Guild Mortgage Review 2026

Guild Mortgage offers a wide range of mortgage options, including conventional and government-backed loans. It stands out for its personalized service and its accessibility to borrowers with no or low credit scores and unique financial situations, offering diverse choices tailored to various needs.

See how we reached our verdict below.

- Rate reduction available for certain loans

- Personalized experience and an extensive network of branches

- Wide selection of specialty loans and homebuyer assistance programs

- No online application

- Mortgage rates not specified online

- Mortgage products not available in New York

Guild mortgage overview

Guild Mortgage was founded in 1960 and is headquartered in San Diego. The lender offers a full range of mortgage products, including government and nongovernment loans, home equity products, specialty mortgages, and programs for borrowers with lower credit scores, nontraditional credit history and unique income situations.

- Areas of service: 49 states (excluding New York) and the Washington, D.C.

- Digital service: Partial online application

- Headquarters: 5887 Copley Drive, San Diego, CA 92111

- Website: GuildMortgage.com

Guild rates and fees

Rates

Guild does not publish its mortgage rates online. However, recent Home Mortgage Disclosure Act (HMDA) data shows that the lender’s rates are fairly competitive compared to other national lenders. In 2024, Guild’s average interest rate was 6.25% across all loan types and 6.11% for purchase loans. These rates were 0.29 percentage points and 0.18 percentage points above the average prime offer rate (APOR), respectively. The APOR is a benchmark that reflects the lowest APR a highly qualified borrower is likely to receive in the current market.

Guild has remained consistently competitive in recent years. In 2023, for example, its average rate was just 0.31 percentage points above the APOR, for all loan types. Since then there’s been a slight improvement in its rates.

Fees

Guild Mortgage does not publish specific information about its loan servicing fees. However, in educational materials available on its website, the lender notes that borrowers can generally expect closing costs to range from 2% to 5% of the home’s value. It also states that a 1% origination fee is typical.

According to 2024 HMDA data, Guild’s average origination fee was $3,928, and its average total loan costs were $8,061 across all loan types. Both figures are higher than the average origination fee ($3,222) and average loan costs ($6,861) among the lenders we reviewed.

Guild’s website provides a cash-to-close calculator that helps prospective borrowers estimate their settlement costs.

Guild Mortgage has several proprietary programs that provide temporary buydowns, 1%- or no-down-payment options, closing cost assistance and more.

- Payment Advantage: A conventional loan with a one-year, lender-paid 1% temporary rate reduction.

- Payment Advantage Plus: A conventional loan with a one-year, seller-paid 2% rate reduction, followed by a one-year, lender-paid 1% rate reduction.

- 3-2-1 Home Plus: For eligible first-time buyers, this program provides $1,250 to $2,500 in closing cost assistance, plus a $2,000 home improvement store gift card.

What types of mortgage loans does Guild offer?

Guild offers a variety of home loans, including:

Guild Mortgage offers conventional loans (nongovernment mortgages) with both fixed- and adjustable-rate options, with financing up to 97% of the purchase price. These loans are available for home purchase, refinance or cash-out refinance and carry repayment terms of 10 to 30 years.

Conventional loan qualification requirements

- 620 minimum credit score

- 3% or 5% minimum down payment

FHA loans, backed by the Federal Housing Administration (FHA), offer financing up to 96.5% of the home purchase price to borrowers with lower credit scores and those seeking a smaller down payment.

FHA loan qualification requirements

- 540 minimum credit score (10% down payment required)

- 3.5% minimum down payment with at least a 580 credit score

Guild’s VA loans, which are available to veterans, service members and surviving spouses, offer several advantages. Backed by the U.S. Department of Veterans Affairs (VA), these loans feature no down payment for eligible borrowers, no private mortgage insurance (PMI) requirement and lower interest rates. Purchase, refinance and cash-out refinance loans are available.

VA loan qualification requirements

- 0% down payment options for eligible borrowers

- Flexible credit qualifications

- Higher debt-to-income (DTI) ratios accepted

Guild offers USDA loans, backed by the U.S. Department of Agriculture (USDA), to low- to moderate-income borrowers purchasing a home in a designated rural area. These loans provide up to 100% financing with typically no required down payment.

