Spring EQ Mortgage Review 2026

SpringEQ is best for those looking for home equity loans or lines of credit, but it could be a useful option for those looking for a mortgage with low down payment requirements.

See how we reached our verdict below.

- Adjustable and fixed-rate HELOCs available

- Low down payment options

- Low credit score requirements

- FHA and VA loans are through third-party partners

- Does not disclose its mortgage rates or fees online

- No physical branches

Spring EQ mortgage overview

Spring EQ is a Pennsylvania-based company that has been in operation since 2016. Primarily known as a home equity lender, Spring EQ also offers mortgages and refinancing.

- Areas of service: Licensed to lend in 48 states (not available in Alaska or New York)

- Digital service: Online loan applications

- Headquarters: 1 West Elm St, Ste 450 Conshohocken, PA 19428-4152

- Website: Mortgage.SpringEQ.com

Spring EQ rates and fees

Rates

Spring EQ doesn’t disclose rate information on its website. Instead, it requires you to share your name, email, phone number and address, first to view its loan options and rates.

According to data from the Federal Financial Institutions Examination Council (FFIEC), in 2024, Spring EQ charged an average interest rate of 10.25% on home loans. It typically offered borrowers rates around 3.84 percentage points above the average prime offer rate (APOR), a benchmark indicative of the lowest APR a bank is likely to offer at that time.

Spring EQ’s rates make it one of the more expensive home lending options on the market and the costliest of the lenders that LendingTree reviewed. But unlike many other mortgage companies, Spring EQ focuses primarily on home equity loans and HELOCs. These typically charge higher interest rates than traditional purchase loans do.

Fees

Spring EQ doesn’t disclose its lender fees and other charges on its website for purchase loans or refinancing loans. However, it does share its typical fees for home equity loans and home equity lines of credit (HELOCs).

We analyzed data from the Federal Financial Institutions Examination Council to get more information on Spring EQ’s loan fees. We found that borrowers paid an average of $2,368 in total loan costs across all loan types in 2024, the lowest among the mortgage companies LendingTree reviewed. Its origination fees were also on the lower side, costing borrowers $855 on average in 2024 — less than many of its competitors. However, borrowers tended to take out smaller loans with Spring EQ than with other mortgage companies, meaning its fees may simply appear lower as a result.

For home equity loans and HELOCs, the following fees apply:

-

Fixed-rate HELOC:

- Administration fee: $999 (In Texas, the fee ranges from $395 to $695 depending on loan amount)

- Annual maintenance fee: $99 per year

-

Adjustable HELOC:

- Administration fee: $999

- Annual maintenance fee: $99

-

Home equity loan:

- Administration fee: $799 (In Texas, the fee ranges from $395 to $695 depending on loan amount)

Spring EQ doesn’t offer any discounts or bonus programs.

What types of mortgage loans does Spring EQ offer?

Through Spring EQ, you can take out a conventional loan (a loan that isn’t guaranteed or insured by the government) to purchase a home.

Conventional loan qualification requirements

- Credit score: 620 or higher

- Down payment: 3% to 5%

Spring EQ connects borrowers to third-party partners for Federal Housing Administration (FHA) loans, government-backed loans with lower credit score and down payment requirements.

FHA loan qualification requirements

- Credit score: 580 or higher

- Down payment: As low as 3.5%

With a loan through the U.S. Department of Veterans Affairs (VA), eligible borrowers can qualify for a mortgage without a down payment through Spring EQ’s third-party lending partners.

VA loan qualification requirements

- No down payment required for eligible borrowers

- No private mortgage insurance (PMI) required

- The VA doesn’t specify a minimum credit score, but lenders may require a score of 620 or higher

Spring EQ offers both home equity loans and HELOCs, which allow you to use some of your established equity to pay down debt, finance home improvements or pay for a child’s college education.

A home equity loan gives you an upfront lump sum, while a HELOC is a line of credit, so you can tap into it repeatedly during the draw period. With Spring EQ, you can borrow up to 90% of your home’s value.

Home equity loan qualification requirements

- Credit score: 640

Spring EQ mortgage qualifications

| Credit score minimum | Conventional: 620 FHA: 580 VA: Not specified Home equity: 640 |

| DTI ratio

Debt-to-income (DTI) ratio compares your monthly gross income to your monthly debt payments.

| Conventional: Not specified FHA: Not specified VA: Not specified Home equity: Not specified |

| Down payment minimum | Conventional: 3% FHA: 3.5% VA: 0% Home equity: Not specified |

Don’t know your credit score? Get your free score on LendingTree Spring today.

Spring EQ doesn’t share the exact minimum requirements it uses to approve or deny applications. However, 2024 data from the FFIEC shows that approved applicants across all loan types had an average loan-to-value (LTV) ratio of 69.9%. Less than half, or 45.4%, had a debt-to-income (DTI) ratio below 40%.

Spring EQ denied about 64% of mortgage applications it received in 2023. That’s high compared to the rejection rates of other large, national mortgage lenders. But Spring EQ is a niche lender specializing in home equity products, which are typically harder to qualify for than first mortgages.

How to apply for a Spring EQ mortgage

1. Choose your loan type

You can see Spring EQ’s different home loan products and receive an estimate of your repayment rates by completing a quick form on its website. The form will ask for your name, property address, phone number and email to start. Alternatively, call Spring EQ at 888-978-9978 and speak with a loan officer to begin the process.

Spring EQ’s focus on home equity products means most applicants go for its home equity loans or HELOCs, although it does offer purchase loans and cash-out refinance loans. For those looking to tap into their home equity, choosing between a home equity loan, HELOC or cash-out refinance comes down to how much money you need, the repayment terms you’re comfortable with and whether you want a second mortgage.

2. Get prequalified

Once you’ve completed the online application form or spoken with a loan officer, you should receive a mortgage prequalification within a few minutes. This is Spring EQ’s estimate of how large a home loan you may qualify for and the associated terms and rates you could get. You will likely need to provide information about your income, credit and down payment or home equity to get prequalified.

Having a mortgage preapproval letter can help you during your search for the right home as it shows sellers you are a serious buyer.

3. Submit a loan application

When you’re ready to make an offer, you’ll need to complete your application to secure the loan. You’ll send Spring EQ proof of your income and assets, such as recent pay stubs, W-2s or tax returns for the last two years and bank statements covering the last two months. The lender will also check your credit score, debt-to-income ratio and down payment funds to make sure you meet its requirements. The actual terms of your approved loan may differ from those provided in the mortgage prequalification.

Find out more about how to apply for a home loan.

- Identification

- Tax documents

- Bank statement

- Pay stubs

- Debt and asset statements

- Gift letters (if you’re using gifted funds)

Is it safe to get prequalified with Spring EQ?

Yes. Spring EQ is a legitimate home loan lender that’s been in operation since 2016. Getting a mortgage prequalification from Spring EQ allows you to get an idea of the loan amount, repayment terms and rates you could qualify for. You’ll usually need to provide an estimate of your income, credit score and down payment or home equity to receive a mortgage prequalification. Lenders also typically run a soft credit check to understand your borrowing history, but this won’t impact your credit score.

Spring EQ’s customer service experience

The Spring EQ website features prominent “Start Now” and “See Your Rate” buttons that let you access the online application for a rate quote. It also has an applicant portal for existing customers to upload their documents and track the status of a new or existing loan. If you need assistance, you can contact Spring EQ in the following ways:

- Phone: 888-978-9978

- Email: [email protected]

Spring EQ will not be your loan servicer. It partners with other companies, like Shellpoint Mortgage Servicing and Select Portfolio Servicing, that will process your payments and provide your monthly statements. After receiving your loan funding, you should get a welcome package explaining your payment options and how to access your online account.

