Home Equity Loan Rates and Lenders in March 2026

Current $50k home equity loan rates are as low as 6.49%.

Current home equity loan rates offered by LendingTree partners

| LOAN AMOUNT | APR AS LOW AS

Rates are calculated based on conditional offers for both home equity loans and home equity lines of credit with 30-year repayment periods presented to consumers nationwide by LendingTree’s network partners in the past 30 days for each loan amount. Rates and other loan terms are subject to lender approval and not guaranteed. Not all consumers may qualify. See LendingTree’s Terms of Use for more details.

| MONTHLY PAYMENT |

|---|---|---|

| $25,000 | 6.49% | $157.85 |

| $50,000 | 6.49% | $315.71 |

| $100,000 | 6.49% | $631.41 |

| $150,000 | 6.13% | $911.42 |

-

Home equity loan rates currently average 6.34%, down from 7.22% compared to this time last year.

Rates are calculated based on conditional offers for home equity loans with a 15-year repayment period presented to consumers nationwide by LendingTree’s network partners in February of the given year for all loan amounts. Rates and other loan terms are subject to lender approval and not guaranteed. Not all consumers may qualify. See LendingTree’s Terms of Use for more details.

- Most lenders allow you to borrow up to 85% of your home’s value.

-

Home equity loan offers on LendingTree averaged $144,330 in early 2025.

Based on home equity loan offers on the LendingTree platform from Jan. 1 to May 31, 2025.

- If you don’t want the risk of losing your home if you default on payments, a cash-out refinance or personal loan may be a good alternative.

Use our home equity calculator to find out how much your loan could be

How much does a $50,000 vs. $100,000 home equity loan cost each month?

If you borrow a 20-year $50,000 home equity loan at today’s rates, you’d pay about $395 per month, whereas a $100,000 home equity loan with a 20-year term would cost $755 — a little less than twice as much.

| $50,000 home equity loan | $100,000 home equity loan | |

|---|---|---|

| Interest rate | 7.31% | 7.10% |

| Monthly payment | $397 | $781 |

| Total interest | $45,282 | $87,515 |

| Total loan cost | $95,282 | $187,515 |

Disclaimer

Monthly payment comparison for a $50k vs $100k home equity loan

Frequently asked questions

- Higher second mortgage rates: You’ll pay a higher rate than you would with a HELOC or cash-out refinance.

- Tougher guidelines: You may need higher scores and lower debt to qualify than you would with a cash-out refinance.

- Reduced equity: You’ll lower your available home equity.

- Another monthly payment: You’ll have two house payments to manage each month.

- Foreclosure risk: You could lose your home if you default on your payments.

It may take two to four weeks to close on a home equity loan. You’ll usually receive your funds following a three-business-day waiting period after your closing.

Home equity loan rates are often higher than interest rates on traditional mortgages. Usually, the more you borrow, the higher your rate will be. Your credit score and loan term will also have an impact on the rate you’re offered.

Yes, it’s possible to get a home equity loan with bad credit, but you may not qualify for as much equity as you need or want. Lenders may reduce your maximum LTV ratio and charge you a significantly higher interest rate. If your scores are below 620, consider a government-backed program like an FHA cash-out refinance or VA cash-out refinance.

