I Shopped for a Personal Loan 15 Times: What I Learned (Even as a Pro)

- I shopped with 15 different lenders and loan marketplaces — including LendingTree — to compare personal loan offers.

- In less than an hour, I received 58 offers, with 32 of those through LendingTree.

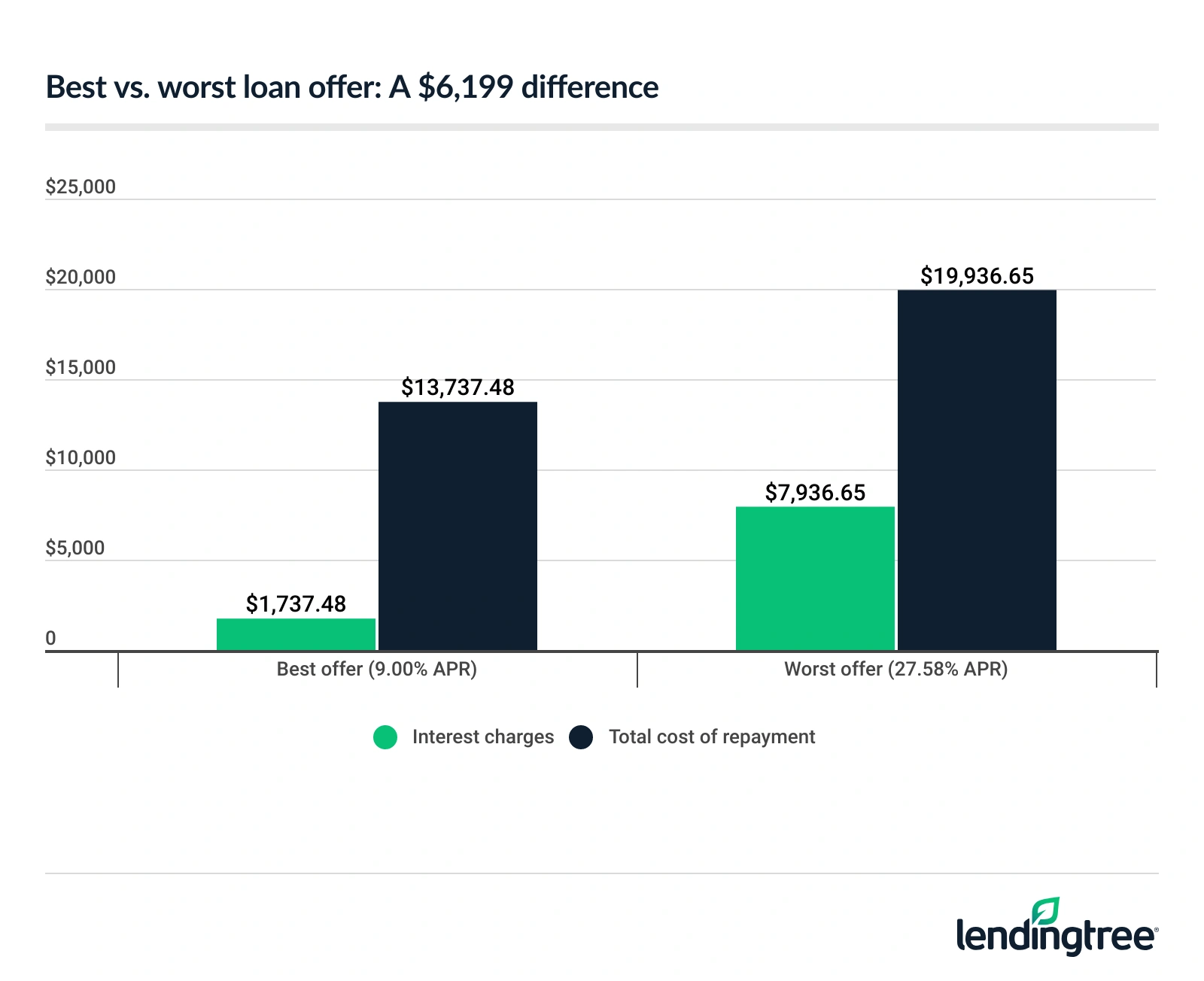

- My offers ranged from 9% to 27.58% APR. The difference between my best and worst offers? Over $6,000 in interest.

- On average, the process took under 3 minutes with each lender or marketplace. Most loan decisions came back in under 30 seconds.

Why I acted like a real borrower and put my credit on the line

I’ve written over 100 articles about loans and debt, but I wanted to go beyond research to experience what requesting a loan actually feels like. So I acted like a real borrower and shopped with 12 lenders and three marketplaces. (Lenders issue loans themselves, while marketplaces like LendingTree show you offers from multiple lenders at once.)

