Understanding the HUD-1 Settlement Statement

A HUD-1 settlement statement is a form that details every charge associated with a mortgage refinance or reverse mortgage. It also outlines who’s responsible for each of those charges — the homebuyer or the seller — as well as any credits for things like taxes, insurance or deposits.

This HUD document summarizes your loan’s final details, and may also be accompanied by a Truth-in-Lending disclosure. Reviewing and understanding the contents of your HUD-1 statement will help you avoid errors that could delay your closing.

- HUD-1 settlement statements are only required for mortgage refinances and reverse mortgages — not for purchase mortgages, HELOCs or most other residential loans.

- The HUD-1 form consists of three pages: an overview of all charges, a detailed breakdown of who pays what fees and a comparison between the Good Faith Estimate and final settlement costs.

- Reviewing your HUD-1 statement carefully before closing helps you verify accuracy, avoid unexpected charges and correct errors that could delay your closing.

Which loan types require a HUD-1 settlement statement?

Federal regulations require a HUD-1 for:

However, the HUD-1 Settlement Statement is no longer used for:

- Purchase mortgages

- Home equity lines of credit (HELOCs)

- Manufactured home or dwelling loans not secured by real property

- Loans made by persons not considered creditors under the federal law known as TRID (such as some seller-financed transactions)

- Temporary financing, including some construction loans

- Land loans (that don’t include financing to place or build a home on the land)

- Standard residential mortgages

Where can I find my HUD-1 settlement statement?

If you haven’t closed on your home yet, reach out to your lender to obtain a copy of your HUD-1 form. Be aware that if you reach out more than one day prior to closing, there’s no guarantee the form will be ready (but it can’t hurt to ask).

If you’ve already closed, look back at your packet of closing documents — it should be there with all of the other required forms and documentation.

HUD-1 settlement statement vs. closing disclosure

The closing disclosure is a consumer-friendly form meant to provide an overview of a loan, including all of the loan terms and costs.

The HUD-1 settlement statement has a far more narrow focus: to itemize the closing costs (called “settlement charges” on the form) for both buyers and sellers. Page 2 of a closing disclosure is roughly comparable to a HUD-1 settlement statement.

| Form name | HUD-1 | Closing disclosure |

|---|---|---|

| What it is | A form summarizing the costs associated with a loan and who has to pay each cost | A form designed to help borrowers review and understand their loan terms before committing at closing |

| Who receives it | Borrowers taking out reverse mortgages and refinances | Most other mortgage loan borrowers |

| Key features | Summary of all loan charges and who owes what, including the property’s purchase price and fees | Summary of all loan charges and who owes what, including the property’s purchase price and fees |

| Deadline | Day of closing | Three days before closing |

What’s included in a HUD-1 form?

The HUD-1 form may seem overwhelming at first glance. However, it’s worthwhile to learn the basics. From a bird’s eye view, the HUD-1 looks like this:

