Alliant Credit Union Personal Loan Review

- APR

- Starting at 8.74%

- Eligibility and access: 3/5

- Cost to borrow: 2.7/5

- Loan terms and options: 5/5

- Repayment support and tools: 5/5

- Must be a long(ish) standing member: With all credit unions, you have to be a member to get a loan. Alliant Credit Union takes it a step further by requiring you to be a member for at least 90 days.

- Anyone can join: You can bypass Alliant Credit Union’s traditional membership requirements by joining the Alliant Credit UnionFoundation. Alliant Credit Union will even pay the required $5 donation for you.

- Quick funding if approved: If Alliant Credit Union approves your loan application, you could get your money the same day that you applied.

- Can’t prequalify: Alliant Credit Union requires a hard credit pull to see if you’re eligible. It also doesn’t specify what credit score it requires.

- Big loans: Most personal loan lenders cap their loans at $50,000. However, you can borrow up to $100,000 with Alliant Credit Union.

- Has a financial hardship program: If you’re having trouble paying your loan, Alliant’s Loan Assistance Program could help.

- Best for established Alliant Credit Union members: Most people won’t qualify for an Alliant Credit Union personal loan — at least, not right away. But if you’ve been a member for at least 90 days, you could get a quick loan at a reasonable rate.

Alliant Credit Union pros and cons

If you’re not already an Alliant Credit Union member and you need an emergency loan, you’ll have to check somewhere else. If you are eligible, though, Alliant Credit Union loans have unique benefits and drawbacks to weigh.

Pros

- Willing to work with you if you’re experiencing financial hardship

- Debt Protection Plan can provide peace of mind (for an additional cost)

- Will get to keep all of your loan, since it doesn’t charge origination fees

- Can reach customer service via live chat (which can be rare for a credit union)

Cons

- Can’t check rates without dinging your credit

- Can’t guess whether you will qualify, as Alliant doesn’t specify its credit score requirements

- No brick-and-mortar branches, so not ideal if you like to do business in person

Alliant Credit Union — a digital-only credit union — offers personal loans from $1,000 to $100,000. Its loans come with perks, including a Loan Assistance Program in case of financial hardship. It doesn’t specify what the program entails, so make sure to call Alliant Credit Union as soon as you think you might fall behind.

You can also sign up for Debt Protection — this will let you cancel some of your loan balance in the event of death, disability or involuntary unemployment. Coverage costs $0.75 to $1.99 per $1,000 that you borrow, so it can get pricey.

Notably, though, Alliant Credit Union doesn’t give much info about credit requirements. This makes it hard to know whether the hard credit hit that comes with applying will be worth it.

When you’re shopping with lenders that don’t let you prequalify for a personal loan, be sure to get all of your applications submitted within 14 days. That way, only one hard credit pull will count against you.

Alliant Credit Union class action lawsuit

In August 2024, Alliant Credit Union settled a class action lawsuit for $86,750. It was accused of discriminating against Deferred Action for Childhood Arrival (DACA) recipients by denying them loans based on their immigration status rather than their creditworthiness.

Alliant Credit Union also agreed to update its policies as part of the settlement.

Alliant Credit Union personal loan requirements

Alliant Credit Union doesn’t specify its credit score requirements — you’ll have to formally apply to see if you qualify. But before you can do that, you’ll need to have been a member for at least 90 days.

Alliant Credit Union does offer personal loans in all 50 states.

The first step — joining Alliant Credit Union — is easy. As long as you meet one of the eligibility requirements below, you can become a member:

- Currently employed by (or retired from) an affiliated employer

- Are an immediate family member to a current Alliant account holder

- Live or work in an eligible community (which are all located near Alliant’s Chicago headquarters)

- Are willing to join the Alliant Credit Union Foundation (Alliant will pay the required one-time $5 donation for you)

If Alliant Credit Union’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that helps you meet your financial goals and can offer you the best-fitting rates, terms and amounts.

How to get a personal loan with Alliant Credit Union

Join the credit union

You have to join Alliant online, as it doesn’t have any physical branches. The process should only take a few minutes. During the process, you’ll choose between a checking account, savings account or certificate of deposit (CD) account.

Savings and checking accounts require a $25 opening deposit, and savings accounts come with a free $5 deposit from Alliant. CD accounts require a $1,000 opening deposit.

Wait at least 90 days and apply online

Once 90 days have passed, you can apply for an online personal loan on Alliant’s website. Have your Social Security number, gross monthly income (what you make before taxes) and job information handy.

Get approved and get your loan

If you’re approved, you could see money in your bank account the same day that you applied. You could also receive it as a check in the mail.

How Alliant Credit Union compares to other personal loan companies

Even if you believe Alliant Credit Union aligns with what you’re looking for in a personal loan, it never hurts to shop around and compare other lenders. Here’s how Alliant stacks up against similar personal loan lenders.

| Lender | Alliant Credit Union | PenFed Credit Union | Upgrade |

|---|---|---|---|

| LendingTree’s rating | 3.6/5 | 4.7/5 | 4.7/5 |

| Minimum credit score | Not specified | Not specified | 580 |

| APRs | Starting at 8.74% | 6.74% – 17.99% | 7.74% – 35.99% (with discounts) |

| Loan amount | $1,000 – $100,000 | $600 – $50,000 | $1,000 – $50,000 |

| Repayment terms | 12 to 60 months | 12 to 60 months | 24 to 84 months |

| Origination fee | None | None | 1.85% – 9.99% |

| Funding timeline | Receive funds as soon as the same day. | Receive funds as soon as one business day. | Receive funds as soon as one business day. |

| Bottom line | Alliant Credit Union offers the biggest, fastest loans, but only if you’ve been a member for 90 days. | Like Alliant, you have to join PenFed to get a loan. But you can borrow right away after joining. Membership is open to everyone. | You can get an online loan through Upgrade with a 580-plus score. You won’t have to join anything, but prepare for an origination fee. |

How we rated Alliant Credit Union

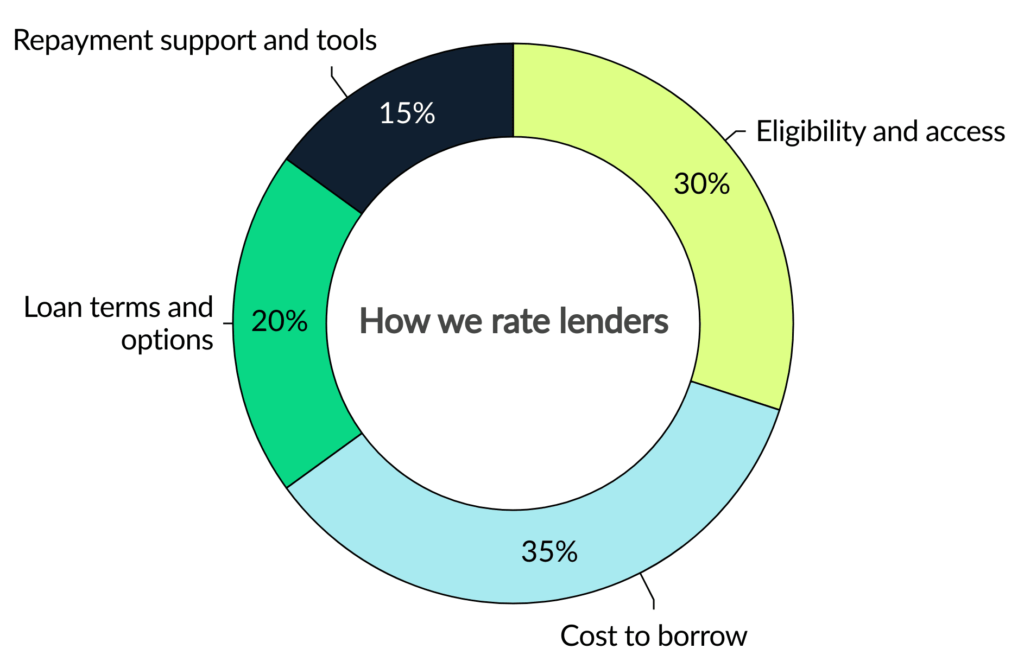

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

This Alliant Credit Union review focuses on personal loans and based on our unbiased, standardized ranking system, its loans are best for a narrow segment of the population — current members. You’ll have to be a member for at least 90 days before you can apply.

Note: Alliant Credit Union is not a bank.

The biggest disadvantage to Alliant Credit Union’s personal loans is the waiting period. You have to be a member for at least 90 days to apply, and it doesn’t let you check rates in the meantime. You might end up waiting 90 days to apply, just to find out that you don’t qualify because of your credit.

Alliant Credit Union doesn’t specify what credit score it requires for a personal loan.

The credit score you need for a personal loan will depend on the lender, but people with scores above 740 generally receive the best rates. You might qualify with a lower score, but high rates might not make the loan worth it. Always use a personal loan calculator to see how much borrowing will cost you in the long run.

Get personal loan offers from up to 5 lenders in minutes

Recommended Articles