I expected to feel vulnerable, and I did. I used my real personal information, including my Social Security number and income, knowing lenders would evaluate and possibly reject me. Despite writing about loans for a living, I was nervous enough to put off applying a few times.

What surprised me most was how much my experience (and rates) varied by lender. Some applications were straightforward, while others were outright confusing. So I used what I learned to build a toolkit to help first-time personal loan shoppers feel confident and prepared.

I shopped with the personal loan companies we recommend on our top LendingTree pages, aside from those I’m not eligible for (like military-only lenders). Comparing 15 companies gave me a solid sense of the overall loan shopping experience.

My loan shopping experience by the numbers

-

What I requested: A $12,000 loan

with a 36-month repayment termClose to the average personal loan debt per borrower, which was $11,631 in Q1 2025.

-

My credit: 846 FICO Score 8, 822 FICO Score 9

You have multiple credit scores, but lenders most commonly use your FICO Scores 8 and 9.

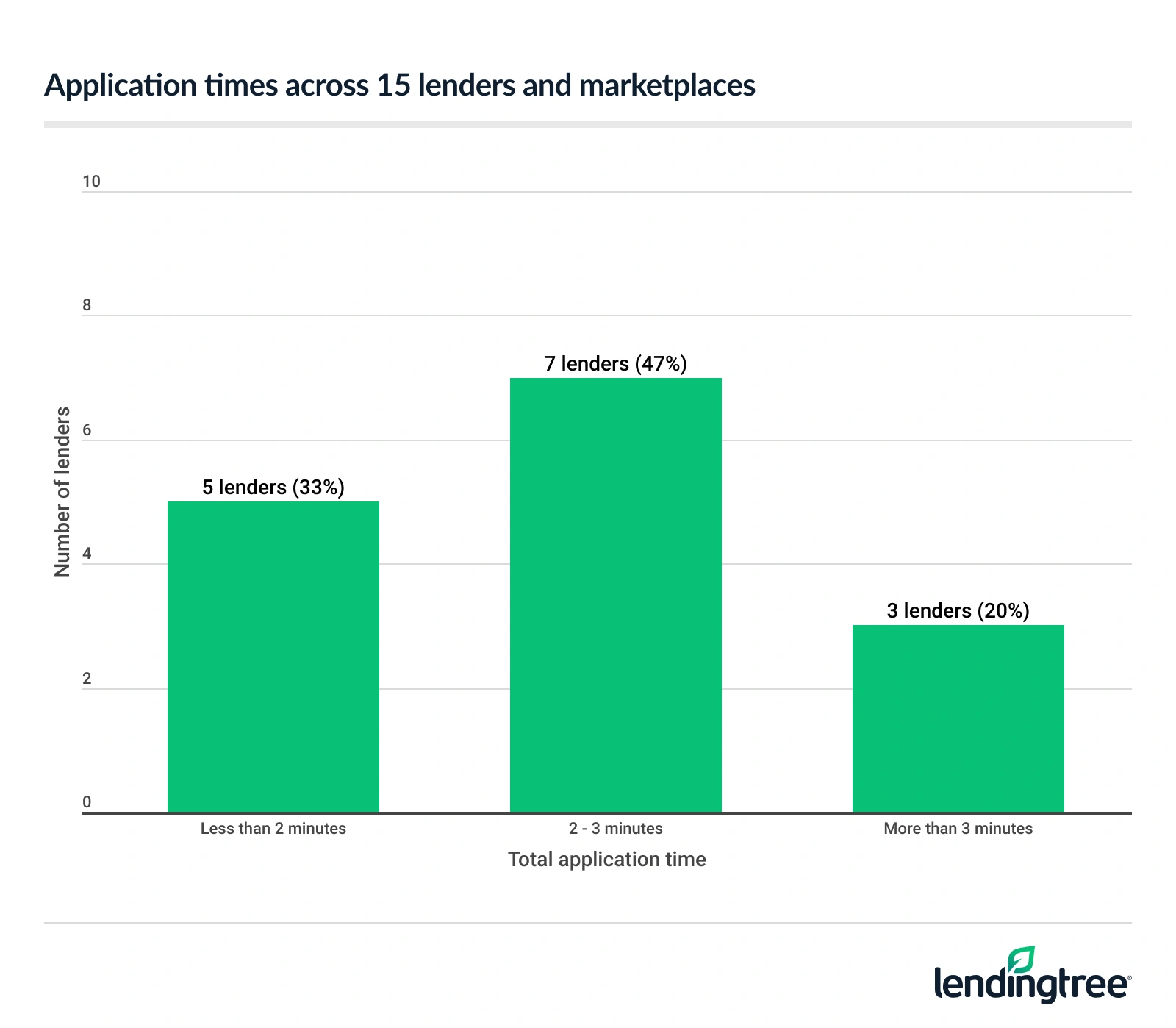

- Average time to fill out form: 2 minutes, 38 seconds

- Lowest offer: 9.00% APR ($1,737.48 in total interest)

- Highest starting offer: 27.58% APR ($7,936.65 in total interest)

- Total number of offers: 58

- Most offers shown by a single platform: 32

- Average number of offers per lender: 3.87

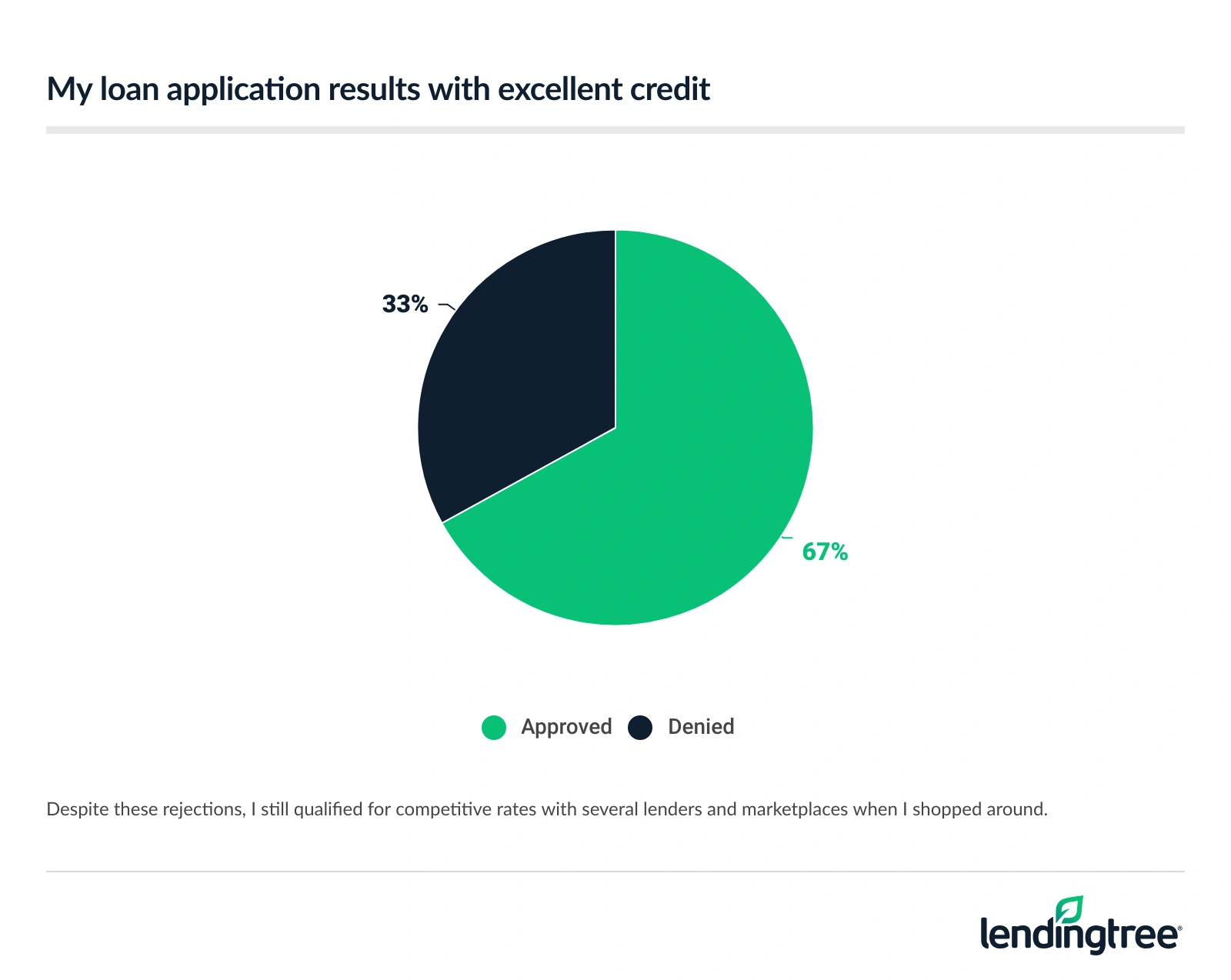

- Rejections: 5

What surprised me (even as a pro)

Loan forms are very fast — and so are decisions

I expected a longer process, but 80% of loan forms took me three minutes or less. It helped that I came prepared with answers to common questions. Use my personal loan toolkit to make the process fast for you, too.

