Most Popular Metros for Gen Z Homebuyers

Gen Z adults (ages 18 to 27 in 2024) are the most recent generation to enter the homebuying market. But where are they buying?

LendingTree analyzed mortgage purchase requests from adult Gen Z users of the LendingTree platform across the nation’s 50 largest metros from Jan. 1 through Dec. 31, 2024. Here’s what we found.

Key findings

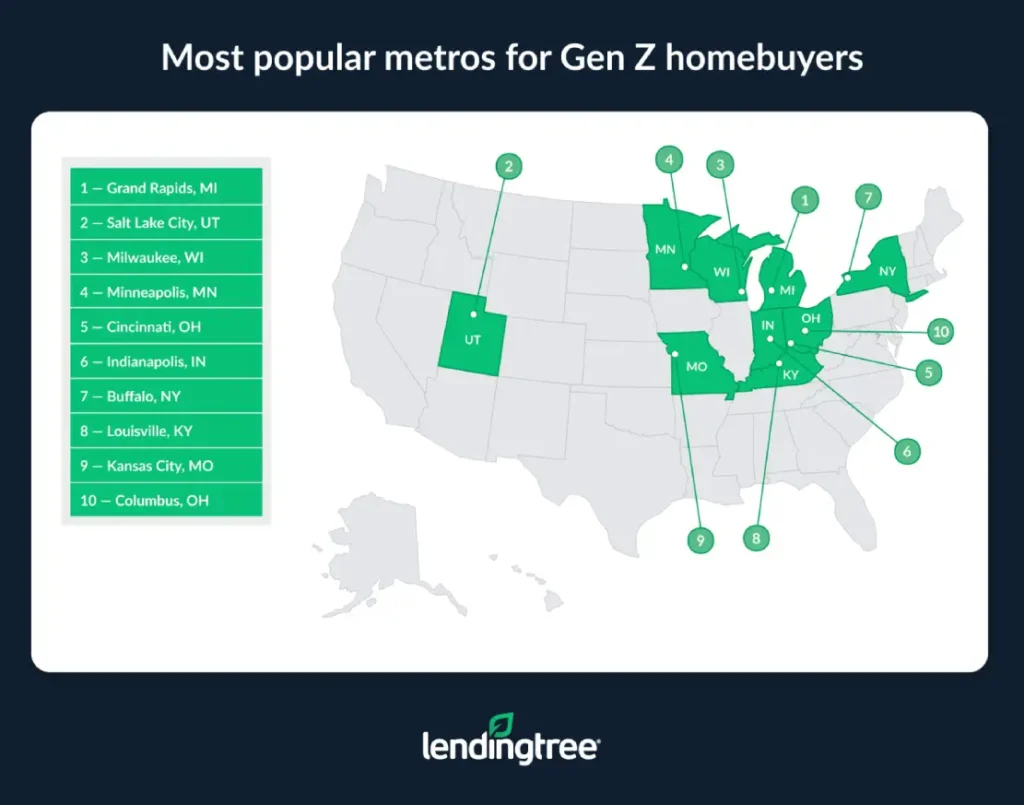

- Grand Rapids, Mich., has the largest share of mortgage requests from Gen Zers. The Michigan metro leads by a solid margin, with Gen Zers comprising nearly a third (31.45%) of mortgage requests. Salt Lake City (24.79%) and Milwaukee (24.33%) follow.

