Best Credit Cards for Bad Credit in February 2026: Secured & Unsecured Options

Key takeaways

- The best credit cards for bad credit have no annual fee and report to all three major credit bureaus.

- While there are cards that don’t require a security deposit, most often your best option is a secured card that requires a refundable security deposit that typically starts at $200.

- Some cards listed offer rewards — even those designed for people with no or low credit.

- LendingTree has selected each card based on accessibility, credit-building potential and overall value — not affiliate incentives.

Bankruptcy, late payments, identity theft, medical bills and more — there’s a long list of life circumstances that can hurt your credit. Whether you’re recovering from financial setbacks or establishing credit for the first time, the right credit card can help you move forward.

At LendingTree, we’ve carefully reviewed and selected a list of credit cards that are best suited for people with bad credit. Our recommendations are based on data, expert analysis and up-to-date information on deposit requirements, credit-building potential and card benefits. This guide is designed to help you take the next step toward better credit health with clarity and confidence.

Compare the best credit cards for bad credit

All the cards on our list charge no annual fee and report your activity to all three major credit bureaus (Experian, Equifax and TransUnion), which is essential for building or rebuilding credit. Most secured cards require a refundable deposit, but a few unsecured options — like the Tilt Motion Card — don’t.

If you’re looking to earn rewards while you rebuild, check out options like the Discover it® Secured Credit Card and U.S. Bank Altitude® Go Visa Signature® Card. And if you’re just getting started, secured picks like the Capital One Platinum Secured Credit Card can help you start off on the right foot.

| Credit Cards | Our Ratings | Deposit required | Rewards Rate | Late Fee | |

|---|---|---|---|---|---|

Discover it® Secured Credit Card

on Discover's secure site Rates & Fees |

(Winner) Best credit card for bad credit

|

$200 to $2,500 | 1% - 2% cash back

| None the first time you pay late. After that, up to $41. |

on Discover's secure site Rates & Fees |

Tilt Motion Card

on Tilt's secure site |

Best credit card for no security deposit

|

None | 1% - 10%

1-10% cash back at select national merchants

| Up to $40 |

on Tilt's secure site |

Amazon Secured Card*

|

Best store credit card for bad credit

|

$100 to $1,000 | 2% cash back

2% back at Amazon.com and Whole Foods Market with an eligible Prime membership

| Up to $5 | |

Capital One Quicksilver Secured Cash Rewards Credit Card

|

Best travel credit card for bad credit

|

Put down a refundable $200 security deposit to get at least a $200 initial credit line | 1.5% - 5% Cash Back

| Up to $40 | |

Capital One Platinum Secured Credit Card

|

Best for a potentially low security deposit

|

Put down a refundable security deposit starting at $49 to get at least a $200 initial credit line | N/A | Up to $40 | |

Business Advantage Unlimited Cash Rewards Secured credit card*

|

Best business credit card for bad credit

|

$1,000 to $10,000 | 1.5% cash back

Unlimited 1.5% cash back on all purchases

| Up to $49 | |

U.S. Bank Altitude Go Visa Secured Card*

|

4.2

Best gas card for bad credit

|

$300 to $5,000 | 1X - 4X points

| Up to $41 | |

opensky® Plus Secured Visa® Credit Card

on Capital Bank, N.A.'s secure site |

Best credit card for bad credit with no credit check

|

$200 to $3,000 | 10% cash back

Up to 10% cash back rewards

| Up to $41 |

on Capital Bank, N.A.'s secure site |

Find the best card for you

| Scenario | LendingTree's recommendation |

|---|---|

| I need the best overall secured card | Discover it® Secured Credit Card |

| I want to build credit with no deposit | Tilt Motion Card |

I’m focused on store rewards| Amazon Secured Card |

|

| I want to save on travel | Capital One Quicksilver Secured Cash Rewards Credit Card |

| I want a secured card with a potentially low security deposit | Capital One Platinum Secured Credit Card |

| I need a business credit card for bad credit | Business Advantage Unlimited Cash Rewards Secured credit card |

| I want a card to use for gas rewards | U.S. Bank Altitude Go Visa Secured Card |

| I want a card with no credit check | opensky® Plus Secured Visa® Credit Card |

How we chose the best credit cards for bad credit

We take a comprehensive, data-driven approach to identify the best credit cards for individuals with bad credit. We use an objective rating and ranking system that evaluates over 200 credit cards from more than 50 issuers. All recommendations are made by LendingTree’s editorial team, completely independent of affiliate partnerships or compensation. Every card is selected based on its merit and ability to help people with bad credit achieve their financial goals. Our goal is to recommend cards that provide value, support credit-building efforts and help cardholders graduate to better financial products over time. To make our picks, we:

- Assess credit cards based on criteria that matter most to people with bad credit, including affordability, ability to upgrade to an unsecured card, fair APRs and credit bureau reporting.