Nearly all (93%) lenders showed me offers or decisions within 30 seconds. Expect a quick response as long as you’re just prequalifying for a loan, which means you’re only getting an estimate of your potential loan terms.

Personal loan forms can be confusing

You’ll see a lot of fine print and niche financial terms. The best lenders will clarify any strange terminology, but not all do, so you may find yourself Googling unfamiliar terms.

Plus, lenders often don’t spell out the next steps, so it’s hard to know how much longer the process will take. You can’t skip forward to preview questions, and you don’t know what you’ll see until you click submit.

Near-perfect credit doesn’t guarantee approval

I’ll be honest — I was surprised to get five loan rejections. There are plenty of reasons lenders deny personal loans, but I thought my excellent credit would be enough to qualify.

Four of the five lenders that rejected me specialize in loans for fair credit or bad credit — lenders that I’m technically overqualified for, at least in terms of credit rating.

Don’t expect insightful reasons for rejection

Lenders must explain why they denied you, but their reasons are sometimes vague and unhelpful. Here are two explanations from different lenders that denied me:

- “Borrower does not qualify for minimum loan amount given application source”

- “Utilization of accounts, number of accounts and/or occurrence of a derogatory event”

It’s hard to make sense of what the lenders are actually saying here. The second rejection cites a laundry list of possible reasons, and the first is so vague that it ultimately sounds like “you don’t qualify because you don’t qualify.”

Some lenders won’t tell you why you were denied unless you send a written request. It can take up to 30 days for them to respond.

My favorite lenders and marketplaces

| In my experience, best for… | Lender/marketplace |

|---|---|

| Lowest APRs (under 11%) | Discover, LendingTree, Upstart |

| Easy application experience

I rated each of these lenders 5/5 for ease of application. Their applications were simple, they explained any complicated questions and told me what would happen next at every step.

| Avant, Discover, SoFi |

| Most offers (32) | LendingTree |

Your loan application toolkit

Personal loan application tips

1. Don’t let nerves and procrastination get the best of you. Even I was nervous to shop for a loan — and I work in this field professionally. But once I started, I realized how fast the process really is. It takes time for lenders to send you your money, though, so apply now if you need money soon.

2. Avoid spam. I set up a Google Voice account and a new Gmail account just for this process, and I turned off notifications. That way, I could avoid calls and emails and check my messages when I was ready to compare loans.

After you close on the loan, remember to update your contact information to your real number and email so you don’t miss important notifications.

3. Don’t click “continue” without understanding what will happen. When you’re looking at offers from a lender, read the fine print to see if the lender will do a hard credit check if you click “continue.” Only let lenders do a hard pull on your credit in a 14-day window to avoid multiple credit hits.

4. Shop around. Shopping around can save you thousands — I would have paid $6,199.17 more with my worst offer than my best. You can apply directly with each lender or get the LendingTree marketplace to do the shopping for you.

Personal loan checklist

Using this checklist will save you time. My loan forms averaged 2 minutes, 38 seconds because I had already gathered most of this information.

Bonus: I’ve also included unexpected questions that I hadn’t seen before, so you’ll be even more prepared than I was.

- Personal info: Name, birthdate, contact info (email, phone, address), citizenship, Social Security number

-

Loan info: Loan amount, loan purpose

, loan termThere are a lot of reasons to get a personal loan, and some of them come with better rates than others — like debt consolidation or home improvement.

- Home info: Rent or own, housing payment

-

Employment: Status

, occupation, name of employer, length of employment, employer phone number and addressFull-time, part-time, self-employed or unemployed

-

Income: Annual income, additional annual income

From sources like bonuses, commission and investments

-

Other (rare) questions: Car payment, car mileage, individual or joint application

, estimated credit scoreA joint loan application is one you apply for with someone who takes equal responsibility for repaying the loan., monthly take-home pay, highest level of education, amounts in checking, savings and investment accounts, current enrollment in debt settlement programDon’t know your score? Find out for free with LendingTree Spring.Debt settlement programs negotiate with your lender on your behalf when you can’t make payments.

Where most people get stuck — and how to move forward

Income

Lenders vary in how they ask for your income. Some want you to include bonuses and commission, while others explicitly ask for your base salary without additional income. Other lenders don’t clarify what counts as income at all.

