Best Cash Advance Credit Cards in February 2026 & What to Know Before You Borrow

Key takeaways

- A cash advance credit card lets you use your card to quickly access cash.

- While a credit card cash advance may seem like a helpful solution in a financial emergency, we don’t recommend using a cash advance due to the high fees and interest rates you’ll have to pay.

- Instead, we recommend using a card with a long 0% intro APR, so you can pay off large purchases over time without paying interest.

- You can also take out a personal loan as a lower-cost option with more flexible terms.

Best cash advance credit cards

You can find a few credit cards that wave the cash advance fee and offer a reasonable APR for cash advances. While a cash advance credit card generally isn’t the best option for paying off debt, you should consider the following cards if you want to opt for a cash advance:

| Credit Cards | Our Ratings | Cash advance fee | Regular Cash Advance APR | Rewards Rate | |

|---|---|---|---|---|---|

PenFed Gold Visa® Card*

|

4.2

|

$0 | 17.99% | N/A | |

PenFed Platinum Rewards VISA Signature® Card*

|

2.9

|

$0 | 17.99% | 1X - 5X points

| |

PenFed Power Cash Rewards Visa® Card*

|

2.5

|

$0 | 17.99% | 1.5% - 2% cash back

2% cash back on all purchases for PenFed Honors Advantage Members, or 1.5% cash back on all purchases.

| |

DCU Visa® Platinum Credit Card*

|

$0 | 12.25% to 18.00% (variable) | N/A | ||

DCU Visa® Signature Cash Rewards Card*

|

N/A | $0 | 15.00% to 18.00% (variable) | 1X point

Earn 1 point for every $1 spent on everyday purchases

| |

DCU Visa® Platinum Secured Credit Card*

|

$0 | 15.25% (variable) | N/A |

How we chose the best cash advance credit cards

We take a comprehensive, data-driven approach to identify the best cash advance credit cards. We use an objective rating and ranking system that evaluates over 200 credit cards from more than 50 issuers. All recommendations are made by LendingTree’s editorial team, completely independent of affiliate partnerships or compensation. Every card is selected based on its merit and ability to help people achieve their financial goals.

What is a cash advance on a credit card?

A cash advance is a way to take the available credit on your credit card and use it to take a loan in the form of cash. Essentially, you’re using your credit card to borrow cash, rather than charging a purchase to your credit card. You’ll have to pay back what you’ve borrowed, and there’s usually no grace period for interest.

Cash advance vs. personal loan

A cash advance is a type of loan, though it’s not the same as a personal loan. A personal loan is a type of installment loan that allows borrowers to take a one-time cash payment. This is paid back plus interest in monthly payments over a set period of time. Cash advances are shorter-term loans from your credit card rather than a lender, and charge higher fees and interest rates than personal loans.

See LendingTree’s top picks for personal loans.

How to get a cash advance on a credit card

Get a cash advance at your bank

- Let your bank teller know you’re looking for a cash advance.

- Use your credit card to complete the transaction.

Get a cash advance at an ATM

- Insert your card.

- Enter your PIN.

- Select the cash advance option.

- Complete the transaction and receive your cash.

Get a cash advance using a check

- If you have a check (sometimes referred to as a convenience check) from your credit card issuer, fill one out and name yourself as the payee.

- Cash or deposit the check at your bank.

Get a cash advance through an online transfer in your account

- Log in to your credit card account.

- Request the cash advance.

- Your cash advance will typically be deposited into your checking account within a few days.

Pros and cons of cash advance credit cards

- Get an emergency loan immediately

- Get cash rather than credit to pay for expenses

- Substantial fees (usually around 5%)

- High cash advance APR (interest rate)

- High purchase APR

- No grace period for interest

- May not have access to your entire credit limit

- Need to apply for a cash advance credit card if your card doesn’t allow cash advances

What are cash advance fees on credit cards?

You’ll usually have to pay a fee for making a cash advance. Most issuers will charge either a flat fee or a percentage, depending on which is greater. The fee is usually around 5% or $10.

-

Credit card cash advance calculator

Example: Let’s take a look at how much a $1,000 cash advance would cost if you paid it back in 30 days using a credit card with a cash advance fee. This card has a cash advance APR of 17.99% and 5% cash advance fee.