- Calculate how much the average cardholder can save annually, factoring in rewards earned, fees (including annual and maintenance fees) and typical spending patterns. We use U.S. Bureau of Labor Statistics data and $300 in monthly spending (the typical starting limit for introductory cards) to simulate real-world usage.

- Rank cards with credit-building features higher. We focus on features like reporting to major credit bureaus, upgrade potential and educational tools. We take away points for features that can be costly to cardholders trying to build credit, such as security deposits, penalty APRs and late payment fees.

Top credit cards for bad credit

(Winner) Best credit card for bad credit

Discover it® Secured Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Earn rewards while rebuilding your credit. Plus, get reviewed for an upgrade to an unsecured card starting at seven months.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter.

- Earn unlimited 1% cash back on all other purchases.

- Easy path to graduate to an unsecured card

- Cash back on every purchase

- $0 annual fee

- High 26.49% Variable APR

- Relatively low maximum credit limit

- Requires initial security deposit

The Discover it® Secured Credit Card is one of the top picks for people rebuilding their credit, thanks to its rare combination of rewards, upgrade potential and $0 annual fee. Discover automatically reviews accounts for opportunities to graduate to an unsecured version starting at just seven months, so it’s a strong fit for people who want to build credit and earn rewards without paying an annual fee.

Editor’s take

“We picked this card as our top secured credit card because it does more than just help you build credit — it rewards you for everyday spending and gives you a clear path to upgrade.”

– Tracy Brackman, senior credit cards editor at LendingTree

Additional card details

- Minimum deposit: $200

- Credit limit: $200 up to $2,500 (equal to your deposit)

- Regular APR: 26.49% Variable APR

- Reports to: All three major credit bureaus (Equifax, Experian and TransUnion)

- Upgrade path: Yes, starting at seven months of on-time payments

→ Learn more about the Discover it® Secured Credit Card

- Click APPLY NOW to apply online.

- No credit score required to apply. No Annual Fee.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. You'll still earn unlimited 1% cash back on all other purchases.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers—only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards.

- Get an alert if we find your Social Security number on the dark web. Activate for free.

- Terms and conditions apply.

- Rates & Fees

Best credit card for no security deposit

Tilt Motion Card

This accessible card doesn’t require a security deposit or a credit check, which makes it easier for people with bad credit to get approved.

- No deposit required

- No credit check required

- Rewards on some purchases

- Credit-building tools

- Path to a higher credit limit

- $0 annual fee

- Limited rewards program

- High 28.24% - 33.24% Variable APR

- May need a linked bank account for approval

The Tilt Motion Card is a solid option for people with limited or less-than-perfect credit who don’t want to pay a deposit upfront. Unlike many other unsecured credit cards for bad credit, this card has a $0 annual fee and no high or hidden fees.

Editor’s take

“This card is a standout if you want access to credit without having to put down a security deposit. With a $0 annual fee and the ability to qualify based on income rather than credit history, it’s an accessible choice for credit-building.”

– Tracy Brackman, senior credit cards editor at LendingTree

Additional card details

- Minimum deposit: None

- Credit limit: See terms

- Annual fee: $0

- Regular APR: 28.24% - 33.24% Variable APR

- Reports to: All three major credit bureaus (Equifax, Experian and TransUnion)

- Upgrade path: Already unsecured

- Click APPLY NOW to apply online.

