Capital One 2026 Program Guide: Earning and Redeeming Miles

Key takeaways

- The Capital One rewards program includes several popular travel credit cards that earn miles.

- This program lets you redeem miles for cash back, gift cards and travel expenses.

- You can also transfer miles to frequent flyer or hotel loyalty partners, mostly at a 1:1 ratio.

- Capital One added a few new transfer partners in late 2025, including Japan Airlines, Qatar Airways and I Prefer Hotel Rewards.

- Capital One miles are worth 0.5 cents to around 1.8 cents and potentially more by LendingTree estimates, depending on how you use them.

- Most of the time, transferring your miles to Capital One’s loyalty program partners is the best way to maximize their value.

How do Capital One rewards work?

Capital One rewards — also known as Capital One miles — are a rewards program currency you can earn by using a qualifying Capital One credit card. Cardholders earn Capital One miles by making credit card purchases. New cardholders may also be able to earn a welcome bonus if they meet a minimum spending requirement within a few months of account opening.

You can redeem Capital One miles for a variety of options, including travel, cash back, gift cards, entertainment purchases, PayPal purchases and purchases made through Amazon. The value of your miles can vary depending on how you redeem them, and you’ll usually get the best value for travel rewards.

Capital One rewards at a glance

-

Do miles expire?

No expiration for the life of the account -

Capital One miles value

0.5 cents to around 1.8 cents per mile (and potentially more) -

What’s your mile-earning potential?

1.25X to 10X miles per dollar spent -

What can you redeem miles for?

Travel through Capital One, point transfers, cash back, gift cards and more

How much are Capital One miles worth?

Capital One miles can be worth anywhere from 0.5 cents each to around 1.8 cents per mile or more. Using your miles for cash back, gift cards, or purchases made through Amazon.com or PayPal.com will get you the least bang for your buck, usually at a value of less than 1 cent per mile.

Miles are worth 1 cent each when redeemed through Capital One’s travel portal, and they can be worth around 1.8 cents each or more when transferred to airline and hotel partners and used for a premium travel redemption. On the other hand, they’re only worth 0.5 cents each when redeemed for cash back.

Capital One miles value

| Redemption Options | Value |

|---|---|

| Cash back | 0.5 cents per mile |

| Gift cards | 0.8 cents per mile |

| PayPal purchases | 0.8 cents per mile |

| Amazon.com purchases | 0.8 cents per mile |

| Capital One experiences | Varies (usually 0.8 cents per mile) |

| Travel statement credits | 1 cent per mile |

| Travel through Capital One portal | 1 cent per mile |

| Miles transfers to airlines and hotels | ~1.8 cents per mile or more |

How to earn Capital One miles

To earn Capital One miles, you’ll need one of this issuer’s travel credit cards. You can earn miles through regular card purchases and spending, or by taking advantage of a welcome offer or referral offer.

Welcome offers can be earned if you spend enough within the first few months of opening an account. Capital One referral offers let cardmembers earn bonus miles by referring friends and family.

Compare Capital One Venture Rewards cards

| Credit Cards | Our Ratings | Annual Fee | Rewards Rate | Welcome Offer | |

|---|---|---|---|---|---|

Capital One VentureOne Rewards Credit Card

|

$0 | 1.25X - 5X Miles

| 20,000 miles

Earn 20,000 Miles once you spend $500 on purchases within 3 months from account opening

| ||

Capital One Venture Rewards Credit Card

|

$95 | 2X - 5X Miles

| 1,000 dollars

Earn up to $1,000 towards travel once you spend $4,000 on purchases within the first 3 months of account opening

| ||

Capital One Venture X Rewards Credit Card

|

$395 | 2X - 10X miles

| 75,000 miles

Earn 75,000 Miles when you spend $4,000 on purchases in the first 3 months from account opening

|

Compare Capital One business rewards cards

| Credit Cards | Our Ratings | Annual Fee | Rewards Rate | Welcome Offer | |

|---|---|---|---|---|---|

Capital One Venture X Business

|

$395 | 2X - 10X Miles

| 150,000 miles

Earn 150,000 Miles once you spend $30,000 in the first 3 months from account opening

| ||

Capital One Spark Miles Select for Business*

|

$0 | 1.5X Miles

1.5 Miles per $1 on every purchase

| 50,000 miles

One-time bonus of 50,000 miles once you spend $4,500 on purchases within 3 months from account opening

| ||

Capital One Spark Miles for Business

|

$0 intro for first year; $95 after that | 2X - 5X Miles

| 50,000 miles

Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening.

