Personal Loan Statistics: 2026

Across America, 25.9 million people carry $269 billion in personal loan debt. While that’s far less than what Americans owe on mortgages, auto loans or credit cards, it signals personal loans are gaining ground fast.

Discover how borrowers use personal loans — and see their impact on consumer finances. Dive into our personal loan statistics for a clearer picture.

Key facts

- Americans owe $269 billion in personal loan debt as of the third quarter of 2025, up $12 billion from the previous quarter and $20 billion from a year earlier ($249 billion). That’s an 8.0% jump from the previous year.

- 25.9 million Americans have a personal loan as of Q3 2025, up from 24.2 million a year earlier. That’s a 7.0% year-over-year increase.

- Personal loan debt comprises 1.4% of all outstanding consumer debt as of Q3 2025. It represents 5.3% of nonhousing consumer debt. By comparison, Americans owe $1.233 trillion in credit card debt, which is 6.6% of total outstanding consumer debt.

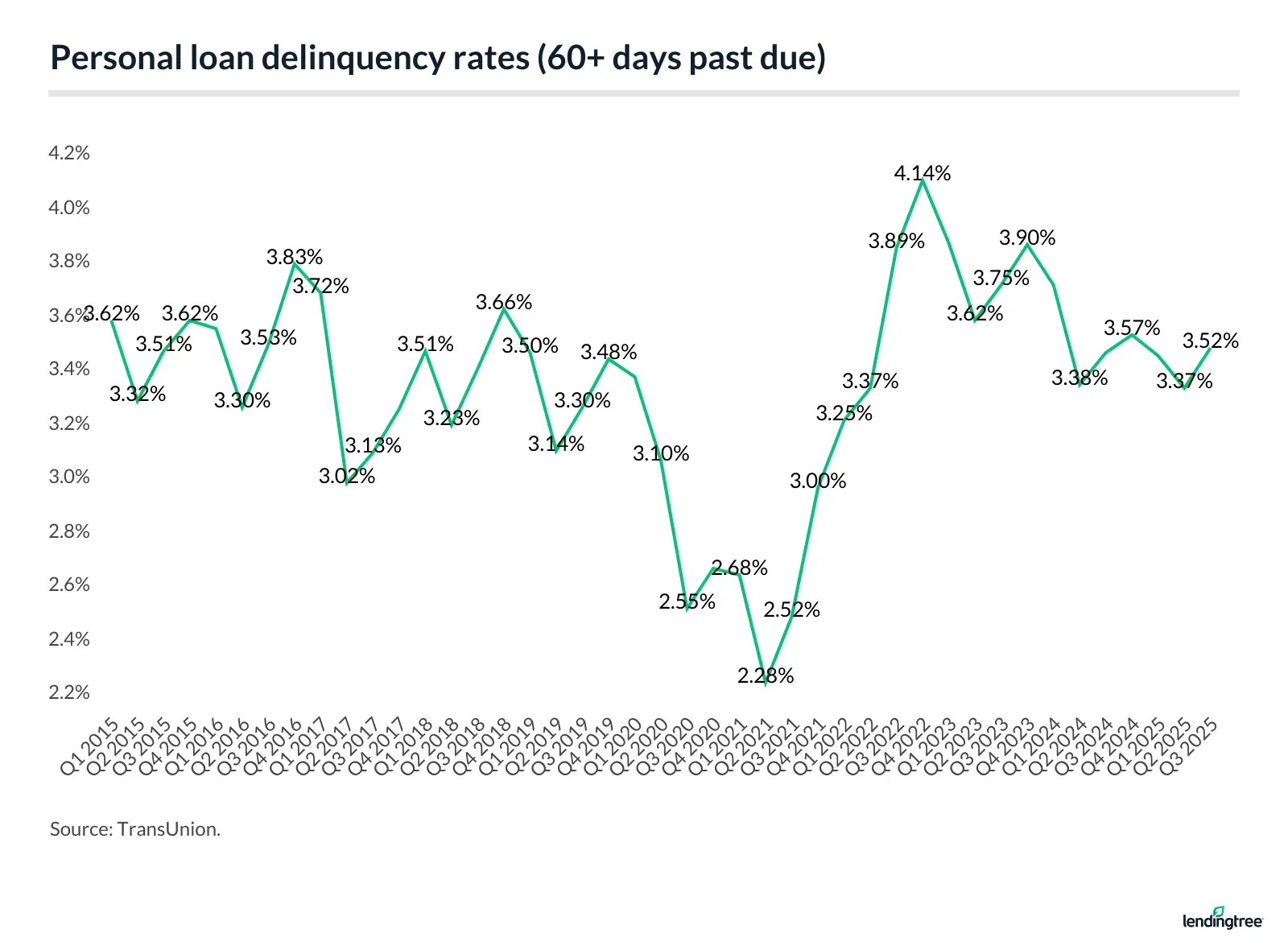

- The delinquency rate (60 days or more past due) for personal loans is 3.52% as of Q3 2025. That’s a minimal increase from 3.50% a year before.

- The average personal loan debt per borrower is $11,724 as of Q3 2025. A year before, the average debt per borrower was $11,652.

