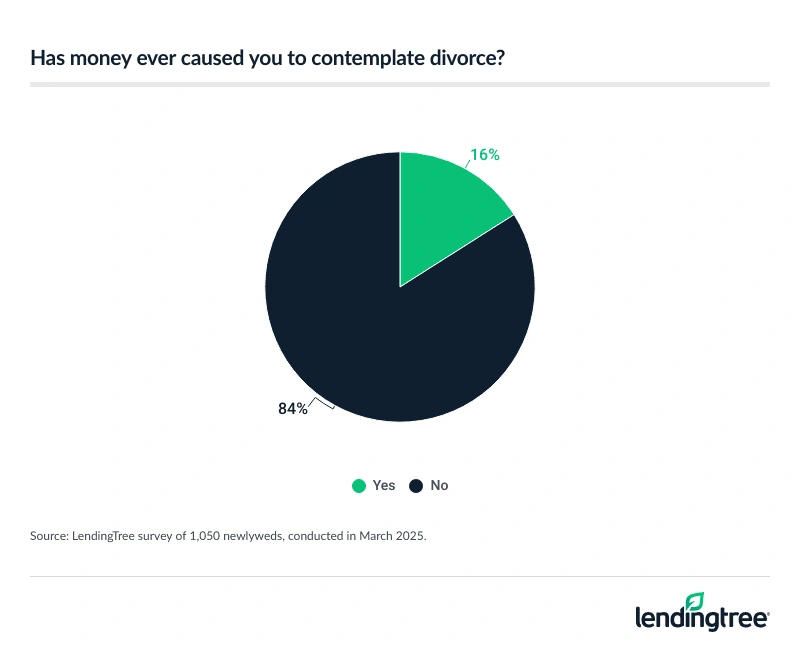

- Money is causing some newlyweds to consider untying the knot. Some newlyweds (16%) say money has already caused them to contemplate divorce. Digging deeper, 19% of those married between six months and a year ago say this.

67% of newlyweds took on debt to pay for their wedding

If you used a credit card or personal loan to pay for your big day, you aren’t alone. The majority (67%) of the newlyweds we surveyed borrowed to pay for their wedding. Among those who borrowed, less than two-thirds (64%) have paid off what they owe.

Of those that still owe, 47% think they’ll be out of wedding debt in six months to a year. Almost half (48%) of couples married within the last six months took on wedding debt but have since paid it off, a higher rate than for those married longer.

Often, debt has a negative connotation — especially wedding debt. After all, you technically don’t need a wedding to get married, but you might need a car loan or mortgage to survive.

But as Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” explains, wedding debt isn’t always a bad thing, even if the debt isn’t tied to something tangible. Still, communication is key.

“Good debt absolutely exists, and it is debt that comes with a return on investment. However, that return doesn’t always have to be financial. I believe that a dream wedding, vacation or some other experience that brings memories that will last a lifetime and strengthen your bonds with your friends and family has a strong return on investment as well.

“All of this requires discipline, though. Good debt goes bad in a hurry when it is too large or taken on too often, so it’s important to set boundaries for yourself. The best way to do that is through open and honest discussion with your partner.”

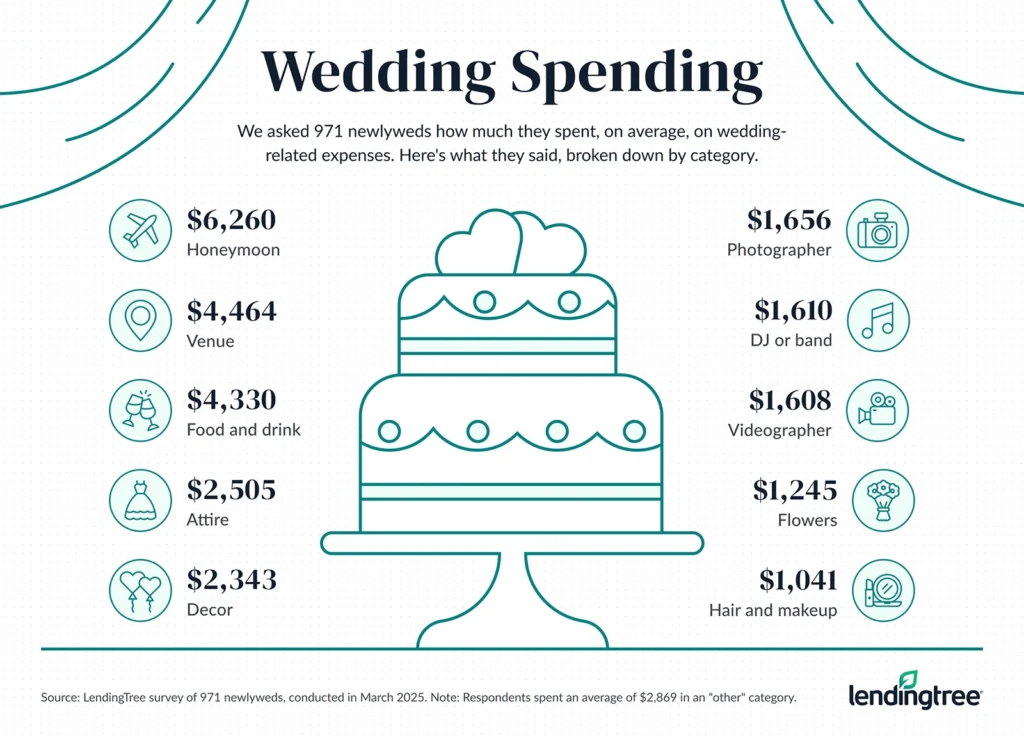

Average wedding expenses

At $6,260 on average, honeymoons were the largest wedding expenses for our survey participants. Even so, 30% wish they spent even more. And 31% of our newlyweds say the honeymoon was worth it the most, compared to other wedding expenses.