|

Sign-up bonuses

One of the best ways to stack up miles for an upcoming trip is to take advantage of a sign-up bonus. A sign-up bonus allows you to earn a lot of miles at once by meeting a minimum spending requirement within a few months of signing up.

The best Capital One credit cards can offer sign-up bonuses ranging from 20,000 miles to 75,000 miles or more, depending on where and when you apply.

Referral bonus

Another great way to accumulate miles quickly is through Capital One’s Refer a Friend program. You may be eligible to earn around 25,000 miles per referral on certain cards by having people apply through a link you supply them.

Annual bonus miles

The Capital One Venture X Rewards Credit Card and Capital One Venture X Business also offer 10,000 annual bonus miles each year the card is renewed and the annual fee is paid. You’ll also get an annual $300 credit for Capital One’s travel booking site with each of these cards.

How to use Capital One rewards

Capital One miles are very flexible when it comes to travel, allowing you to redeem miles for nearly any kind of travel expense up to 90 days after the purchase. You also have many other ways to redeem miles, including gift cards and cash back. This makes Capital One travel credit cards a good option for people who want more flexibility.

Capital One’s Travel portal is similar to online booking sites like Expedia or Priceline. Essentially, cardholders can use the portal to shop for flights, hotel stays and car rentals, then book the travel they want at a rate of 1 cent per mile.

Capital One’s travel portal also lets you redeem a combination of miles and cash rewards if you are short on miles for the booking you want. If you have the Capital One Venture X Rewards Credit Card or Capital One Venture X Business, you can even book travel with a combination of cash, miles and your $300 annual travel credit.

Cardholders with Capital One travel credit cards can also redeem their miles to cover travel purchases charged to their card. This can be a good option whether you want to book a hotel or flight directly with a travel brand, like Wyndham or Air Canada, or if you want to book travel through a discount travel site like Expedia.

This redemption option is worth 1 cent per mile, meaning 75,000 miles are worth $750 in travel statement credits. Also, Capital One is very flexible with its definition of travel, allowing you to redeem miles for most types of travel up to 90 days past the purchase.

Capital One also offers a range of airline and hotel partners, most of which let users transfer their miles at a 1:1 ratio. You can find great deals with some of these programs — including Aeroplan, Avianca, British Airways and Turkish Airlines — that allow you to stretch your miles farther.

Capital One Rewards even added new transfer partners in late 2025, including Japan Airlines, Qatar Airways and I Prefer Hotel Rewards. However, any of the Capital One transfer partners have the potential to get you more value for each mile you redeem.

| Transfer Partner | Point Transfer Ratio (Capital One miles to points/miles) |

|---|---|

| Aeromexico Rewards | 1,000:1,000 |

| Air Canada Aeroplan® | 1,000:1,000 |

| ALL Accor Live Limitless | 1,000:500 |

| Avianca LifeMiles | 1,000:1,000 |

| British Airways Executive Club | 1,000:1,000 |

| Cathay Pacific Asia Miles | 1,000:1,000 |

| Choice Privileges | 1,000:1,000 |

| Emirates Skywards | 1,000:1,000 |

| Etihad Guest | 1,000:1,000 |

| EVA Air | 1,000:750 |

| Finnair Plus | 1,000:1,000 |

| Flying Blue (Air France) | 1,000:1,000 |

| I Prefer Hotel Rewards | 1,000:2,000 |

| Japan Airlines Mileage Bank | 1,000:750 |

| JetBlue TrueBlue | 1,000:600 |

| Qantas Frequent Flyer | 1,000:1,000 |

| Qatar Airways Privilege Club | 1,000:1,000 |

| Singapore Airlines KrisFlyer | 1,000:1,000 |

| TAP Miles&Go | 1,000:1,000 |

| Turkish Airlines Miles&Smiles | 1,000:1,000 |

| Virgin Red | 1,000:1,000 |

| Wyndham Rewards | 1,000:1,000 |

How can transfer partners help you get outsized value for your Capital One rewards? While redeeming miles with airline or hotel partners can help you get above the average valuation of 1 cent per mile, it’s possible to get even more than that if you’re willing to look for deals.

