11 Best Rewards Credit Cards in March 2026: Cash Back, Travel and Everyday Value

Key takeaways

- There are two main types of rewards credit cards: travel and cash back.

- The Chase Sapphire Preferred® Card is our pick for the best travel rewards credit card because of its generous rewards, valuable sign-up bonus and ability to transfer points to many travel partners.

- The Capital One Savor Cash Rewards Credit Card is best for cash back rewards because of its high rewards rate in a number of popular spending categories.

- To get the value for each rewards card in our list, we looked at the average value of the card over two years, taking sign-up bonuses, annual bonuses, ongoing earning rate and the annual fee into account. Read more about how we determine each card’s value.

Winner: Best rewards credit card

Winner: Best rewards credit card

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is the best rewards card for travelers who want flexible and valuable points for a reasonable $95 annual fee. With a generous rewards rate and sign-up bonus, it’s easy to rack up points quickly and redeem them at several airline and hotel partners.

Travel rewards credit cards

- Best rewards credit card: Chase Sapphire Preferred® Card

- Best luxury travel rewards credit card: Chase Sapphire Reserve®

- Best airline rewards credit card: AtmosTM Rewards Ascent Visa Signature® credit card

- Best hotel rewards credit card: World of Hyatt Credit Card

- Best business rewards credit card: Ink Business Preferred® Credit Card

Cash back rewards credit cards

- Best cash back rewards credit card: Capital One Savor Cash Rewards Credit Card

- Best credit card for gas rewards: Citi Custom Cash® Card

- Best dining rewards card: Chase Freedom Unlimited®

- Best credit card for U.S. Supermarkets: Blue Cash Preferred® Card from American Express

- Best rewards credit card for fair credit: Amazon Prime Store Card

- Best rewards credit card for students: Capital One Savor Student Cash Rewards Credit Card

12 top rewards credit cards

| Credit Cards | Our Ratings | Rewards Rate | Welcome Offer | Annual Fee | |

|---|---|---|---|---|---|

Chase Sapphire Preferred® Card

on Chase's secure site Rates & Fees |

1X - 5X points

| 75,000 points

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

| $95 |

on Chase's secure site Rates & Fees |

|

Chase Sapphire Reserve®*

|

1X - 8X points

| 125,000 points

Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

| $795 | ||

AtmosTM Rewards Ascent Visa Signature® credit card*

|

1X - 3X points

| 80,000 points

Earn 80,000 bonus points and a $99 Companion Fare (plus taxes and fees from $23) with this offer. To qualify, make $4,000 or more in purchases within the first 120 days of opening your account.

| $95 | ||

World of Hyatt Credit Card*

|

1X - 9X points

| 30,000 points

Earn 30,000 bonus points after you spend $3,000 on purchases in your first 3 months from account opening. Plus, earn 2 bonus points per dollar in the first 6 months on purchases that normally earn 1 bonus point, on up to $15,000 spent.

| $95 | ||

Ink Business Preferred® Credit Card*

|

1X - 3X points

| 100,000 points

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

| $95 | ||

Capital One Savor Cash Rewards Credit Card

|

1% - 8% cash back

| $200 Cash Back

Earn $200 Cash Back after you spend $500 on purchases within 3 months from account opening

| $0 | ||

Citi Custom Cash® Card*

|

1% - 5% cash back

| $200 cash back

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

| $0 | ||

Chase Freedom Unlimited®

on Chase's secure site Rates & Fees |

1.5% - 5% cash back

| $200 cash back

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

| $0 |

on Chase's secure site Rates & Fees |

|

Blue Cash Preferred® Card from American Express

|

1% - 6% cash back

| As High As $300 statement credit

You may be eligible for as high as $300 cash back after spending $3,000 in purchases on your new Card in the first 6 months. Welcome offers vary and you may not be eligible for an offer. Cash back is received as Reward Dollars, redeemable for statement credit or at Amazon.com checkout. Terms Apply.

