States Where $1,000 Car Payments Are Most Common

Nearly one in 10 Americans with auto loans have monthly payments of $1,000 or more on one of them, and 40.3% of those four-digit-payment loans were taken out in 2024 alone.

LendingTree reviewed the anonymized credit reports of about 180,000 Americans with active loans on new or used vehicles and leases in the first quarter of 2025 to see how common four-digit payments are. While these payments are far more the exception than the rule in every state and age group, it’s clear that a large number of Americans took them on last year.

Here’s more on what we found.

- $1,000 car payments are more common than you might think. 8.6% of Americans with auto loans for new or used vehicles and leases had at least one monthly payment of $1,000 or more in the first quarter of 2025. A whopping 40.3% of these $1,000-plus payments originated in 2024.

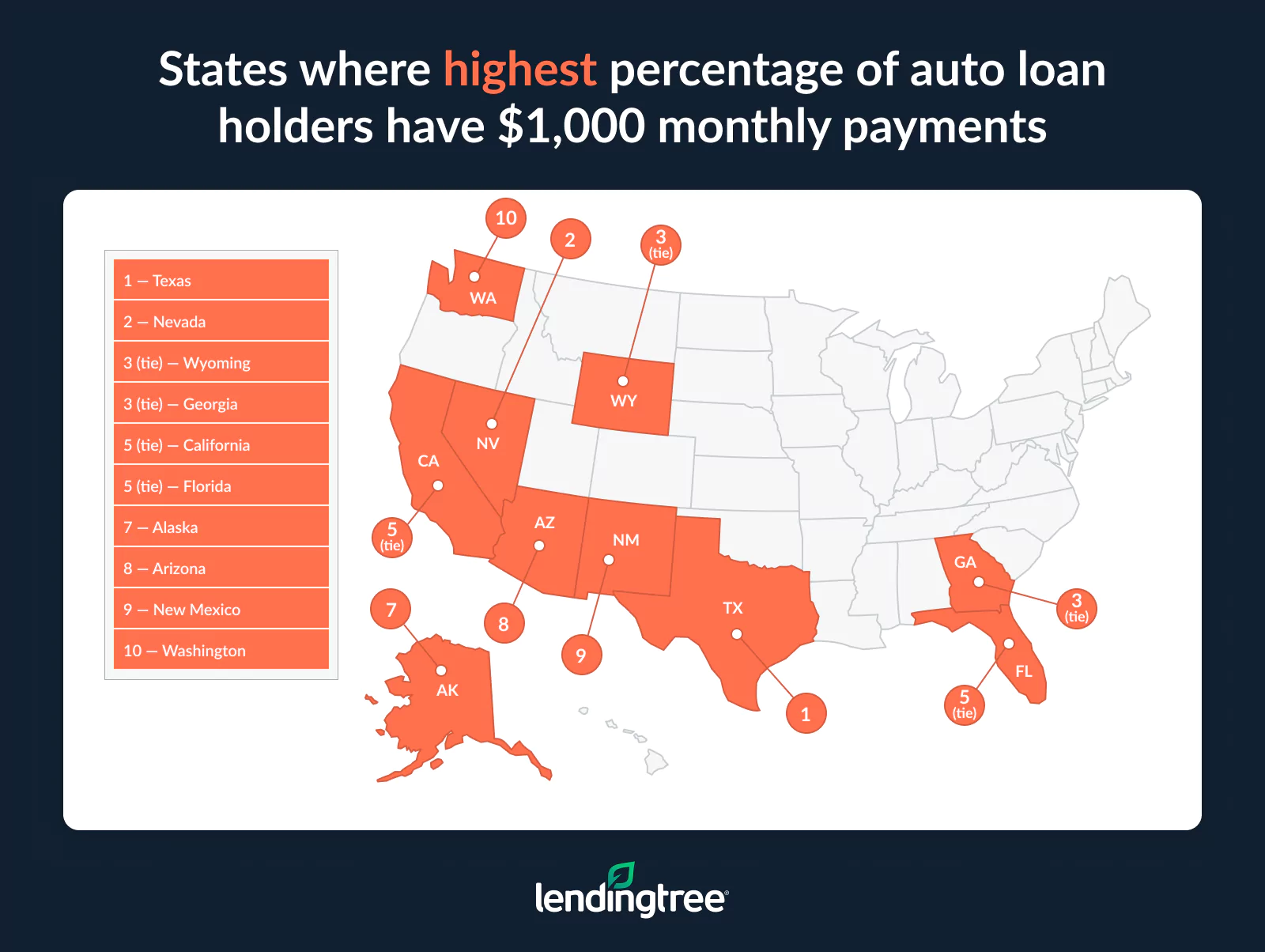

- High car payments are most common in Texas. 12.8% of auto loan holders in Texas have at least one monthly auto payment of $1,000 or more, surpassing Nevada (11.9%) and Wyoming and Georgia (tied at 11.6%). In eight other states, including California and Florida, at least 10.0% of people with auto loans have a $1,000 payment.

