Integra Credit Personal Loan Review

- APR

- 149.00% – 399.00%

- Eligibility and access: 4.5/5

- Cost to borrow: 1.8/5

- Loan terms and options: 2.5/5

- Repayment support and tools: 2/5

Integra Credit is a lender that specifically caters to consumers with bad credit. Its annual percentage rates (APRs), terms, amounts and fees all vary depending on the state you live in.

- Limited availability: This lender only offers installment loans in 23 states, which will exclude many potential borrowers.

- High APRs: If you live in a state where you can take out a loan with Integra Credit, expect to pay a hefty sum in interest — Integra APRs range from 149.00% to 399.00%. Financial advocates generally agree that the maximum affordable APR is 36%.

- Small loan amounts: Integra Credit only offers small loans that range from $500 to $3,000, depending on where you live. If you’re looking to borrow a larger sum, you’ll need to look elsewhere.

- Short repayment terms: If you borrow money from Integra Credit, you’ll only have 10 to 21 months to repay it. The terms of your loan will depend on where you live.

- Best for bad-credit borrowers: Integra Credit may be an option for consumers with bad credit who have trouble qualifying for other types of credit. However, due to the cost of borrowing, it’s best to avoid this lender if possible.

Integra Credit pros and cons

While Integra Credit does offer some positives, its loans are extremely expensive.

Pros

- Quick funding timeline

- No prepayment penalties

- Offers small loan amounts

Cons

- Extremely high APRs

- Short repayment terms

- Not available everywhere

While most loans start at $1,000 or more, Integra Credit offers loans as small as $500 in some states. Integra Credit will send your money in as little as 24 hours after you sign your loan agreement, which can help if you’re in need of access to quick cash. You can also repay your loan before it’s due and not have to worry about being charged a prepayment penalty.

On the other hand, Integra Credit charges APRs that can be as high as those for a payday loan. And while traditional personal loans come with repayment terms that typically range from 12 to 84 months, Integra Credit only offers terms from 10 to 21 months. The high APR and short repayment period could make an Integra loan difficult to repay.

Integra Credit requirements

Not only do you have to live in a state where Integra Credit operates, but you’ll also have to be of legal age to sign a contract where you live (typically 18 years old).

| Minimum credit score | Not specified |

| Residency | Must be a U.S. resident and live in one of the following states to get an installment loan from Integra Credit:

|

| Administrative requirements |

|

If Integra Credit’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that helps you meet your financial goals and can offer you the best-fitting rates, terms and amounts.

How to get a personal loan with Integra Credit

While you will have to create an account with Integra Credit, the overall application process is simple with a quick funding timeline.

Create an account

To get an Integra Credit loan, you’ll first need to create an account with the company. You’ll need to provide some of your personal information — such as your name, email and phone number — as well as your state of residence and how much you plan to borrow.

Fill out an application

Once you’ve created an account, you’ll fill out an online application and supply income information. To verify your income, you may need to provide documentation like recent pay stubs, bank statements or W-2s.

You’ll also need to give your address and Social Security number during the application process.

Close on your loan

If Integra Credit chooses to approve your loan request, you’ll need to sign your loan documents and accept the loan. After this, Integra Credit can typically deposit your money as soon as the next business day.

If you’re struggling to qualify for a personal loan, work on boosting your chances of getting approved. This can include cutting down on the amount of debt you carry or making sure to submit payments on time to increase your credit score.

How Integra Credit compares to other personal loan companies

Even if you believe Integra Credit aligns with what you’re looking for in a personal loan, it never hurts to shop around and compare other lenders. Here’s how Integra Credit stacks up against similar personal loan lenders.

| Integra Credit | Upstart | OppLoans | |

|---|---|---|---|

| LendingTree’s rating | 2.8/5 | 4.4/5 | 3.3/5 |

| Minimum credit score | None | None | |

| APRs | 149.00% – 399.00% | 6.50% – 35.99% | 129.00% – 195.00% |

| Loan amounts | $500 – $3,000 | $1,000 – $75,000 | $500 – $5,000 |

| Repayment terms | 10 to 21 months | 36 to 60 months | 9 to 18 months |

| Origination fee | None | Varies | None |

| Funding timeline | Receive funds as soon as the next business day | Receive funds as soon as the next business day | May receive funds as soon as the same business day |

| Bottom line | Out of these three lenders, Integra Credit has the highest APRs by far. It also has the least flexible loan amounts. However, similar to the other two lenders, it offers quick funding. | Upstart is a great option for bad-credit borrowers. Even its max APR is affordable, and while you’ll have to pay an origination fee, you can repay your loan over a significantly longer period. | While OppLoans has slightly less flexible repayment terms than Integra Credit, its APRs are lower. It also has slightly more varied loan amount options and potentially quicker funding than Integra Credit. |

