APR vs. Interest Rate: What’s the Difference and Why It Matters

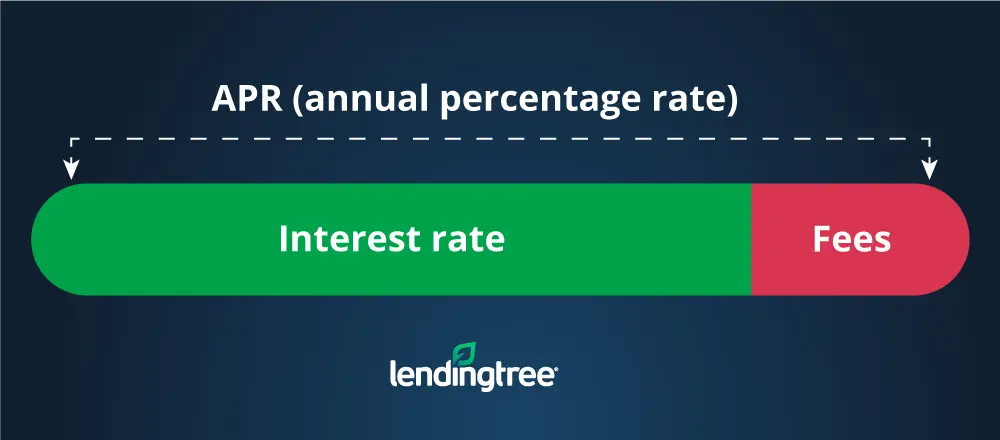

An APR (annual percentage rate) measures the total cost of your loan, plus interest and fees. Your interest rate is how much you’re paying on top of principal (or your original loan amount) to borrow. Both are shown as a percentage.

It can be confusing, especially since some lenders use interest and APR interchangeably. Knowing the difference will give you a better idea of how much your loan will cost you, monthly and over time.

- Interest is the percentage the lender charges you for borrowing money, on top of the loan amount (called the principal). It’s also used to calculate your monthly payments.

- APR measures the total cost of your loan, plus interest and fees. It assumes you’ll keep your loan for its full term.

- Two loans with the same interest rate won’t always cost the same. A loan with a higher APR will cost more over time because it includes extra fees in addition to interest.

APR vs. interest rate: A quick overview

What is an interest rate?

Your interest rate is the base cost of borrowing money. Interest rate doesn’t include fees — it’s simply a percentage of your loan that you’ll be paying on top of your principal. Your principal is the amount you’re borrowing.

There are a couple of ways a lender can calculate interest, including the simple interest method and the compounding interest method.

Simple interest: On a simple interest loan, you’ll only pay interest on the amount you borrowed.

Compounding interest: On a compounding interest loan, you’ll pay interest on your principal and the interest your loan accrues. In other words, you’ll pay interest on your interest.

Most installment loans (like personal loans, auto loans and mortgages) are simple interest. Credit cards, in contrast, tend to have compounding interest. Carrying a balance from billing cycle to billing cycle can be an easy way for debt to get away from you.

What is an APR?

Your APR shows you how much you’re really paying once fees are included. It also assumes you’re keeping your loan until the end of its term.

APRs usually work in one of two ways:

- Fixed-rate APRs: With a fixed-rate, your interest stays the same throughout the life of your loan. Personal loans, auto loans, home equity loans and some mortgages are fixed-rate loans.

- Variable APRs: Variable APRs go up and down with market conditions. Your monthly payments will vary, depending on the rate you’re paying at the time. Credit cards, personal lines of credit, home equity lines of credit and some mortgage loans have variable rates.

APRs are usually more accurate when it comes to comparing loan prices because they include interest and fees.

APR vs. interest rate on mortgage loans

You should usually focus on APR instead of interest rates when you’re loan shopping — but with mortgages, that’s not always the case.

You might want to pay more attention to interest rates if:

- You don’t plan on staying in the home long.

- You think you’ll refinance your mortgage sooner rather than later.

If you only keep the loan for a few years, your APR isn’t as important, since it applies to the loan’s full term. This is especially true with mortgages, where your APR and interest rate could be very different because of mortgage points and origination fees.

In that case, take a close look at interest rates. A higher APR with a lower interest rate might end up a better deal if you close the loan early.

Understanding the APRs on variable- and adjustable-rate loans

So far, we’ve only been working with fixed-rate loans in our examples.