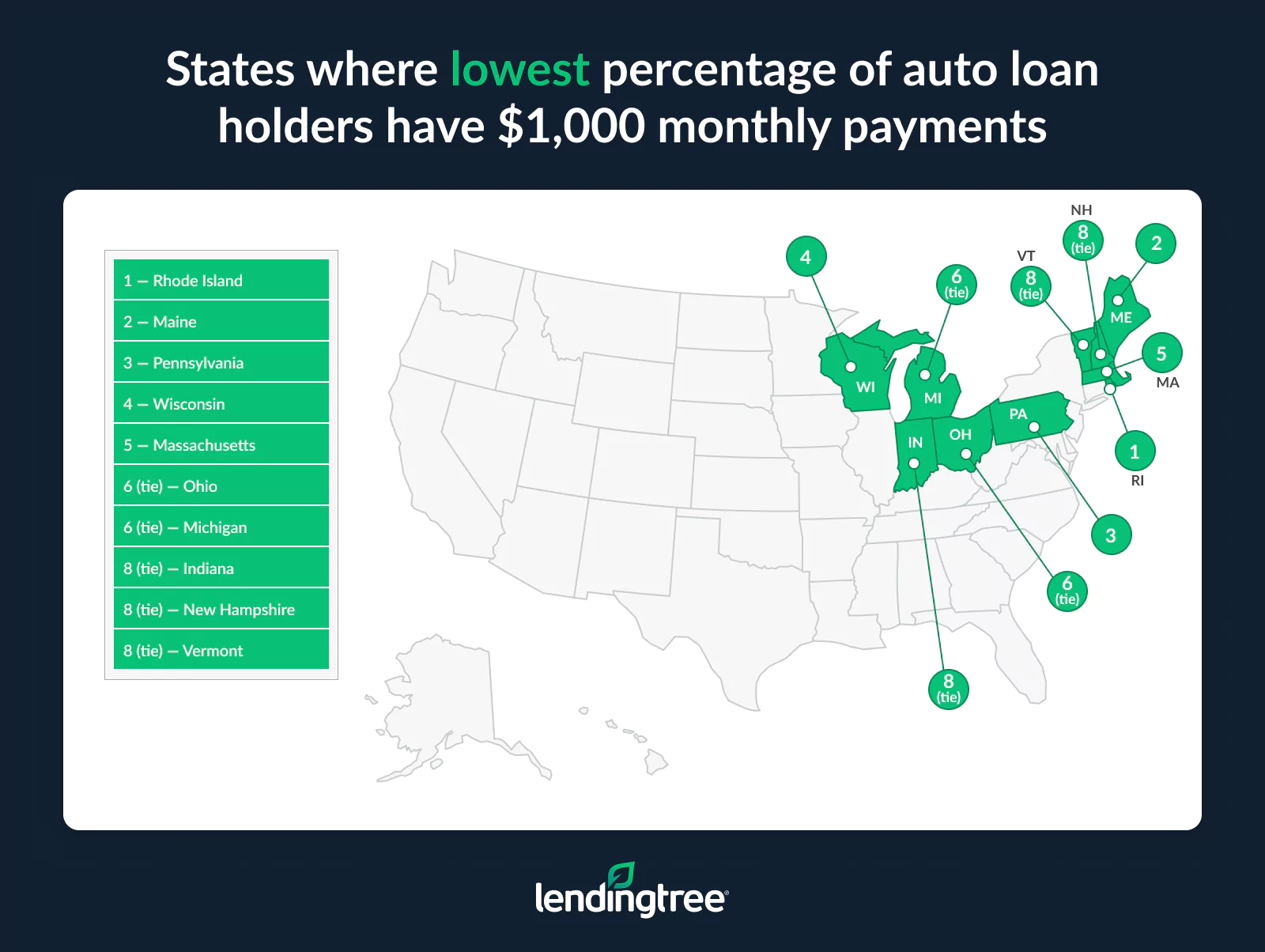

- Four-figure car payments are least common in Northeast and Midwest states. Six of the 10 states with the lowest rate of auto loan holders making at least one $1,000 payment are in the Northeast, and four are in the Midwest. Rhode Island has the lowest rate at 4.8%, below Maine (5.1%) and Pennsylvania (5.2%).

- Gen Xers are driving the biggest auto loan payments. 10.8% of Gen Xers with auto loans make at least one payment of $1,000 or more. Baby boomers (8.6%) and millennials (8.0%) follow, versus just 3.2% of Gen Z auto loan holders.

- Higher credit scores are linked to larger auto loan monthly payments. Auto loan holders with super-prime scores of 720 or higher are most likely to have monthly auto loan payments of $1,000 or more (10.4%), while those with deep subprime scores below 580 are least likely at just 5.2%.

$1,000 car payments are more common than you think

It’s a tough time to be in the market for a car. Prices are high — the average cost of a new vehicle is nearly $50,000, according to Kelley Blue Book — and there’s concern that they could increase further due to tariffs. Combine still-high interest rates with this, and things only look worse. Given that volatile mix, perhaps it shouldn’t be surprising that $1,000 car payments are becoming far more common.

In the first quarter of 2025, 8.6% of Americans with auto loans had at least one monthly payment of $1,000 or more. That’s still a relatively small percentage of auto loan borrowers. However, a deeper dive revealed something disturbing: 40.3% of these $1,000-plus-payment loans originated in 2024.