How we rated Integra Credit

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

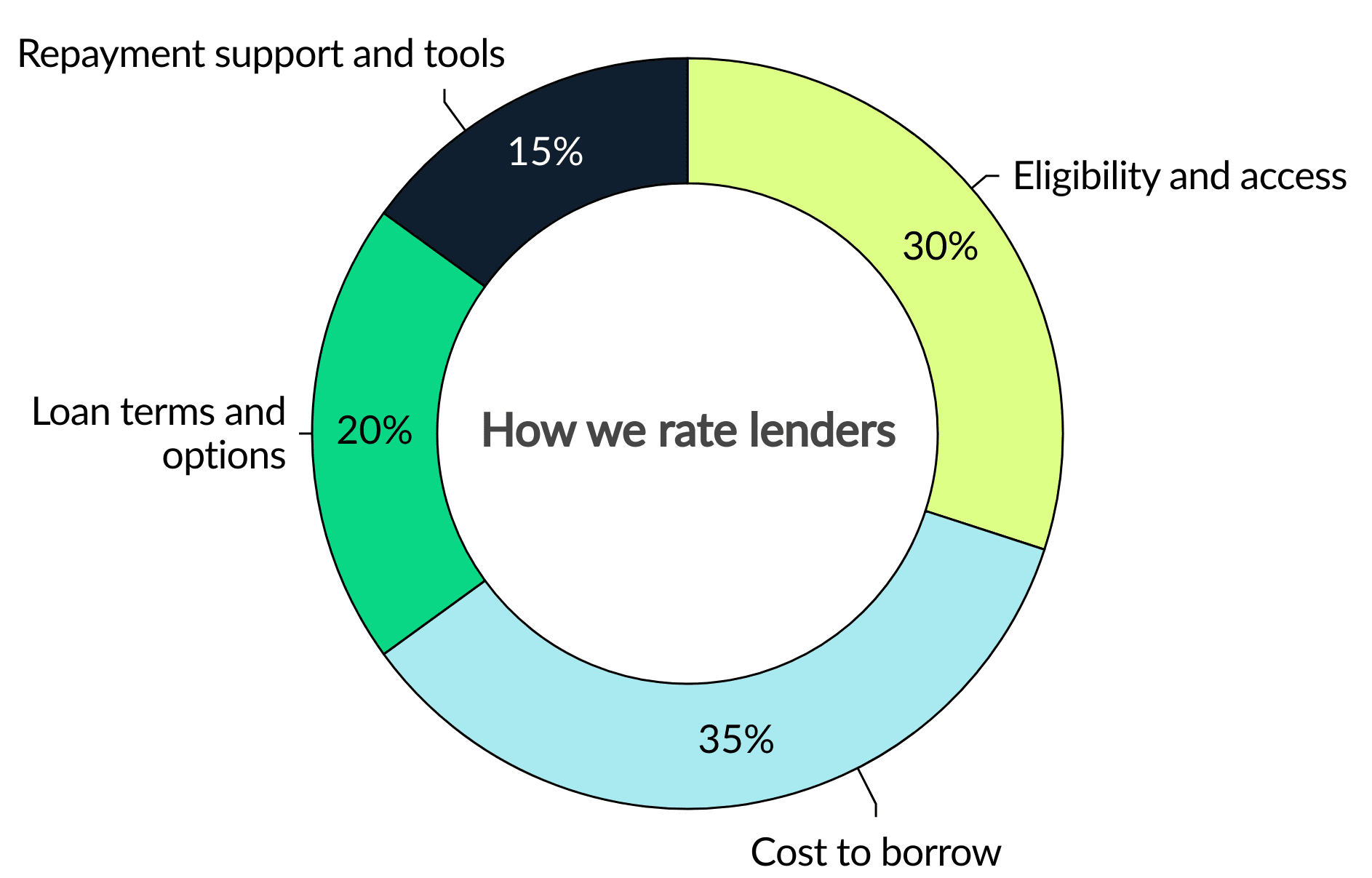

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

Integra Credit has similar APRs to payday loans, which can also get as high as 400%. However, where Integra Credit differs from traditional payday loans is its loan amount offerings and repayment terms. Payday lenders typically only provide loans up to $1,000 with terms of about two weeks.

Depending on the state you live in, Integra Credit may charge you late fees if you don’t make your monthly payments on time. If you don’t pay after 180 days, lenders generally consider your account delinquent and sell it to a debt collection agency.

Integra Credit deposits your money as soon as the next business day after you sign your loan agreement. This falls in line with the typical funding timeline for most lenders, which commonly ranges from one to five days.

Get personal loan offers from up to 5 lenders in minutes