Chase Mortgage Review 2026

Chase is a top lender for first-time homebuyers and those looking for a mortgage with a low down payment requirement. It offers multiple government-backed options and specialty programs, as well as added benefits like an on-time close guarantee.

See how we reached our verdict below.

- Relationship discounts for existing customers

- On-time closing guarantee

- Low down payment options

- Doesn’t specify income or credit requirements

- USDA loans aren’t available

- Home loan advisors aren’t available in all states

Chase mortgage overview

Chase is a subsidiary of J.P Morgan, a leading financial holding company, and is one of the biggest mortgage originators in the U.S.

- Areas of service: 50 states and the District of Columbia

- Digital service: Offers online applications in addition to physical branches

- Headquarters: 270 Park Avenue, New York, NY 10017

- Website: Chase.com

Chase rates and fees

Rates

Chase publishes its current rates online and updates them daily (Monday through Friday) with the latest information. Its rates are quite competitive — in 2024, Chase’s rates were on average 0.11 percentage points higher than the average prime offer rate (APOR) — a benchmark that reflects the rates low-risk consumers can expect.

Fees

Chase doesn’t disclose its fees (such as application fees or origination fees) on its website. However, by analyzing data from the Federal Financial Institutions Examination Council (FFIEC), we found that the average total cost of taking out a mortgage through Chase in 2024 was $5,080 — lower than the industry average.

Chase has several special programs and discounts:

- DreaMaker Mortgage: Chase’s DreaMaker mortgage is a home loan that has flexible credit guidelines and requires as little as 3% as a down payment. However, you’ll need to meet certain income requirements, depending on where you live.

- Relationship discount: If you have an existing bank account or investment account with Chase or J.P. Morgan, you can qualify for an interest rate reduction of as much as 0.25%.

- Friends and family discount: Friends and family members of Chase employees can qualify for an interest rate reduction of an extra 0.125% on purchase and refinance loans.

What types of mortgage loans does Chase offer?

Chase offers a variety of home loans, including:

With Chase, conventional mortgages can have fixed or adjustable rates, and you can choose a loan term of 15 or 30 years. It also offers conventional cash-out refinance options.

Conventional loan qualification requirements

Chase doesn’t disclose its income or credit requirements, but borrowers will need to meet the following requirements:

- A minimum down payment of 3% to 20%

Through Chase, borrowers can take out Federal Housing Administration (FHA) loans, a government-backed option with lower credit score and down payment requirements.

Plus, some borrowers may qualify for the Chase Homebuyer Grant, a program that provides up to $7,500 in funding to use toward closing costs or the down payment.

FHA loan qualification requirements

Chase doesn’t disclose its FHA credit or income requirements, but generally, you’ll need to meet the following requirements:

- A minimum down payment between 3.5% and 10%

- A minimum 500 to 580 credit score

Military veterans and their families can purchase homes with as little as 0% down with VA loans, which are backed by the U.S. Department of Veterans Affairs (VA).

VA loan qualification requirements

Chase doesn’t list its specific VA loan requirements, but borrowers typically need to meet the following criteria:

- No down payment requirement for eligible borrowers

- No private mortgage insurance (PMI) required

- The VA doesn’t specify a minimum credit score, but lenders may require a 620 score or higher

- VA funding fee (unless you qualify for an exemption)

Chase does offer jumbo loans, which are mortgages that exceed conforming loan limits. For most areas, the conforming loan maximum for a one-unit home is $832,750 ($1,249,125 in areas with a high cost of living).

Jumbo loan qualification requirements

- Down payments for a jumbo second home loan start at 15%

- Down payments for jumbo investment property loans start at 20%

- Finance up to $9.5 million (or up to 89.99% of the home’s purchase price)

Chase offers home equity lines of credit (HELOCs). It doesn’t offer home equity loans.

If you take out a HELOC from Chase, you’ll pay an origination fee that is rolled into the loan and won’t exceed 4.99% of your total credit line.

Chase mortgage qualifications

| Credit score minimum | Not specified |

| DTI ratio

Debt-to-income (DTI) ratio compares your monthly gross income to your monthly debt payments.

| Not specified |

| Down payment minimum | Conventional: 3% FHA: 3.5% VA: 0% Jumbo: 10% to 20% |

Don’t know your credit score? Get your free score on LendingTree Spring today.

Although Chase doesn’t disclose its income or credit score requirements, we analyzed 2024 information from the Home Mortgage Disclosure Act (HMDA) to provide some insight. In 2024, Chase denied 12.8% of mortgage applications across all loan types, which is on the lower end for large lenders.

Chase was most likely to approve borrowers with an average loan-to-value (LTV) ratio of 72% or lower and a debt-to-income (DTI) ratio under 40%.

How to apply for a Chase mortgage

1. Choose your loan type

Visit Chase’s website and navigate to the “Home loans” section. Next, select your goal, such as buying a new home or refinancing an existing mortgage. The platform has three subpages depending on the type of homebuyer you are: first-time homebuyer, experienced homebuyer or those shopping for a second home or investment property. When you select one of these categories, the site will show you the appropriate mortgage options for that situation.

2. Get prequalified

Chase doesn’t have a prequalification tool, so the only way to view personalized rates and loan options is to submit your personal information and meet with a home loan advisor. Chase does offer mortgage preapproval.