Since the average auto loan term for new and used vehicles ranges from five to six years, that recent spike in four-digit-payment loans means a lot of Americans may be stuck with massive payments for years to come. While many of these loans are taken on by higher-income, wealthier Americans with no concerns about paying off those bills every month, it’s also likely that many others with these loans will struggle in the face of other economic headwinds.

Texas is 4-figure car payment capital of U.S.

In a dozen states, at least 10.0% of people with auto loans have one with a monthly payment of $1,000 or more.

The nation’s three most populous states — California, Texas and Florida — are on that list, but the Lone Star State stands above the rest. In Texas, 12.8% of auto loan holders have one with a four-digit monthly payment, edging out Nevada (11.9%) and Wyoming and Georgia (both 11.6%).

Most of the states atop the list are among the biggest in the nation in terms of area, the kinds of places where you’re likely going to need a car or truck to get around. Outside of the giant metros, you’re in car-and-truck country, even in California.

While these states share some similarities, there are also significant differences — primarily in terms of income. California and Washington are among the highest-income states in the nation, while New Mexico is among the lowest. Needless to say, that income makes a huge difference when you’re facing a $1,000 car payment.

Northeasterners, Midwesterners least likely to have $1,000 car payments

While the South and West dominate the top of the list of states where $1,000 car payments are most common, the bottom is overrun with Northeastern and Midwestern states.

Rhode Island has the lowest percentage of auto loan holders with four-digit payments (4.8%), slightly lower than Maine (5.1%) and Pennsylvania (5.2%). Wisconsin, Massachusetts, Ohio and Michigan aren’t far behind.

As with the top of the list, we see major income discrepancies here. Rhode Island, Massachusetts and New Hampshire residents have some of the highest average incomes in the nation, while their counterparts in Ohio, Michigan and Indiana don’t.

Full rankings: Where auto loan holders have $1,000 monthly payments

| Rank | State | Percentage |

|---|---|---|

| 1 | Texas | 12.8% |

| 2 | Nevada | 11.9% |

| 3 | Wyoming | 11.6% |

| 3 | Georgia | 11.6% |

| 5 | California | 11.3% |

| 5 | Florida | 11.3% |

| 7 | Alaska | 10.7% |

| 8 | Arizona | 10.5% |

| 9 | New Mexico | 10.4% |

| 10 | Washington | 10.3% |

| 11 | Louisiana | 10.0% |

| 11 | Maryland | 10.0% |

| 13 | Colorado | 9.9% |

| 14 | Montana | 9.6% |

| 15 | Mississippi | 9.2% |

| 16 | Arkansas | 8.9% |

| 17 | North Dakota | 8.8% |

| 17 | Hawaii | 8.8% |

| 19 | Tennessee | 8.7% |

| 20 | Virginia | 8.0% |

| 21 | Oklahoma | 7.9% |

| 21 | Alabama | 7.9% |

| 21 | Utah | 7.9% |

| 21 | New York | 7.9% |

| 25 | South Carolina | 7.8% |

| 26 | South Dakota | 7.7% |

| 27 | North Carolina | 7.4% |

| 28 | West Virginia | 7.2% |

| 28 | Kansas | 7.2% |

| 30 | Illinois | 7.1% |

| 31 | New Jersey | 7.0% |

| 32 | Idaho | 6.9% |

| 32 | Connecticut | 6.9% |

| 34 | Missouri | 6.8% |

| 34 | Minnesota | 6.8% |

| 36 | Oregon | 6.7% |

| 37 | Nebraska | 6.6% |

| 38 | Iowa | 6.3% |

| 39 | Delaware | 6.1% |

| 40 | Kentucky | 6.0% |

| 41 | Vermont | 5.8% |

| 41 | New Hampshire | 5.8% |

| 41 | Indiana | 5.8% |

| 44 | Michigan | 5.6% |

| 44 | Ohio | 5.6% |

| 46 | Massachusetts | 5.5% |

| 47 | Wisconsin | 5.3% |

| 48 | Pennsylvania | 5.2% |

| 49 | Maine | 5.1% |

| 50 | Rhode Island | 4.8% |

Gen Xers driving biggest car payments

By age, we see older Americans are more than twice as likely as the youngest to have a $1,000 car payment.

Our analysis found that Gen Xers ages 45 to 60 lead the way, with about one in nine (10.8%) auto loan holders having at least one payment of $1,000 or more. Baby boomers ages 61 to 79 (8.6%) and millennials ages 29 to 44 (8.0%) aren’t far behind, while just 3.2% of Gen Z auto loan holders ages 18 to 28 are in the four-digit car payment club.

Generations and monthly auto loan payments of $1,000 or more

| Generation | Percentage |

|---|---|

| Gen Zers | 3.2% |

| Millennials | 8.0% |

| Gen Xers | 10.8% |

| Baby boomers | 8.6% |

There are two primary reasons why it makes sense that Gen Xers would be the most likely to have $1,000 car payments. One is that Gen Xers are in their prime earning years. That high income makes it more likely, all other things being equal, that a financial institution would be willing to give them an auto loan so large that it would require a four-digit monthly payment.

The second reason: their credit scores.

Those with high credit scores most likely to have 4-digit monthly payments

The higher your credit score, the better your odds of getting most any type of loan, including those with $1,000 monthly payments. While Gen Xers may not have credit scores as high as baby boomers on average, their scores tend to be higher than those of their younger counterparts. That combination of a high credit score and high income is powerful, likely allowing them access to loans of all types whenever they need them.

Still, it isn’t just Gen Xers with high credit scores who are more likely to have that four-digit auto loan payment. The higher your credit score, the more likely you are to have one. Those with super-prime credit scores of 720 or higher (out of 850) are most likely to have monthly auto loan payments of $1,000 or more (10.4%). On the other side of the credit spectrum, those with deep subprime scores (below 580) are least likely, as just 5.2% of those borrowers have one.

Credit score ranges and monthly auto loan payments of $1,000 or more

| Credit score range | Percentage |

|---|---|

| Deep subprime (below 580) | 5.2% |

| Subprime (580 to 619) | 6.3% |

| Near-prime (620 to 659) | 7.7% |

| Prime (660 to 719) | 9.3% |

| Super-prime (720 or above) | 10.4% |

While those with poor credit and amazing credit can both end up with $1,000 monthly auto loan payments, they may do so for different reasons. For those with great credit, the primary driver may be the loan amount. However, the main culprit for those with poor credit would be the interest rate on the loan. That’s because rates can be three or more times higher for those with crummy credit than for those with strong credit.

Control what you can control to drive down your costs

One thousand dollars represents 10.9% of a U.S. household’s monthly income on average. Given how tight most families’ budgets are and how little financial wiggle room most families have, that’s a big deal. It’s clearly not an amount of money that should be spent lightly, regardless of how much we as a nation love our vehicles.

The good news is that there are steps you can take to control your costs if you’re in the market for a new car.

- Get your credit in order. There’s little in life that’s more expensive than having crummy credit. This report is further proof. If you have some time before you need to get that new (or new-to-you) car, focus your efforts on improving your credit score. Ideally, that would mean paying down your other balances, though that’s easier said than done. It can also include setting up autopay to make sure your bills are always paid on time, checking your credit report for mistakes and removing any that you find or asking your credit card issuer for a higher credit limit to improve your credit utilization. (Just make sure you don’t spend that newly available credit in the meantime.)

- Crunch the numbers to know what you can afford. Auto loan calculators can help you get a feel for what you can fit into your budget. Before you use one, however, make sure you do your homework to understand what interest rates are typical for people with credit scores similar to yours. Once you know that, you can tinker with the loan amount, interest rate and term length to find your sweet spot for a monthly payment.

- Don’t forget a down payment. Even a small down payment can help keep your monthly auto loan payments out of the four-digit range. If you won’t need that new car for a few months, it makes sense to put money aside from each paycheck and earmark it for a future down payment. Taking advantage of high returns from high-yield savings accounts — often 4.00% or more yearly — can help you turbocharge those savings. Of course, if your old car still has value, consider selling it yourself to maximize its value.

- Once you know what you can afford, consider what you actually need. Just because a bank will loan you the money for a $50,000 car doesn’t mean you need to take it. It’s so easy to get swept up by the excitement of car shopping with all its bells and whistles and horsepower and speed, but that makes it so important to focus on what matters, especially when you’re on a tight budget.

- Compare lenders’ rates and get preapproved before going to the dealership. Taking the time to comparison shop for the best loan rates can save you a small fortune in interest over the life of that loan. There’s a difference among lenders, and you’re likely to pay too much if you don’t shop around. Once you find the rate you want, get preapproved for the loan before hitting the lot. Dealerships rarely have the best financing deals, so walking into the showroom with a good deal in hand means you can focus more on getting the right vehicle and less on getting the best rate.

Methodology

LendingTree researchers analyzed a sample of about 180,000 anonymized credit reports of LendingTree users from Jan. 1 to March 31, 2025 — the first quarter of 2025.

The analysis focused on users with active auto loan debts, including both individual and joint accounts. We calculated the percentage of consumers with at least one monthly auto loan payment of $1,000 or more.

The analysis was conducted nationally and by state, generation and credit score. We defined generations based on the following age groups in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Get auto loan offers from up to 5 lenders in minutes