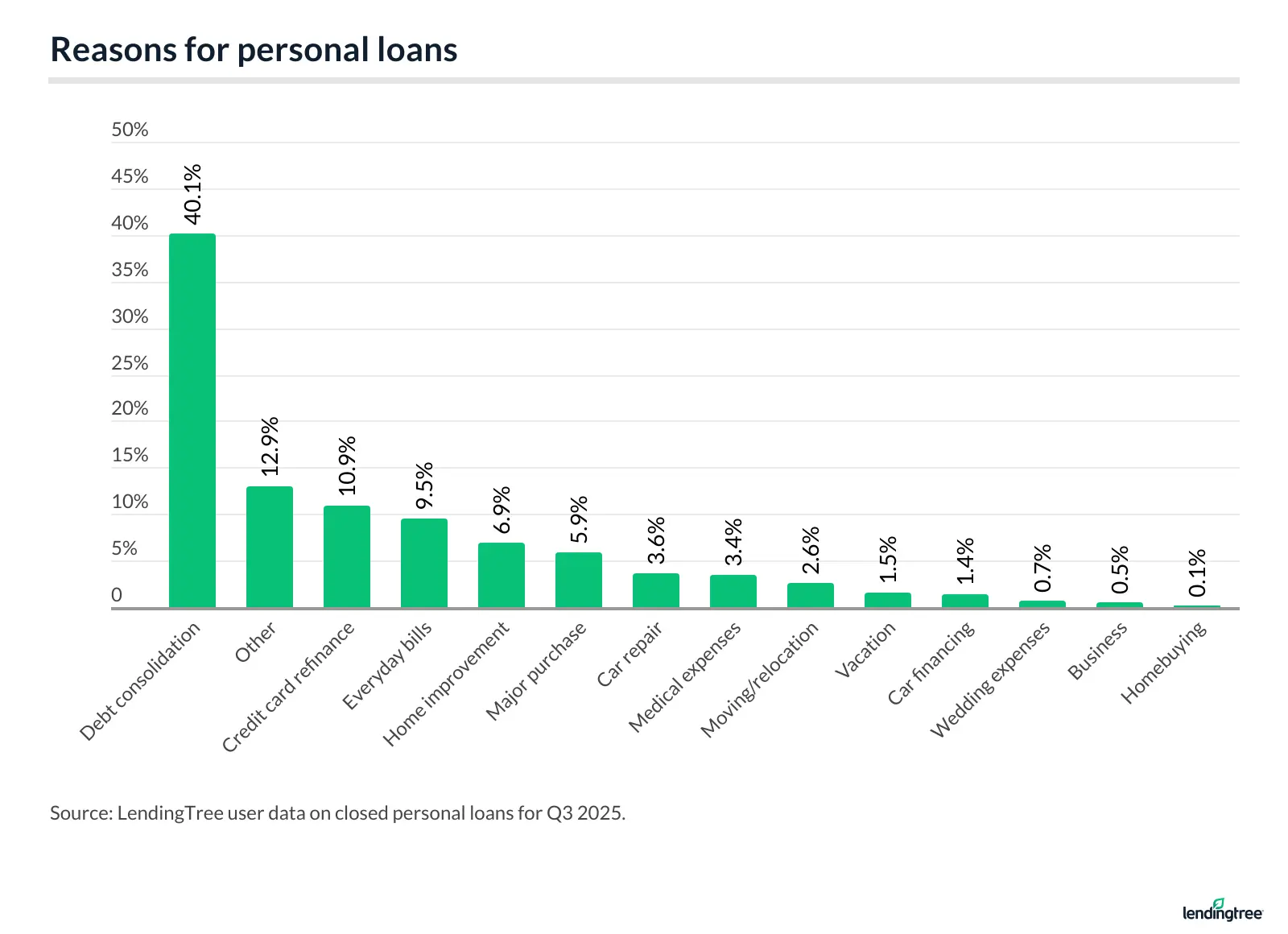

- Almost half of borrowers (51.0%) take out a personal loan to consolidate debt or refinance credit cards. The next-closest reason is for everyday bills (9.5%).

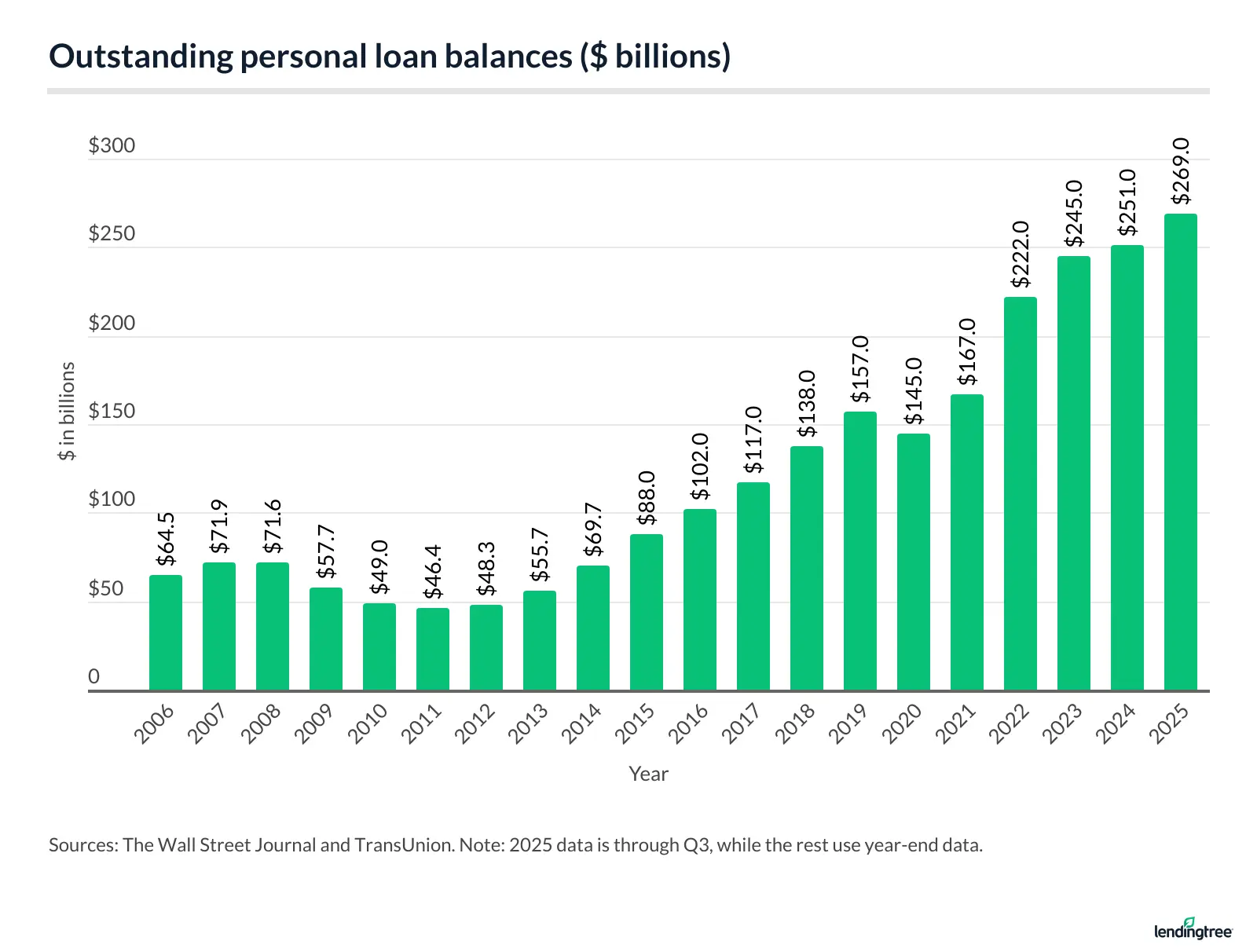

Americans owe $269 billion in personal loan debt

Personal loan borrowers owe $269 billion in debt as of Q3 2025 — up $12 billion from the previous quarter, marking the highest amount in the 19-plus years for which data is available. It’s an 8.0% increase from Q3 2024, when Americans owed $249 billion.