Buyers can confirm property and income eligibility with the USDA.

USDA loan qualification requirements

- 540 minimum credit score

- Home located in a rural area, as defined by the USDA

- Low to moderate income, based on area

With Guild’s jumbo loans, borrowers can secure larger mortgage amounts that exceed Federal Housing Finance Agency (FHFA) limits.

Jumbo loan qualification requirements

- Loan amount must exceed county limits

- Strong credit scores, assets and income

Guild’s home equity options include home equity loans (HELoans) up to $500,000 and home equity lines of credit (HELOCs) up to $750,000, allowing homeowners to access a significant amount of their home’s equity for various purposes. The lender offers both fixed- and adjustable-rate HELOC options.

Home equity loan and HELOC qualification requirements

- 640 minimum credit score (HELoan)

- Can borrow up to 90% (HELoan) or 95% (HELOC) of home’s equity

Guild mortgage qualifications

| Credit score minimum | Conventional: 620 FHA: 540 (580 with a 3.5% down payment) VA: Not specified USDA: 540 |

| DTI ratio

Debt-to-income (DTI) ratio compares your monthly gross income to your monthly debt payments.

| Conventional: 50% FHA: 43% VA: 41% USDA: Not specified |

| Down payment minimum | Conventional: 3% or 5% FHA: 3.5% (10% with credit scores below 580) VA: As low as 0% USDA: As low as 0% |

Don’t know your credit score? Get your free score on LendingTree Spring today.

Guild Mortgage has a high approval rate compared to other national lenders. In 2024, the company approved 95.5% of loan applications, according to HMDA data. Guild also appears to be relatively flexible with its lending criteria, showing an average loan-to-value (LTV) ratio of 85.4% across all loan types. Additionally, 61.3% of approved applicants have a debt-to-income (DTI) ratio of 40% or higher.

How to apply for a Guild mortgage

1. Choose your loan type

To view Guild’s loan offerings, visit GuildMortgage.com and click “Mortgage Loans” in the menu up top. This will take you to a landing page where the lender provides a list of common borrower scenarios to help match you with an appropriate loan. Alternatively, the drop-down menu under “Mortgage Loans” offers a full list of the lender’s mortgages and programs.

2. Get prequalified

Guild does not offer prequalification or rate quotes online; you’ll need to connect with a local loan officer or initiate a loan application.

3. Submit a loan application

Guild allows you to start a loan application online, but you must work with a loan officer to complete the process. Moving forward with your application lets you get preapproved and see your potential loan amount and interest rate. With Guild’s Lock and Shop program, you can lock in your interest rate for up to 120 days while shopping for a home. This option is available for conventional, FHA and VA loans, though it requires an up-front fee.

Find out more about how to apply for a home loan.

- Identification

- Tax documents

- Bank statement

- Pay stubs

- Debt and asset statements

- Gift letters (if you’re using gifted funds)

Is it safe to get prequalified with Guild?

Aside from needing to work with a Guild loan officer, the lender does not provide specific details about its prequalification process. Unlike many lenders that offer online prequalification with a soft credit inquiry (which doesn’t affect your credit score), Guild does not have this feature. It does provide a prequalification calculator that estimates a loan amount based on user-provided information.

Guild’s customer service experience

New customers can contact Guild Mortgage Monday through Friday from 6 a.m. to 5 p.m. PT, or use the website to locate a loan officer or local branch. Guild’s website does not offer live chat, but you can submit an online form to have a loan officer contact you.

- Phone: 800-971-3864

- Mail: Guild Mortgage Company, LLC, Attn: Customer Service Department, 5887 Copley Drive, 3rd Floor, San Diego, CA 92111

Once you have a Guild loan, customer service is available Monday through Friday from 5 a.m. to 5 p.m. PT.

- Phone: 800-365-4441

How does Guild compare to other lenders?

| |||

| LendingTree’s rating |

Expert review from LendingTree.

Back to our Guild summary |

Expert review from LendingTree.

Read our Guild vs. AmeriSave comparison |

Expert review from LendingTree.