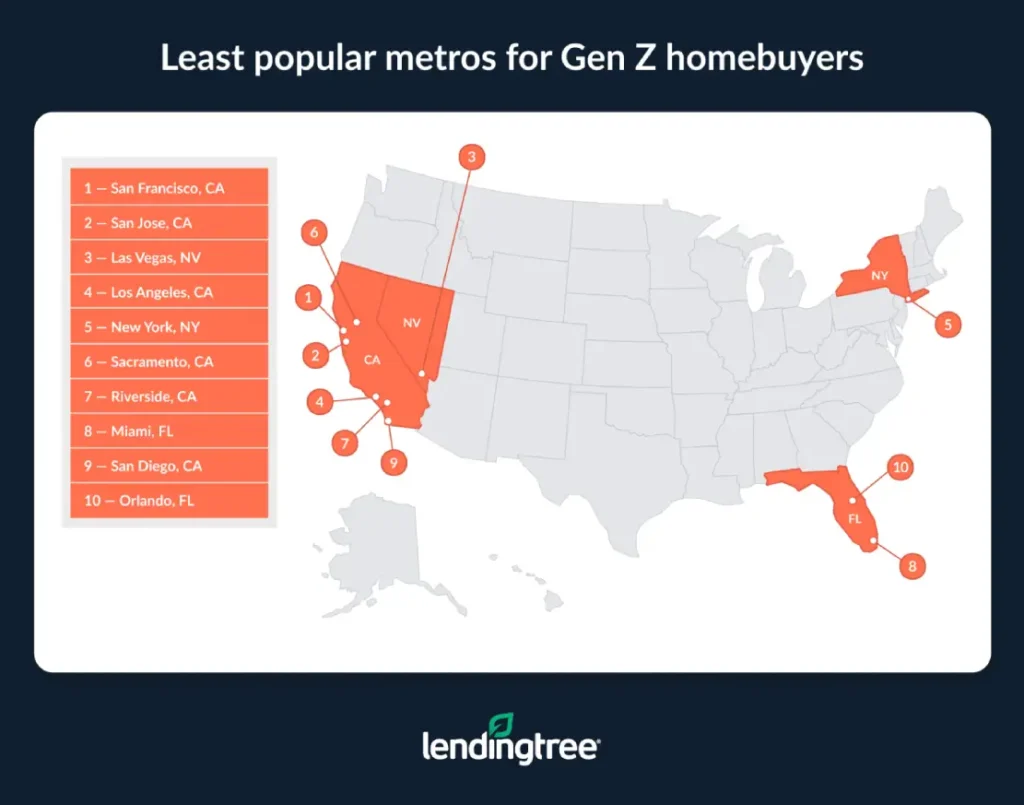

- Expensive Western metros have the smallest rate of mortgage requests from Gen Zers. San Francisco (9.68%) is the only big metro where Gen Zers account for less than 10.00% of requests. San Jose, Calif. (11.31%), and Las Vegas (12.07%) follow.

- Potential Gen Z homebuyers have average credit scores above 700 in just two metros. Those two are San Francisco and San Jose, each at 705. Meanwhile, the lowest average among potential Gen Z homebuyers is 666 — nearly 40 points lower.

- Average down payments differ by as much as $150,000. Down payments among potential Gen Z homebuyers range from an average of $181,350 in San Jose down to $29,916 in Pittsburgh.

- Mortgage loan request amounts also vary significantly. In San Jose, the average loan request from potential Gen Z buyers is $713,704, versus $177,479 in Pittsburgh. That’s a $536,000-plus difference.

Gen Zers comprise 31.45% of mortgage requests in Michigan metro

Among the 50 largest U.S. metros, Grand Rapids, Mich., has the largest share of mortgage requests from Gen Zers. Here, Gen Zers account for 31.45% of mortgage requests.

Salt Lake City follows in a distant second, at 24.79%. Milwaukee (24.33%) rounds out the top three.

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — believes these rankings boil down to affordability.

“Grand Rapids and Milwaukee are relatively average cost-of-living areas where homeownership may not be out of the question for younger people,” he says. “Salt Lake City, on the other hand, isn’t as affordable, but it has seen its young population explode in size in recent years, thanks in part to a thriving tech scene and booming economy. That economic growth has helped many young people in the area flourish economically to where they can afford to buy a house and put down roots in the area.”

Western metros have smallest share of mortgage requests from Gen Zers

Conversely, Western metros have the smallest rate of mortgage requests from Gen Zers.

San Francisco is at the bottom at 9.68% — the only metro analyzed where Gen Zers account for less than 10.00% of mortgage requests. Fellow California metro San Jose (11.31%) and Las Vegas (12.07%) follow.

“Price would likely be the biggest factor in San Francisco and San Jose,” Schulz says. “The cost of buying a house is just so high that many young people see it as a pipe dream. Meanwhile, Las Vegas has a reputation for being a more transient city, so people may be a little less likely to look to put down long-term roots there. While that may not be the case for the area’s many retirees, it might well be true among younger people who move there.”

Overall, six of the 10 least popular metros for potential Gen Z homebuyers are in California. Despite this, one California metro finished in the top 20: Fresno, Calif., where 19.24% of mortgage requests belong to Gen Zers — good for 18th.

Gen Zers in 2 California metros have highest average credit scores

Credit scores may be an important part of homebuying, but potential Gen Z homebuyers have average credit scores above 700 in just two metros: San Francisco and San Jose, both at 705.

Metros where potential Gen Z homebuyers have highest average credit scores

| Rank | Metro | Avg. credit score |

|---|---|---|

| 1 | San Jose, CA | 705 |

| 1 | San Francisco, CA | 705 |

| 3 | Boston, MA | 696 |

The average among potential Gen Z homebuyers in Virginia Beach, Va., is 666 — nearly 40 points lower. Across all metros analyzed, the average credit score is 681.

Schulz says that reflects broader state trends.

“When you compare various states’ credit scores, you see a big range, so it’s reasonable to expect the same when you compare age groups in varying states,” he says. “In general, little in life is more expensive than crummy credit. Poor credit scores keep people from being able to borrow, and if they are able to borrow, they wind up paying far more than others in interest and fees. It can cost you tens of thousands of dollars, so it’s crucial to try to firm up your credit before shopping for a home.”

In 45 of the 50 biggest metros, the average age of potential Gen Z homebuyers is 24. In the other five — San Francisco, San Jose, New York, Providence, R.I., and Boston — it’s 25.

Average Gen Z down payments, loan requests vary significantly

Not only do credit scores vary, but so do down payment amounts.

Potential Gen Z homebuyers in just four metros were expecting to put down above $100,000, and they’re all in California: San Jose ($181,350), San Francisco ($163,591), Los Angeles ($128,449) and San Diego ($108,615).

Metros where potential Gen Z homebuyers plan highest down payments

| Rank | Metro | Avg. down payment |

|---|---|---|

| 1 | San Jose, CA | $181,350 |

| 2 | San Francisco, CA | $163,591 |

| 3 | Los Angeles, CA | $128,449 |

Conversely, the average down payment among potential Gen Z homebuyers is just $29,916 in Pittsburgh — the only metro below $30,000. Oklahoma City ($30,532) and Buffalo, N.Y. ($30,671), follow.

Schulz says that’s a huge difference and speaks to how different life can be across metros.

“For most people of any age in the vast majority of metros, a down payment of $180,000 is pretty much laughably out of reach,” he says. “A $30,000 down payment, however, while certainly daunting, may seem more doable. That difference is enough to force some people in an area to feel that owning a home is impossible and to keep people who might seek affordable housing to not even consider a given area.”

Understandably, mortgage loan request amounts also vary. Metros where down payments are highest also rank highest here. In San Jose, the average loan request from potential Gen Z buyers is $713,704. Meanwhile, the average mortgage loan request is $177,479 in Pittsburgh.

Full rankings: Most popular metros for Gen Z homebuyers

| Rank | Metro | Share of mortgage purchase requests | Avg. credit score | Avg. down payment | Avg. requested loan amount |