Interest:

- 0.1799 cash advance APR ÷ 365 days in a year = 0.0004928 daily interest rate

- 0.0004928 daily interest rate x $1,000 cash advance = $0.49 daily interest

- $0.49 daily interest x 25 days (number of days in a billing cycle) = $12.25 in interest

Cash advance fee:

- $1,000 cash advance x 0.05 cash advance fee = $50 in fees

Cash advance cost:

- $50 fees + $12.25 interest = $62.25 total

The interest and fees for a $1,000 cash advance in this scenario are more than 6% of the principal. This is a hefty amount compared to what you might pay with a personal loan, and assumes you would pay off the balance in the first month. If you continue to carry a balance, the interest could build up rapidly.

Cash advance credit cards by issuer

If you don’t want to join a credit union, you’ll find that many cards offer cash advances, including the cards below. Keep in mind that these cards come with cash advance fees and high cash advance APRs.

| Credit Cards | Our Ratings | Cash advance fee | Regular Cash Advance APR | Rewards Rate | |

|---|---|---|---|---|---|

Chase Freedom Flex®*

|

Chase

|

Either $10 or 5% of the amount of each transaction, whichever is greater. | 28.49% Variable | 1% - 5% cash back

| |

Capital One Savor Cash Rewards Credit Card

|

Capital One

|

5% of the amount of the cash advance, but not less than $5 | 28.49% (Variable) | 1% - 8% cash back

| |

Citi Double Cash® Card

on Citibank's secure site Rates & Fees |

Citi

|

5% of each cash advance; $10 minimum | 29.74% (Variable) | 2% - 5% cash back

|

on Citibank's secure site Rates & Fees |

Wells Fargo Reflect® Card*

|

Wells Fargo

|

Refer to Important Credit Terms | Refer to Important Credit Terms | N/A | |

BankAmericard® credit card*

|

Bank of America

|

See Terms | See Terms | N/A | |

Discover it® Cash Back

on Discover's secure site Rates & Fees |

Discover

|

Either $10 or 5% of the amount of each cash advance, whichever is greater. | 28.49% Variable APR | 1% - 5% cash back

|

on Discover's secure site Rates & Fees |

How to avoid taking a cash advance

There are other ways to borrow cash that are less risky and less expensive than a cash advance. We suggest leaving a cash advance as a last resort and trying one of these first:

Use a card with a 0% intro APR

A 0% intro APR credit card offers up to 21 months to pay off an emergency purchase without paying interest. This is a much better option than a cash advance. These cards also come with lower APRs and sign-up bonuses that can help you pay off the purchase. Plus, many of these cards have no annual fee.

| Credit Cards | Our Ratings | Intro Purchase APR | Regular APR | Rewards Rate | |

|---|---|---|---|---|---|

Capital One Savor Cash Rewards Credit Card

|

0% intro on purchases for 12 months | 18.49% - 28.49% (Variable) | 1% - 8% cash back

| ||

Chase Freedom Unlimited®

on Chase's secure site Rates & Fees |

0% Intro APR on Purchases for 15 months | 18.24% - 27.74% Variable | 1.5% - 5% cash back

|

on Chase's secure site Rates & Fees |

|

Blue Cash Preferred® Card from American Express

|

0% on purchases for 12 months | 19.49%-28.49% Variable | 1% - 6% cash back

| ||

Chase Freedom Flex®*

|

0% Intro APR on Purchases for 15 months | 18.24% – 27.74% Variable | 1% - 5% cash back

| ||

Citi Custom Cash® Card*

|

N/A | 17.49% - 27.49% (Variable) | 1% - 5% cash back

| ||

Wells Fargo Autograph® Card*

|

0% intro APR for 12 months from account opening on purchases | 18.49%, 24.49%, or 28.49% Variable APR | 1X - 3X points

|

→ See LendingTree’s picks for the best 0% APR credit cards.