Page 1 of HUD-1: Overview of all loan charges

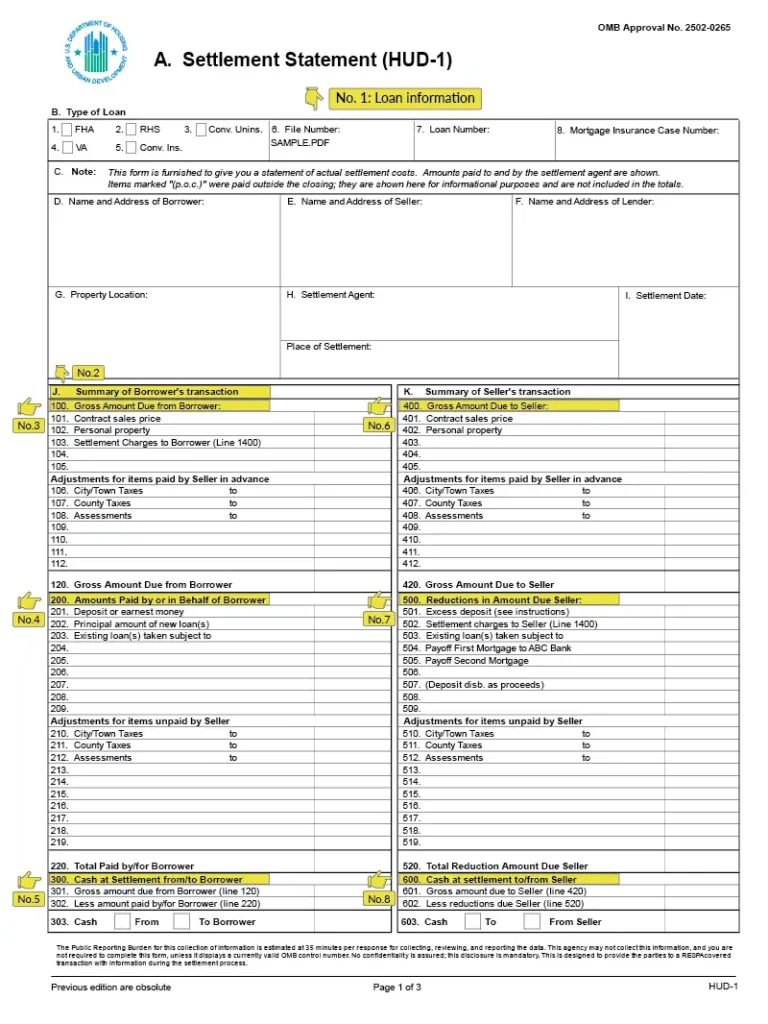

The first page of the settlement statement has a transaction overview, including the amount of cash you’ll need to bring to closing. The sections below are highlighted to give you an idea of what they look like on the HUD-1 settlement statement you’ll receive.

No. 1: Basic information

At the top of Page 1, you’ll see basic information about your mortgage transaction, including what kind of loan you’re getting and who’s involved in the transaction. Double-check that everything is accurate, including your chosen loan type and the spelling of your name.

No. 2: Summary of borrower’s transactions

This section summarizes the details from Page 2 of the settlement statement. You’ll want to pay particular attention to Line 303, which explains how much money you need to bring to closing.

If this number is higher than you expected, you’ll want to discuss it with your loan officer before you sign your closing papers.

No. 3 (Section 100): Gross amount due from borrower

This section explains the amount you owe, including the property’s purchase price (if you’re buying a home) and any associated fees. You’ll find an itemized breakdown of all the fees contributing to this total on Page 2. Line 120 explains the total amount you owe.

No. 4 (Section 200): Amount paid by or on behalf of borrower

This section details any credits you’ll receive toward costs you’ve already paid, or that the seller is paying. Line 201 shows the money you’ve already paid (for example, an earnest money deposit), while Line 202 reflects the principal amount of the new loan.

If the seller is paying closing costs, it should indicate “seller credit” or “seller paid costs” here. Line 220 will add up all the credits in this section.

No. 5 (Section 300): Cash at settlement from/to borrower

This section lets you know if you need to bring cash to the closing table.

In most cases, the closing costs for a reverse mortgage or refinance will be subtracted from the loan, so you won’t need to bring funds to the closing. However, if you’re buying a manufactured home or using a reverse mortgage to purchase a home, you’ll likely need to bring cash to closing.

Line 303 explains the total cash you’ll bring to closing.

No. 6 (Section 400): Gross amount due to seller

This section provides an accounting of the costs the seller is paying, including property tax assessments they’ll pay through the date that the sale is completed.

No. 7 (Section 500): Reductions in amount due to seller

This reflects costs deducted from the seller’s proceeds, including any loans that are secured by the property and any other costs that need to be paid by the seller to complete the sale.

No. 8 (Section 600): Cash at settlement to/from seller

This is the total amount the seller will receive at closing. This section is only filled in if you’re buying a home.

