Carrington Mortgage Services Mortgage Review 2026

Carrington Mortgage Services is a mortgage lender and servicer that is based in California and operates in all 50 states. It’s a good choice for new homebuyers looking for a variety of loan programs and for those with poor, fair or thin credit.

See how we reached our verdict below.

- Variety of loan products

- Options for homebuyers with low credit

- In business more than 15 years

- No home equity loans

- No home equity lines of credit (HELOCs)

- Rates not published online

Carrington Mortgage Services mortgage overview

- Areas of service: Services mortgages in all 50 states and Puerto Rico. Licensed to lend in all states except Massachusetts.

- Digital service: Yes. While this lender does not specialize in digital mortgages, you can apply for a loan online and manage your mortgage on the website or through the mobile app.

- Headquarters: 500 North State College Boulevard, Suites 1030, 1300 and 1400, Orange, CA 92868

- Website: https://www.carringtonmortgage.com/

Carrington Mortgage Services rates, terms and fees

Rates

Carrington Mortgage Services doesn’t share detailed information about its mortgage rates online. This lender’s average interest rate for all loan types in 2024 was 7.32%, according to data from the Federal Financial Institutions Examination Council (FFIEC). Its average interest rate for home purchase loans was 5.95%, and the average rate for refinancing was 6.07%. Carrington Mortgage Services offers fairly competitive rates when compared with other mortgage lenders.

The Carrington Mortgage Services rate spread decreased by 0.18 percentage points, from 146 percentage points to 128 percentage points, from 2023 to 2024, according to FFIEC data. The rate spread is the difference between the average prime offer rate (APOR), which is the lowest rate a bank is likely to offer an individual, and the average APR the lender offered to mortgage borrowers in 2024. The bigger the rate spread, the more costly the loan.

Fees

Carrington Mortgage Services discloses some, but not all, of its fees online. The average total cost of a loan through Carrington Mortgage Services in 2024 was $9,380, according to FFIEC data. Typical fees include origination fees, application fees, appraisal fees and other closing costs. It’s wise to look at the average total costs of getting a mortgage with a particular lender, since many lenders charge different types of fees.

The total cost of getting a home loan with Carrington Mortgage Services is on the higher end compared with other lenders we surveyed, which ranged from $2,368 to $12,406, according to 2024 FFIEC data.

Carrington Mortgage Services does not offer discounts to the general population. Its only discounts are for employees and employees’ qualified family members that vary based on the type of loan. For example, employees can choose either 0.25% off the interest rate or a waiver of processing and/or underwriting fees worth up to a discount of $1,395. For Ginnie Mae loans, employees can get 0.25% off the rate and fees reduced to $495. This lender also offers $1,000 off closing costs for qualified family members of employees.

What types of mortgage loans does Carrington Mortgage Services offer?

Carrington Mortgage Services offers a variety of home loans including:

Carrington Mortgage Services offers several types of conventional loans, including fixed-rate 15- and 30-year mortgages, high-LTV loans and mortgages through the Home Possible and HomeReady programs.

Conventional loan qualification requirements

- Minimum credit score of 620

- Down payment minimum not disclosed

- Private mortgage insurance (PMI) requirements not disclosed

- Maximum debt-to-income ratio of 43%

Carrington Mortgage Services offers FHA loans, which are mortgages insured by the Federal Housing Administration (FHA). FHA-backed mortgages offer competitive interest rates, lower down payments and lower credit score requirements than some other types of home loans.

FHA loan qualification requirements

- Minimum credit score of 500 or 580 (depending on down payment amount)

- Down payment not disclosed

- Upfront and annual mortgage insurance premiums (MIP) regardless of down payment amount

- Maximum debt-to-income ratio of 43%

Carrington Mortgage Services offers VA loans, which are mortgages backed by the Department of Veterans Affairs (VA) and are available to U.S. service members and veterans and their families. VA loans offer lower interest rates and typically don’t require a down payment or PMI, making homeownership more affordable for those who qualify.

VA loan qualification requirements

- Minimum credit score not disclosed

- Down payment: None for eligible borrowers

- One-time VA funding fee

- Maximum debt-to-income ratio not disclosed

Carrington Mortgage Services offers USDA loans, which are mortgages backed by the U.S. Department of Agriculture (USDA). USDA home loans can help to make homeownership more affordable for homebuyers in rural areas with zero-down-payment options, lower credit scores accepted and no cash reserves required.

