Pushing Down on Me, Pressing Down on You: States Where People Feel Under Pressure to Move

Though moving on your terms can be rewarding, feeling pressure to leave your home can be stressful and difficult. This is especially true in today’s economy, where persistently high inflation, mortgage rates, and home and rent prices can make it hard to find an affordable place.

Amid these economic headwinds, many people report feeling pressured to move. To examine how many people in the U.S. feel this pressure, LendingTree analyzed new data from the U.S. Census Bureau Household Pulse Survey.

Specifically, we looked at U.S. adults 18 and older who indicated whether they felt (or didn’t feel) pressured to move in the six months before the survey. (Our calculations excluded adults who didn’t answer the two pressure-related questions.) We found that 22.04% of adults who responded felt pressured to move.

Key findings

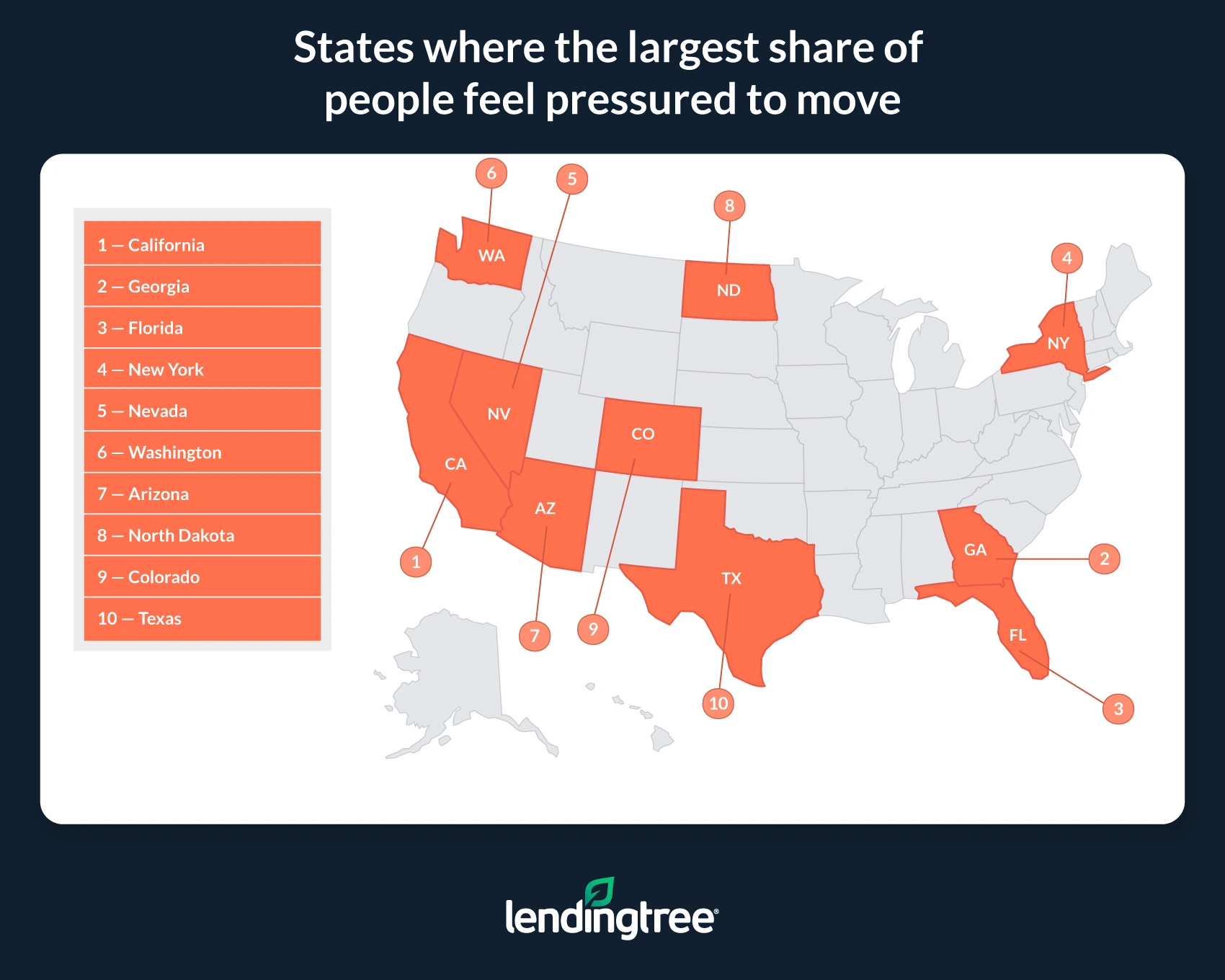

- Adults in California, Georgia and Florida are most likely to feel pressure to move. In California, 28.75% of the population included in our study reports feeling pressured to move. In Georgia and Florida, that figure is 27.78% and 25.98%, respectively.