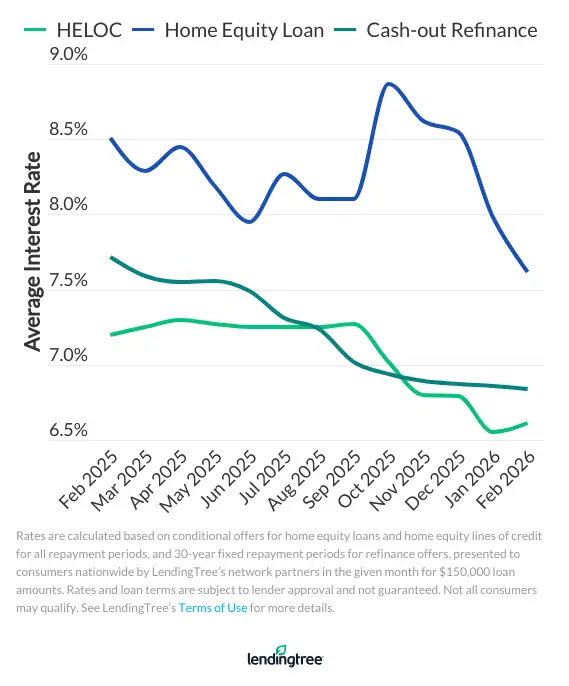

How home equity loan rates are trending on LendingTree and what this means for you

Interest rate vs. APR

The current average annual percentage rate (APR) for a 30-year, $100,000 home equity loan is 6.49%.

Home equity loan rates are relatively high right now, especially compared to the low rates we saw before the pandemic. Interest rates tend to fall when the Federal Reserve cuts the federal funds rate, which it did most recently on Dec. 10, 2025. Home equity loan rates have been trending downward since August. That said, we shouldn’t expect any dramatic decreases since the Fed projects only one rate cut in 2026.

“There’s reason to hope that home equity loan rates may continue to fall in the next few months,” according to Matt Schulz

Even if rates don’t go down much, a home equity loan may still be a good idea if it can help you consolidate debt, cover an emergency expense or tackle a project that provides long-term value (like home improvements).

How is my home equity loan rate determined?

Credit score

The higher your credit score, the better your rate will be. Most lenders require a 620 minimum, but some require 660 or 680 for the best rates.

DTI ratio

Debt-to-income (DTI) ratio shows how much monthly income goes to debt payments. Lenders typically allow a 43% maximum, but lower ratios earn better rates.

LTV ratio

Loan-to-value (LTV) ratio compares your loan amount to your home’s value. A lower LTV gives you a lower rate. Most lenders cap this at 85%, but some offer high-LTV loans.

Get your free credit score on LendingTree Spring today.

Our LendingTree expert picks for the best home equity loan lenders

| Lender | User ratings | Best for | |

|---|---|---|---|

|

(2621)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| Low credit scores | |

| User reviews coming soon | High LTV ratios | |

| User reviews coming soon | Online experience | |

| User reviews coming soon | Rate and closing cost discounts | |

|

(729)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| Fast closings |

Best for Low credit scores: Rocket Mortgage

- Updates rates on its website daily

- Provides an easy online application

- Serves all 50 states and the District of Columbia

- Doesn’t offer home equity lines of credit (HELOCs)

- Doesn’t operate brick-and-mortar locations

Rocket Mortgage offers a home equity loan for borrowers with credit scores as low as 680, though you’ll need at least a 760 score to borrow up to a 90% LTV. Rocket also offers the option to combine your first and second mortgage with a cash-out refinance.

You’ll have the best chance of qualifying for a mortgage with Rocket Mortgage if you have a 73% loan-to-value (LTV) ratio or better, according to nationwide data from 2023. That year, about 49% of approved borrowers had a debt-to-income (DTI) ratio under 40%.

“The service was prompt and extremely pleasurable. Who works on the weekend or after hours? Our representative. So glad we chose Rocket Mortgage.”

— Barbara from Elmont, NY (June 2023)

“I did not expect this process to happen so fast, it only took three and a half weeks to close. My Loan officer Kevin was great and walked us through every step.”

— Aundreas from Auburn, GA (March 2023)

“We had a quick close and Steve’s involvement was critical in hitting the timelines that were necessary, including a last minute issue that he quickly resolved to get us to closing.”

— Matt from Alpharetta, GA (May 2023)

Read more reviews.