Here’s an overview of the amounts Americans have owed on personal loans over time:

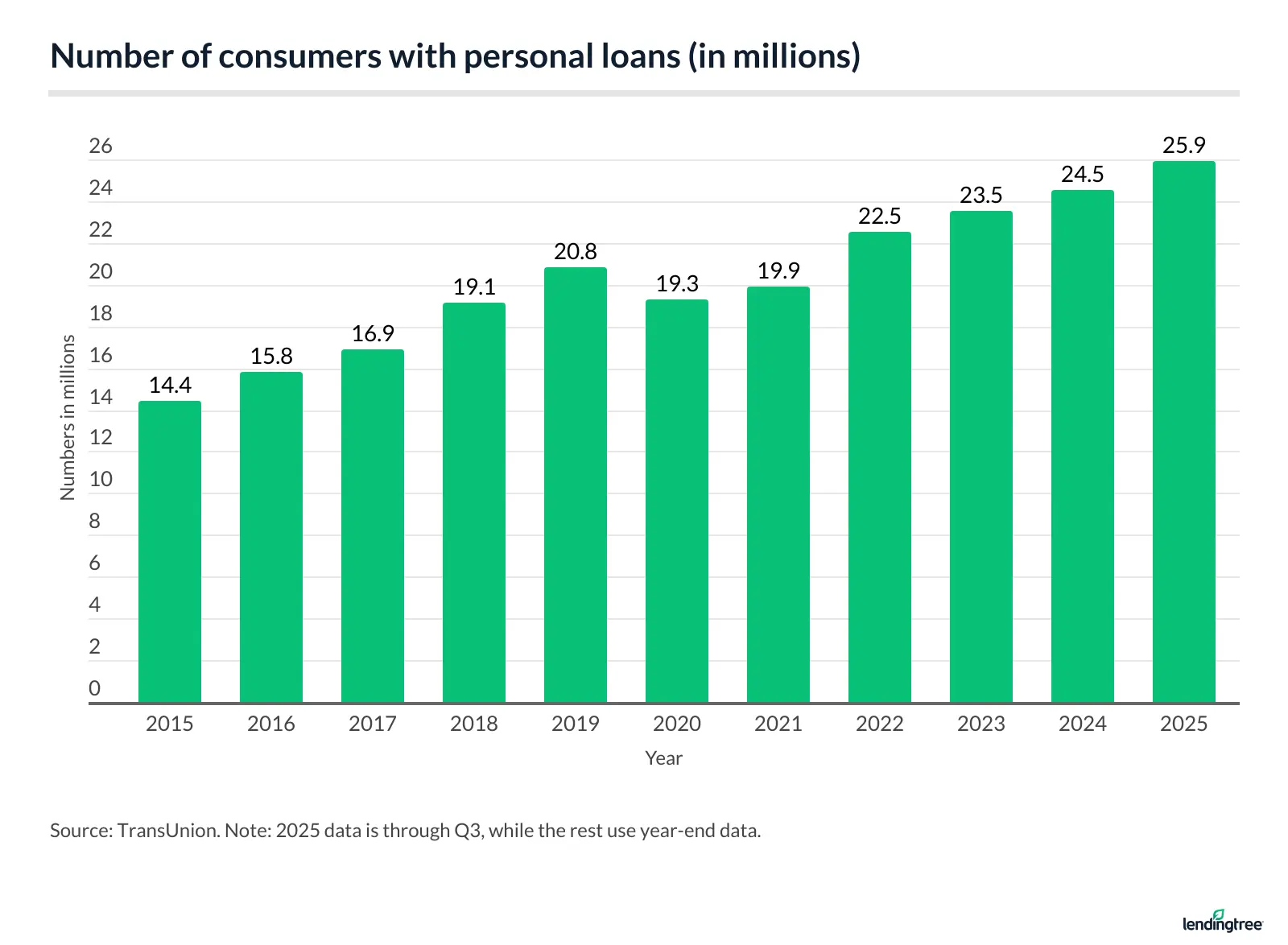

25.9 million Americans have a personal loan

As of Q3 2025, 25.9 million Americans have a personal loan, up from 24.2 million in Q3 2024.