Read our Guild vs. Pennymac comparison |

| Minimum credit score | 540 to 620 | 500 to 620 | 580 to 620 |

| Minimum down payment | 0% to 5% | 0% to 3.5% | 0% to 3.5% |

| Rate spread

Rate spread is the difference between the average prime offer rate (APOR) — the lowest APR a bank is likely to offer any private customer — and the average annual percentage rate (APR) the lender offered to mortgage customers in 2023. The higher the number, the more expensive the loan.

| 0.29% | 2.63% | 0.81% |

| Loan products and programs |

|

|

|

| Better for: | Borrowers looking for specialty loans and programs who prefer a more traditional banking experience. | Prospective homebuyers with a credit score less than 620. | Borrowers with low credit looking for a digital lending experience. |

Guild vs. AmeriSave

Guild and AmeriSave both offer a similar range of standard mortgage products, including conventional, FHA, USDA and VA loans, as well as home equity options in 49 states, excluding New York. But Guild has a more extensive selection of specialty loans and programs, and much lower average rates than AmeriSave. As a more traditional lender, Guild requires homebuyers to work with a loan officer to complete an application, while AmeriSave functions as an online-only lender, offering a digital application and streamlined lending process.

Ultimately, if borrowers prefer a more traditional lending experience or unique loan options, Guild is the better choice.

Read more in our full AmeriSave mortgage review.

Guild vs. Pennymac

Guild and Pennymac both provide conventional mortgage options to low-credit borrowers. Pennymac offers a fully online application, but it lacks physical branches, first-time homebuyer programs, HELOCs and USDA purchase loans. Meanwhile, Guild provides a more traditional banking experience with personalized service and a range of proprietary loans. Though it does not have an online application process, Guild’s website makes it easy to locate local branches and loan officers.

While these two lenders approve borrowers with credit scores under 600, the odds of approval for a Guild mortgage may be higher for borrowers with poor or bad credit, as they may qualify with a credit score as low as 540.

Read more in our full Pennymac mortgage review.

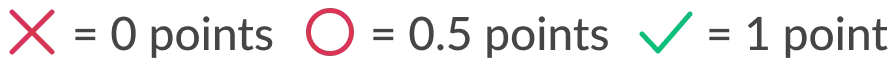

How LendingTree rated Guild Mortgage

LendingTree’s mortgage lender rating is based on a five-point scoring system that factors in several features, including digital application processes, available loan products and the accessibility of product and lending information.

LendingTree’s editorial team calculates each rating based on a review of information available on the lender’s website. Lenders receive a half-point on the “offers standard mortgage products” criterion if they offer only two of the three standard loan programs (conventional, FHA and VA). In some cases, additional information was provided by a lender representative.

Guild’s scorecard:

❌ Publishes rates online

✅ Offers standard mortgage products

✅ Includes detailed product info online

✅ Shares resources about mortgage lending

⭕ Provides an online application

Frequently asked questions

Guild Mortgage offers limited online features, primarily focusing on homebuyer education and mortgage calculators, including prequalification, closing cost and total mortgage payment calculators. These tools are valuable for helping homebuyers assess affordability and make informed decisions.

Licensed in 49 states and the Washington, D.C., Guild Mortgage is a well-established lender with a history of serving homebuyers since 1960.

You can view info on Guild’s state licenses and registrations through the Nationwide Multistate Licensing System and Registry (NMLS) website.

Taking out a Guild Mortgage may temporarily lower your credit score, but it typically drops by 20 points, on average, and rebounds within a year, according to a LendingTree study.

According to external industry ratings, Guild performs well on certain customer satisfaction measures. In the 2025 J.D. Power U.S. Mortgage Servicer Satisfaction Study, Guild ranked second nationwide among mortgage servicers. Though the company is not accredited with the Better Business Bureau (BBB), it is rated A-plus by the BBB. However, its average customer rating on the BBB is less than 2 out of 5 stars (based on more than 30 reviews), with positive comments about responsive loan officers and clear explanations, and complaints focusing on loan delays and poor customer service.

Compare Multiple Prequalification Offers