USDA loan qualification requirements

- Minimum credit score 550

- Little-to-no-minimum down payment

- Upfront and annual guarantee fees not disclosed

- Maximum debt-to-income ratio not disclosed

Carrington Mortgage Services offers jumbo loans, which are mortgages for which the loan amount is larger than the current conforming loan amount limit ($806,500 in 2025).

Jumbo loans typically require a higher credit score and down payment amount than most other types of conventional loans. These mortgages may be needed to purchase homes in areas with a high cost of living, where purchase prices often exceed conforming loan amount limits.

Jumbo loan qualification requirements

- Minimum credit score not disclosed

- Minimum down payment not disclosed

- Cash reserve requirements not disclosed

- Maximum debt-to-income ratio not disclosed

Carrington mortgage qualifications

| Credit score minimum | 500 to 620 |

| DTI ratio

Debt-to-income (DTI) ratio compares your monthly gross income to your monthly debt payments.

| Conventional: 43%FHA: 43%VA: N/AUSDA: N/AJumbo: N/A |

| Down payment minimum | Conventional: N/AFHA: N/AVA: 0%USDA: 0%Jumbo: N/A |

Don’t know your credit score? Get your free score on LendingTree Spring today.

Carrington Mortgage Services doesn’t disclose information on the exact criteria it uses to approve or deny applications. However, nationwide mortgage lending data from 2024 shows that Carrington Mortgage Services had an average loan-to-value (LTV) ratio of 74.5% for approved applicants. Less than half of approved applicants (36.6%) had a debt-to-income (DTI) ratio of 40% or less.

Carrington Mortgage Services denied 53.2% of home purchase loan applications in 2024, which is high compared to many other large mortgage lending companies that have denial rates in the low teens through mid-30s.

How to apply for a Carrington mortgage

1. Choose your loan type

From the home page, www.carringtonmortgage.com, navigate to the “Manage My Home” tab, then select “Buy a Home” on the Carrington Mortgage Services home page. Answer the prompts to enter your desired purchase price and ZIP code along with your down payment amount, income and credit score. Then choose your desired loan product from the list of loans deemed a fit.

2. Get prequalified

Getting prequalified for a mortgage allows you to get an estimated loan amount and a prequalification letter. This can help you determine how much house you can afford and show sellers you’re serious about buying a home.

3. Submit a loan application

Once you apply, the lender will begin the underwriting process. You may get approved for a mortgage and obtain a mortgage rate lock, which guarantees you a specific interest rate for a set period of time.

- Identification

- Tax documents

- Bank statement

- Pay stubs

- Debt and asset statements

- Gift letters (if you’re using gifted funds)

Find out more about how to apply for a home loan.

Is it safe to get prequalified with Carrington Mortgage Services?

Yes, it’s safe to get prequalified or preapproved for a mortgage with Carrington Mortgage Services. Getting preapproved helps you to settle on an affordable purchase price and loan type before you start shopping. A preapproval letter also shows real estate agents and sellers that you’re a serious buyer.

Prequalification typically is based on estimated information, while preapproval is based on verified information, which will lead to a hard inquiry on your credit report. Both prequalification and preapproval have many benefits, including making you more competitive with other buyers.

Carrington Mortgage Services’ customer service experience

You can shop for loans, manage your mortgage and refinance your loan on the Carrington Mortgage Services website. You can also contact a licensed loan officer via phone at the following number:

- Phone: 888-267-0584

If you’re an existing customer and need help with your Carrington Mortgage Services mortgage, you can log into the website or call customer service:

- Phone: 800-561-4567

Unlike some competing mortgage lenders, Carrington Mortgage Services does not provide email contact information or online chat. This makes the company less convenient for customers who prefer these methods of contact with customer service.

