BMO Mortgage Review 2026

BMO offers a significant amount of financial assistance to qualifying U.S. homebuyers, including discounts on interest rates and closing costs, down payment help and other special offers. However, the Canadian-owned bank makes it challenging for mortgage shoppers to compare loans, as it doesn’t offer online prequalification or much detail on potential loan rates or terms.

See how we reached our verdict below.

- Below-average origination and loan fees

- Wide range of discounts and promotions

- Substantial down payment and closing cost assistance for eligible borrowers

- Higher-than-average interest rates

- Doesn’t offer USDA loans

- Website doesn’t provide detailed terms or rates on most mortgage products

BMO mortgage overview

BMO, formerly BMO Harris, is the U.S. arm of Canadian conglomerate BMO Financial Group. The bank recently took over more than 500 branch locations from Bank of the West. As a result, BMO now has close to 1,000 brick-and-mortar branches across the country.

- Areas of service: Nationwide

- Digital service: You can initiate a mortgage application online, but you must speak with a mortgage banker to get prequalified

- Headquarters: 320 S. Canal St., Chicago, IL 60606

- Website: BMO.com

BMO rates and fees

Rates

Except for home equity loans and lines of credit, BMO doesn’t publish mortgage rates online; customers must apply to get rate information. But thanks to data from the Home Mortgage Disclosure Act (HMDA), you can see what BMO has previously charged new mortgage applicants.

BMO’s mortgage rates are higher-than-average compared to other large national banks. According to HMDA data, the average rate for all BMO home loan types was 8.70% in 2024 — more than one percentage point (1.04) higher than the average prime offer rate (APOR). APOR is a benchmark rate that indicates the lowest rate a bank is likely to offer a customer in the current market. In 2023, BMO’s rate spread was 1.01 percentage points.

Fees

While BMO falls short in competitive interest rates, it makes up for it by charging lower fees than most national lenders. BMO does not disclose fees for most mortgage products online; however, according to HMDA data, in 2024, the bank charged an average origination fee of $2,121 and average total loan costs of $5,495. That’s well below the average origination fee of $3,222 and total expenses of $6,861 charged by the 33 other lenders we reviewed.

Home equity borrowers will be pleased to know BMO covers most or all of the closing costs on home equity loans and home equity lines of credit (HELOCs); however, that typically means paying higher interest rates. Additionally, the bank charges a $75 annual fee during the HELOC’s draw period.

BMO offers several money-saving promotions, including:

- A 0.125% rate cut for most conventional and jumbo loans and 0.25% for HELOCs when you set up autopay from a BMO Checking account

- A rate discount of up to 0.625% on jumbo mortgages and up to 0.50% on HELOCs for qualifying borrowers with BMO deposit accounts

- May offer special closing cost discounts on conventional and government-backed mortgages for qualified customers.

- $16,000 or more in down payment and closing cost assistance for eligible borrowers

What types of mortgage loans does BMO offer?

BMO offers a variety of home loans, including:

- Conventional loans

- FHA loans

- VA loans

- Jumbo loans

- Home equity loans

BMO offers fixed-rate mortgages, adjustable-rate mortgages (ARMs), low-down-payment mortgages and cash-out refinances.

Conventional loan qualification requirements

- Minimum 620 to 640 credit score

- Minimum 5% down payment (1% or 0% down for eligible borrowers)

For borrowers with limited down payment funds or imperfect credit, BMO offers FHA loans backed by the Federal Housing Administration (FHA) for purchase or refinance.

FHA loan qualification requirements

- Minimum 580 credit score

- Minimum 3.5% down payment (as little as 0% down for eligible borrowers)

Active-duty service members and veterans may qualify for a VA loan, a mortgage backed by the U.S. Department of Veterans Affairs (VA), for purchase or refinance.

VA loan qualification requirements

- Minimum 580 credit score

- No down payment options available

Borrowers planning to purchase a more expensive property and borrow more than $806,500 may qualify for a fixed- or adjustable-rate jumbo mortgage.

Jumbo loan qualification requirements

- Minimum 10% down payment

- No mortgage insurance required

BMO offers a fixed-rate home equity loan with repayment terms of five, 10, 15 or 20 years. BMO also offers a home equity line of credit (HELOC) with a 20-year term. Both products feature little or no closing costs; however, HELOC borrowers pay a $75 annual fee during the 10-year draw period.

Home equity loan qualification requirements

- Minimum 700 credit score for a home equity loan

- Minimum 650 to 680 credit score for a HELOC

BMO mortgage qualifications

| Credit score minimum | 580 to 640 |

| DTI ratio

Debt-to-income (DTI) ratio compares your monthly gross income to your monthly debt payments.

|

|

| Down payment minimum |

|

Don’t know your credit score? Get your free score on LendingTree Spring today.

BMO is a relatively selective lender, according to 2024 HMDA data. The bank has a 58.4% approval rate on home loans. Its borrowers also tend to have strong application profiles. In 2024, for example, most new mortgage holders made sizable down payments, with an average loan-to-value (LTV) ratio of just 60.7%. Nearly half (45.5%) of approved borrowers had a debt-to-income ratio (DTI) below 40%.

How to apply for a BMO mortgage

1. Choose your loan type

From the home page, click on “Mortgages.” Then choose from the menu of mortgage options: Fixed Rate Mortgage, Low Down Payment Mortgages, Cross-Border Mortgage Program, Adjustable Rate Mortgage, Jumbo Mortgages or Refinance.

2. Get prequalified

Request a prequalification by filling out a mortgage contact form.

3. Submit a loan application

Navigate to “Mortgages Overview” and click “Apply Now” to apply online. You can also apply by phone at 1-888-482-3781 or connect with a BMO mortgage specialist.

Find out more about how to apply for a home loan.

- Identification

- Tax documents

- Bank statement

- Pay stubs

- Debt and asset statements

- Gift letters (if you’re using gifted funds)

Is it safe to get prequalified with BMO?

Yes. But unlike lenders that offer a quick prequalification with just a soft credit check or an online preapproval, BMO requires a more extensive process. You’ll have to speak with a mortgage banker who will pull your credit and evaluate your personal information before giving you a loan estimate.

BMO’s customer service experience

For new mortgage inquiries and applications, BMO Mortgage Bankers are available by phone from 8 a.m. to 7 p.m. CT Monday through Thursday, from 8 a.m. to 6 p.m. CT on Friday and from 8 a.m. to 1 p.m. on Saturday.

- Phone: 1-888-482-3781

Once you’ve submitted an application or closed on a loan, you can check your application or loan status online, by phone, mail or contact form.

- Phone: 1-888-340-2265

- Mail: BMOB M O Bank N.A. Attention: NOE1290

1 Corporate Drive, Suite 360

Lake Zurich, Illinois 60047-8945

How does BMO compare to other lenders?

| LendingTree’s rating |

Expert review from LendingTree.

Back to our BMO summary |

Expert review from LendingTree.

Read our BMO vs. Wells Fargo comparison |

Expert review from LendingTree.

Read our BMO vs. Flagstar Bank comparison |

| Minimum credit score | 580 to 640 | 620 to 640 | 580 to 620; “No credit score” loans available |

| Minimum down payment | 0% to 5% | 0% to 3.5% | 0% to 5% |

| Rate spread

Rate spread is the difference between the average prime offer rate (APOR) — the lowest APR a bank is likely to offer any private customer — and the average annual percentage rate (APR) the lender offered to mortgage customers in 2024. The higher the number, the more expensive the loan.

| 1.04 percentage points | 0.05 percentage points | 0.60 percentage points |

| Loan products and programs |

|

|

|

| Better for: | Borrowers who qualify for the bank’s no- and low-down payment offerings. | Borrowers who qualify for the best possible interest rates. | Mortgage applicants looking for a fully remote experience or a USDA loan. |

BMO vs. Wells Fargo

Wells Fargo also offers down payment and closing cost assistance to qualifying borrowers, but not quite as much as BMO offers. Wells Fargo stands out for its highly competitive interest rates. According to HMDA data, the average rate for a home loan from Wells Fargo was 6.37% in 2024, just slightly above the APOR of 6.32%.

Read more in our full Wells Fargo mortgage review.

BMO vs. Flagstar Bank

Flagstar offers more competitive interest rates than BMO and a full range of mortgage products, including USDA loans. Flagstar also stands out for its digital experience. Borrowers can get a quick prequalification before applying online. Or they can meet remotely with a loan officer rather than calling or meeting in person.

Read more in our full Flagstar Bank mortgage review.

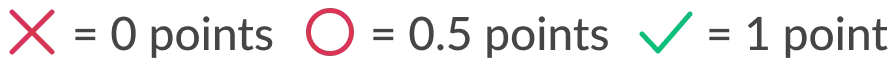

How LendingTree rated BMO Mortgage

LendingTree’s mortgage lender rating is based on a five-point scoring system that factors in several features, including digital application processes, available loan products and the accessibility of product and lending information.

LendingTree’s editorial team calculates each rating based on a review of information available on the lender’s website. Lenders receive a half-point on the “offers standard mortgage products” criterion if they offer only two of the three standard loan programs (conventional, FHA and VA). In some cases, additional information was provided by a lender representative.

BMO’s scorecard:

⭕ Publishes rates online

✅ Offers standard mortgage products

✅ Includes detailed product info online

✅ Shares resources about mortgage lending

✅ Provides an online application

Frequently asked questions

BMO’s digital offerings are relatively modest. However, the bank offers helpful mortgage resources and tools, including a “Rent or Own” calculator and an “Extra Mortgage Payments” calculator.

Yes. BMO is the seventh-largest bank in North America by asset size and has been in business since 1817.

You can view more info about BMO’s state licenses and registrations through the Nationwide Multistate Licensing System and Registry (NMLS) website.

A new mortgage will temporarily lower your credit score — but typically by around 20 points, which you’ll likely gain back within a year, according to LendingTree research. With consistent on-time payments, getting a mortgage could even help your score improve.

BMO Bank is a well-respected lender with an A+ rating from the Better Business Bureau (BBB).

However, recent reviews on BBB and Trustpilot suggest that the bank may be experiencing some growing pains. Many of the bank’s most negative reviews are from former Bank of the West customers, which BMO acquired in 2023. Some of the most consistent customer complaints include poor communication and unfriendly service. But not every reviewer was unhappy; others praised BMO for being easy to work with and dependable.

Compare Multiple Prequalification Offers