- No annual fee and no security deposit required

- 1-10% cash back at select national merchants

- See if you’re pre-approved instantly without impacting your credit score. Be considered for all three Tilt cards to maximize chances of approval

- No Credit Score? No problem. Credit history isn’t required for approval

- Credit limit increases in as early as 4 months for qualified borrowers

- Build credit alongside hundreds of thousands of Tilt card members

- Tilt reports to all 3 major credit bureaus

- Freeze your card in the mobile app at any time for peace of mind

- Zero liability fraud coverage

- Card issued by WebBank

Best store credit card for bad credit

Amazon Secured Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Build your credit while earning cash back on Amazon and Whole Foods purchases with an eligible Prime membership.

- Cash back on Amazon purchases

- Security deposit as low as $100

- Extremely low 10.00% non-variable APR

- $0 annual fee

- Reports to the three major credit bureaus

- Requires a Prime membership to earn rewards

- Can only be used to make Amazon purchases

- Low maximum credit line

The Amazon Secured Card is a practical $0-annual-fee option for people with limited / poor credit who frequently shop on Amazon. It gives cardholders the opportunity to earn rewards which can be easily redeemed on Amazon with a Prime membership — which is rare for secured cards.

Editor’s take

“This is a great pick, since its focus on Amazon purchases helps make it simple to manage while building credit. By focusing on one retailer, it’s easier to track spending and stay on top of payments.”

– Tracy Brackman, senior credit cards editor at LendingTree

Additional card details

- Minimum deposit: $100

- Credit limit: $100 to $1,000 (equal to your deposit)

- Annual fee: $0

- Regular APR: 10.00% non-variable APR

- Reports to: All three major credit bureaus (Equifax, Experian and TransUnion)

- Upgrade path: Yes, after 12 months to the Amazon Store Card

→ Learn more about the Amazon Secured Card

- No annual fee

- Minimum $100 security deposit up to $1,000

- Join Prime to get 2% back on Amazon.com

Best travel credit card for bad credit

Capital One Quicksilver Secured Cash Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Automatic account reviews in as little as six months to see if you qualify for a higher credit line with no additional deposit.

- Earn 1.5% Cash Back on every purchase, every day

- Earn 5% Cash Back on hotels, vacation rentals and rental cars booked through Capital One Travel

- Chance to graduate to an unsecured card

- $0 annual fee

- Elevated cash back on every purchase

- High earning rate on hotels and rental cars booked through Capital One’s travel portal

- Foreign transaction fee: None

- High 28.99% (Variable) APR

- No sign-up bonus

The Capital One Quicksilver Secured Cash Rewards Credit Card is one of the most rewarding secured cards available, offering an elevated flat rewards rate on general purchases and an even higher cash back rate on hotels, vacation rentals and rental cars booked through Capital One’s travel portal. It also doesn’t charge foreign transaction fees — making it an ideal choice for teens traveling outside of the U.S.

Editor’s take

“With helpful features, like automatic credit line reviews and a clear path to upgrade to an unsecured card, this card provides a simple, yet rewarding way to build credit while saving on international trips and everyday travel spending.”

– Tracy Brackman, senior credit cards editor at LendingTree

Additional card details

- Minimum deposit: $200

- Credit limit: $200 to $3,000 (equal to your deposit and based on your credit worthiness)

- Regular APR: 28.99% (Variable) APR

- Annual fee: $0

- Reports to: All three major credit bureaus (Equifax, Experian and TransUnion)

- Upgrade path: Yes, after six months of on-time payments

→ Learn more about the Capital One Quicksilver Secured Cash Rewards Credit Card

- No annual or hidden fees, and you can earn unlimited 1.5% cash back on every purchase, every day. See if you're approved in seconds

- Put down a refundable $200 security deposit to get at least a $200 initial credit line

- Building your credit? Using a card like this responsibly could help

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Earn unlimited 5% cash back on hotels, vacation rentals and rental cars booked through Capital One Travel

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Best for bad credit with a potentially low deposit

Capital One Platinum Secured Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.This card is worth looking into if you want the chance to pay less than the standard $200 security deposit — though it’s not guaranteed.

- Chance to graduate to an unsecured card

- Minimum deposit starting at $49 to get at least a $200 initial credit line

- $0 annual fee

- High 28.99% (Variable) APR

- Doesn’t earn rewards

- Relatively low maximum credit limit

The Capital One Platinum Secured Credit Card is a straightforward, no-frills secured card designed for people who want a simple path to building or rebuilding credit. And unlike most secured cards that require a minimum security deposit of $200 to secure an initial credit line of $200, this card offers the rare opportunity to qualify for an initial $200 line of credit for just a $49, $99 or $200 deposit.