The number of people with loans decreased during the coronavirus pandemic, from a previous high of 20.8 million at the end of 2019 to 18.7 million in Q2 2021. Following that, there were six consecutive increases, after which the number declined from 22.5 million in Q4 2022 to 22.4 million in Q1 2023. The number has since increased by millions.

Here’s a look at the number of consumers with personal loans dating to 2015:

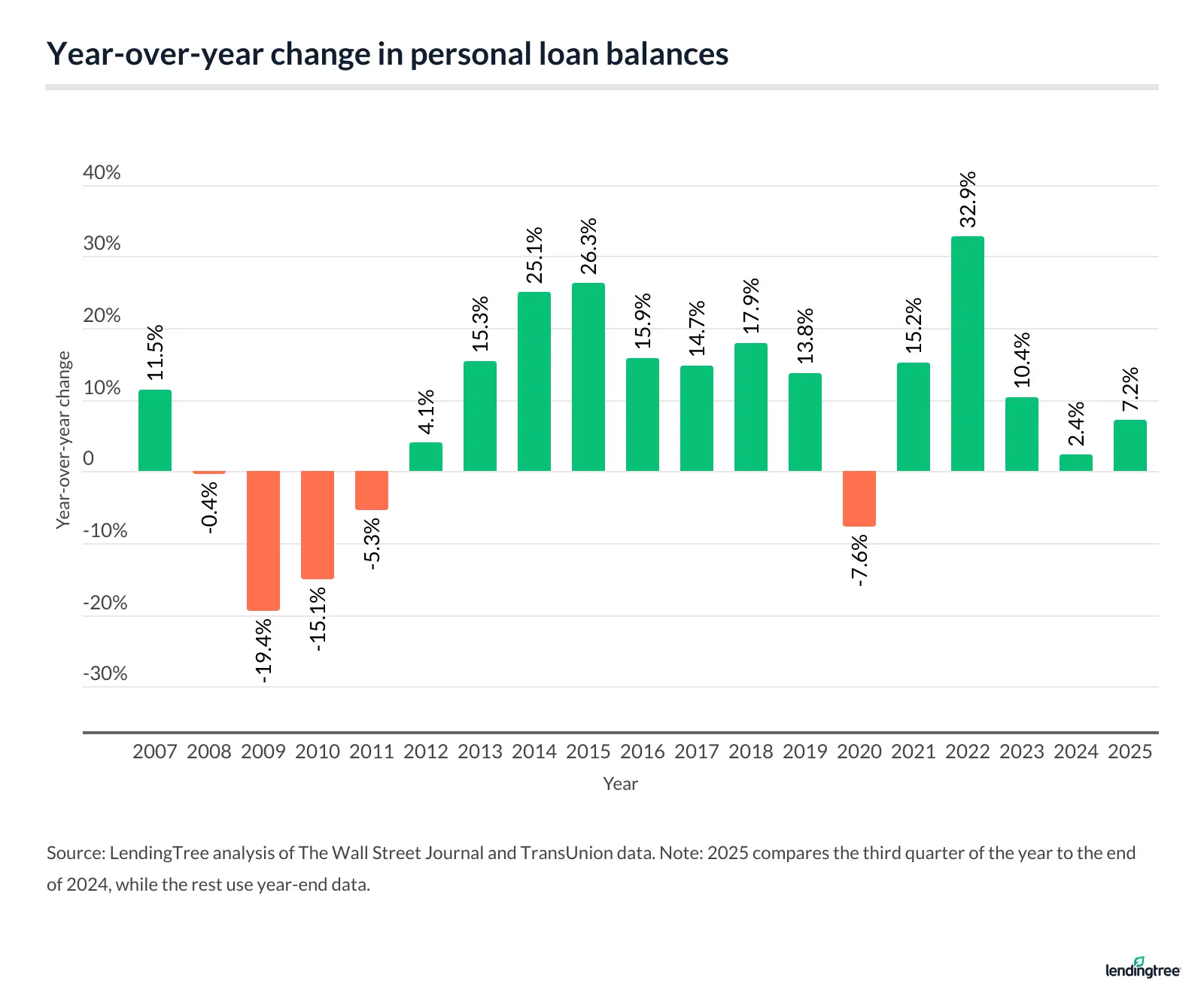

Personal loan growth returns after dropping early in pandemic

The massive, nearly decade-long rise in personal loan debt ended in 2020, thanks to the pandemic. Personal loan balances fell 7.6% in 2020, marking the first decline since 2011.

But personal loan debt balances spiked 15.2% in 2021, reversing the previous year’s downward movement. Q3 2025 balances are up 7.2% from the end of 2024.

Here’s a closer look at the ups and downs since 2007:

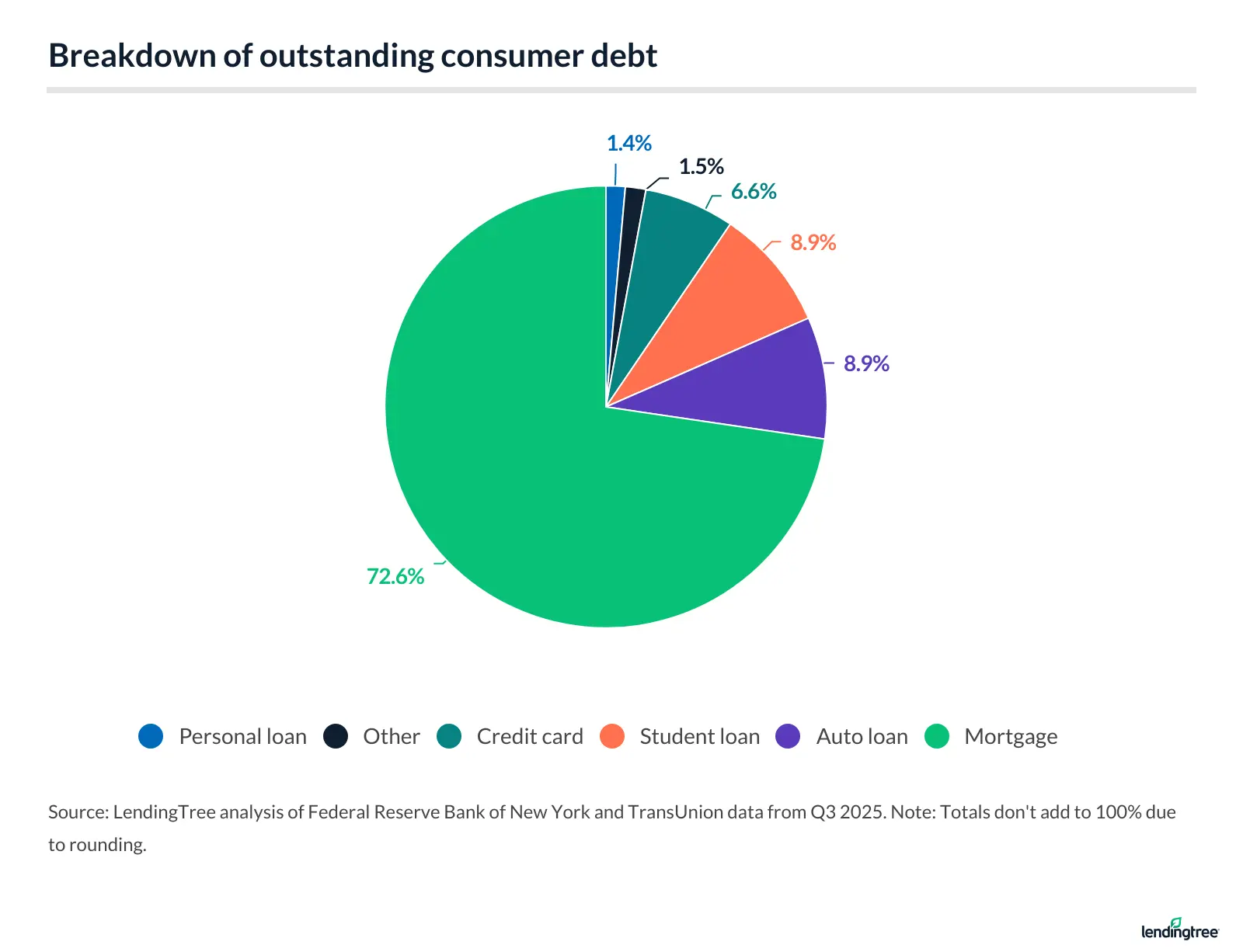

Personal loans account for 1.4% of consumer debt

Personal loans remain a tiny slice — just 1.4% — of American consumer debt, even after major gains in the last decade.