Page 2 of HUD-1: Detailed breakdown of every charge

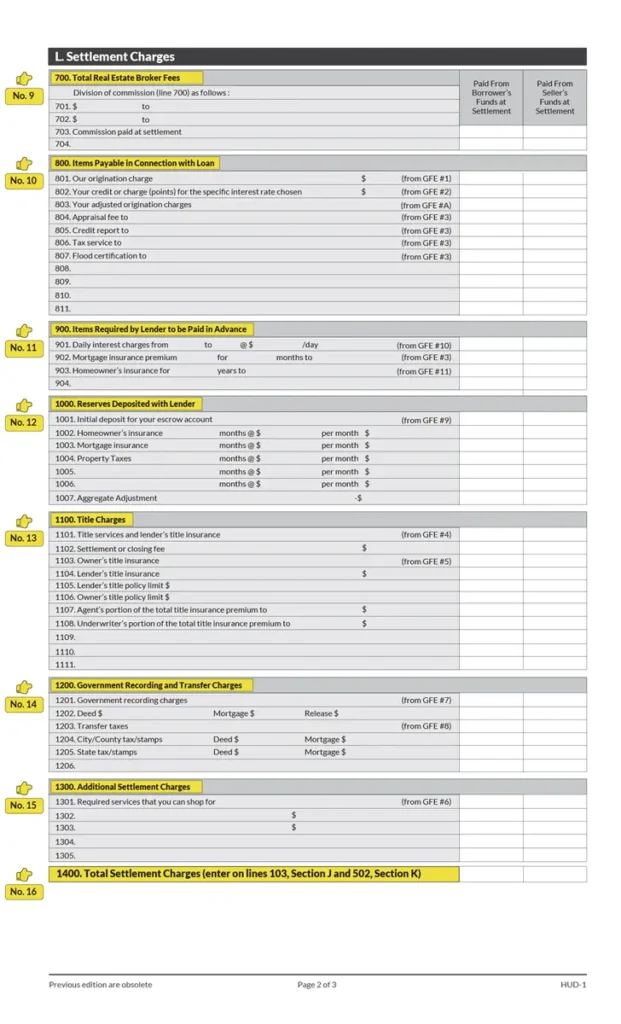

On the HUD-1, Page 2 spells out all the itemized charges associated with your loan and whether the buyer (you) or the seller will pay them. Check that you’re not paying fees that the seller or the lender have agreed to pay.

Manufactured homebuyers may see entries in the seller’s section. In most cases, though, reverse mortgage borrowers will only see data in the borrower’s section — unless a reverse mortgage is being used for a purchase.

No. 9 (Section 700): Total real estate sales/broker’s fees

If real estate agents were involved in the transaction, the commission paid to them for their services is reflected here. The fee is often a percentage of the price you paid for the property.

No. 10 (Section 800): Items payable in connection with the loan

Most loans have origination fees, points paid in advance (to reduce your interest rate) and various other fees. You’ll probably pay most of these fees at closing — however, if you’ve paid a fee in advance, it will be marked “POC” in section 800, which means “paid outside of closing.”

Some people finance their closing costs when they’re taking out a reverse mortgage or refinance. But even if you’re financing these costs, they’ll be outlined here.

No. 11 (Section 900): Items required by lender to be paid in advance

Depending on when you close, you’ll pay some interest on the new loan you’re taking out. The closer you are to the end of the month, the less you’ll pay in daily interest charges. Mortgage insurance premiums have to be collected at the closing, and your homeowners insurance premium will also need to be paid in advance so your home will be insured at closing.

No. 12 (Section 1000): Reserves deposited with lender

If you’re using an escrow account to pay for taxes or insurance, you’ll see upfront deposits listed in this section. Refinance and reverse mortgage borrowers are responsible for their own insurance and tax payments and shouldn’t see escrow deposits. However, if your closing date is around the time that property taxes are due in your area, you may end up having to pay the tax bill at closing.

No. 13 (Section 1100): Title charges

Title charges are the costs of changing ownership, such as title examination fees and attorneys fees. You’ll pay title fees regardless of whether you’re buying a home or refinancing it.

Lenders always require new title work to confirm that there are no new liens, judgments or owners on your property that would impact the purchase. New title insurance will also be required on a refinanced property, even though you purchased title insurance when you bought the home.