After loan disbursement, here’s how to contact your loan servicer:

-

Shellpoint Mortgage Servicing:

- 800-365-7107

- shellpointmtg.com

-

Select Portfolio Servicing:

- 800-258-8602

- spservicing.com

Spring EQ’s customer support options are more limited than many other lenders. It does not have a customer support chat function on its website or an app for use on a mobile phone like its large bank competitors do. The outsourcing of its loan servicing may also confuse some customers about where to go for help.

How does Spring EQ compare to other lenders?

| LendingTree’s rating |

Expert review from LendingTree.

Back to our Spring EQ summary |

Expert review from LendingTree.

Read our Spring EQ vs. Chase comparison |

Expert review from LendingTree.

Read our Spring EQ vs. Alliant comparison |

| Minimum credit score | 580 | 620 to 650 | Not published |

| Minimum down payment | 0% | 0% to 3.5% | 0% to 5% |

| Rate spread

Rate spread is the difference between the average prime offer rate (APOR) — the lowest APR a bank is likely to offer any private customer — and the average annual percentage rate (APR) the lender offered to mortgage customers in 2024. The higher the number, the more expensive the loan.

| 3.84% | 0.11% | 0.35% |

| Loan products and programs |

|

|

|

| Better for: | Borrowers looking for a home equity loan or HELOC with its high maximum loan limits. | Borrowers looking for a wider range of loan options, as well as current customers who may qualify for a rate discount. | Borrowers who want a variety of options for low-down-payment loans. |

Spring EQ vs. Chase

While Spring EQ specializes in home equity options, Chase has more options to purchase properties. With Chase, you can qualify for special programs, such as the DreaMaker mortgage, to qualify for a mortgage with a lower down payment requirement. Chase also offers jumbo loans with clear and transparent rates.

Read more in our full Chase mortgage review.

Spring EQ vs. Alliant Credit Union

Alliant Credit Union offers a broader range of mortgage products than Spring EQ, including USDA and jumbo loans. It also offers construction loans so you can build your dream home. With Alliant’s website, you can apply (and view loan rates and fees) entirely online.

Read more in our full Alliant mortgage review.

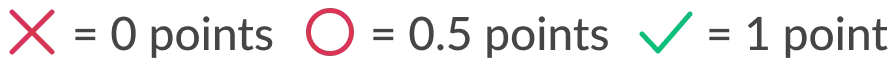

How LendingTree rated Spring EQ

LendingTree’s mortgage lender rating is based on a five-point scoring system that factors in several features, including digital application processes, available loan products and the accessibility of product and lending information.

Specialty lenders, like Spring EQ, are given a slightly different rating from other lenders because their expertise covers a narrower range of loan products. Lenders specializing in home equity products receive a half-point if they offer only one of the two standard home equity products (home equity lines of credit and home equity loans), and one point if they offer both.

In some cases, additional information was provided by a lender representative.

Spring EQ’s scorecard:

❌ Publishes rates online

✅ Offers standard mortgage products

✅ Includes detailed product info online

✅ Shares resources about mortgage lending

✅ Provides an online application

Frequently asked questions

On its website, Spring EQ offers educational resources, including guides and articles on the homebuying process, as well as an online prequalification tool you can use to start the mortgage process.

Yes, Spring EQ is a legitimate lender. It has been in operation since 2016, and it has served over 120,000 homeowners. The lender is licensed to do business in 48 states.

When you apply for a loan from Spring EQ (or any lender), the lender will perform a hard credit pull, which can cause your credit score to drop. If you take out a loan, the loan will appear on your credit report, affecting your credit mix and new credit. And, if you miss a payment, the negative payment history will also affect your credit.

Reviews of Spring EQ are mixed. While there are no reviews about the lender on TrustPilot, it does have reviews on the Better Business Bureau, where the lender has an A+ rating. Of about 40 reviews, some praised the company’s staff and responsiveness, but many customers complained about issues with communication, difficulty getting answers to questions and loan processing delays.

Compare Multiple Prequalification Offers