A Single Home in San Jose or More Than Half a Dozen in Buffalo? How Home Prices in the Silicon Valley Capital Compare to the Rest of the Country

While tales of high housing costs in the San Jose, Calif., metropolitan area are nothing new, it can still be difficult to put into perspective just how expensive the metro is.

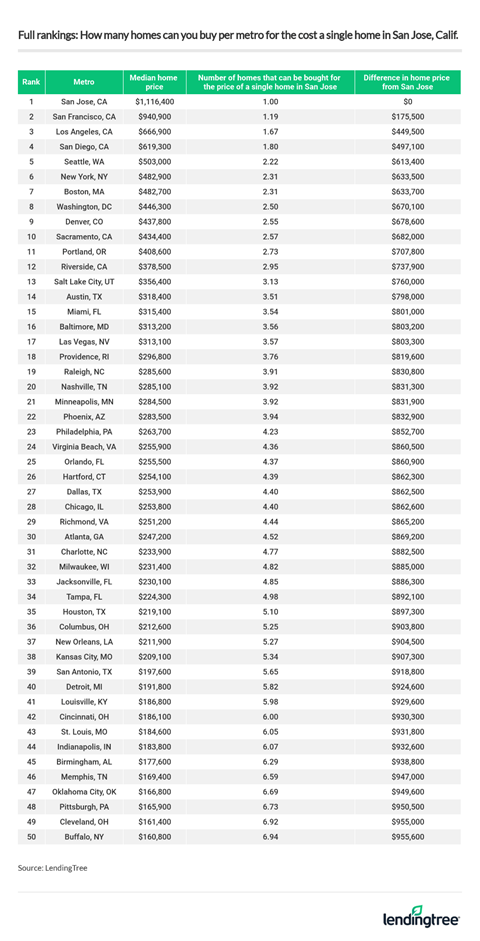

With that in mind, LendingTree compared housing costs in the Silicon Valley capital with housing costs in the nation’s other 49 largest metros. Namely, LendingTree used U.S. Census data to determine how many median-priced housing units, single-family or otherwise, a person could buy for the cost of a single, median-priced home in San Jose.

Ultimately, LendingTree’s study found that for the cost of a one housing unit in San Jose, a buyer could purchase up to seven homes in other parts of the country.

Key findings

- At a cost of $1,116,400, a single, median-priced home in San Jose, Calif. is worth an average of 4.3 homes in another one of the nation’s largest metros. There are many factors that contribute to the steep price of homes in the area, like the prevalence of wealthy buyers, a dense population and a lack of housing supply.

- San Francisco is the metro with housing costs that are the closest to those in San Jose. Nonetheless, at a cost of $940,900, a median-priced home in San Francisco is $175,500 cheaper than a median-priced home in San Jose.

- Even in areas known for their high real estate prices, like Seattle and New York, a buyer could afford two homes for the price of one in San Jose. In Seattle, the median home value difference is $613,400 less than in San Jose; in New York, the difference is $633,500.

- For the cost of a single home in San Jose, a person could buy nearly seven houses in Buffalo, N.Y., the metro with the least-expensive housing in LendingTree’s study. A median-priced home in Buffalo costs $160,800, meaning that a person could buy 6.9 homes there for the cost of one home in San Jose.

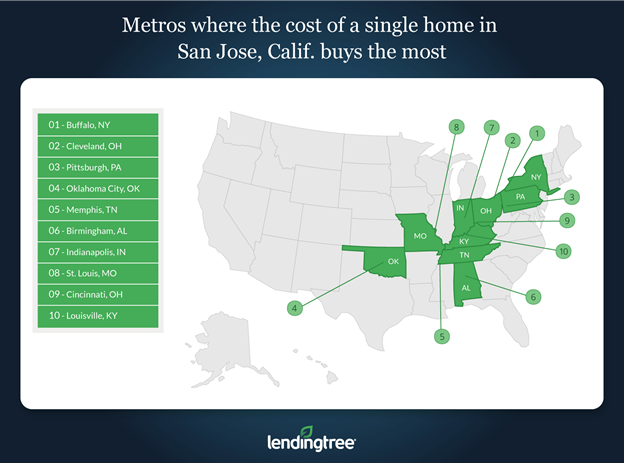

Metros where the cost of a single home in San Jose buys the most

1: Buffalo, N.Y.

- Median home price: $160,800

- Difference between the median home prices in the two cities: $955,600

- Number of homes that can be purchased for the cost of a single home in San Jose: 6.94

2: Cleveland

- Median home price: $161,400

- Difference between the median home prices in the two cities: $955,000

- Number of homes that can be purchased for the cost of a single home in San Jose: 6.92

3: Pittsburgh

- Median home price: $165,900

- Difference between the median home prices in the two cities: $950,500

- Number of homes that can be purchased for the cost of a single home in San Jose: 6.73

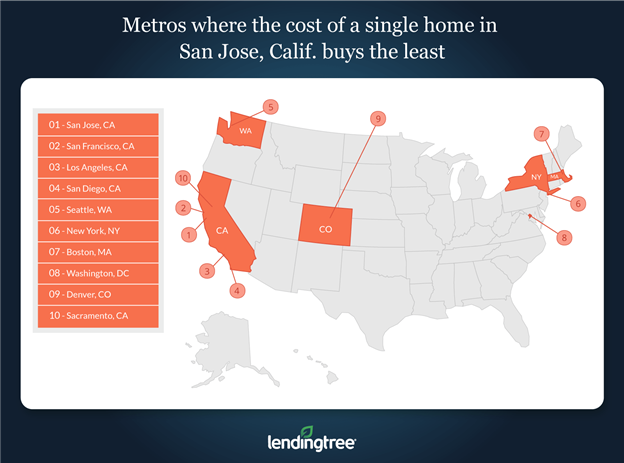

Metros where the cost of a single home in San Jose buys the least

1: San Francisco

- Median home price: $940,900

- Difference between the median home prices in the two cities: $175,500

- Number of homes that can be purchased for the cost of a single home in San Jose: 1.19

2: Los Angeles

- Median home price: $666,900

- Difference between the median home prices in the two cities: $449,500

- Number of homes that can be purchased for the cost of a single home in San Jose:1.67

3: San Diego

- Median home price: $619,300

- Difference between the median home prices in the two cities: $497,100

- Number of homes that can be purchased for the cost of a single home in San Jose: 1.80

How can homebuyers tackle hot home prices?

As LendingTree’s study shows, homes in places like San Jose are incredibly expensive, relative to most other parts of the U.S. That being said, home prices are hot all across the country, even in areas that aren’t usually known for expensive real estate.

As a result, buyers could face significant price-related challenges no matter where they move. Fortunately, that doesn’t mean that homeownership will be an unachievable goal for them, as there are a few tips that can help them navigate a hot housing market.

Shop around for a mortgage before buying

One reason why people are able to afford homes even in the midst of such steep price increases is because mortgage rates are currently near record lows. But just because rates are low, doesn’t necessarily mean that the first rate you’re offered will be the best rate you can get. By loan shopping before you buy a home, you can potentially get a lower rate and save tens of thousands of dollars over the life of your loan.

Weigh different loan types

There are a variety of different loan types available to borrowers, from conventional 30-year, fixed rate mortgages to FHA and VA loans. Depending on factors including your down payment amount and credit score, applying for a certain type of loan can increase your approval chances and also enable you to afford a more expensive property than might otherwise be the case.

Consider moving somewhere cheaper

Though it might be hard to accept, being priced out of a market does happen. If you’re in a situation where home prices are prohibitively expensive in your desired area, consider moving to a different market. While leaving your dream location might not be ideal, you may find that another part of the country not only better fits your budget, but also your lifestyle.

Methodology

All of the data used in this study comes from the U.S. Census Bureau’s 2019 American Community Survey with one-year estimates (the most recent survey available at the time of this piece’s writing).

Median home value figures refer to the median reported value of all owner-occupied housing units in a given area. According to the Census, “a housing unit is a house, an apartment, a group of rooms or a single room occupied or intended for occupancy as separate living quarters.”

To determine the number of homes that a person could buy per city, LendingTree divided the cost of a median-priced housing unit in San Jose, Calif., by the cost of a median-priced housing unit in each of the nation’s 50 largest metropolitan statistical areas, as determined by population.