No. 14 (Section 1200): Government recording and transfer charges

In general, you’ll need to pay for a new deed and for your city to record a new mortgage. The city, county and state taxes for these fees (as applicable) are noted in this section.

No. 15 (Section 1300): Additional settlement charges

This section will have various charges related to pest inspections, lead-based paint testing, home warranties and other charges that haven’t yet been listed.

No. 16 (Section 1400): Total settlement charges

This section adds all the charges in Sections 700 through 1300. The total on this line should match Line 103 for borrowers and Line 502 for sellers (on Page 1).

Page 3 of HUD-1: Summary of changes between the Good Faith Estimate (GFE) and settlement, plus a loan summary

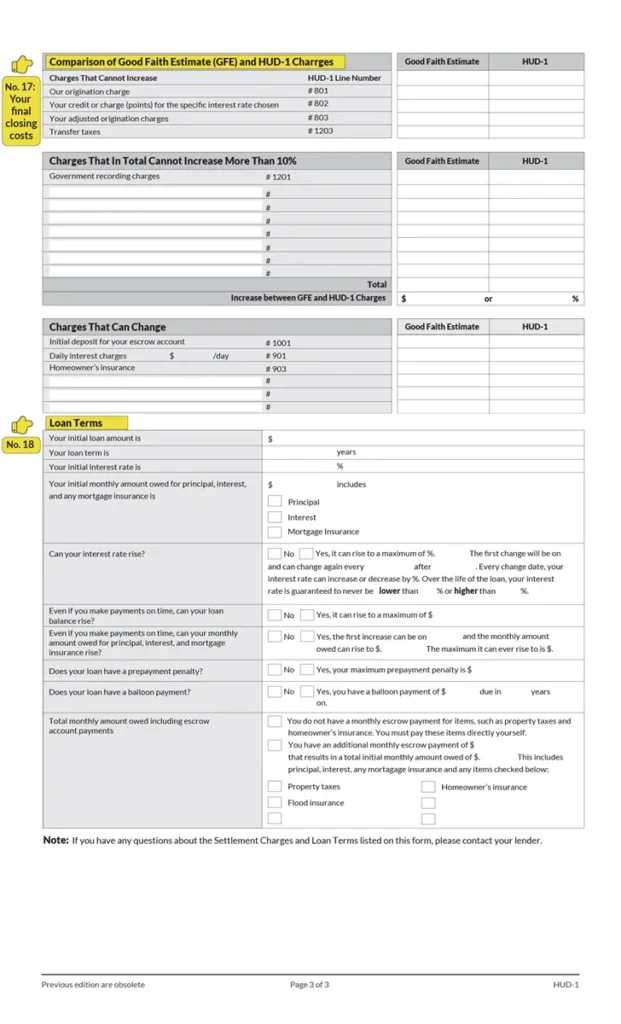

Page 3 compares your actual settlement charges and the charges listed in your Good Faith Estimate (GFE). The settlement statement lists charges in three sections: The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

There may be valid reasons these fees end up higher or lower, and your lender will have to notify you of why they’ve changed within three days .It’ll also have to provide you with an updated GFE reflecting the amount of the cost increases, so you have the opportunity to review them.

No. 17: Your final closing costs

This section includes charges that can’t change, as well as those that can’t change by more than 10%. If there’s a difference between the amount listed in the Good Faith Estimate and the final amount on the HUD-1 statement, these will be notated here.

In general, refinance and reverse mortgage borrowers shouldn’t see many changes compared with the data in their GFE. Still, you’ll want to ask your lender to explain any changes in this section.

No. 18: Your loan terms

The bottom of Page 3 in the HUD-1 document explains your loan’s details. Talk with your lender about anything that doesn’t make sense and continue asking questions until any and all issues are cleared up.

This section includes crucial information — for example, your loan amount, loan repayment term and final interest rate. It also notes your initial monthly payment, whether it can increase and the specifics of how your interest rate could increase. Further, you’ll see boxes about prepayment penalties and balloon payments.

Because these features can affect when you can pay off your loan, as well as how much your payments may increase with time, make sure you understand them fully.

Compare Home Equity Offers