Comparatively, Americans owe $1.233 trillion in credit card debt, which accounts for 6.6% of their outstanding debt.

If you remove mortgages from the picture, personal loans account for 5.3% of nonhousing debt.

3.52% of personal loan accounts are 60 days or more past due

An estimated 3.52% of personal loan accounts are 60 days or more past due as of Q3 2025 — a 0.6% increase from 3.50% in Q3 2024 and a 6.1% decrease from 3.75% in Q3 2023.

Still, that figure is significantly higher than delinquency rates for other common loan types, such as mortgages (1.36%), auto loans (1.45%) and credit cards (2.37%). (Note that credit card delinquencies are tracked at 90 or more days.)

Despite personal loan delinquency rates being higher than those of other loan types, it’s interesting to compare today’s figures with the 30-day delinquency rate of 4.77% on consumer loans in 2009, when the Great Recession ended.

Average personal loan debt per borrower is over $11,700 — and the APRs owed

The average personal loan debt per borrower is $11,724 as of Q3 2025. That compares with:

- $11,652 in Q3 2024

- $11,692 in Q3 2023

- $10,749 in Q3 2022

On average, borrowers with credit scores of 680 or higher see personal loan APRs that are competitive with those on credit cards.

The average APR on new credit card offers is 23.96% as of December 2025, with minimum and maximum rates between 20.36% and 27.55%. As the chart below shows, individuals with excellent credit who apply for a personal loan are likely to receive a better rate than those with less favorable credit.

Personal loan statistics by borrower credit score

| Credit score range | Avg. APR | Avg. loan amount |

|---|---|---|

| 720+ | 15.46% | $21,804 |

| 680-719 | 23.27% | $18,638 |

| 660-679 | 27.30% | $14,842 |

| 640-659 | 29.19% | $12,757 |

| 620-639 | 30.57% | $11,601 |

| 580-619 | 31.96% | $10,941 |

| 560-579 | 33.39% | $11,631 |

| Less than 560 | 31.24% | $11,587 |

However, subprime borrowers — who may not be eligible for other types of credit — typically have to pay higher rates if they receive loan offers.

Consumers often borrow personal loans to pay down debt

Over half (51.0%) of LendingTree users with personal loans intend to pay down debt, including 40.1% for debt consolidation and 10.9% for refinancing credit card debt.

The next most popular uses for a personal loan are paying for everyday bills (9.5%) and home improvements (6.9%).

These statistics spotlight just how vital it is for borrowers to use personal loans wisely.

Borrowers who use this product can come out ahead — but only if they weigh the decision, find a favorable personal loan and practice responsible debt management.

Expect personal loan debt to keep growing

Personal loan debt keeps climbing — and this isn’t likely to stop. As credit card balances surge, more Americans are eyeing personal loans to keep debt in check.

People often turn to personal loans to help manage their credit card debt, and they can be effective tools for doing so. If you have really good credit, a 0% balance transfer credit card may be a better option for consolidating and refinancing other debts. Still, a personal loan can also be a strong option.

While balances will likely keep growing, interest rates likely won’t do the same. The Federal Reserve cut interest rates in September, October and December. Still, given the current economic uncertainty, additional rate reductions are far from guaranteed.

Remember, it’s essential to understand that people don’t only take out personal loans when they’re struggling financially. Many people use them when remodeling their homes, starting a business, planning a wedding or vacation and making other big purchases. They do it because they feel financially secure enough to take on short-term debt. Despite many economic headwinds, there’s no question that millions of Americans feel that way today, and those folks will also help drive consumer demand for personal loans higher.

All signs point to more personal loan growth ahead. Some borrowers may stumble, but those who utilize these loans to conquer debt could see real financial wins.

Sources

- TransUnion

- The Wall Street Journal

- Federal Reserve Bank of New York

- LendingTree

Get personal loan offers from up to 5 lenders in minutes