New Construction vs. Existing Home: Which Is Right For You?

It’s easy to feel torn when trying to decide between buying a new construction vs. existing home. Building a house that matches your vision of a dream home can have a huge pull, but it also comes with some pitfalls you might not face with an existing home.

We’ll walk you through the pros and cons of each option and make sure you know what to expect — because everything from your cost to your timeline will change based on your decision.

- A new construction home is one that has never been lived in. It could be at any stage of construction when you buy it, and the stage it’s in will partially determine how much input you have on its final form.

- An existing home is a home that has already been built and lived in.

- The price of a new home is likely to be relatively close to that of an existing home, but this can vary significantly depending on your local housing market.

Overview: Buying new construction vs. existing home

| New construction home | Existing home | |

|---|---|---|

| Median price | $392,300 | $414,900 |

| Minimum down payment | 5% to 20% | 0% to 3.5% |

| Additional costs at closing | Traditional closing costs plus 10% earnest money deposit | Traditional closing costs |

| Interest rates | 7.90% | 5.69% to 6.55% |

| Timeline | 8 to 12 months | 40 to 50 days |

The costs of building vs. buying a home

As of late-2025, new homes actually cost around 5.4% less on average than existing homes.

$414,900

Median sales price: Existing homes

$392,300

Median sales price: New homes

In the past, newly built homes have been significantly more expensive than existing homes — but that gap has been getting smaller and, occasionally, the trend even reverses itself.

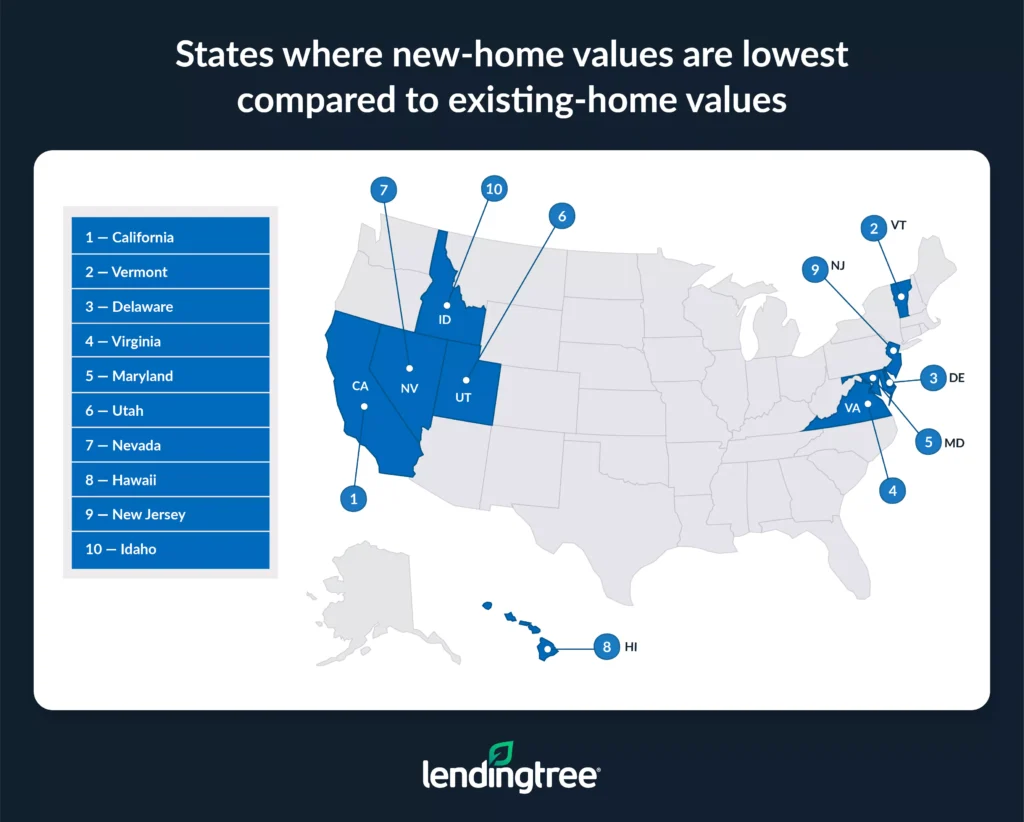

In many areas, it’s substantially cheaper to buy a new home than an existing one. In others, you may continue to see a gap more in line with the “old normal,” with new homes costing around 15% more than existing homes.

Rising mortgage rates and low housing inventory play a large role in the high cost of existing homes and have pushed some borrowers into the new construction market.

Source: LendingTree New vs. Existing Homes study

Comparing additional costs and fees: New construction vs existing homes

The process to finance a home is similar, whether you’re buying a brand-new home or purchasing an existing one. However, if you plan to design and build a custom home, you’ll need a special construction loan to purchase the land, build the home and finance the home over time. These tend to come with extra costs and fees, making them more expensive than a standard mortgage.

Interest rates

The cost to borrow money goes up when you’re building a home using a construction loan rather than buying an existing home with a traditional mortgage. The higher interest rate offsets the risk your lender is taking on when they give you money to complete a complex construction project.

Closing costs

A new or custom build can also come with higher closing costs than an existing home — that’s because builders often require large deposits. It’s common for a builder to want 10% of the total construction costs paid upfront. This is a form of “earnest money” — it shows that you’re serious about and invested in the project, and is usually a portion of your down payment amount.

