How Much Does a Car Cost?

- The average used car costs about $26,000, while a new car costs about $49,000. Upfront fees add another $2,000 to $5,000.

- Car loan payments range from an average of $521 per month for a used car to $745 for a new car. You’ll also spend an average of $375.59 per month on car ownership.

- You can save money on your car by negotiating the price, buying used and shopping around for a car loan.

How much is a car?

The average price of a new car is $48,799, while used cars cost $25,547 on average per Kelley Blue Book. You can pay this cost upfront or spread it out over time with an auto loan.

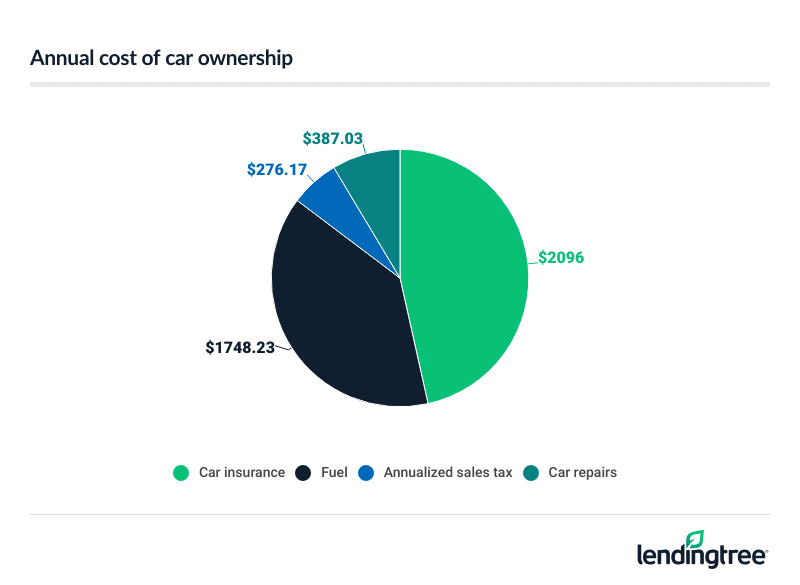

On average, owning and maintaining a car costs $375.59 per month, according to a LendingTree study. This includes fuel, insurance, repairs and sales tax.

Upfront vs. ongoing costs

There are two types of car costs: the upfront costs you’ll pay at the dealership and the ongoing costs of owning and financing your car.

| Average upfront costs | Average ongoing costs |

|---|---|

| New car price: $48,799* Used car price: $25,547* Down payment: About $2,600 – $9,800 (or 10% of the used car price, 20% of the new car price) Fees (including taxes, title and documentation fees): About $2,000 – $4,900 (or 8% to 10% of the car’s price) | New car payment: $745 per month Used car payment: $521 per month Cost of ownership: $375.59 per month ($4,507.11 per year) |

Upfront costs

Upfront costs are what you’ll pay when you buy your car. Here’s what you’ll need to budget for:

- Purchase price or down payment. If you pay in cash, you’ll pay the purchase price of your car. If you’re getting a loan, you’ll typically make a down payment before you drive it home. Some manufacturers and dealerships offer zero-down car loans for borrowers with excellent credit, but monthly payments for those loans will be more expensive.

- Fees. You’ll also need to budget for dealer fees. Some of these are mandatory, like taxes, title and license fees. Others are negotiable, like market adjustments and GAP insurance. Ask your dealer for an itemized list of fees and compare it to our lists of unavoidable and negotiable dealer fees.

Ongoing costs

If you get a car loan, you’ll make monthly payments for a set amount of time — an average of 69 months for new cars or 67 months for used cars. Every car owner will also pay for ongoing costs, like fuel, insurance and maintenance.

Cars cost a total of $4,507.11 per year to own and maintain, according to a recent LendingTree study. This number can vary significantly by state, from $3,029.58 in New Hampshire to $6,118.86 in Nevada. Learn more about the average cost of car ownership in your state.

How much should you spend on a car?

Use our car affordability calculator to estimate how much you can afford to spend on your car. Remember that just because you can afford to spend a certain amount, it doesn’t mean you should — you can choose a cheaper car and put the savings toward paying off debt or building an emergency fund.

How to save money on your car

Negotiate the purchase price and dealer fees

One of the best ways to save money on your car is to negotiate the car price. Come prepared with research on the car’s MSRP, a preapproved car loan offer and a list of mandatory and optional dealer fees. Try to reduce or eliminate any optional fees above the MSRP. And if you’re feeling pressured to commit, don’t be afraid to walk away and try your luck somewhere else.

Choose used or certified pre-owned

Buying a used or certified pre-owned car will reduce the price of your car by an average of more than $23,000, and you can still get many of the benefits of buying a new car if you shop smart for a used car.

If you’re concerned about getting a lemon or a car that wasn’t maintained properly, consider buying a certified pre-owned car. These cars are typically inspected and refurbished up to the manufacturer’s standards, and they come with extended warranties in case something does go wrong.

Shop around for a car loan

Think of shopping around for a car loan like shopping for the car itself — the only way to be sure you’re getting the best deal is to get several offers or quotes. Shopping around for the best car loan rate could save you an average of $5,198.

You can get quotes directly from lenders on their websites or use a service like LendingTree to get offers from up to five trusted auto lenders in a couple of minutes. It’s free, simple and secure.

Make a bigger down payment

Putting more money down when you buy a car can be a smart way to get a smaller car loan. This means you’ll borrow less, have lower monthly payments and pay less interest over time.

Choose the right loan term

The right repayment term will depend on your goals. If you want to save money on your car loan, choose a short loan term — you’ll spend less money on interest, but you’ll have higher monthly payments in the meantime.

If you want lower monthly payments, choose a longer loan term. But be careful about choosing the longest car loan you qualify for — the longer you stretch out your loan term, the more money you’ll spend on your car loan.

Improve your credit

What does your credit score have to do with how much your car costs? If you’re getting a car loan, your credit score can mean the difference between affordable monthly payments and ones that are outside your budget.

Lenders use your credit score to decide what rates to offer you. The better your credit, the lower your rates and the less you’ll pay to borrow money for your car. In fact, raising your credit score from “fair” to “very good” can help you save an average of $2,316 on your car loan. Learn more about how to improve your credit fast.

Shop around for insurance

“A lot of people think that they can negotiate car insurance rates but unfortunately, that’s not the case,” says Carol Pope, licensed car insurance agent and LendingTree senior writer.

“If you want to save money on car insurance, shop around at every renewal. Each company has its own way of calculating rates, so you could get wildly different premiums across companies. Car insurance rates are always changing, too, so a company that was expensive in the past could be the cheapest now.”

Get cash back for gas

Gas is a big part of car ownership, but you can cut costs with a gas credit card. These cards offer discounts or rewards for using them at gas stations. You can also use an app like GasBuddy to find the cheapest gas near you.

Get auto loan offers from up to 5 lenders in minutes