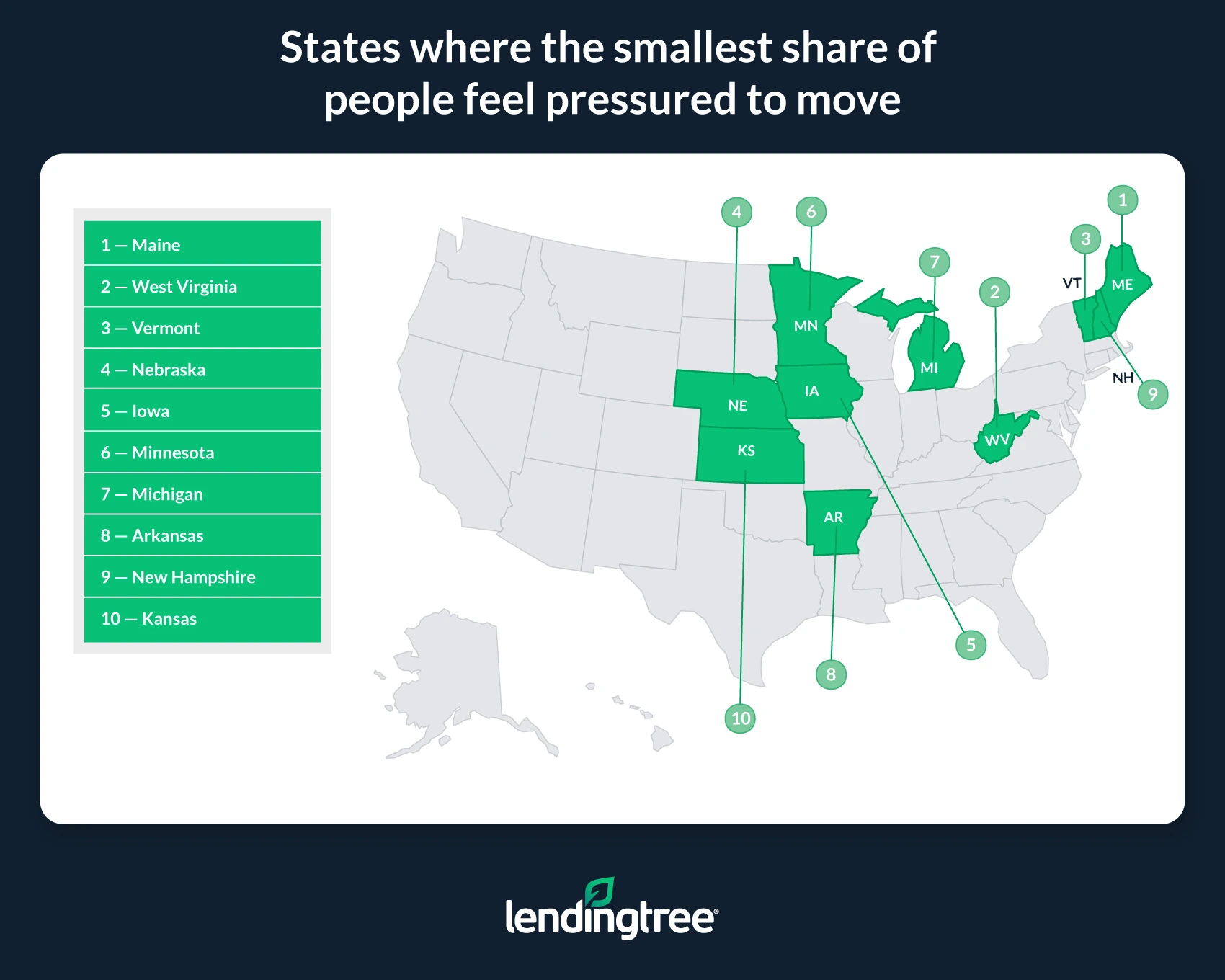

- Maine, West Virginia and Vermont have the smallest share of adults who feel pressured to move. Among those analyzed in our study, 10.40% in Maine feel pressured to move, followed by West Virginia and Vermont at 12.68% and 15.16%, respectively.

- Most people who feel pressured to move don’t leave their homes. Nationwide, just 21.56% of adults who feel pressured to move do so because of that pressure. This figure varies by state, with Delaware having the largest percentage of pressured adults who moved (32.81%) and Alaska having the smallest (12.63%).

- Numerous factors — from rent increases to unsafe neighborhoods — are commonly cited as why people feel pressured to move. Nationwide, 39.79% of the respondents included in our study say a rent increase was why they felt pressured to move. Other common sources of pressure include landlords not making repairs (22.98%) and living in unsafe neighborhoods (18.10%). Keep in mind that respondents are allowed to select more than one reason why they feel pressured to move, meaning many may feel badgered by multiple sources.

While the reasons respondents could select for why they feel pressured to move are largely rent-focused, the survey also looks at nonrenters. Because of this, other factors like falling behind on mortgage payments might also be major reasons some people feel pressured to move. The variety of unlisted reasons is likely why “other” was the most common option, at 50.90%.

States where the largest share of people feel pressured to move

1. California

- Share of selected adult population that feels pressured to move: 28.75%

- Share of selected adult population that doesn’t feel pressured to move: 71.25%

- Share of adult population under pressure to move that moved as a result: 20.37%

- Share of adult population under pressure to move that didn’t move as a result: 79.63%

2. Georgia

- Share of selected adult population that feels pressured to move: 27.78%

- Share of selected adult population that doesn’t feel pressured to move: 72.22%

- Share of adult population under pressure to move that moved as a result: 28.51%

- Share of adult population under pressure to move that didn’t move as a result: 71.49%

3. Florida

- Share of selected adult population that feels pressured to move: 25.98%

- Share of selected adult population that doesn’t feel pressured to move: 74.02%

- Share of adult population under pressure to move that moved as a result: 24.17%

- Share of adult population under pressure to move that didn’t move as a result: 75.83%

States where the smallest share of people feel pressured to move

1. Maine

- Share of selected adult population that feels pressured to move: 10.40%

- Share of selected adult population that doesn’t feel pressured to move: 89.60%

- Share of adult population under pressure to move that moved as a result: 21.16%

- Share of adult population under pressure to move that didn’t move as a result: 78.84%

2. West Virginia

- Share of selected adult population that feels pressured to move: 12.68%

- Share of selected adult population that doesn’t feel pressured to move: 87.32%

- Share of adult population under pressure to move that moved as a result: 24.14%

- Share of adult population under pressure to move that didn’t move as a result: 75.86%

3. Vermont

- Share of selected adult population that feels pressured to move: 15.16%

- Share of selected adult population that doesn’t feel pressured to move: 84.84%

- Share of adult population under pressure to move that moved as a result: 26.51%

- Share of adult population under pressure to move that didn’t move as a result: 73.49%

Why people are unlikely to be forced from their homes

While a significant share of U.S. adults report feeling pressured to move, the majority of renters or owners don’t appear to be at serious risk of losing their current residences.

On the contrary, even in the face of persistent inflation and high housing prices, active foreclosures and foreclosure starts, as well as mortgage delinquencies, remain lower than before the COVID-19 pandemic. In that same vein, even though evictions occur and many people report being behind on their rent, a large majority of adults living in renter-occupied households are caught up on their rent payments.

In other words, data indicates renters and homeowners are generally equipped to handle payments in the current environment. In addition to the legal and logistical challenges that can arise when a landlord or lender tries to force someone from their home, this helps explain why so few people lose their houses, even though some might still feel pressured to move.

Of course, this isn’t to say that paying for housing is a walk in the park — that isn’t always the case. Nonetheless, the data indicates most people aren’t teetering on the edge of eviction or foreclosure, even with today’s economic headwinds.

Tips for dealing with being pressured to move by a lender or landlord

Feeling like you’ll be forced out of your home is anything but enjoyable. But some tips can help people navigate being pressured to move.

- As soon as you run into problems, talk with your lender or landlord. Though it might not always seem this way, landlords and lenders often prefer to avoid an eviction or a foreclosure. Forcing someone from their home can be time-consuming and expensive. If you’re having trouble paying your housing bills, you may be able to come to an agreement with your lender or landlord that helps you keep your home — like a mortgage forbearance or a temporary rent pause. Talking with your landlord or lender can also help you negotiate your exit from a property without involving the police.

- Know your rights. Depending on where you live, a landlord or lender may not be able to force you from your home without a court order, even if you’re seriously behind on your payments. If you think you’re being unfairly pressured to move, you may be able to take legal action to help you keep your home. If you want to know more about your rights, contact your local housing authority or the U.S. Department of Housing and Urban Development (HUD).

- Plan as far ahead as you can. There could be instances where, no matter what you do, you may not be able to stay in your home. If you find yourself in this situation, try to plan as far in advance as possible. The more time you give yourself to find a new place and move your belongings, the less stressful you can make what’ll probably already be an extremely difficult situation.

Methodology

Data in this study comes from Week 60 of the U.S. Census Bureau Household Pulse Survey, fielded July 26 through Aug. 7, 2023 — the latest at the time of writing.

Many Household Pulse Survey respondents didn’t report whether they felt (or didn’t feel) pressured to move. For this study, LendingTree subtracted those respondents from the totals when calculating the share of people who felt (or didn’t feel) pressured to move.

When this study refers to a selected adult population, it’s referring to the population of adults who indicated whether they felt pressured to move — not the entire adult population.

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles

On the Move: Nearly 3 in 10 Homeowners and Renters Across the Nation’s Largest Metros Moved in 2019 or Later

Less for More: New-Home Sizes Have Decreased Slightly Nationwide, While Prices Per Square Foot Have Jumped 95%

31% of Americans Are Considering a Move in 2023 Amid Financial and Economic Homeownership Fears