Editor’s take

“We like this card because it offers the opportunity to qualify for a lower deposit amount than most secured cards — making it a more accessible option for those looking to rebuild credit without the upfront financial strain.”

– Tracy Brackman, senior credit cards editor at LendingTree

Additional card details

- Minimum deposit: $49, $99 or $200 (based on creditworthiness)

- Credit limit: $200 to $1,000 (equal to or greater than your deposit and based on credit worthiness)

- Regular APR: 28.99% (Variable) APR

- Annual fee: $0

- Reports to: All three major credit bureaus (Equifax, Experian and TransUnion)

- Upgrade path: Yes, after six months of on-time payments

→ Learn more about the Capital One Platinum Secured Credit Card

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get at least a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking to access your account from your desktop or smartphone, with Capital One's mobile app

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Best business credit card for bad credit

Business Advantage Unlimited Cash Rewards Secured credit card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Using a secured credit card is a smart way to start your business’s financial health on the right foot.

- $0 annual fee

- Cash back on all purchases

- Ability to transition to an unsecured card

- Complimentary access to business credit scores

- Cash flow management tools

- Minimum required security deposit may be too high for some

- No welcome offer

- No bonus earning categories for business purchases

The Business Advantage Unlimited Cash Rewards Secured credit card is an excellent option for small business owners with bad or limited credit who want to build their credit profile while earning rewards. It offers unlimited 1.5% cash back on all purchases with a $0 annual fee, making it one of the few secured business cards on the market — let alone a secured business card that combines credit-building with ongoing value. Plus, you’ll have access to cash flow management tools and free business credit score tracking.

Editor’s take

“While there aren’t many secured business card options out there, this card creates an opportunity for business owners looking to build or rebuild credit while benefiting from cash back rewards.”

– Tracy Brackman, senior credit cards editor at LendingTree

Additional card details

- Minimum deposit: $1,000

- Regular APR: 26.99% variable APR

- Annual fee: $0

- Reports to: All three major credit bureaus (Equifax, Experian and TransUnion)

- Upgrade path: Possibly, with responsible use — though not all business owners may qualify

→ Learn more about the Business Advantage Unlimited Cash Rewards Secured credit card

- Earn unlimited 1.5% cash back on all purchases, with no annual caps

- $0 annual fee

- Open an account with a $1,000 minimum deposit

- Cash flow management tools, including automatic payments, transfers and download into QuickBooks

Best gas card for bad credit

U.S. Bank Altitude Go Visa Secured Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.This gas card will help you build credit while earning rewards at the pump, restaurants, grocery stores and more.

- Earn 4X points on dining, takeout and restaurant delivery (on your first $2,000 each quarter)

- Earn 2X at grocery stores, grocery delivery, streaming services, gas stations and EV charging stations

- Earn 1X on all other purchases

- Elevated rewards in popular spending categories

- Streaming credit

- $0 annual fee

- Potentially high line of credit

- High 28.49% variable variable APR

- Requires a credit check and hard inquiry

If you spend a considerable amount on gas purchases, the U.S. Bank Altitude Go Visa Secured Card is one of the most rewarding secured cards available. For a $0 annual fee, you’ll earn elevated rewards on dining (up to the quarterly maximum), groceries, streaming services and gas. Cardholders also get a $15 streaming service credit after 11 months of eligible streaming purchases.

Editor’s take

“We like this card because it can help you build credit with responsible usage — all while earning elevated rewards on everyday purchases — like gas, groceries, dining and streaming services.”

– Tracy Brackman, senior credit cards editor at LendingTree

Additional card details

- Minimum deposit: $300

- Credit limit: $300 to $5,000 (equal to your deposit)

- Regular APR: 28.49% variable variable APR

- Annual fee: $0 annual fee

- Reports to: All three major credit bureaus (Equifax, Experian and TransUnion)

- Upgrade path: Yes, with responsible use

- 4X points on dining, takeout and restaurant delivery (on your first $2,000 each quarter).

- 2X points at grocery stores and gas stations/EV charging stations.

- 1 point per $1 spent on all other eligible purchases.

- No annual fee.