Get a personal loan

If you aren’t in a hurry to get cash, you may want to look into a personal loan. APRs for personal loans currently range from around 5.99% to 35.99%. If you have a good credit score, a history of on-time payments, a steady income and a low debt-to-income ratio, you’re likely to be offered an interest rate lower than what you’d pay on a credit card cash advance. Personal loans offer set monthly payments and repayment dates, and interest generally doesn’t start accruing from day one.

→ See LendingTree’s guide on how to apply for a personal loan.

Do a balance transfer to another credit card

If you’re trying to make room on a credit card for a large purchase, a balance transfer might be an option. A balance transfer credit card allows you to transfer debt from one card to another. A balance transfer can significantly reduce fees and interest, making it a more affordable option compared to a cash advance. Plus, many balance transfer credit cards come with an intro APR on balance transfers, meaning you won’t pay any interest for anywhere from six to 21 months.

According to LendingTree’s balance transfer credit card report, the most common duration of a 0% balance transfer offer is 15 months.

→ See LendingTree’s picks for the best balance transfer credit cards.

Request an extension on your payment

In situations where you have an unexpected expense like a major home or car repair or a medical bill, don’t underestimate the power of an honest conversation with the company’s billing department. See if they can delay the payment date or split the bill into monthly payments. Whatever you do, being proactive and acknowledging the debt will go a long way.

Borrow from family and friends

Borrowing from people you know isn’t the best strategy — but in a pinch, it could be an option. Generally, your loved ones may be more willing to help you out in troubled times. They’re likely to be flexible with repayment terms and expect little, if any, interest.

The downside is that if they need the money back before you’ve repaid it, or if you don’t hold up your end of the bargain, your relationship could become awkward. If you decide to borrow from your family, create a personal loan contract, so you’ll all be on the same page.

Get early access to your paycheck

Rather than pay interest on a credit card cash advance or a personal loan, you may be able to use a mobile app to get money from your paycheck before payday. While you may end up paying a tip or a small fee to use one of these apps, you’ll likely pay less than the interest and fees you would pay for a credit card cash advance.

Three paycheck apps worth considering:

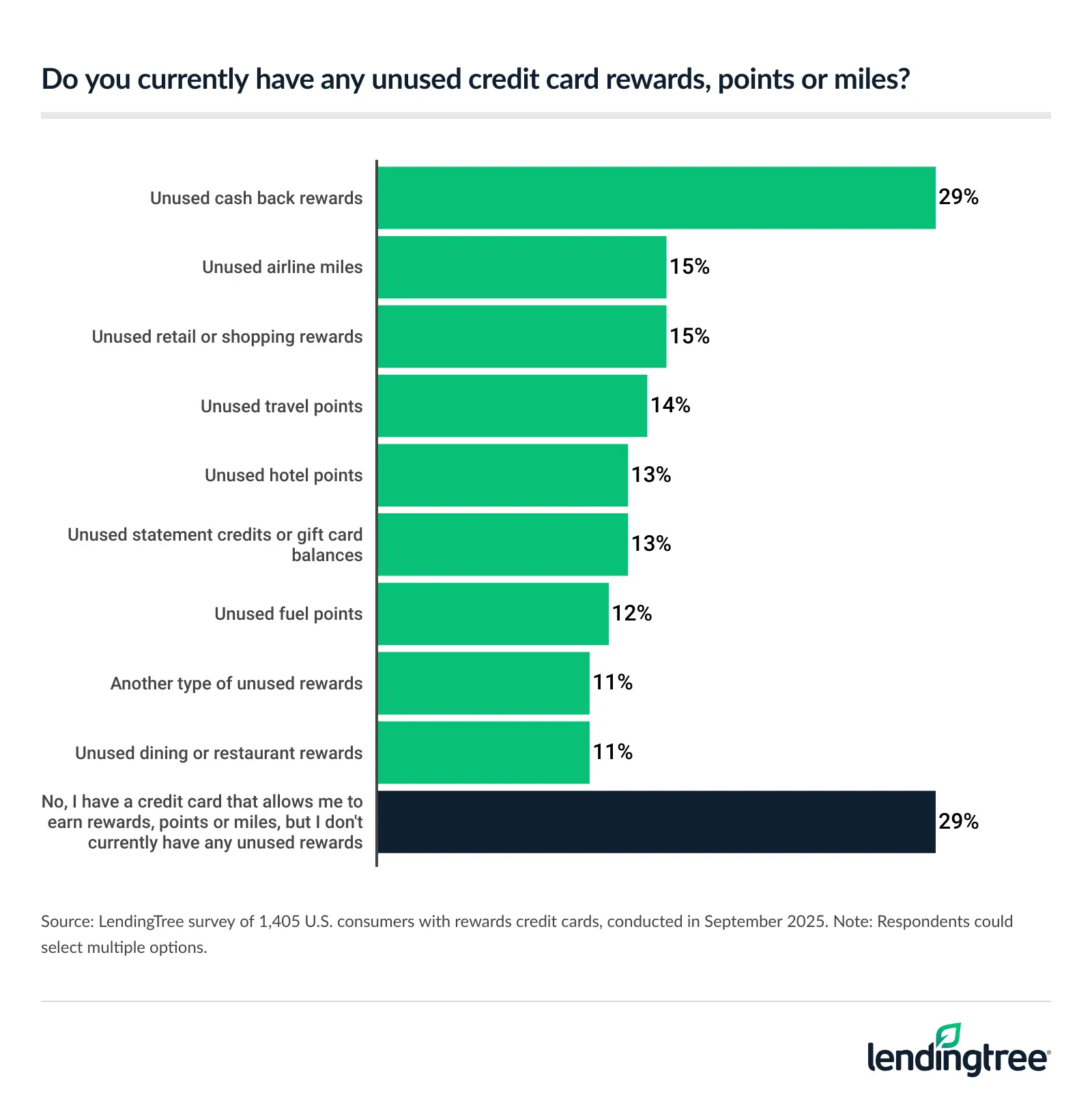

Do you have unused rewards in your credit card account?

You may have more cash in your account than you think. According to a LendingTree survey, nearly 3 in 4 credit cardholders are sitting on unused cash back, points or miles. In fact, 31% of rewards cardholders haven’t cashed out any rewards in the past year.

Redeeming the rewards you’ve earned can save you money on everyday purchases or assist in paying down your credit card balance. Just be sure you’re not spending more or going into debt in order to earn additional rewards.

Frequently asked questions

A cash advance is when you use your credit card to get cash. For example, if you use your credit card to withdraw cash from an ATM (which will require a PIN), this is a cash advance. You might also get convenience checks in the mail, offering you the ability to get cash from your credit card.

You can’t borrow cash from your credit card without doing a cash advance, but there are other ways to earn cash from your credit card. Cash back credit cards offer anywhere from 1% to 6% cash back on purchases. This can be redeemed as a direct deposit, a statement credit, a paper check by mail or an ATM withdrawal.

We don’t know of any credit cards that offer a 0% APR for a cash advance. Most cash advance credit cards charge interest as soon as you complete the cash advance. However, credit union credit cards often come with a lower-than-average APR for cash advances.

You can get a cash advance at an ATM, but you’ll need to know your PIN for your credit card.

It’s typical for issuers to limit how much cash you can get from a cash advance. This cap might be set at a percentage of your card’s credit limit, such as 30%. To find out your exact cash advance limit, check your online account or call the number on the back of your card.

Many credit cards charge a cash advance fee in the vicinity of 5%. So, for example, it would cost you $15 to get a $300 cash advance on a card with a 5% cash advance fee. It is possible to find credit cards with no cash advance fee, but they typically require a credit union membership.

Taking a cash advance doesn’t hurt your credit score because it’s not a specific item that’s listed on your credit report. However, as you repay the advance, making late payments on your credit card may cause a drop in your credit score.

If you have a credit card that allows cash advances, you can withdraw cash from an ATM or at a bank in a couple of minutes.

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the PenFed Gold Visa® Card, PenFed Platinum Rewards VISA Signature® Card, PenFed Power Cash Rewards Visa® Card, DCU Visa® Platinum Credit Card, DCU Visa® Signature Cash Rewards Card, DCU Visa® Platinum Secured Credit Card, Chase Freedom Flex®, Wells Fargo Reflect® Card, BankAmericard® credit card, Citi Custom Cash® Card and Wells Fargo Autograph® Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.