Best for High LTV ratios: Navy Federal Credit Union

- Allows qualified homeowners to borrow up to 100% of their home’s value

- More likely to approve borrowers with a DTI over 40% than other top lenders

- Serves all 50 states

- Only serves military borrowers and their families

- Doesn’t publish rates on its website

You’ll have the best chance of qualifying for a mortgage with Navy Federal if you have a 77% loan-to-value (LTV) ratio or better, according to nationwide data from 2023. That year, about 42% of approved borrowers had a debt-to-income (DTI) ratio below 40%.

Best for Online experience: TD Bank

- Offers an online rate quote before submitting an application

- Lower average loan cost for home improvement loans than other top lenders

- Allows homeowners to borrow against investment properties

- Doesn’t serve most states

- Doesn’t disclose fees it charges

TD bank’s website is streamlined and easy to use, with a rate tool that customizes options based on your location. Terms range from five to 30 years and rate information is simple to find. TD Bank offers borrowers a 0.25% interest rate discount for its home equity loan products if you open a TD bank checking or savings account with automatic payment deductions. An added bonus: A TD Bank home equity loan can be secured by an investment property — most home equity lenders only allow you to borrow against your primary residence.

You’ll have the best chance of qualifying for a mortgage with TD Bank if you have a 62% loan-to-value (LTV) ratio or better, according to nationwide data from 2023. That year, about 50% of approved borrowers had a debt-to-income (DTI) ratio under 40%.

Best for Rates and closing cost discounts: BMO

- Origination fees are competitively low

- Operates over 1,000 branches

- Provides an online application

- Higher interest rates

- Doesn’t publish rates on its website

BMO offers the highest discounts on home equity loan rates of any lender we reviewed. They offer loans with terms that range from five to 20 years. You can check rates online, browse detailed information about loan programs and even watch mortgage-related videos on their website. There’s also an online application and a guide to help you through the process.

You’ll have the best chance of qualifying for a mortgage with BMO if you have a 63% loan-to-value (LTV) ratio or better, according to nationwide data from 2023. That year, about 48% of approved borrowers had a debt-to-income (DTI) ratio below 40%.

Best for Fast closings: Spring EQ

- Offers fast funding (21 days on average)

- Allows you to tap up to $500,000 of your home equity

- Allows a higher LTV ratio maximum than most other top lenders

- Doesn’t disclose fees on its website

- Doesn’t offer rate quotes unless you share personal information

Spring EQ is the only lender we reviewed that specializes exclusively in home equity loan products. You can also borrow up to 95% of your home’s value — much more than the max 85% LTV most lenders allow. Homeowners can convert equity to cash in as little as 14 days, although 21 days is the average, according to Spring EQ’s website.

You’ll have the best chance of qualifying for a mortgage with Spring EQ if you have a 70% loan-to-value (LTV) ratio or better, according to nationwide data from 2023. That year, about 45% of approved borrowers had a debt-to-income (DTI) ratio below 40%.

“From the moment I reached out for assistance with my loan application, they exhibited professionalism, expertise and a genuine commitment to helping me achieve my financial goals.”

— Kelly from Cleveland, OH (April 2024)

“Their higher LTV made my equity amount so much more accessible. I highly recommend them.”

— Maria from Miami, FL (October 2022)

“The process was very easy. Every person I dealt with made me feel as if I was their number one customer. They were all extremely courteous, respectful and professional. When I’m ready to refinance Spring EQ will be my first choice for that process.”

— Gisela from Bushkill, PA (September 2022)

“It was important we receive the funds quickly. We actually applied to three places and decided to use the company that would fund us first! Drew and David recognized our concerns and definitely helped us speed up the process. Everything worked out just perfectly!”

— Michael from Kingsburg, CA (September 2022)

Read more reviews.

Read more about how we chose our best home equity lenders.

How to get banks to compete for your business with LendingTree

Shopping for a home equity loan shouldn’t mean filling out tons of applications. With one form, compare rates from our network of vetted home equity lenders — when banks compete, you win.

1. Tell us what you need

Take two minutes to tell us about yourself, your home and when you need the money.

2. Shop your offers

If you qualify, we’ll send you offers from up to five lenders from the nation’s largest lender network.

3. Access your home equity

You’ll choose the lender that fits your budget and needs and send in a formal application. They’ll send you the money for your home equity loan if you’re approved.

How are home equity loan rates different from HELOC rates?

Although HELOC rates are usually lower than home equity loan rates, home equity lines of credit often have variable interest rates. This means that, while home equity loans have stable monthly payments, HELOC payments are likely to change over time.

Consumers sometimes confuse home equity loans with home equity lines of credit (HELOCs), but they work very differently: A HELOC is a line of credit that can be used like a credit card. Like a cash-out refinance, both are loan options for pulling from home equity. You can read our comparison if you’re unsure whether to choose a home equity loan or HELOC. Home equity loans and HELOCs usually come with the same eligibility requirements.

Considering all three? Check out our article Cash-Out Refinance vs. Home Equity Loan or HELOC: Which Is Better for You?

While rising home values have helped many homeowners build equity, the amount available to tap through a home equity loan depends heavily on where you live. The average price per square foot for new homes has surged 74% over the past decade, from $97 in 2014 to $169 in 2024 — but this growth hasn’t been uniform across the country.

Geographic disparities are striking: in the West, prices per square foot more than doubled, growing 105% to reach $224 in 2024, compared to 63% growth in the Midwest, where prices reached $165. These regional differences mean homeowners in high-cost areas have accumulated far more equity to potentially borrow against.

For homeowners considering a home equity loan, this geographic lottery can mean the difference between accessing substantial funds for renovations or debt consolidation versus having limited borrowing power, even after years of homeownership.

Learn more about how a home equity loan works.

Best uses for a home equity loan

Home improvements

Use your home equity to make upgrades or renovations that could increase your home’s value.

Debt consolidation

If you have high-interest credit cards or personal loans, you can use a HELOC to consolidate that debt and save on monthly interest charges.

Home repairs

Home equity can help you fund home repairs after a natural disaster, or simply prep for a rough winter.

No matter what you plan to use your home equity loan for, LendingTree can help you find the best lender for your situation. Follow these three simple steps to start comparing rates from our network of vetted lenders — when banks compete, you win.

-

Provide your details

Share a little bit about yourself so we can match you with offers. It’s simple, free and secure. -

Compare offers

Review your quotes and compare your available home equity loan options. -

Get your cash

Choose your best offer and finalize your home equity loan application.

Why you can trust LendingTree with your home equity loan

25+ years in business. 110+ million Americans served. $260+ billion in funded loans.

Security

Instead of sharing information with multiple lenders, fill out one simple, secure form in five minutes or less.

Savings

We’ll match you with up to five lenders from our network of 300+ lenders who will call to compete for your business.

Support

We provide ongoing support with free credit monitoring, budgeting insights and personalized recommendations to help you save.

How our home loan experts chose our best home equity loan lenders

To determine the best home equity loan lenders, we reviewed data collected from 35 lender reviews completed by the LendingTree editorial staff for 2025.

Each lender review gives a rating between zero and five stars, based on several factors including loan features and loan variety, digital application processes and the availability of product and lending information online. To be eligible for the “best of” home equity loan title, lenders must have a lender review rating of at least four stars. To be considered for our “best overall” pick, lenders must issue mortgages in at least 35 states.

We awarded extra points to lenders that:

- Publish home equity loan rates online

- Provide detailed information about one or several different home equity loan options

- Offer a loan-to-value (LTV) ratio above the 85% industry standard

- Offer fast closing options

- Offer products with rate discounts or no closing costs

Our editorial team brought together the data from our lender reviews, as well as the scores awarded for home equity-specific characteristics, to find the lenders with a product mix, information base and guidelines that best serve the needs of home equity loan borrowers.