By comparison, you can purchase an existing home with 3.5% to 10% down using an FHA loan backed by the Federal Housing Administration, or as low as 3% down with a conventional loan.

Pros and cons of building a new home

Pros

- Attractive and up-to-date design features

- More customization options

- Lower maintenance and utility costs

Cons

- Slower move-in timeline

- Location is unlikely to be near a city center

- Additional costs, like HOA fees, are common

Pros

- You’ll get a modern floor plan. Newly constructed homes are designed to appeal to today’s buyers, so you’re more likely to find a floor plan that fits with the way you live. Most new homes have an open floor plan, large windows and more storage than an older home.

- You may be able to personalize your home. You’ll likely get the chance to customize some part of the house, but how much depends on whether you build a custom home or buy a home from a builder. For instance, many builders allow you to choose finishes, fixtures and optional features. You may also be able to make structural changes to the exterior and interior or choose the floors, appliances, cabinets, paint colors and lighting fixtures.

- You’ll likely have lower maintenance costs. Since the systems, appliances, roof and foundation are new, you’re less likely to pay for major or minor repairs within the first few years of homeownership. That can make a big difference for first-time homebuyers who are adjusting to owning rather than renting.

- You’ll have warranties on some parts of your home. If something does go wrong and needs repairs, you may have an extra layer of protection: warranties. Builders typically offer one- or two-year warranties on items like plumbing and electrical systems. Some also offer 10-year warranties on structural items. On top of that, you’ll typically also have a manufacturer’s warranty on the new appliances and heating and air conditioning system in the house.

- You’ll probably pay less in utility bills. Your utility bills may be lower, as newly built homes adhere to the latest building codes and are often more energy-efficient than older homes.

- Your home will likely be “smarter” than an older home. New homes often have locks, thermostats and other features that can be controlled with your smartphone.

Cons

- You may have to wait longer to move. It takes about eight months, on average, to complete construction on a single-unit home, according to data from the U.S. Census Bureau. If you need to move more quickly, an existing home may be a better option, unless you can find a recently completed or nearly completed home from a builder.

- The location may not be ideal. Given the high cost of land in urban and close-in suburban areas in many markets, many new homes are built in more distant locations. This could mean a longer commute or less access to amenities you enjoy.

- You’re likely to need to pay homeowner association fees. While there can be advantages to a homeowners association (HOA), including community amenities and rules that keep properties well-maintained, some homeowners prefer not to live within an HOA. About two-thirds (67%) of newly built homes are in an HOA, according to Census data. Of course, if you’re building a totally custom home, you likely won’t be in an HOA.

- You may be responsible for landscaping. Some builders include plants or grass with a new home, but others may leave the landscaping to you. Depending on your lot size, this could make the cost of building a home higher than buying an existing one. If you love greenery, it can also mean gritting your teeth and waiting for new plants to establish roots and begin to flourish.

Pros and cons of buying an existing home

Pros

- Quicker, more reliable timeline

- Potentially better, more established location

- Possibility of making upgrades that’ll add to the home’s value

Cons

- Outdated or undesirable design features

- Fewer customization options

- Higher maintenance and utility costs

Pros

- You may be able to move quickly. When you buy an existing home, you and the sellers will negotiate the timeline for the closing and moving day. If you want to move quickly, you likely can. But when you’re building a new home, you’re dependent on the builder’s timeline. That timeline can be less certain because of potential delays due to weather issues, obtaining materials or hiring contractors.

- You may prefer the location. Most newly built homes are in locations more distant from an urban core or inner suburb, because those areas have less available land for new development. If you want to live closer to a city or amenities like coffee shops, stores and restaurants, an existing home may be a better bet.

- You’re moving into an established neighborhood. Other top location-related priorities for many homebuyers are the local school district and a sense of community. When you buy an existing home, you’re buying in a neighborhood with schools, parks, shopping centers and commuter routes already in place. In new communities, many of those amenities have yet to be built.

- You’re more likely to have mature landscaping — and maybe a bigger yard. Whether they’re on your land or just in the neighborhood, thriving plants are more likely to be near an existing home than a recently constructed one. And, depending on the community, older homes often have larger lots.

- You can add value with upgrades. Some homebuyers prefer a “fixer-upper” so they can personalize it and possibly increase its resale value with cosmetic upgrades. You may qualify to finance your purchase with a fixer-upper loan, which you can use to renovate the house before you move in. Plus, if a home comes with physical details or stories that add charm, in some cases, these elements are attractive enough to also add to a home’s resale value.

Cons

- Your floor plan and design features may be outdated. Older homes might not quite match what you picture when you think of a light, airy dream home. Many have smaller closets and windows and a more closed-off, formal floor plan. Popcorn ceilings, wall-to-wall carpet and other dated features may also tag along for the ride, bringing you on a deflating tour of the design trends of yesteryear.

- Your home’s design will be less personal. Adding a finished attic or a sunroom, or choosing kitchen cabinets and counters to suit your tastes can be accomplished more easily with a newly built home. Remodeling to change an existing home’s structure can be complicated and expensive.

- You may need to budget for some big repairs. Depending on the home’s age and condition, repairs that can cost you thousands may be around the corner. The average age of an existing home is about 40 years, and most appliances have a lifespan of about nine to 14 years, according to AARP.

- Your utility bills could be higher. An existing home may have less energy-efficient appliances, an older heating and air conditioning system, less insulation and lower-performing windows. That means your home can use or lose a lot of extra energy and increase your monthly utility bills.

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles