PenFed Mortgage Review 2026

PenFed Credit Union offers a range of home loan options for military and nonmilitary borrowers. Homebuyers who want to get preapproved online and lock in their rate may also like this lender.

See how we reached our verdict below.

- Broad selection of loan options, including conventional, FHA and VA

- Competitive mortgage rates

- Mortgage refinance options available

- Preapproval and rate lock options

- Doesn’t offer USDA loans

- Limited branch locations nationwide

PenFed Credit Union mortgage overview

Originally founded in 1935, PenFed Credit Union (short for Pentagon Federal Credit Union) is one of the largest credit unions in the United States. While its offerings are geared toward military members and veterans who want to access affordable banking products, individuals don’t need a military affiliation to join.

- Areas of service: All 50 states, plus Washington, D.C., Guam, Puerto Rico, and Okinawa, Japan

- Digital service: Borrowers can apply for a mortgage with PenFed entirely online, upload their loan documents and more.

- Headquarters: 7940 Jones Branch Drive, McLean, VA 22102

- Website: PenFed.org

PenFed Credit Union rates and fees

Rates

PenFed Credit Union offers competitive mortgage rates, especially for borrowers who qualify for the best rates and terms.

PenFed’s rate spread increased from 0.53 percentage points in 2023 to 0.72 percentage points in 2024, according to national Home Mortgage Disclosure Act (HMDA) data. That means its rates in 2024 were 0.72 percentage points higher than the average prime offer rate (APOR), a benchmark rate that shows the lowest rate a bank is likely to offer applicants. Higher rate spreads indicate a more expensive mortgage.

Despite the increase, PenFed’s rate spread in 2024 was lower than many other lenders including Bank of America, Navy Federal Credit Union and TD Bank. Then again, the majority of lenders we profiled in 2024 featured lower mortgage rates than PenFed.

Fees

According to PenFed Credit Union, typical closing costs for a mortgage run from 2% to 5% of the purchase price of a home. In its online mortgage disclosures, PenFed states that rates quoted for conventional loans assume a 1% origination fee, not to exceed $1,995. Outside of that, the lender doesn’t publish specific closing costs and fees that apply to its home loans.

HMDA data shows that PenFed’s total loan costs were $8,214 on average in 2024, and its average origination fees were $3,687. This puts PenFed Credit Union in the middle of the pack compared with the national lenders included in the data.

PenFed offers help with closing costs of up to $2,300, but only if you also work with a real estate agent in its network to purchase a home.

What types of mortgage loans does PenFed Credit Union offer?

PenFed Credit Union offers a variety of home loans including:

PenFed Credit Union offers conventional home loans for qualified buyers who have a minimum 3% down payment. Fixed-rate and adjustable-rate mortgages (ARMs) are available. Buyers with a down payment of less than 20% will need to pay private mortgage insurance (PMI).

Conventional loan qualification requirements

- 3% minimum down payment

- Credit score requirements not specified, though lender says minimum is typically 620

- Maximum debt-to-income ratio (DTI) not disclosed

PenFed also offers FHA home loans with down payment requirements as low as 3.5%. FHA loan limits apply, and borrowers must pay both up-front and ongoing FHA mortgage insurance on their loans. FHA loans can be used to purchase homes with one to four units.

FHA loan qualification requirements

- 3.5% minimum down payment

- Credit score requirements not specified, though lender says minimum is typically 620

- Maximum DTI ratio not specified

- Property appraisal from an FHA-approved appraiser

VA loans are available to military members, veterans and eligible spouses, and they are known for offering less stringent credit requirements, low closing costs and no requirement for mortgage insurance. These loans, which are backed by the U.S. Department of Veterans Affairs, are also offered with $0 down in some cases.

Homeowners can also apply for a VA interest rate reduction refinance loan (IRRRL) with PenFed.

VA loan qualification requirements

- As low as 0% down for eligible borrowers

- Credit score requirements not specified, though lender says minimum is typically 620

- Certificate of eligibility (COE) from the U.S. Department of Veterans Affairs

- Military discharge paperwork (DD214) for veterans

For borrowers looking to purchase more expensive real estate, PenFed also offers jumbo loans in amounts from $832,751 up to $3 million. These loans come with fixed-rate or adjustable-rate options.

Jumbo loan qualification requirements

- Credit score requirements not specified, though lender says minimum is typically 700

- Minimum 10% to 25% down payment

- Maximum DTI not specified

- Larger amount of cash reserves required

PenFed Credit Union offers home equity lines of credit (HELOCs) that let borrowers access some of their existing home equity without changing the terms of their primary mortgage. HELOCs from PenFed range from $25,000 to $500,000, with a 10-year draw period and 20-year repayment period. Applicants who qualify for the Express program can close in as little as 15 days.

HELOC qualification requirements

- Minimum credit score not specified

- DTI requirements not specified

- Appraisal may be required

PenFed Credit Union mortgage qualifications

| Credit score minimum |

|

| DTI ratio

Debt-to-income (DTI) ratio compares your monthly gross income to your monthly debt payments.

|

|

| Down payment minimum |

|

Don’t know your credit score? Get your free score on LendingTree Spring today.

HMDA data for PenFed shows that in 2024, the average loan-to-value (LTV) ratio for approved borrowers was 70.2% across all loan types. This means the average PenFed borrower had a down payment of 29.8% of their home’s purchase price. More than 40% of approved borrowers (42.7%) had a DTI below 40% in 2024. PenFed approved about half of all loan applicants for mortgages in 2024, as well.

Based on this information, you may have a better chance at loan approval if you increase your down payment amount and pay down consumer debt to lower your DTI.

How to apply for a PenFed Credit Union mortgage

1. Choose your loan type

In the main menu on the PenFed Credit Union website, navigate to “Mortgage & Home Equity,” then select “Loan Types” to compare qualification requirements. Choose from conventional loans, FHA loans, VA loans, jumbo loans and HELOCs. You can tap the “Apply Now” button on these loan pages and you’ll be prompted to log in. If you’re not already a member, you can log in as a guest and PenFed will open a membership account for you prior to closing.

2. Get preapproved

PenFed lets you get preapproved for a mortgage online, and you may even be able to lock in your mortgage rate for 60 days. Note that mortgage preapproval can be completed entirely online through a portal, although you can also speak with a loan representative to begin the process.

3. Submit a loan application

PenFed offers an online mortgage dashboard for customers in the homebuying process and beyond. This dashboard lets applicants apply for a mortgage online, track their progress and submit loan documents. After the loan process is complete, buyers can use the portal or mobile app to make mortgage payments and track their loan repayment process.

Find out more about how to apply for a home loan.

- Identification

- Tax documents

- Bank statement

- Pay stubs

- Debt and asset statements

- Gift letters (if you’re using gifted funds)

Is it safe to get preapproved with PenFed Credit Union?

PenFed Credit Union lets you get preapproved for a mortgage through its Power Buyer program. This move lets you determine how much you can afford to purchase, and it comes with a preapproval certificate that can help your offer on a home stand out.

Getting preapproved with PenFed lets you lock in a mortgage rate for 60 days. You can also extend the rate lock for another 30 days with a prorated daily fee.

Note that mortgage preapproval with PenFed requires an underwriting review and a hard inquiry on your credit reports.

PenFed Credit Union’s customer service experience

You can contact PenFed Credit Union in a branch or over the phone. Home loan servicing is available to U.S. customers as follows:

Existing customers with mortgages and home equity loans

- Monday to Friday from 8 a.m. to 8 p.m. ET

- Phone: 800-585-9055

New applicants and those with questions about mortgages and HELOCs

- Monday to Friday from 8 a.m. to 8 p.m. ET, Saturday from 9 a.m. to 5 p.m. ET

- Phone: 800-970-7766

Customers with loans in processing to closing

- Monday to Friday from 9 a.m. to 9 p.m. ET

- Phone: 866-386-7193

You can also contact PenFed through the bank’s secure messaging system, which you can access through your PenFed online dashboard.