| $0 intro annual fee for the first year, then $95. | ||

Amazon Prime Store Card*

|

5% back at Amazon.com

Amazon Prime members can earn 5% back at Amazon.com

| $60 Amazon gift card

$60 Amazon Gift Card upon approval

| $0 | ||

Capital One Savor Student Cash Rewards Credit Card

|

1% - 8% cash back

| $50 Cash Back

Earn $50 Cash Back when you spend $100 in the first three months

| $0 |

How we chose the best rewards credit cards

We take a comprehensive, data-driven approach to identify the best rewards credit cards. We use an objective rating and ranking system that evaluates over 200 credit cards from more than 50 issuers. All recommendations are made by LendingTree’s editorial team, completely independent of affiliate partnerships or compensation. Every card is selected based on its merit and ability to help people achieve their financial goals. We use the following criteria to make our picks:

We calculate the rewards earned for the average cardholder using Bureau of Labor statistics data and an annual spend of $20,000, minus the annual fee. This value includes sign-up bonuses and annual bonuses (including annual free night certificates). We look at the average rewards earned over two years to balance out a card’s ongoing value with its first-year value.

We consider how easy the rewards are to use, looking at factors like expiration dates, minimum redemption thresholds, blackout dates and the availability of flexible redemption options like travel statement credits and cash back.

We also compare a card’s benefits — such as purchase protections, travel protections, elite status benefits and travel credits — against benefits from other cards.

Note that our ratings are a starting point for comparing and choosing the best rewards credit card. However, your needs may be different from the average cardholder. You should consider the amount you’re likely to spend in a card’s bonus categories and which benefits you value to choose the best card for you.

Best rewards credit card

The Chase Sapphire Preferred® Card is one of the most valuable rewards credit cards available. It offers a generous rewards rate on several categories, including dining and travel — plus a high sign-up bonus that’s easy to earn. It has a reasonable $95 annual fee, much of which can be offset by the card’s travel benefits and an annual hotel credit of up to $50. With 14 hotel and airline partners to choose from, it’s easy to put your valuable Chase points to good use.

Chase Sapphire Preferred® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards rate: 1X - 5X points

- Highly valuable sign-up bonus

- Flexible points that can be transferred to travel partners

- Annual Chase TravelSM hotel credit worth up to $50

- Up to 75% bonus on travel portal redemptions

- Excellent travel protections

- $95 annual fee

- No airport lounge access

- No complimentary elite status

The Chase Sapphire Preferred® Card is the best rewards card for most travelers looking for a flexible and valuable card for a moderate ($95) annual fee. Its solid rewards rate on many different spending categories and high sign-up bonus let you earn points quickly. Plus, the card offers excellent travel insurance and a wide variety of hotel and airline transfer partners at a 1:1 ratio.

Estimated value of rewards earned

- First year value: $2,272

- Ongoing value: $772

- Click APPLY NOW to apply online.

- Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases

- Earn up to $50 in statement credits each account anniversary year for hotel stays through Chase Travel℠

- 10% anniversary points boost - each account anniversary you'll earn bonus points equal to 10% of your total purchases made the previous year.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

- Member FDIC

- Rates & Fees

Best travel credit cards

Best luxury travel rewards credit card

Chase Sapphire Reserve®*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards rate: 1X - 8X points

- Over $1,200 in annual travel credits

- Over $1,500 in annual lifestyle credits

- Lounge access

- IHG® One Rewards Platinum Elite status

- Annual travel credit of up to $300

- Extensive travel protections

- $795 annual fee

- $195 authorized user fee

- Credits can be overwhelming

The Chase Sapphire Reserve® has plenty of benefits and credits that can help you save if you value luxury travel. Its array of travel, dining and lifestyle credits alone could more than pay for the $795 annual fee if you take advantage of them. The card’s valuable rewards rate, sign-up bonus and selection of transfer partners can also help make the annual fee worth it.

Estimated value of rewards earned

- First-year value: $5,222

- Ongoing value: $2,722

- Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

- Get more than $2,700 in annual value with Sapphire Reserve.

- Earn 8x points on all purchases through Chase Travel℠, including The Edit℠ and 4x points on flights and hotels booked direct. Plus, earn 3x points on dining worldwide & 1x points on all other purchases

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Access over 1,300 airport lounges worldwide with a complimentary Priority Pass™ Select membership, plus every Chase Sapphire Lounge® by The Club with two guests. Plus, up to $120 towards Global Entry, NEXUS, or TSA PreCheck® every 4 years

- Get up to $150 in statement credits every six months for a maximum of $300 annually for dining at restaurants that are part of Sapphire Reserve Exclusive Tables.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Coverage, Lost Luggage Insurance, no foreign transaction fees, and more.

