Can You Be Denied a Refinance? 6 Common Reasons Why

Can you be denied a refinance? Absolutely, and it’s more common than you might think. More than 4 in 10 (42%) refinance applications are rejected, typically for reasons like having too much debt, poor credit, insufficient home value or incomplete paperwork. Understanding why refinances get denied — and what you can do about it — can help you improve your chances of approval on your next attempt.

6 reasons a refinance is denied

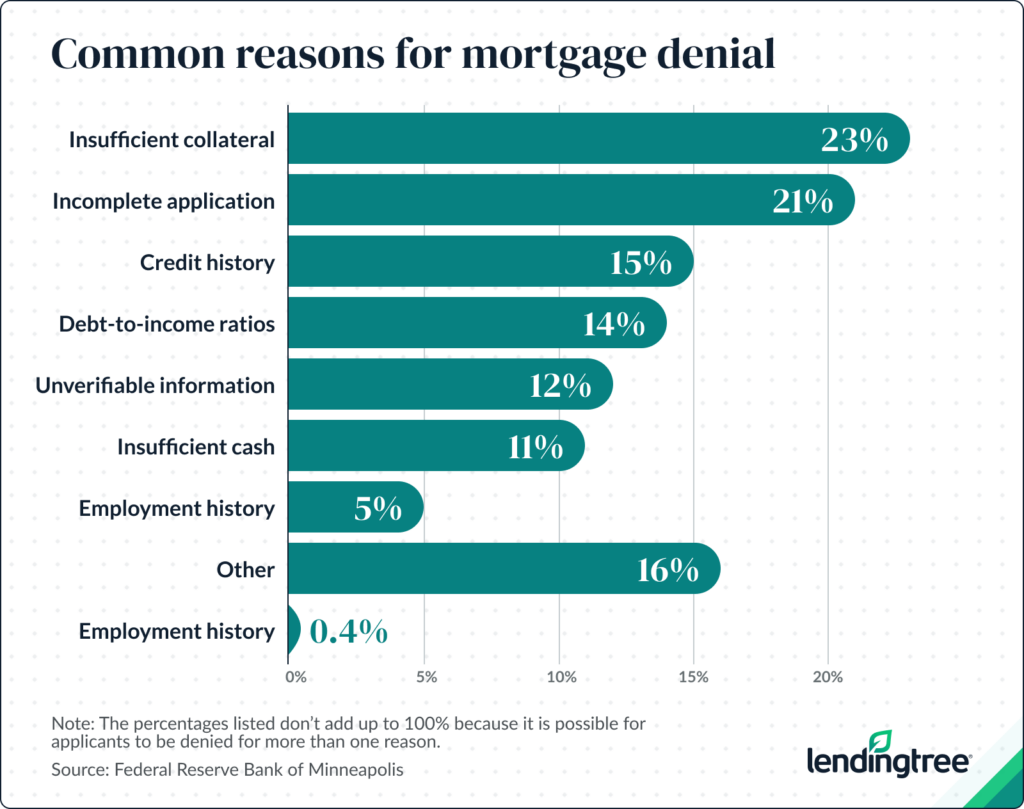

Refinance denial reasons tend to fall into one of several categories, according to data collected under the Home Mortgage Disclosure Act. Here are some of the most common:

1. You have too much debt

The most common reason for refinance loan application denial is too much debt. Lenders typically limit your debt-to-income (DTI) ratio, which measures the total monthly payments you make toward your debt each month against your gross monthly income.

The exact limit depends on your lender and loan type, but the maximum DTI ratio allowed typically sits in the range of 41% to 45%. For more detailed information, read our guide to minimum mortgage requirements.

2. You have bad credit

Your credit score helps lenders gauge how likely you are to repay a loan. To be approved for a conventional loan, you’ll typically need a minimum 620 credit score. The median credit score of someone taking out a mortgage, however, is higher — 772 as of early 2025 — which means you may have a harder time qualifying for a refinance with a lower score.

You may also be denied for a refinance even if your credit scores are acceptable, but you recently went through bankruptcy. The waiting period ranges from one to four years, depending on the mortgage type you’re applying for.

3. Your home’s value dropped

When you apply for a refinance, your lender will make sure the property is worth enough to justify replacing your current mortgage. If your home’s value comes back lower than the loan amount you need, your loan may be denied.

This can be an issue if your home’s value dropped significantly since you first bought it. If you’re underwater on your mortgage — meaning you owe more than the property is worth — it can be tough to refinance.

You may also be denied if your home is in poor condition, or if you’ve made improvements that weren’t permitted by local housing authorities. However, these aren’t automatically deal-breakers in all cases, so it’s worth discussing options with your lender.

4. Your application was incomplete

A surprisingly common reason lenders deny refinance applications is because the loan application was incomplete. If your lender doesn’t have all the information it’s asked for, it may choose to send you a letter informing you that your application is incomplete, or simply deny your refinance.

Pay close attention to the documents and data your lender is asking for when you apply for a refinance loan. This could include pay stubs, W-2 forms, tax returns or other documents needed to verify your income.

5. Your lender can’t verify your information

Lenders will double-check to verify some information in your mortgage application. As an example, for your employment history, they may contact your current or former employers to see how long you worked there. If your lender has trouble with this process, your mortgage may be denied.

6. You don’t have enough cash

When you refinance a home, you often have to bring some cash to the table to pay for closing costs and fees to close the new loan. Sometimes, your lender is willing to roll these costs into your loan or give you a credit in exchange for charging you a higher interest rate — this is also known as a no-closing-cost refinance. This isn’t always an option, though, and “insufficient cash” is a fairly common reason lenders deny refinance applications.

Yes, even if your lender has declared you “clear to close” — that is, has approved your loan application and set a closing date — it’s possible for you to still get a loan denial. However, these cases are rare and typically only happen if you actively do something to alter your credit history or employment status.

Clear-to-close only lasts for a few days to a week, so just sit tight. Don’t take out any new loans, apply for any new credit or quit your job during that window.

Mortgage loans can’t be denied after closing, except in cases of outright fraud. But if you change your mind, you do have the right to cancel your refinance loan within three days of closing.

My refinance was denied, now what?

If your lender denied your mortgage refinance application, it’s not the end of the world. About 42% of people who applied for a mortgage refinance were denied, as of early 2025. But just because one lender denies your home loan application, it doesn’t mean that every lender will.

Be sure to ask for the specific reason you were denied. The law requires a lender to give you an “adverse action” notice with reasons for the loan rejection. However, the notice doesn’t have to be in writing unless you request it. Further, you may not be entitled to a notice if you were denied for prequalification rather than preapproval or approval.

How to get approved after you’ve had a denial

Check your credit report for errors

If your refinance was denied due to your credit history, your lender must tell you the numerical score it reviewed and the agency that provided it. You can get a free copy of your credit report from the major reporting agencies. Take a close look at the report and make sure all the information is accurate. And if you see something on your credit report that you don’t think is legitimate, you can dispute it.

Common errors on a credit report include credit cards or loans that aren’t yours, incorrect balances reported on credit lines, incorrect late payments that were actually made on time and multiple accounts reported for a single debt. These errors could lower your credit scores enough to make you ineligible for a refinance.

Take steps to improve your credit

If your credit score is keeping you from refinancing, you’ll want to raise it as quickly as possible. Since your payment history makes up 35% of your credit score, the most important thing you can do to improve your credit is to make sure all your mortgage payments and other bills are paid on time.

You should also do what you can to make current any past-due accounts. Plus, try to keep your credit card balances under 30% of their limit, and only apply for loans you absolutely need.

For personalized guidance on boosting your credit, try LendingTree Spring.

Paying down your debt

Paying off some (or all!) of your debt lowers your DTI ratio and may improve your credit score. Try to pay off some of your balances completely, whether that means eliminating a personal loan or paying off your auto or student loan. In the meantime, avoid taking on new debt. Remember that additional monthly obligations will skew your DTI ratio and make it harder to refinance your mortgage.

Try a specialized refinance program

If you keep getting denied due to your home’s value, there may be a specialized program that can help. There are nonqualified mortgage (non-QM) lenders that offer refinance programs with no waiting period after a bankruptcy or foreclosure. And if your loan was denied because your lender couldn’t calculate enough self-employed income to qualify you, bank statement programs are available that allow you to avoid providing tax returns.

Recommended Articles