Read the fine print around the income question. Does the lender use a tooltip or other language to explain what to include? If not, a simple Google search for “What can you include as income for [lender name]” should get you the information you need.

Want a real human to answer your questions? Some lenders offer live support via chat or list their phone number on the loan form. If they don’t, do a quick online search for “[lender name] contact.” Look for “application support” or “customer service.”

Terms to know

Personal loans come with their own language. Here are a few common terms you might see.

- Interest rate: Your interest rate is the cost of borrowing. It’s expressed as a percentage and doesn’t include any fees.

- APR: A loan’s annual percentage rate (APR) helps you calculate how much you’ll spend to borrow money with that lender. It’s expressed as a percentage that includes both interest rate and fees.

- Loan term: Your loan term is how long you’ll have to pay back your personal loan. Short-term loans help you save money on interest over the life of your loan, but they come with higher monthly payments. Long-term loans are the opposite — you’ll pay more in the long run in exchange for lower monthly payments.

- Origination fee: Personal loan lenders commonly charge one-time origination fees for lending to you. Lenders typically take this fee from the loan before sending you the money.

- Prepayment penalty: Some lenders charge a fee for making early payments or paying off the loan in full before it’s due, but many lenders don’t. Check your loan agreement to make sure you won’t have to pay a prepayment penalty for early payments.

Why lenders ask certain types of questions

The questions on personal loan forms are designed to assess your creditworthiness, or the odds you’ll pay back the loan.

Most questions are fairly standard, but some lenders like Upstart ask additional questions about your education, employment history, assets and even your car payment. This is because they’ve found a link between the answers and your likelihood to repay the loan.

Ultimately, lenders want borrowers who can afford to pay them back. Having stable employment, assets (like retirement and investment accounts), high income and limited debt obligations (like a car payment or mortgage) can help you qualify for better rates.

Use a calculator to choose the right loan

When lenders show you offers, they tend to list rates and monthly payments but skip the total cost of the loan. To get the best deal, compare your offers with a personal loan calculator and look at the total interest paid.

The best deal? The loan with the lowest total cost of interest that still fits your monthly budget.

What to expect after you apply

You’ll see one of the following after finishing a personal loan prequalification form, typically within 30 seconds:

- An offers page. Yay! You meet what the lender’s looking for at this stage. You could see anywhere from one to dozens of loan offers. Lenders typically show you a list of offers that you can scroll through, but some marketplaces like LendingTree allow you to filter and sort by APR or monthly payment. Use a personal loan calculator to compare your offers and get the best deal.

- A rejection notice. If the lender decides that you’re not qualified, you’ll see a rejection notice and a promise to follow up with you about why. Lenders typically send their reasons via email or mail.

- A rejection notice, plus a link to another site. Some lenders get a referral fee for sending you to other lending companies. You can apply with the new lender, but approval isn’t guaranteed. It’s just a cross-sell, not a second chance with the original lender.

Lenders tend to fall into one of two categories after you apply: salesperson or ghost. You can’t do much if you don’t hear from a lender after they’ve denied you, but you can get an especially persistent lender to stop contacting you.

Stop lender emails: You can unsubscribe from lender emails just like you’d unsubscribe from a streaming service. Just look for the word “unsubscribe” in the footer of the email.

Stop lender calls: Lenders will eventually stop calling, but you can prevent more calls by answering the phone and asking to be removed from their call list. You can also try blocking individual numbers of repeat callers.

Once you’ve prequalified, your lender will make it easy for you to finish applying and get your money. Look out for emails with buttons leading directly back to your offers page. The LendingTree marketplace saves your offers for you — you can see them by signing in to LendingTree Spring.

Follow the instructions from your lender. You may need to upload documents to confirm your identity, address, employment or income. Then, you’ll sign the loan paperwork. Your lender will send you your money once you’re officially approved.

Methodology

I requested a loan from 15 major online lenders or marketplaces over the course of a week in July 2025. I chose lenders we frequently recommend on LendingTree.

As a personal finance writer covering the lending landscape, my goal was to understand the full borrower experience firsthand and highlight not just rates and terms, but also points of stress and confusion throughout the process.

I used my real information and tracked key metrics for each lender, including:

- Time to complete the form and receive an offer

- Number and type of questions asked, including documentation requests

- Ease of navigation, clarity of loan terms and any red flags or stress points

I didn’t accept or fund any of the loan offers I received. All opinions are my own and don’t reflect the views of LendingTree. Your results and experiences may vary.

Get personal loan offers from up to 5 lenders in minutes