How does Carrington Mortgage Services compare to other lenders?

| LendingTree’s rating |

Expert review from LendingTree.

|

Expert review from LendingTree.

|

Expert review from LendingTree.

|

| Minimum credit score | 500 to 620 | 580 to 620 | 500 |

| Minimum down payment | 0% to 3.5% | 0% to 3.5% | 0% to 3.5% |

| Rate spread

Rate spread is the difference between the average prime offer rate (APOR) — the lowest APR a bank is likely to offer any private customer — and the average annual percentage rate (APR) the lender offered to mortgage customers in 2024. The higher the number, the more expensive the loan.

| 1.28% | 0.46% | 2.63% |

| Loan products and programs |

|

|

|

| Better for: | Buyers with a credit score under 620. | Borrowers looking for renovation loan options. | Buyers looking for a home equity line of credit. |

Carrington Mortgage Services vs. Fairway Independent Mortgage

Both Carrington Mortgage Services and Fairway Independent Mortgage offer a wide range of loan options. However, Carrington Mortgage Services’ minimum credit score is significantly lower, so it may be a better option for borrowers who have poor credit scores or who are building their credit.

Borrowers looking for a loan for a home remodel may want to consider Fairway Independent Mortgage. This lender stands out for its range of home renovation loan products that many other lenders don’t offer.

Read more in our full Fairway Independent mortgage review.

Carrington Mortgage Services vs. AmeriSave

Carrington Mortgage Services and AmeriSave both offer a wide range of mortgage products. However, AmeriSave offers both HELOCs and home equity loans, which Carrington Mortgage Services doesn’t.

AmeriSave’s rate spread is more than double that of Carrington Mortgage Services (1.28% vs. 2.63%, respectively), making Carrington Mortgage Services’ loans more affordable on average.

Read more in our full AmeriSave mortgage review.

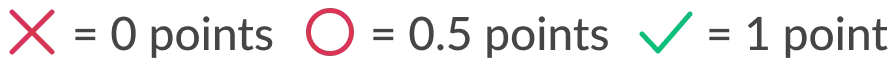

How LendingTree rated Carrington Mortgage Services

LendingTree’s mortgage lender rating is based on a five-point scoring system that factors in several features, including digital application processes, available loan products and the accessibility of product and lending information.

LendingTree’s editorial team calculates each rating based on a review of information available on the lender’s website. Lenders receive a half-point on the “offers standard mortgage products” criterion if they offer only two of the three standard loan programs (conventional, FHA and VA). In some cases, additional information was provided by a lender representative.

Carrington Mortgage Services’ scorecard:

❌ Publishes rates online

✅ Offers standard mortgage products

✅ Includes detailed product info online

⭕ Shares resources about mortgage lending

✅ Provides an online application

Frequently asked questions

A Carrington Mortgage Services mortgage offers a range of choices and flexibility when it comes to credit score and down payment requirements. You can go online to use their mortgage affordability calculator, compare loans and apply for a mortgage. Once you get a loan, you can manage your mortgage online on the Carrington Mortgage Services website or by using the mobile app.

Carrington Mortgage Services is a legitimate mortgage lender that’s based in California and makes and services a variety of home loans. The company is a subsidiary of Carrington Holding Company LLC and has been in business for nearly 18 years.

You can view more info about Carrington Mortgage Services’ state licenses and registrations through the Nationwide Multistate Licensing System and Registry (NMLS) website.

A Carrington Mortgage Services home loan may affect your credit score. Completing a full application for a mortgage leads to a hard pull on your credit, meaning the lender formally checks your credit history. This typically causes a slight dip in your credit. A LendingTree study on homebuying and credit shows homebuyers’ scores usually fall by no more than 20 points on average and typically rebound within a year.

Carrington Mortgage Services has a history of customer complaints and was the subject of an enforcement action by the CFPB. In 2022, the CFPB ordered Carrington Mortgage Services to refund improperly charged late fees to consumers and pay a penalty of $5.25 million after failing to adequately administer federal COVID-19 forbearance protections for its mortgage borrowers. The CFPB Consumer Complaint Database includes more than 2,900 complaints against Carrington Mortgage Services since 2011.

The company is not accredited by the Better Business Bureau (BBB), where it has a rating of 1 out of 5 stars based on 169 customer reviews. The BBB website also lists 353 complaints against Carrington Mortgage Services in the past three years, with 96 closed in the last 12 months.

Compare Multiple Prequalification Offers