Comparing APRs on variable-rate loans, including adjustable-rate mortgages (ARMs), can be like trying to hit a moving target. With these loans, interest rates usually start lower than their fixed-rate alternatives but can go up over time.

If you want to compare ARM rates using APR, you’ll need to understand that the APR won’t reflect the maximum interest rate the loan could reach. To compare ARMs, it’s also important to compare apples to apples — a 30-year fixed to 30-year fixed, 5/1 ARM to 5/1 ARM and so on.

ARMs are structured so that the lower APR is only fixed for an initial period, usually between one month and 10 years. Once that time is up, the loan will “adjust” according to a benchmark interest rate known as an index.

The lender will then also add a margin — a set amount of percentage points — to the index in order to calculate your interest rate. The timetable associated with an ARM’s fixed and adjustable periods will be right in its name: In the case of a 5/1 ARM, for example, the rate is fixed for the first five years and then adjusts annually thereafter.

Comparing APR vs. interest rate on other types of loans

We’ve reviewed how APR and interest works on mortgages. Let’s take a look at other types of loans.

Personal loans

Origination fees are the most common type of fee that can drive up a personal loan APR.

When you’re shopping for a personal loan, don’t get your hopes up when you see a company’s advertised minimum APR. Unless you’re getting a no-fee loan, your APR will probably be higher because of origination fees.

If the company charges an optional origination fee, the lowest APR assumes your loan won’t have one. If all loans get an origination fee and that fee is presented as a range (1% to 5%, for example), the minimum APR is based on the lowest origination fee possible.

The best way to cut out the guesswork is to prequalify. It doesn’t hurt your credit score and it’ll give you a better idea of what to expect.

Auto loans

Auto loan APRs can include doc fees, loan processing fees and options like extended warranties.

If the dealer is setting up your auto loan and you notice a big spread between your APR and interest rate, you could be getting charged dealer fees for a bunch of add-ons. Review your contract carefully.

In addition, lenders generally let dealers add a couple of percentage points to your interest rate as a commission. This inflated rate is called a “sell rate” — the “buy rate” is your interest rate, minus this markup.

Consider getting a preapproved car loan before heading to the lot. Shopping for your own loan makes sure that what you see is what you really qualify for.

Credit cards

With credit cards, APR and interest rate usually mean the same thing. However, different credit card transactions can have different rates, even on the same card.

Credit card APR is a little different compared to other types of loans — for one, it’s variable. It doesn’t include your annual fee or any other credit card fees you might have.

Credit cards also have different APRs, depending on what you’re using it for. For example, you’re probably going to pay a different APR on purchases than you would a cash advance.

In an ideal world, you should pay your credit card balance in full every month. If you do, you won’t have to worry about paying interest at all.

Get banks to compete for your business with LendingTree

Curious how much you could save with LendingTree? We were too, so we conducted some studies. On a 30-year, fixed-rate mortgage, you could save over $80,000 on average in interest by shopping around. For personal loans, LendingTree shoppers can save an average of $1,659.

We’ve been America’s premier loan shopping site since 1996 — here’s how it works.

Tell us what you need. Answer basic questions about who you are and how much money you need — we’ll take care of the rest. It’s free, simple and secure.

Shop your offers. We’ll send you offers from up to five trusted lenders. Compare your offers side by side to see which one will save you the most money.

Get your money. Choose a lender and finalize your loan quickly. You could see money in your account within 24 hours, depending on the type of loan you need and the lender you choose.

4 tips to remember when you’re loan shopping

- Focus on APR vs. interest rate based on your needs. It makes sense to focus on interest rate if you care most about getting the best deal on your monthly payments. If you’re more concerned about saving money in the long haul, give more weight to APRs.

- Keep the loan term in mind. You might be tempted to get a loan with a longer term because of its lower monthly payments. However, it’s important to remember that you’ll pay more in interest over the life of the loan with a longer term.

- Ask about additional fees. Although APRs can be a powerful comparison tool, they aren’t foolproof — especially when it comes to mortgage loans. Mortgage lenders are required to include certain costs in their APR calculations, but there are additional fees (your appraisal fee, for example) that may not be represented in the APR.

- If buying discount points, calculate a “break-even point.” When you pay for mortgage points, you’re essentially paying some interest upfront to receive a lower interest rate in return. But if you don’t stay in the home long enough, you won’t recoup what you spent on points.

To calculate a break-even point, divide the amount you paid in points by the amount you stand to save each month due to the lower rate. The result will be the number of months you need to remain in the home in order to break even.

Get personal loan offers from up to 5 lenders in minutes