Best credit card for bad credit with no credit check

opensky® Plus Secured Visa® Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.You don’t have to worry about your credit history standing in the way of better credit health by applying for a card with no credit check.

- No credit check required

- Possibility of a credit limit increase or upgrade to an unsecured card

- Up to 10% cash back rewards

- $0 annual fee

- Foreign transaction fee

- High initial minimum security deposit

The opensky® Plus Secured Visa® Credit Card is a strong option for people with bad credit who want a simple way to build their credit. Unlike many secured cards, it doesn’t require a credit check to apply, making it more accessible for those with rocky credit histories. Plus, it comes with a $0 annual fee and offers credit limit reviews and a graduation path to an unsecured card in as little as six months.

Editor’s take

“This card is a great pick for those with bad credit, since it removes barriers for approval by not requiring a credit check while offering the opportunity to upgrade to an unsecured option.”

– Tracy Brackman, senior credit cards editor at LendingTree

Additional card details

- Minimum deposit: $300

- Credit limit: $300 to $3,000 (equal to your deposit)

- Regular APR: 28.24% (variable) APR

- Annual fee: $0

- Reports to: All three major credit bureaus (Equifax, Experian and TransUnion)

- Upgrade path: Yes, after six months of on-time payments

→ Learn more about the opensky® Plus Secured Visa® Credit Card

- Click APPLY NOW to apply online.

- No annual fee – keep more money in your pocket!

- No credit check required – 89% approval rate with zero credit risk to apply!

- Earn up to 10% cash back on everyday purchases

- Boost your credit score fast—2 out of 3 opensky® cardholders see an average increase of 47 points after 6 months

- Track your progress with free access to your FICO® score in our mobile app

- Build your credit history with reporting to all three major credit bureaus: Experian, Equifax, and TransUnion

- Seamless payments—add your card to Apple Pay, Google Pay, and Samsung Pay

- Start with as little as $300 – Secure your line with a refundable security deposit

- Fast and easy application—apply in minutes with our mobile-first experience

- Flexible payment options—pick a due date that works for you

- More time to fund—spread your security deposit over 60 days with layaway

- Join 1.6 million+ cardholders who have used opensky® to build better credit!

Build your credit with confidence: Common questions about bad credit answered

Secured vs. unsecured credit cards: What's right for me?

Choosing between a secured and unsecured credit card depends on your credit history, financial goals and available funds.

A secured credit card requires a refundable security deposit, which acts as your credit limit. These cards are easier to qualify for and are ideal for people with poor or no credit history. Many issuers of secured cards report to all three credit bureaus and can help you build or rebuild credit over time.

An unsecured credit card, or traditional credit card doesn’t require a deposit, but approval usually depends on your credit score and financial profile.

| Feature | Secured card | Unsecured card |

|---|---|---|

Requires deposit| Yes | No |

|

| Approval odds* | Higher for bad credit | Lower for bad credit |

| Credit reporting | Usually all three bureaus | Usually all three bureaus |

| Upgrade potential | Often, with on-time payments | Already unsecured |

If you’re just starting or rebuilding your credit, a secured card may be the safer and more accessible option. If you have fair credit or a limited history of responsible borrowing, you may qualify for a basic unsecured card designed for credit building — though a secured card may be a better option since it’s likely to have lower fees and offer a graduation path to a better card.

→ Learn more about secured vs. unsecured credit cards

How much should I put down for a secured card deposit?

The amount you choose to deposit on a secured credit card determines your credit limit and can impact how helpful the card is for building your credit. Most secured cards require a minimum deposit of $200, but some allow you to contribute up to $5,000 or more.

Ideally, you should choose a deposit amount that allows you to keep your credit utilization ratio below 30%. However, you shouldn’t strain your budget to increase your limit. It’s more important to make in-full, on-time payments than to submit a high deposit. Choose an amount you can comfortably afford without jeopardizing your emergency savings or ability to pay off your balance each month.

Some cards, like the Capital One Platinum Secured Credit Card, may offer an initial limit higher than your deposit, depending on your credit profile. Others let you increase your deposit over time.

How long does it take to graduate to an unsecured card?

Depending on the issuer, you may be able to graduate from a secured to an unsecured credit card in as little as six to 12 months — but this is determined heavily by your payment history and overall credit behavior.

Some secured card issuers, like Discover, begin automatic reviews for graduation eligibility after seven months of opening your account. These reviews typically assess whether you’ve made on-time payments, kept your balances low and avoided other negative impacts on your credit.

To improve your odds of graduating faster, you should:

- Always pay your bill on time by setting up automatic payments

- Keep your credit utilization low (ideally under 30% of your limit)

- Don’t apply for too many new credit accounts while building credit

Graduation to an unsecured card isn’t guaranteed, and not all secured cards offer automatic reviews. If upgrading is important to you, choose a card like the Discover it® Secured Credit Card or Capital One Platinum Secured Credit Card, both of which offer a path to unsecured status.

Once you graduate, you’ll typically get your deposit refunded and may gain access to better credit terms, including higher limits and lower APRs.

Will applying for a credit card hurt my score even more?

Applying for a credit card can temporarily impact your credit score, but the effect is usually minor and short-lived. These are the factors that can help you decide whether the ding on your credit score is worth it:

Hard vs. soft inquiries

When you apply for a credit card, most issuers will perform a hard inquiry, which lowers your score by a few points each time it occurs and remains on your credit for two years (although the negative impact lessens over time). Prequalification, on the other hand, typically uses a soft inquiry — another type of credit check which does not affect your credit score.

Why it matters

One hard inquiry isn’t a big deal, but multiple inquiries in a short period of time can add up, especially if you’re applying for several lines of credit at once.

Why it can be worth it long term

If you’re approved and use the card responsibly, the positive activity can outweigh the initial dip from the inquiry and actually help improve your score over time.

Can I get a credit card after I've filed for bankruptcy?

You can get a credit card even if you’ve filed for bankruptcy — but your options are likely limited. Before you apply for a credit card, your bankruptcy must have been discharged already. The time it takes for your debt to be discharged depends on whether you filed for Chapter 7 or Chapter 13 bankruptcy.

Some Reddit users report getting qualified for credit cards after bankruptcy from just a day or week after their discharge to a few years after:

- “I got approved for a [Capital One credit] card a week after I filed.”

- “I couldn’t get a credit card until like two years post-[bankruptcy]. I got six [credit cards] now….”

- “I finished my [bankruptcy] 15 years ago and the day after it all closed out, I applied for a secured card. Got the secured card and got a second.”

Timelines for getting credit card approval after bankruptcy vary — but you may be ready to apply for a new card sooner than you think.

Regardless of the type of bankruptcy you’ve gone through, you can follow these tips to look for the right credit card for you and start rebuilding your credit:

Getting credit card prequalification can give you insight into your chances of getting approved for free and without a ding to your credit score. Getting preapproval does not guarantee you’ll be approved, but it can be a good indicator of the types of cards you can be approved for.

Some credit cards, like the opensky® Plus Secured Visa® Credit Card, don’t run a hard credit check and instead look at other financial factors like your income and bills paid. This can help increase your chances of getting approved compared to a regular secured credit card that does check your credit.

Banks that market toward people with bad credit specifically can often come with unsavory terms — like hidden and/or high fees. This can include banks like Credit One and First Progress. If you apply for one of their cards, make sure you look into the card’s terms and conditions.

Capital One and Discover are two reputable banks that offer several options for people with bad credit. These banks have excellent customer service and transparent terms, so your money is likely to be safer. Keep in mind that both these banks run credit checks for your cards — and not every lender outside of mainstream institutions is predatory.