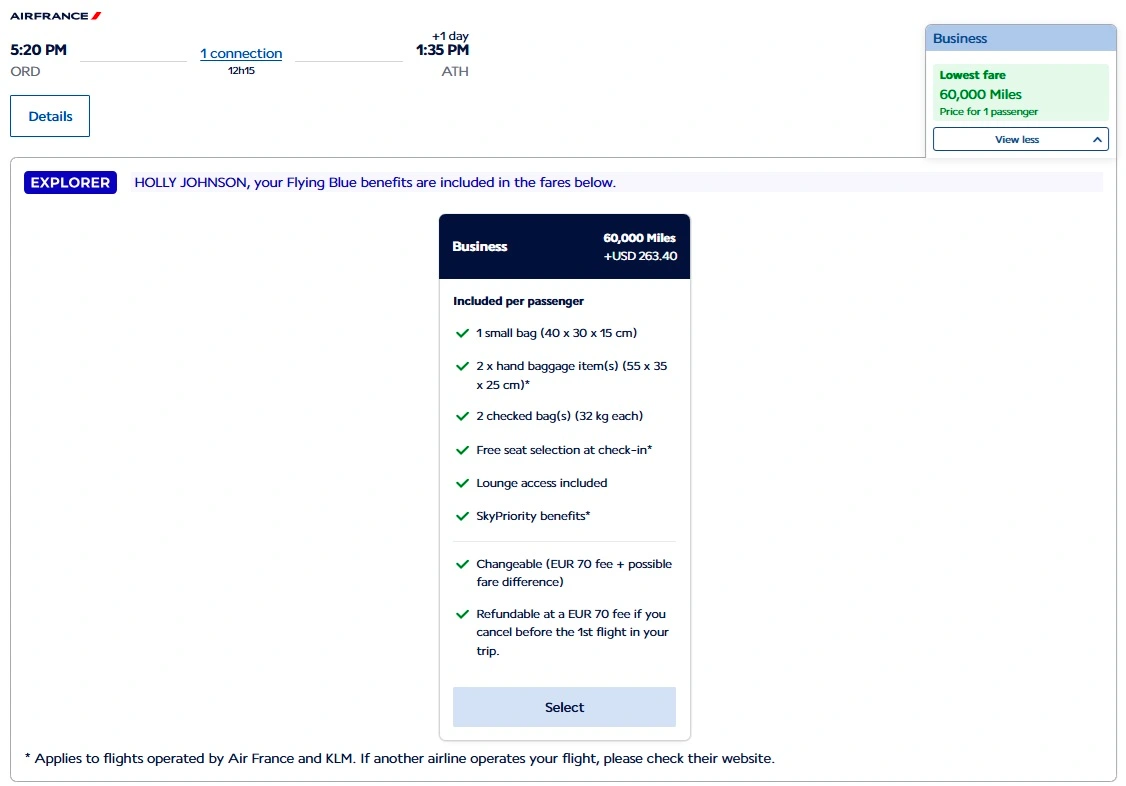

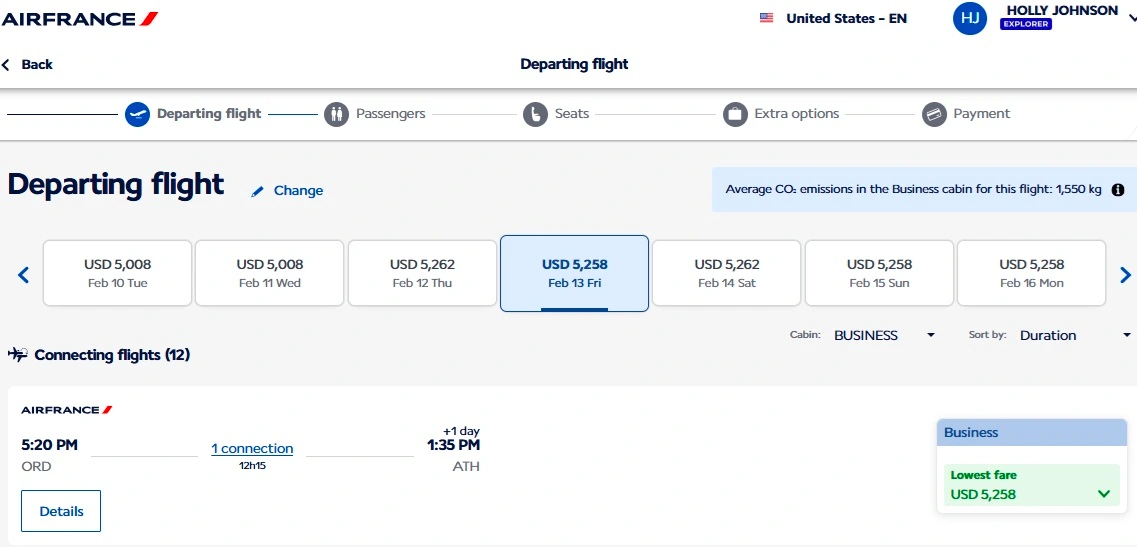

Take this Air France (Flying Blue) flight we found in February of 2026. It’s possible to book a Business class flight with this partner for 60,000 miles plus $263.40 in airline taxes and fees.

That’s an incredible deal considering the cash price for this one-way flight comes out to $5,258. This gives you a points valuation of approximately 8.3 cents per mile.

Unfortunately, most Capital One partners are foreign airlines, which can make it challenging to redeem miles with them. However, many of these airlines belong to an airline alliance. You can redeem your miles for flights on their alliance partners to travel to most places, including within the U.S.

For example, you can redeem Air France (Flying Blue) miles for flights on SkyTeam partners like Delta Air Lines and Virgin Atlantic.

Learn more about Capital One transfer partners

You can also use Capital One miles to shop for merchandise. This is made possible by shopping online and using PayPal as a payment method, or by shopping through Amazon.com. Each option comes with a redemption value of 0.8 cents per mile.

Capital One miles can also be used for various gift card options that may change over time. Most gift card options have a minimum redemption value of 0.8 cents per mile. But occasionally, you can find heavily discounted gift cards that give you a good return on your miles. Examples of gift card options include:

- Retail stores

- Restaurants

- Food delivery services

- Grocery stores

- Gas stations

- Hotels

- Airlines

- Spas

- Wellness brands

You can also use Capital One miles to book various experiences and events, which can include sporting events, concerts, Broadway-style shows, culinary experiences and more. There are also experiences that are exclusive to Capital One card members, which change throughout the year.