- Get complimentary Apple TV+, the exclusive streaming home of Apple Originals. Plus Apple Music — all the music you love, across all your devices. Subscriptions run through 6/22/27 — a value of $250 annually

- Member FDIC

Best airline rewards credit card

AtmosTM Rewards Ascent Visa Signature® credit card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards rate: 1X - 3X points

- Generous welcome offer

- Annual Companion Fare after qualifying purchases

- Path to elite status

- Free checked bag

- Preferred boarding

- $95 annual fee

- Limited destinations

The AtmosTM Rewards Ascent Visa Signature® credit card is an excellent pick for travelers who frequent Alaska Airlines. For a moderate $95 annual fee, you’ll get a high earning rate and sign-up bonus plus a few airline-specific benefits. Those include free checked bags for you and up to six guests, preferred boarding and a path to elite status. You can also receive a $99 Companion Fare (plus taxes and fees from $23) on Alaska Airlines or Hawaiian Airlines operated flights within North America after qualifying spending.

Estimated value of rewards earned

- First-year value: $1,764*

- Ongoing value: $533*

- Earn 80,000 bonus points and a $99 Companion Fare (plus taxes and fees from $23) with this offer. To qualify, make $4,000 or more in purchases within the first 120 days of opening your account.

- Receive a $99 Companion Fare (plus taxes and fees from $23) each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year. Valid on all Alaska Airlines and Hawaiian Airlines flights within North America booked on AlaskaAir.com.

- Earn unlimited 3 points for every $1 spent on eligible Alaska Airlines and Hawaiian Airlines purchases. Earn unlimited 2 points for every $1 spent on eligible gas, EV charging station, cable, streaming services and local transit (including ride share) purchases. And earn unlimited 1 point per $1 spent on all other purchases.

- Earn a 10% rewards bonus on all points earned from card purchases if you have an eligible Bank of America® account.

- Free checked bag on Alaska Airlines and Hawaiian Airlines and enjoy priority boarding on Alaska Airlines, for you and up to 6 guests on the same reservation, when you pay for your flight with your card — Also available for authorized users when they book a reservation too.

- Earn and redeem across 1,000+ destinations worldwide with oneworld® Alliance member airlines and 30+ global air partners.

- Plus, no foreign transaction fees and a low $95 annual fee.

Best hotel rewards credit card

World of Hyatt Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards rate: 1X - 9X points

- Solid sign-up bonus

- High earning rate on Hyatt stays

- Annual free night reward after spending requirement

- Path to elite status

- $95 annual fee

- Free night certificate limited to Category 1-4 properties

- Perks and rewards mostly limited to Hyatt

The World of Hyatt Credit Card can help you save on hotel stays if you like staying at Hyatt properties. You can get a good sign-up bonus, free night every year at any Category 1-4 Hyatt hotel or resort after reaching a spending threshold and a path to further elite status for a $95 annual fee.

Estimated value of rewards earned

- First-year value: $995*

- Ongoing value: $755*

- Earn 30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening. Plus, up to 30,000 more Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Points, on up to $15,000 spent.

- Enjoy complimentary World of Hyatt Discoverist status for as long as your account is open.

- Get 1 free night each year after your Cardmember anniversary at any Category 1-4 Hyatt hotel or resort

- Receive 5 tier qualifying night credits towards status after account opening, and each year after that for as long as your account is open

- Earn an extra free night at any Category 1-4 Hyatt hotel if you spend $15,000 in a calendar year

- Earn 2 qualifying night credits towards tier status every time you spend $5,000 on your card

- Earn up to 9 points total for Hyatt stays – 4 Bonus Points per $1 spent at Hyatt hotels & 5 Base Points per $1 from Hyatt as a World of Hyatt member

- Earn 2 Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airlines, on local transit and commuting and on fitness club and gym memberships