|---|---|---|---|---|---|

| 1 | Grand Rapids, MI | 31.45% | 686 | $34,831 | $212,627 |

| 2 | Salt Lake City, UT | 24.79% | 687 | $68,905 | $390,187 |

| 3 | Milwaukee, WI | 24.33% | 686 | $46,402 | $243,905 |

| 4 | Minneapolis, MN | 23.93% | 691 | $48,671 | $273,481 |

| 5 | Cincinnati, OH | 23.80% | 682 | $37,749 | $215,407 |

| 6 | Indianapolis, IN | 23.30% | 678 | $37,181 | $229,050 |

| 7 | Buffalo, NY | 23.18% | 676 | $30,671 | $190,868 |

| 8 | Louisville, KY | 22.84% | 672 | $33,688 | $207,620 |

| 9 | Kansas City, MO | 22.63% | 679 | $38,151 | $227,381 |

| 10 | Columbus, OH | 22.39% | 677 | $40,151 | $243,177 |

| 11 | Oklahoma City, OK | 21.63% | 668 | $30,532 | $199,344 |

| 12 | Pittsburgh, PA | 21.33% | 675 | $29,916 | $177,479 |

| 13 | Detroit, MI | 20.98% | 678 | $36,679 | $198,389 |

| 14 | St. Louis, MO | 20.69% | 676 | $31,662 | $199,634 |

| 15 | Birmingham, AL | 20.27% | 674 | $35,250 | $215,785 |

| 16 | Nashville, TN | 20.09% | 685 | $57,310 | $319,248 |

| 17 | Charlotte, NC | 20.05% | 686 | $50,203 | $294,346 |

| 18 | Fresno, CA | 19.24% | 678 | $48,687 | $315,090 |

| 19 | Cleveland, OH | 19.14% | 685 | $37,412 | $197,880 |

| 20 | Phoenix, AZ | 18.88% | 680 | $57,599 | $337,765 |

| 21 | Denver, CO | 18.70% | 692 | $72,643 | $393,932 |

| 22 | Boston, MA | 17.94% | 696 | $88,823 | $452,887 |

| 23 | Philadelphia, PA | 17.80% | 678 | $49,639 | $271,462 |

| 24 | Dallas, TX | 17.79% | 677 | $50,932 | $291,092 |

| 25 | San Antonio, TX | 17.62% | 669 | $36,161 | $233,640 |

| 26 | Chicago, IL | 17.60% | 684 | $52,735 | $267,082 |

| 27 | Austin, TX | 17.46% | 686 | $63,686 | $335,005 |

| 28 | Baltimore, MD | 17.10% | 687 | $46,821 | $273,750 |

| 29 | Raleigh, NC | 17.02% | 687 | $52,663 | $295,344 |

| 30 | Memphis, TN | 16.89% | 668 | $41,432 | $219,616 |

| 31 | Providence, RI | 16.71% | 685 | $57,430 | $337,500 |

| 32 | Jacksonville, FL | 16.64% | 672 | $38,175 | $253,910 |

| 33 | Portland, OR | 16.26% | 688 | $66,168 | $370,650 |

| 34 | Houston, TX | 16.21% | 672 | $44,957 | $260,668 |

| 35 | Tampa, FL | 16.05% | 675 | $46,519 | $286,503 |

| 36 | Atlanta, GA | 15.99% | 672 | $52,092 | $290,222 |

| 37 | Virginia Beach, VA | 15.84% | 666 | $34,986 | $254,716 |

| 38 | Seattle, WA | 15.45% | 689 | $81,481 | $434,270 |

| 39 | Richmond, VA | 15.31% | 677 | $42,070 | $265,146 |

| 40 | Washington, DC | 15.27% | 693 | $75,883 | $397,648 |

| 41 | Orlando, FL | 15.06% | 678 | $47,134 | $297,447 |

| 42 | San Diego, CA | 14.80% | 691 | $108,615 | $554,346 |

| 43 | Miami, FL | 14.20% | 676 | $67,973 | $362,186 |

| 44 | Riverside, CA | 13.98% | 669 | $60,613 | $395,932 |

| 45 | Sacramento, CA | 13.73% | 685 | $70,144 | $390,754 |

| 46 | New York, NY | 13.54% | 688 | $88,968 | $425,374 |

| 47 | Los Angeles, CA | 13.17% | 687 | $128,449 | $581,558 |

| 48 | Las Vegas, NV | 12.07% | 670 | $60,403 | $326,891 |

| 49 | San Jose, CA | 11.31% | 705 | $181,350 | $713,704 |

| 50 | San Francisco, CA | 9.68% | 705 | $163,591 | $635,915 |

Buying a home as a Gen Zer: Top expert tips

Breaking into the homebuying market may feel daunting as a Gen Zer, particularly if you live in one of the top 50 metros. For these consumers, Schulz offers the following advice:

- Comparison shop for rates. “Shopping around is almost always good advice, but rarely more so than when buying a house,” he says. “Taking the time to compare the rates available from multiple lenders can save you tens of thousands of dollars over the life of your mortgage.”

- Build your emergency savings. “The costs of owning a home go way beyond the purchase price and never stop coming,” he says. “Plus, many of the costs are things that you won’t expect. Having a substantial emergency fund to help when the refrigerator breaks or the air conditioner dies can be an absolute lifesaver financially, keeping you from having to take on credit card debt.”

- Get preapproved before you start shopping. A mortgage preapproval shows sellers you’re a serious buyer and gives you a picture of what you can afford. It can also help streamline the homebuying process and keep you within your budget in a competitive market.

Methodology

Researchers analyzed mortgage purchase requests from users of the LendingTree platform across the nation’s 50 largest metros from Jan. 1 through Dec. 31, 2024.

Utilizing Pew Research Center ranges, LendingTree analysts defined Gen Zers as being born in 1997 through 2012. We then limited this to adults ages 18 to 27 as of 2024.

Researchers compared total mortgage purchase requests to those from potential adult Gen Z homebuyers. Analysts also looked at their credit scores, down payments and loan amounts.

View mortgage loan offers from up to 5 lenders in minutes