How does PenFed Credit Union compare to other lenders?

| |||

| LendingTree’s rating |

Expert review from LendingTree.

Back to our PenFed Credit Union summary |

Expert review from LendingTree.

Read our PenFed Credit Union vs. Rocket Mortgage comparison |

Expert review from LendingTree.

Read our PenFed Credit Union vs. Veterans United comparison |

| Minimum credit score | Typically 620 | 580 | 620 |

| Minimum down payment | 0% to 3.5% | 0% to 3.5% | 0% to 3.5% |

| Rate spread

Rate spread is the difference between the average prime offer rate (APOR) — the lowest APR a bank is likely to offer any private customer — and the average annual percentage rate (APR) the lender offered to mortgage customers in 2023. The higher the number, the more expensive the loan.

| 0.72% | 0.87% | -0.12% |

| Loan products and programs |

|

|

|

| Better for: | Homebuyers who have good or excellent credit and want access to a range of loan options at competitive rates. | Borrowers who are looking for a fully digital home loan process, as mortgage details can be handled online. | People looking for VA loans, as the lender’s expertise with these loans is a benefit. |

PenFed Credit Union vs. Rocket Mortgage

Like PenFed, Rocket Mortgage offers conventional mortgages, FHA loans, VA loans, jumbo loans and home equity products at competitive interest rates. But Rocket Mortgage is known for its fully digital mortgage experience that lets buyers move through the process by submitting documents online. You can also use Rocket Mortgage to refinance your home.

Read more in our full Rocket Mortgage review.

PenFed Credit Union vs. Veterans United

Both PenFed and Veterans United serve military-affiliated borrowers, but Veterans United stands out for its experience and expertise when it comes to VA loans. The lender also offers conventional mortgages, FHA loans and USDA loans. Based on 2024 HMDA data, average mortgage rates from Veterans United were also lower than most other national lenders, including PenFed, and so were its average total loan costs.

Read more in our full Veterans United mortgage review.

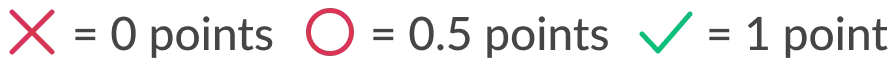

How LendingTree rated PenFed Mortgage

LendingTree’s mortgage lender rating is based on a five-point scoring system that factors in several features, including digital application processes, available loan products and the accessibility of product and lending information.

LendingTree’s editorial team calculates each rating based on a review of information available on the lender’s website. Lenders receive a half-point on the “offers standard mortgage products” criterion if they offer only two of the three standard loan programs (conventional, FHA and VA). In some cases, additional information was provided by a lender representative.

PenFed Credit Unions scorecard:

✅ Publishes rates online

✅ Offers standard mortgage products

⭕ Includes detailed product info online

✅ Shares resources about mortgage lending

✅ Provides an online application

Frequently asked questions

PenFed has a highly rated mobile app that lets users track their loan process and make mortgage payments on the go. Customers can also complete these tasks in their PenFed online dashboard.

PenFed Credit Union is a legitimate credit union that’s been in operation since 1935. The institution currently serves 2.9 million members worldwide and has more than $30 billion in assets.

You can view more info about PenFed Credit Union’s state licenses and registrations through the Nationwide Multistate Licensing System and Registry (NMLS) website.

While applying for a mortgage with PenFed could temporarily impact your credit score, a LendingTree credit score study shows that the impact is typically minimal and temporary. Your score could drop by as much as 20 points but you can generally increase your credit score within about one year by making on-time payments on your mortgage.

PenFed has an average rating of just under 4 out of 5 stars across more than 1,900 customer reviews on Trustpilot. PenFed has an A-plus rating from the Better Business Bureau (BBB), though it is not accredited and its profile page shows more than 400 complaints in the last three years. The bulk of the lender’s complaints relate to auto loans, credit cards and other financial products outside of mortgages.

Compare Multiple Prequalification Offers