Best business rewards credit card

Ink Business Preferred® Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards rate: 1X - 3X points

- Generous sign-up bonus

- Elevated points on travel and select business categories

- $0 foreign transaction fees

- Travel and purchase protections, including primary rental car insurance

- Employee cards at no additional cost

- Spending cap on highest earning rate

- High spending requirement to earn sign-up bonus

One of the best features of the Ink Business Preferred® Credit Card is its large sign-up bonus. This card allows you to stack up valuable Chase Ultimate Rewards® points on a variety of business categories (including travel), making it one of the most rewarding cards on our list. Further, you’ll get flexible redemption options, including a 1:1 transfer to several airline and hotel loyalty programs.

Estimated value of rewards earned

- First year value: $2,193*

- Ongoing value: $393*

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- Member FDIC

Best cash back rewards credit cards

Best cash back rewards credit card

Capital One Savor Cash Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards rate: 1% - 8% cash back

- $0 annual fee

- Easy-to-earn sign-up bonus

- Valuable rewards rate

- Long intro APR on purchases and balance transfers

- Low rewards rate outside of bonus categories

- Target and Walmart are excluded from grocery store cash back rate

The Capital One Savor Cash Rewards Credit Card is an excellent cash back card since it offers an unlimited elevated rewards rate on a variety of common spending categories for a $0 annual fee. If you combine this with a 2% cash rewards card like the Wells Fargo Active Cash® Card, you can maximize your savings even more.

Estimated value of rewards earned

- First-year value: $652*

- Ongoing value: $452*

- Earn a one-time $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening

- $0 annual fee and no foreign transaction fees

- Earn unlimited 3% cash back at grocery stores (excluding superstores like Walmart® and Target®), on dining, entertainment and popular streaming services, plus 1% on all other purchases

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels, vacation rentals and rental cars booked through Capital One Travel

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

- 0% intro APR on purchases and balance transfers for 12 months; 18.49% - 28.49% variable APR after that; balance transfer fee applies

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Why it’s in my wallet

“I like having the Capital One Savor Cash Rewards Credit Card because I earn 3% cash back on dining and takeout, and can easily redeem the rewards as a statement credit. In addition, since it doesn’t have a foreign transaction fee and I don’t have a travel card, I was also able to use it when I went to a friend’s wedding abroad.”–Sarah Fisher, deputy editor

Best credit card for gas rewards

Citi Custom Cash® Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards rate: 1% - 5% cash back

- Earn 1% - 5% cash back, with gas included in the top earning category

- Cash back earned automatically (no need to opt in)

- Decent sign-up bonus

- $500 spending cap on 5% cash back rate each billing period

- You only earn 1% cash back on other purchases

- 3% foreign transaction fee

- No travel protections

The Citi Custom Cash® Card offers one of the highest cash back rates available on gas, if gas is your highest category of spending in a month. Its unique rewards program lets you earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Gas is included in the eligible categories.

Estimated value of rewards earned

- First year value: $622*

- Ongoing value: $422*

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 17.99% - 27.99%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2026.

- No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

Best dining rewards card

Chase Freedom Unlimited®

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards rate: 1.5% - 5% cash back

- $0 annual fee

- Long intro APR on purchases and balance transfers

- Can use cash back as points with another Chase Ultimate Rewards® card

- Solid travel and purchase protections

- Balance transfer fee

- Foreign transaction fee

The Chase Freedom Unlimited® is a $0-annual-fee card with a valuable rewards rate on dining among other select categories, plus an elevated rewards rate on everything else. It also comes with perks like purchase protections and a long intro APR on purchases and balance transfers. This would also be a good card to add to your wallet in addition to other cards with elevated rates in categories like groceries or gas.

Estimated value of rewards earned

- First-year value: $622

- Ongoing value: $422

- Click APPLY NOW to apply online.

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

- Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases.

- No minimum to redeem for cash back. You can use points to redeem for cash through an account statement credit or an electronic deposit into an eligible Chase account located in the United States!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 18.24% - 27.74%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

- Rates & Fees

Best groceries credit card

Blue Cash Preferred® Card from American Express

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards rate: 1% - 6% cash back*

- Extremely high earning rate on U.S. supermarket purchases and elevated rewards on other categories

- Large welcome offer

- Intro APR on purchases

- Valuable credits

- Annual spending cap on highest rewards rate

- Foreign transaction fee (2.7% of each transaction after conversion to US dollars.)

Our top card pick for cash back on groceries is the Blue Cash Preferred® Card from American Express because of its high earnings rate compared to other cards. You can earn a high cash back rate at U.S. supermarkets, up to $6,000 per year. If you max out the $6,000 spend threshold each year – which can be easy to do, especially if you buy household and pet care products at the supermarket – you’ll earn $360 back annually on those purchases alone. You also earn rewards at a high rate on a variety of other categories, including U.S. gas station purchases, U.S. streaming subscriptions and transit. Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

Estimated value of rewards earned

- First year value: $815*

- Ongoing value: $420*

- Click APPLY NOW to apply online.

- Apply and find out your welcome offer. As High As $300 cash back* after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply, and if approved: 1. Find out your offer amount 2. Accept the Card with your offer 3. Spend $3,000 in 6 months 4. Receive the cash back. *Cash back is received in the form of Reward Dollars that can be redeemed for a statement credit or at Amazon.com checkout.

- $0 intro annual fee for the first year, then $95.

- Enjoy 0% intro APR on purchases and balance transfers for 12 months from the date of account opening. After that, your APR will be a variable APR of 19.49%-28.49%.

- Plan It®: Buy now, pay later with Plan It. Split purchases of $100 or more into equal monthly installments with a fixed fee so you don’t have the pressure of paying all at once. Simply select the purchase in your online account or the American Express® App to see your plan options. Plus, you’ll still earn rewards on purchases the way you usually do.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year in eligible purchases (then 1%), 6% cash back on select U.S. streaming subscriptions, 3% cash back at eligible U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more) purchases and 1% cash back on other purchases. Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.

- Get up to a $10 monthly statement credit after using your enrolled Blue Cash Preferred® Card for a subscription purchase, including a bundle subscription purchase, at DisneyPlus.com, Hulu.com, or Stream.ESPN.com U.S. websites. Subject to auto-renewal.

- Terms Apply.

- Rates & Fees

Why it’s in my wallet

“The Blue Cash Preferred® Card from American Express is a great card for my everyday expenses. I get a high cash back* rate on my U.S. supermarket and transportation purchases, including taxis and public transit, and I just apply those rewards directly to my bill as a statement credit. I typically prefer credit cards without an annual fee, but the streaming subscription credit** offsets the annual fee — so for me, it’s worth the cost.”– Sarah Fisher, deputy editor at LendingTree

Best rewards credit card for fair credit

Amazon Prime Store Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards rate: 5% back at Amazon.com

- $60 Amazon Gift Card upon approval

- $0 annual fee

- High rewards rate on Amazon purchases

- Accessible to people with fair credit

- Prime membership required to earn cash back

- Deferred interest applies on promotional financing

- High interest rate

- Can only use this card for Amazon purchases

The Amazon Prime Store Card is a worthwhile card for anyone who shops frequently with Amazon Prime. You’ll earn even more on purchases and get a $60 Amazon Gift Card upon approval with no spending requirement.

Estimated value of rewards earned

- First year value: $564*

- Ongoing value: $414*

- Choose 0% APR financing: Buy now and pay over time with equal monthly payments on qualifying purchases. Terms apply.

- No annual fee

- Zero fraud liability: You are protected from unauthorized charges.

- Join Prime to earn 5% back: Prime Store Card members can earn 5% back at Amazon.com and Whole Foods Market (In-Store Code required) with an eligible Prime membership.

Best student rewards credit card

Capital One Savor Student Cash Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Rewards rate: 1% - 8% cash back

- Unlimited high rate of cash back

- Rewards are simple to redeem

- Travel and purchase protections

- Foreign transaction fees: None

- Potentially high APR

- No intro APR on purchases or balance transfers

The Capital One Savor Student Cash Rewards Credit Card offers some of the best rewards for a student credit card, thanks to its bonus earnings on dining, grocery stores and entertainment. It also comes with better-than-usual benefits for a starter card, including extended warranty and travel accident insurance. Plus, it’s a great card to bring on your semester abroad, since you don’t have to worry about foreign transaction fees.

