Axos Bank Personal Loan Review

- APR

- 11.79% – 20.84%

- Eligibility and access: 4/5

- Cost to borrow: 2.3/5

- Loan terms and options: 4.2/5

- Repayment support and tools: 3/5

Founded in 2000, Axos Bank is a digital financial institute headquartered in San Diego. The bank offers large personal loans — ranging from $7,000 to $50,000 — and caters to borrowers with strong credit.

- Competitive(ish) APRs: With a starting rate of 11.79%, you might be able to find a cheaper loan somewhere else if you have an 800+ credit score. On the flip side, Axos caps its rates at 20.84%, which is a lot lower than the maximum rate of 35.99% that many online lenders offer.

- Unique cashback perk: You can get up to 10% annualized cashback on your personal loan payment with an eligible Total Loan Rewards Checking account. Axos limits this cashback amount to $100 a month, a respectable chunk of change.

- No bad credit loans: If you don’t have a credit score of at least 730, you won’t qualify for an Axos Bank personal loan.

- No small loans: If you’re looking for a small personal loan, you’ll have to apply elsewhere. Personal loans at Axos Bank start at $7,000.

- Charges an origination fee: Axos will keep 1.00% - 2.00% of your loan funds as an origination fee.

- Best if you have very good credit and want to switch banks: Axos isn’t just an online lender, it’s a full-on digital bank. If you maintain an eligible Total Loan Rewards Checking account with Axos Bank, you can get up to $100 cashback per month on your personal loan payment.

Axos Bank pros and cons

Axos Bank personal loans can come with some great features but like any other lender, Axos has its downfalls, too.

Pros

- Can earn cashback on your monthly personal loan payments with an eligible Axos checking account

- Rates capped at 20.84%, lower than a lot of online lenders

- Able to change your due date

Cons

- Must maintain a certain amount in checking account to qualify for cashback

- Can’t add a second person to your application and get a joint loan

- Charges an origination fee on every loan

- Not the cheapest rates if you have excellent credit

Although it has a high minimum credit score requirement (730+), Axos Bank isn’t the most competitive for excellent credit. For instance, LightStream only accepts good to excellent credit and its annual percentage rates (APRs) start at 6.49% (with autopay).

Axos also charges an origination fee on every loan. Many online lenders only charge these if you have bad credit.

Even so, this lender is worth exploring if you need a loan and a new bank. By opening a Total Loan Rewards Checking account, you could get up to 10% annualized cashback on your personal loan payments.

This is how it works:

Axos Bank determines cashback eligibility on a monthly basis. If you have at least double your monthly personal loan payment in your checking account on the last day of the month, you’ll get 0.83% cashback on your monthly payment (0.83% multiplied by 12 months is roughly 10%) the following month. Cashback is limited to $100 per month.

Axos Bank requirements

Axos Bank doesn’t provide some details around its personal loan requirements such as income or debt-to-income ratio (DTI), but here’s what we do know:

| Minimum credit score | 730 |

| Length of credit history | At least four years |

| Required documents |

|

If you meet the basic requirements listed above, you may need to disclose how you plan to use your personal loan. While Axos Bank does allow borrowers to use its funding for a variety of purposes, there are certain expenses you cannot put the money toward.

Axos Bank loans CAN be used for…

- Debt consolidation

- Home improvement

- Major purchases

- Medical bills

- Special occassions and events

- Legal bills

Axos Bank loans CANNOT be used for…

- Investments, stocks and securities

- Cryptocurrency

- College expenses

- Short-term real estate bridge financing

If Axos Bank’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that helps you meet your financial goals and can offer you the best-fitting rates, terms and amounts.

How to get a personal loan with Axos Bank

1. Check your credit score

Checking your credit score can give you an idea of whether you’ll qualify with a lender. It can also give you insight as to what interest rates you may qualify for. To qualify for an Axos Bank loan, you’ll need a credit score of at least 730.

2. Estimate how much you need to borrow

You can borrow anywhere from $7,000 to $50,000 from Axos Bank. However, before you apply for a loan, it’s a good idea to budget for how much you can afford. You can use a personal loan calculator to estimate your potential monthly payments.

3. Prequalify for a loan

During this part of the process, you’ll need to tell Axos Bank how much you need to borrow, your preferred repayment term and how you plan to use the money. Prequalification won’t impact your credit score and it’s a good idea to check if you prequalify with multiple lenders. This way, you can compare rates and see which lender is willing to offer you the best package.

4. Verify your information

If you do decide to go with Axos Bank, you’ll need to verify your information that you provided during the application process. You’ll need to provide your Social Security number, a copy of your driver’s license or state ID and proof of income. Axos Bank will perform a hard credit check if you choose to move forward with the loan, which can cause your credit score to drop by a handful of points.

5. Close on your loan

In the final stage, you’ll need to officially accept your loan by signing a contract agreeing to repay it. Be sure to look over and understand the terms of the agreement before signing. Once you’ve signed, Axos Bank will provide your funds within two days.

How Axos Bank compares to other personal loan companies

Even if you believe Axos Bank aligns with what you’re looking for in a personal loan, it never hurts to shop around and compare other lenders. Here’s how Axos Bank stacks up against similar personal loan lenders.

| Axos Bank | Discover | LendingClub | |

|---|---|---|---|

| LendingTree’s rating | 3.3/5 | 4.6/5 | 4.4/5 |

| Minimum credit score | 730 | 720 | 600 |

| APRs | 11.79% – 20.84% | 7.99% – 24.99% | 6.53% – 35.99% |

| Loan amounts | $7,000 to $50,000 | $2,500 to $40,000 | $1,000 to $60,000 |

| Repayment terms | 36 to 72 months | 36 to 84 months | 24 to 84 months |

| Origination fee | 1.00% – 2.00% | None | 0.00% – 8.00% |

| Funding timeline | May receive funds within two days | May receive funds as soon as the next business day | May receive funds within 24 hours of loan approval. |

| Bottom line | Axos Bank’s cashback program could save you money as you pay off what you borrowed. All the same, you can probably find a cheaper lender if you have excellent credit. | Discover lets you spread out your loan payments from 36 to 84 months. This can help make your monthly payments more manageable, but you’ll likely pay more overall interest. | LendingClub lets you borrow as little as $1,000, so it may work best if you need a small loan. And although it has the lowest credit score requirement, it has the highest origination fees. |

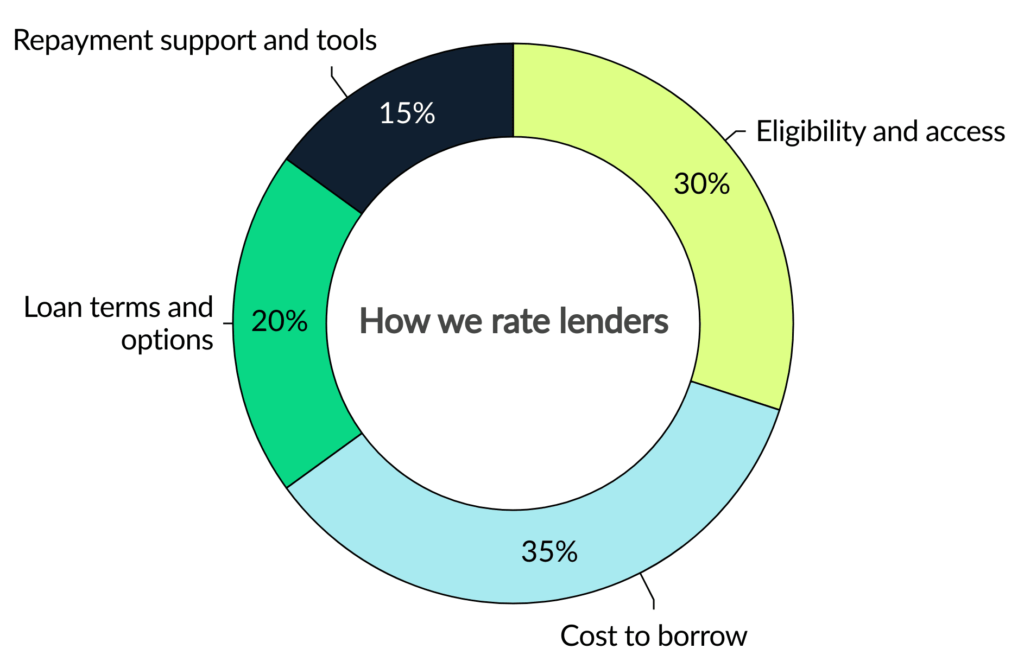

How we rated Axos Bank

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

Axos Bank may be a good option for personal loans as long as you have strong credit and need to borrow at least $7,000.

Axos is probably best suited for those who are willing to switch to (or start a new account with) a new bank. You can get cashback on your personal loan payments with an eligible Axos Total Loan Rewards Checking account.

To qualify for an Axos Bank personal loan, you’ll need to have a credit score of 730 or higher. If yours is lower than that, you’ll need to take steps to improve your credit score.

Axos Bank performs a hard credit pull if you plan to follow through with a personal loan — however, the lender does allow you to prequalify first. Prequalification lets you check rates without hurting your credit score.

Get personal loan offers from up to 5 lenders in minutes