3. Submit a loan application

Chase allows applicants to start the mortgage application process online. Once you submit your personal details, Chase will connect you with a home loan advisor to guide you through the process and issue you a preapproval letter.

Find out more about how to apply for a home loan.

- Identification

- Tax documents

- Bank statement

- Pay stubs

- Debt and asset statements

- Gift letters (if you’re using gifted funds)

Is it safe to get prequalified with Chase?

Chase is a reliable company with an excellent reputation, so it’s safe to get a preapproval letter from the lender for a mortgage. Getting a preapproval is a critical part of the homebuying process — it gives you a good idea of how much money you can borrow, and many sellers won’t entertain offers from buyers without one.

Chase’s customer service experience

Although Chase doesn’t offer 24/7 live customer support, you can reach customer service by phone or by visiting a branch. You can also set up a meeting with a home loan advisor in person or over the phone, which can be a good choice if you want more personalized guidance or have lots of questions. Chase also has a mobile app you can use to manage your mortgage after you’ve purchased your home.

- Phone: 800-848-9136

- For customer support in Spanish: 855-280-4198

Chase has a good reputation for customer support: It was ranked 9th out of 25 lenders in the J.D. Power 2025 U.S. Mortgage Origination Satisfaction Study.

How does Chase compare to other lenders?

|  |  |

|

| LendingTree’s rating |

Expert review from LendingTree.

Back to our Chase summary |

Expert review from LendingTree.

Read our Chase vs. AmeriSave |

Expert review from LendingTree.

Read our Chase vs. Alliant |

| Minimum credit score | Not specified | 500 | Not specified |

| Minimum down payment | 0% to 3.5% | 0% to 3.5% | 0% to 5% |

| Rate spread

Rate spread is the difference between the average prime offer rate (APOR) — the lowest APR a bank is likely to offer any private customer — and the average annual percentage rate (APR) the lender offered to mortgage customers in 2024. The higher the number, the more expensive the loan.

| 0.11% | 2.63% | 0.35% |

| Loan products and programs |

|

|

|

| Better for: | Existing Chase customers and first-time homebuyers | Borrowers with credit scores below 620 | Borrowers who want to take out a USDA loan |

Chase vs. AmeriSave

Both AmeriSave and Chase offer conventional, FHA, VA, jumbo loans and HELOCs. However, AmeriSave is upfront about its credit score requirements, and it’ll work with borrowers in the fair credit range. This makes it an appealing option if your credit score is below 620.

At the same time, Chase stands out from AmeriSave thanks to its closing guarantee: If your home doesn’t close on time due to the bank’s issues, it will give you $5,000.

Read more in our full AmeriSave mortgage review.

Chase vs. Alliant

Unlike Chase, which is a for-profit corporation, Alliant is a credit union, a not-for-profit organization. Credit unions often offer lower rates and have less stringent requirements than banks, so they can be a good option when you’re shopping for a loan.

Alliant also offers USDA loans, which Chase doesn’t, making the credit union a good choice if you’re considering financing a rural property.

Read more in our full Alliant Credit Union mortgage review.

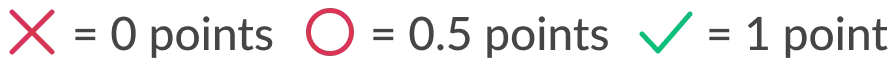

How LendingTree rated Chase Mortgage

LendingTree’s mortgage lender rating is based on a five-point scoring system that factors in several features, including digital application processes, available loan products and the accessibility of product and lending information.

LendingTree’s editorial team calculates each rating based on a review of information available on the lender’s website. Lenders receive a half-point on the “offers standard mortgage products” criterion if they offer only two of the three standard loan programs (conventional, FHA and VA). In some cases, additional information was provided by a lender representative.

Chase’s scorecard:

✅ Publishes rates online

✅ Offers standard mortgage products

✅ Includes detailed product info online

✅ Shares resources about mortgage lending

✅ Provides an online application

Frequently asked questions

Chase allows you to start the application process online, and you can view updated mortgage rates. Chase also has several online tools, including mortgage calculators, affordability calculators and homebuyer assistance program databases.

Chase is a legitimate lender that offers mortgages in all 50 states. It’s one of the largest mortgage originators in the country.

You can view more info about Chase’s state licenses and registrations through the Nationwide Multistate Licensing System and Registry (NMLS) website.

Taking out a home loan from Chase — or any lender — can affect your credit score in several ways. When you apply for a loan, the lender will perform a hard credit check, and each hard credit inquiry can ding your score. Once the loan is disbursed, it’ll show up on your credit report and impact your credit mix — and as you make payments, your timely payment history can positively affect your credit.

Whether a lender is a good match will depend on several factors, including your credit score, the type of home you’d like to buy and your budget. Chase has several mortgage programs, and existing customers can take advantage of its interest rate discounts.

Notably, Chase’s reviews on TrustPilot aren’t great — it has a score of just over 1 out of 5 stars, based on more than 2,400 reviews. However, the overwhelming majority of TrustPilot reviews are about its credit cards, auto loans and other products, so they don’t necessarily reflect the typical Chase mortgage experience.

Chase has an A+ rating with the Better Business Bureau (BBB), but also just above a 1-star rating based on nearly 40 customer reviews. In complaints about Chase’s mortgage division, some customers reported issues with the loan servicing department and errors with payments.

View mortgage loan offers from up to 5 lenders in minutes