Estimated value of rewards earned

- First year value: $129*

- Ongoing value: $79*

- Earn unlimited 3% cash back at grocery stores (excluding superstores like Walmart® and Target®), on dining, entertainment and popular streaming services, plus 1% on all other purchases

- Early Spend Bonus: Earn $50 when you spend $100 in the first three months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Enjoy no annual fee, foreign transaction fees, or hidden fees

- Earn unlimited 5% cash back on hotels, vacation rentals and rental cars booked through Capital One Travel

- Earn up to $500 a year by referring friends and family when they're approved for a Capital One credit card

- Earn 8% cash back on entertainment purchases when you book through the Capital One Entertainment portal

- Build your credit with responsible card use

- Whether you're at a 4-year university, community college or other higher education institution, this card might be an option for you

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

How to choose the best rewards credit card

- Decide whether you want to earn cash back or points/miles: If you travel a lot, you can squeeze a lot more value out of points and miles than cash back if you transfer directly to travel partners. If you’re not a big traveler, then cash back cards are a better option.

- See what areas you spend the most on: Finding out the types of purchases you make the most can help you look for cards with rewards rate that will help you earn the highest rewards. Some categories to consider comparing include gas, groceries, travel, dining and entertainment.

- Think about what level of annual fee makes sense for you: Credit card annual fees can range from $0 to nearly $800. You can get a lot of value out of no-annual-fee cards, but you may have to opt for a higher-annual-fee card if you want better benefits and rewards.→ Check out the best no-annual-fee credit cards

- Compare sign-up bonuses and benefits: If you’re torn between card options with similar rewards rate, comparing sign-up bonuses and different card benefits could help you make the best decision. Different issuers typically offer different travel and purchase protections, credits and travel perks.→ Check out the best credit card sign-up bonuses

- Find out if you’re pre-qualified and apply: It’s important to choose a card that’s compatible with your credit score. If your credit’s not in good shape, it’s a good idea to see if you’re pre-approved for a card, as it can give you a good idea of whether you qualify or not. Keep in mind that getting pre-approval does not guarantee you’ll be approved when you officially apply.

How to maximize credit card rewards

Use multiple cards to maximize category bonuses.

Combining rewards rates of different credit cards can help you earn the highest rates across several of your most common spending categories.

Use shopping portals to earn additional rewards on online shopping.

When you shop online, be sure to see if the merchant you’re buying from is on your credit card issuer’s shopping portal. Shopping via these portals can help you rack up even more rewards.

Get your spouse or partner involved as your “Player 2.”

Having another person as your “Player 2” means there are twice as many opportunities to earn rewards, whether that’s using the same cards or pooling together points from different credit cards or rewards programs.

Use credit cards for your business or side hustle.

Look for opportunities or areas to use your credit cards (or apply for a credit card) that you might not be already, like any businesses or side hustles you have. Make sure your credit card strategy is molded around your existing spending habits instead of getting cards for the sake of spending more and earning rewards.

Don’t transfer points until you’ve verified that there’s award space available.

Transferring your points to a travel partner is permanent — so before you pull the trigger, make sure your travel plans are all still available. Since points transfers are usually instantaneous, it’s best to transfer right before you’re about to book your hotels or flights.

Take advantage of transfer bonuses to loyalty programs.

Credit card issuers regularly offer transfer bonuses to different airline and hotel loyalty programs. Before you decide to transfer your points to a particular program, see if there are any promotions in your travel portal that you can take advantage of, so you can figure out the best way to redeem your credit card travel points.

What are points and miles worth?

Credit card points and miles are worth different amounts depending on your issuer and where (and when) you redeem them. Take a look at how different banks and redemption options compare:

Rewards value by bank*

| Credit card points | Estimated value per point |

|---|---|

| Chase Ultimate Rewards® |

|

| American Express Membership Rewards® |

|

| Citi ThankYou® Rewards |

|

| Capital One Miles |

|

Rewards value by airline*

| Airline | Average value per mile |

|---|---|

| American Airlines | $0.018 |

| Delta Air Lines | $0.011 |

| JetBlue | $0.012 |

| Southwest Airlines | $0.014 |

| United Airlines | $0.013 |

Rewards value by hotel*

| Hotel | Average value per point |

|---|---|

| World of Hyatt | $0.020 |

| Choice Privileges | $0.008 |

| Marriott Bonvoy | $0.009 |

| Hilton Honors | $0.005 |

| IHG | $0.005 |

Would you trade rewards for a cap on credit card interest rates?

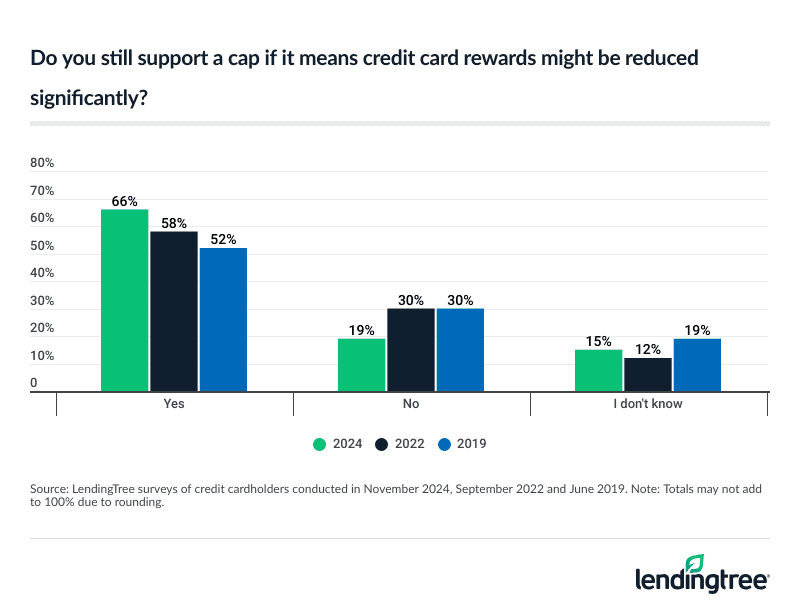

According to a LendingTree survey, more than 3 in 4 cardholders support a cap on credit card interest rates. Additionally, 66% of Americans say they’d back a cap, even if it leads to lower rewards on credit cards. This number is up from 58% in 2022 and 52% in 2019.

Keep reading

Learn more about how rewards credit cards work

Frequently asked questions

The best credit card for travel rewards is the Chase Sapphire Preferred® Card. It comes with an accessible annual fee of $95 plus benefits that will easily help you make up for it, like a hotel credit of up to $50 as well as access to flexible and valuable Chase Ultimate Rewards® points.

Cash back is a type of credit card reward that returns a portion of your spending as money. Typically, this reward is a percentage of your purchase amount. You can redeem cash back for statement credits that are directly applied to your balance, bank account deposits, checks, gift cards and more.

Typically, the IRS doesn’t consider credit card rewards taxable income. They are instead treated as rebates or discounts, since you usually earn them as a result of your spending. That said, if the reward doesn’t require that you spend a certain amount to earn it (e.g. a sign-up bonus that you earn instantly), the IRS may consider it taxable income. If you’re unsure about a specific situation, we recommend contacting a tax professional.

Our pick for the best cash back credit card is the Capital One Savor Cash Rewards Credit Card because it offers elevated rewards in popular spending categories like grocery stores, dining, entertainment and popular streaming services. See all of LendingTree’s picks for best cash back credit cards.

Yes, there are a few ways you can sell your credit card rewards to individuals or businesses through online marketplaces, forums or brokers. But it’s not recommended. Instead, we recommend another option like redeeming for gift cards or donating your points to charity.

For most cards, rewards won’t expire as long as your account remains open and in good standing. However, depending on your credit card, your rewards may expire if you don’t redeem them or use your card within a given time period. You should always read a card’s terms and conditions before applying.

*Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout.1. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Chase Sapphire Reserve®, AtmosTM Rewards Ascent Visa Signature® credit card, World of Hyatt Credit Card, Ink Business Preferred® Credit Card, Citi Custom Cash® Card, Amazon Prime Store Card and Wells Fargo Active Cash® Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.