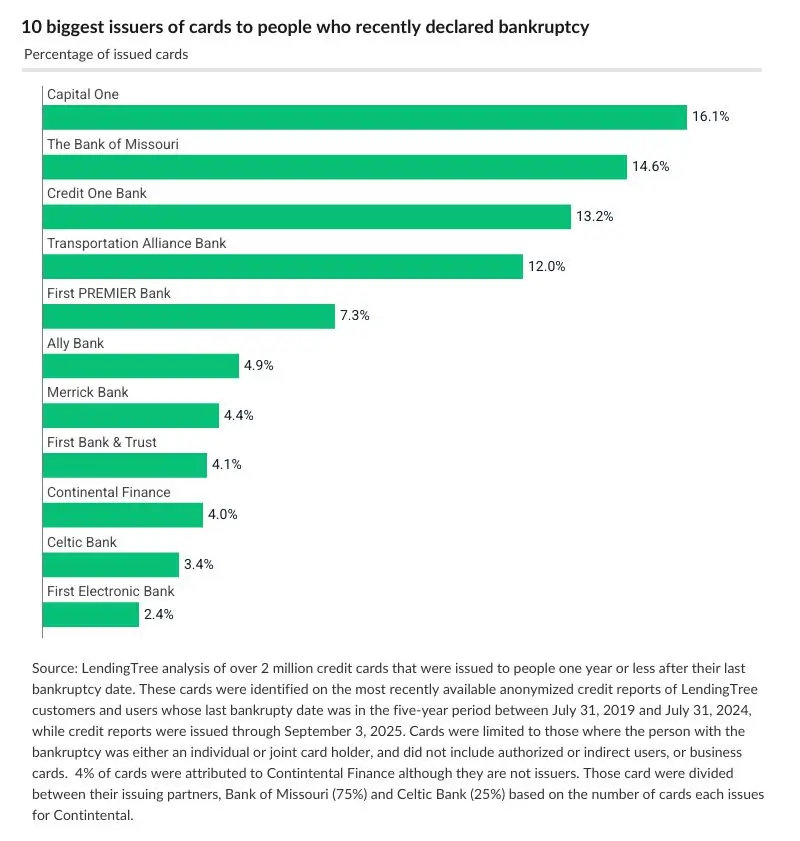

A recent LendingTree analysis of over 2 million post-bankruptcy credit card acceptances showed that Capital One had the highest percentage (16.1%) of cards issued. Behind Capital One is The Bank of Missouri with 14.6% and Credit One with 13.2%.

Capital One could be a good option for your first credit card application post-bankruptcy — but if you opt for a different or smaller issuer, be sure to look out for hidden or high fees.

It’s not uncommon for people who have gone through bankruptcy to struggle with qualifying for secured credit cards. If that’s the case for you, some ways you can build credit without a credit card include becoming an authorized user, getting a credit-builder loan or getting a personal loan with a cosigner.

What's the fastest way to improve my credit score with a new card?

If you’re starting fresh with a new credit card, you can potentially improve your score in as little as three to six months with these good habits:

- Always pay on time.

Payment history is the most important factor in your credit score. Even one late payment can set you back significantly. - Keep your credit utilization ratio low.

Aim to use less than 30% of your available credit. For example, if your credit limit is $300, try to keep your balance below $90. - Pay your balance in full each month.

This avoids interest charges and also shows lenders you’re responsible with credit. - Avoid unnecessary credit applications.

Each hard credit inquiry can slightly lower your score. Only apply for cards or loans when needed. - Set up autopay or reminders.

Making consistent on-time payments builds trust with lenders and improves your score over time.

While credit repair won’t happen overnight, these simple practices can lead to noticeable improvements within just a few months.

Quick FAQs about building credit

A credit score below 580 is generally considered bad by most lenders. FICO® Scores range from 300 to 850, and a low score typically indicates a history of missed payments, high credit utilization or limited credit history. While a bad score can make it harder to qualify for unsecured traditional credit cards, there are still good options available to help rebuild.

Yes, many secured credit cards and some unsecured starter cards are designed for people with little or no credit history. These cards often use your income or security deposit as a substitute for credit experience. Be sure to choose one that reports to all three major credit bureaus to help you establish a positive credit history over time.

Missing a credit card payment can hurt your credit score and may trigger late fees or a penalty APR. If your payment is more than 30 days late, it could be reported to the credit bureaus and remain on your credit report for up to seven years. Set up autopay or reminders to avoid missing due dates.

Some secured cards offer automatic reviews for upgrade eligibility after several months of on-time payments. Cards like the Discover it® Secured Credit Card and Capital One Platinum Secured Credit Card may graduate you to an unsecured version and return your deposit.

If you use your card responsibly—paying on time and keeping your balance low—you may start to see improvements in as little as three to six months. Larger gains may take longer depending on your credit history and other financial behaviors.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the U.S. Bank Altitude® Go Visa Signature® Card, Amazon Secured Card, Business Advantage Unlimited Cash Rewards Secured credit card, U.S. Bank Altitude Go Visa Secured Card and Amazon Store Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.