A third of newlyweds felt pressured to spend more than they could afford

Scrolling through impossibly perfect wedding inspo posts can make it easy to lose sight of what’s really important — the love you have for your partner. Of the newlyweds we surveyed, 34% felt pressured to spend more than they were comfortable with to impress guests.

Still, not all couples caved. Most stuck close to their budgets (53%), although a not-insignificant 32% went over. Out of the generations we surveyed, millennials (ages 29 to 44) were most likely to go over budget, at 36%.

You might want to consider saving on your wedding by keeping it simple. Most of our surveyed newlyweds regret spending so much on the celebration itself, like the venue, food and drink, flowers and the DJ/band.

How much is the average wedding?

Here’s how much our survey respondents spent on their wedding, honeymoon included. Please note that totals don’t add to 100% due to rounding.

- Less than $10,000: 11%

- $10,000 to $19,999: 14%

- $20,000 to $29,999: 22%

- $30,000 to $44,999: 26%

- $45,000 to $59,999: 17%

- $60,000 or more: 11%

Most newlyweds regret how much they spent on their weddings

More than half of the newlyweds we surveyed wish they had spent differently on their weddings (52%), but not necessarily more. In fact, it was split down the middle — 26% wished they spent more and 26% wished they spent less.

Who are the satisfied 48%? Couples with a lower income, mostly. Newlyweds making less than $30,000 a year were the most satisfied with how much they spent on their wedding (58%). Those making $50,000 to $99,999 were the least satisfied, with only 47% who were OK with how much they spent.

Schulz explains that skipping the hype is key to a wedding day with no financial regrets. “Spend on what really matters to you. Don’t spend on what doesn’t. There are a million things that wedding planners, influencers and websites say that you should spend money on to have the ‘perfect’ wedding, but if you listen to all of it, you’ll end up broke. It is your day. Spend the money around it on things that matter most to you and the ones you love.”

How do newlyweds pay for their weddings?

We asked our newlyweds what they used to primarily pay for their weddings, even if they took out some debt. Although the majority used mostly savings, nearly a quarter leaned on credit cards.

- Savings: 46%

- Credit cards: 24%

- Help from parents/relatives: 16%

- Personal loan: 11%

- We didn’t pay for any wedding expenses: 2%

- Other: 1%

Money was the biggest source of stress during the wedding planning process

Can you trust your family to get along for a few hours? Will the weather hold out during your outdoor ceremony? There’s a lot to get stressed out about when planning a wedding. The biggest one? Money, according to our survey.

We asked newlyweds what caused the most stress while they were planning their wedding. Money tops the list, at 23%. That’s even higher than general prewedding jitters.

Most newlyweds have argued about money — with some already considering divorce

A small number of survey participants say they argued about money both before and after their wedding (9%).

Fighting before the wedding (when stress is presumably highest) was common. About a third (29%) argued about money leading up to the wedding, but only 15% say they fought about money after the wedding.

Money has even led 16% of newlyweds to consider splitting.

Respondents married between six months and a year were the most likely to admit that they’ve contemplated divorce (19%). The number drops to 12% for those married between one and two years ago.

How do newlyweds spend the money they’re gifted?

If you’ve ever wondered what happened to your card after you put it on the gift table, our survey might help. Here’s how our couples spent their monetary wedding gifts.

- Honeymoon: 41%

- Paid off wedding debt: 24%

- Saved it: 22%

- Paid off nonwedding debt: 8%

- Didn’t receive any monetary gifts: 3%

- Other: 2%

For richer or for poorer: Avoiding financial stress during your wedding — and beyond

Communication is key to a happily ever after, and Schulz agrees. When asked what advice he’d give to couples planning their wedding day, he said:

- Figure out what you really want: Talk about what matters the most. Maybe the bachelorette party is a big deal to you, but you don’t care much about the music at your wedding. Maybe your partner has their heart set on a specific wedding venue but isn’t concerned with an open bar. Once you know each other’s priorities, you can use them to craft a budget and guide your spending.

- Stay cool and compromise: It’s important to understand that you’re not going to agree on everything all the time, but if you’re able to have rational, nonjudgmental conversations about money topics on a regular basis, there’s a good chance that you’ll find room for compromise and understanding along the way.

- Talk, talk, talk: Open communication about money today is the best way to avoid money arguments later. Money talk may lead to some awkward conversations around the dinner table, but it is far better to have these discussions early than when things have already gone off the rails. And if your partner refuses to talk about money, consider it a gigantic red flag. Long-term relationships cannot work if the partners are never willing to talk about money.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,050 U.S. newlyweds ages 18 to 79 from March 12 to 19, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Newlyweds are those who got married within the past two years at the time the survey was conducted.

Get debt consolidation loan offers from up to 5 lenders in minutes