Rewards redeemed through Capital One Entertainment are typically worth 0.8 cents per mile.

You can also redeem Capital One miles as a statement credit to cover any purchases made to your card, but you’ll only get 0.5 cents per mile in value if you go this route.

You can also redeem miles for a check in the mail, but that means getting a redemption value of just 0.5 cents per mile.

Given the low value for cash back, Capital One miles are not the best option if you want the flexibility to cash out your miles. Chase Ultimate Rewards®, in comparison, offers 1 cent per point for cash back.

You can also transfer miles to friends or family members if they also have a Capital One credit card that earns the same type of rewards.

Frequently asked questions

Capital One Shopping is a browser extension that lets individuals earn rewards when they make purchases with retail partners. This program is completely separate from the rewards you earn with Capital One credit cards.

No, Capital One miles do not expire if your account is open and in good standing. When your credit card rewards don’t expire, it’s easier to save up for a big redemption when you’re ready.

You can redeem Capital One miles for gift cards, statement credits and merchandise, as well as travel through a portal or transfers to airline and hotel partners.

The Capital One Platinum Credit Card doesn’t offer cardholders any rewards points or cash back on purchases.

You can maximize your Capital One miles by looking for high-value transfer opportunities with hotel and airline loyalty programs.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Capital One Spark Miles Select for Business has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.