Jumbo vs. Conventional Loans

What separates jumbo loans and conventional, conforming loans is simply how much you’re borrowing. Conventional loans let you borrow up to the conforming loan limit, but if you need more, you’ll have to use a jumbo loan.

You can access conventional and jumbo loans through private lenders like banks or through loan programs backed by government agencies. We’ll cover how to find your local conforming loan limit and explain how the requirements differ for jumbo versus conventional loans.

Jumbo vs. conventional loan: What’s the difference?

A conventional loan, a type of conforming loan, does not exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). A jumbo loan, which is a type of nonconforming loan, is a loan that surpasses the loan limits set by the FHFA.

The 2025 conforming loan limit for a single-family home in most of the U.S. is $806,500, but rises to $1,209,750 in some high-cost areas. The Federal Housing Finance Agency (FHFA) sets national and local limits for loan amounts each year. Doing so draws a line in the sand, which defines whether a loan is conforming or nonconforming, based on its amount. So in 2025, a jumbo loan for a single-family home is a loan greater than $806,500 or $1,209,750, depending on the location.

View the full U.S. map of 2025 conforming loan limits by county.

The conforming loan limit is set to prevent homebuyers from biting off more than they can chew and potentially losing their homes to foreclosure. However, jumbo loans exist to help borrowers purchase luxury homes or homes in unusually expensive areas.

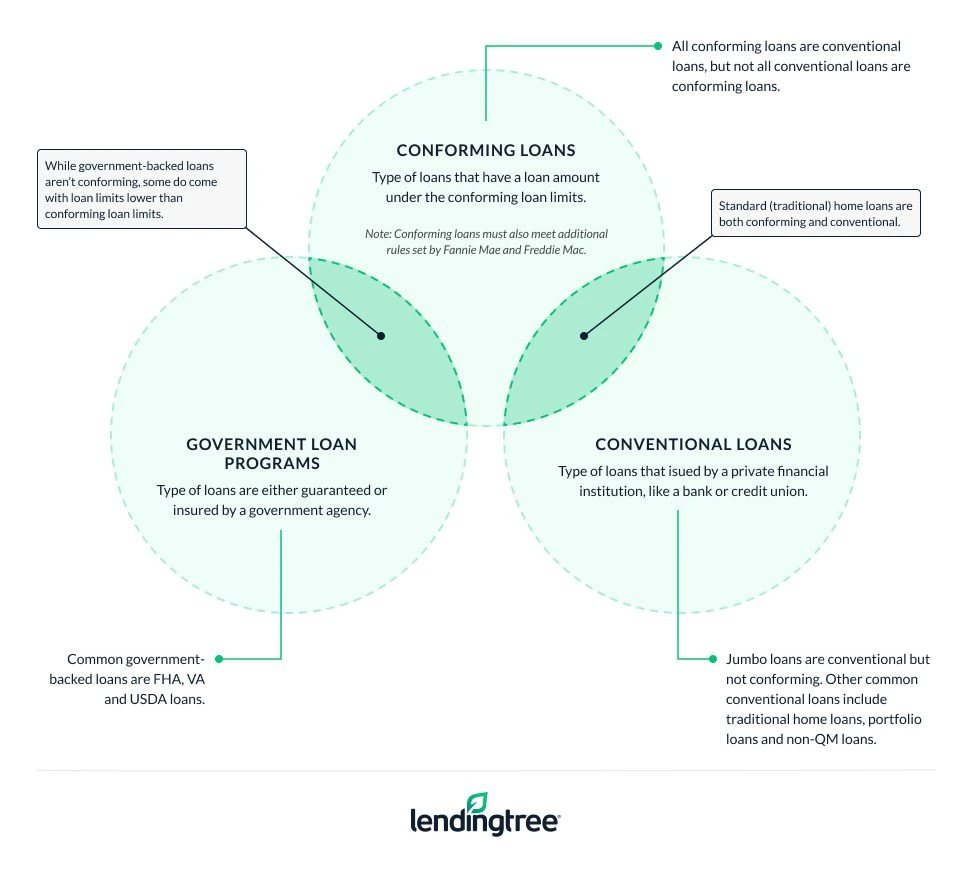

Alternative ways to define mortgage loans: Conforming loan vs. conventional loan

There are two ways of classifying mortgage loans: by loan program or by loan amount. If you remember to keep those approaches to loans separate, the many labels used to describe loans will be far less confusing.

- Loan types include conforming loans, conventional loans and government loans (also called nonconventional loans).

- Loan programs include loans like conforming loans, adjustable-rate mortgages, jumbo loans, and FHA loans, and can be either conventional or nonconventional.

Conventional loans vs. government-backed loans

| Conventional loans | vs. | Government-backed loans |

|---|---|---|

→ Backed by a bank, credit union, Fannie Mae, or Freddie Mac | → Backed by government agencies |

|

Conventional loans are mortgages you can get through loan programs that aren’t backed by a government agency. Instead, they’ll often be backed by banks, credit unions, Fannie Mae or Freddie Mac.

Conversely, government agencies back nonconventional loans. Examples include:

You could potentially get any type of loan — conventional or government — from a conventional lender, whether you need a “regular” or jumbo loan. But only the VA offers government-backed jumbo loan programs, allowing eligible military borrowers with full entitlement to borrow as much as they need.

No, Fannie Mae and Freddie Mac are government-sponsored enterprises (GSEs), not government agencies. They were created by Congress but operate as corporations.It’s important not to think of Fannie and Freddie as government agencies because the loans they back aren’t considered government-backed loans. Learn to associate Fannie and Freddie with conventional lending, and you’ll be good to go.

Conforming vs. nonconforming loans

Jumbo loans can be conventional (backed by a private institution) or nonconventional (backed by a government agency). However they’re always nonconforming, since they exceed the conforming loan limits. A jumbo loan is the largest personal, residential mortgage you can get.

Conforming loan limits vary by county and are $806,500 in lower-cost areas and $1,209,750 in some high-cost areas.

Check the conforming limits in your county.

Ready to get started? Get personalized rate offers from top lenders.

Jumbo vs. conventional loan requirements

It’s usually much harder to qualify for a jumbo loan than a conforming conventional loan, and will take significant amounts of cash and a high income.

| Jumbo (conventional) | Jumbo (VA) | Conventional (conforming) | |

|---|---|---|---|

| Maximum loan amount | No limit (varies by lender) | No limit with full entitlement, FHFA conforming loan limits with partial entitlement | $806,500 to $1,209,750 depending on location |

| Credit score | 700 | No minimum set by the VA, but many lenders require at least 620 | 620 |

| Down payment | 20% | 0% | 3% |

| Debt-to-income (DTI) ratio | 45% | 41% | 45% |

| Cash reserves | Six to 24 months’ worth of mortgage payments | Only in special cases involving multiunit rental properties | Two to six months’ worth of mortgage payments.Typically required if your:• Credit score is below 700• DTI is above 36%• Down payment is low |

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles