On this page

- What is a foreign transaction fee?

- Which credit cards have no foreign transaction fees?

- Top credit cards with no foreign transaction fee

- How to spot credit card foreign transaction fees

- When are foreign transaction fees charged?

- How to avoid foreign transaction fees

- Do FX fees count when earning credit card rewards?

- Conversion charges

- FAQs

What is a Foreign Transaction Fee and How does it work?

Key takeaways

- Foreign transaction fees (also known as FX fees) are added to purchases made in a foreign currency or processed by a foreign bank.

- These fees (typically ranging from 1% to 3%) can also apply when traveling abroad or shopping online from international retailers.

- Many credit cards have no foreign transaction fees, making them a smarter option for international purchases.

Planning an international getaway or shopping from an overseas retailer? Watch out — foreign transaction fees can sneak up on you, adding extra costs to every swipe. These pesky little charges are often buried deep in the terms and conditions of your credit card agreement and can add 1% to 3% onto your purchases. To avoid getting nickel-and-dimed abroad, try to use a credit card that doesn’t charge foreign transaction fees.

What is a foreign transaction fee?

A foreign transaction (FX) fee is a type of surcharge on your credit card bill. It appears when you make a purchase that either passes through a foreign bank or is in a currency other than the U.S. dollar (USD). This fee is charged by many credit card issuers, typically ranging from 1% to 3% of the transaction.

The foreign transaction fee consists of two parts:

- Network fee (or currency conversion fee):

This part of the FX fee is charged by the credit card network (Visa or Mastercard, for example). Visa and Mastercard both charge a fee of 1%. Regardless of the type of credit card, this fee is applied to all transactions. - Issuing bank fee:

Depending on the credit card you use, some issuers add a charge on top of the network fee, usually around 2%. Other issuers don’t add their own and even go as far as absorbing the network fee, so you won’t have to pay anything.

Even though there are two parts to the fee, foreign transaction fees are typically assessed as a single charge to your credit card statement per purchase. Card issuers decide whether and how these fees are assessed.

How are foreign transaction fees calculated?

Imagine you pay €93 while on vacation in Spain, using a card on the Mastercard network that has a 2% issuing bank fee. With the currency conversion, this works out to around $100 in USD.

Based on that converted amount, Mastercard will charge 1% on top of the cost of your room. Then, your card issuer will charge another 2% on top of that.

Therefore, the actual cost of your hotel comes out to be ($100 * (1% + 2%)) + $100 = $103. This might not seem like much, but an extra 3% on top of all your vacation expenses can quickly add up.

Remember that exchange rates factor in when dealing with most foreign transactions. Being charged €20 for lunch doesn’t mean your credit card will be charged $20. The charge will be converted to dollars using the current exchange rate. Both Mastercard and Visa calculate exchange rates to convert all foreign-denominated transactions to USD. Foreign transaction fees are charged based on the USD transaction after currency conversion has taken place.

Which credit cards have no foreign transaction fees?

There are many credit cards that waive foreign transaction fees as a benefit, and most of these are travel credit cards. Many co-branded hotel and airline cards carry no foreign transaction fees, while premium travel rewards cards (i.e., travel rewards cards with high annual fees) also typically won’t charge foreign transaction fees.

Cards with no annual fees or foreign transaction fees are rarer — however, there are at least a handful on the market, including the Capital One VentureOne Rewards Credit Card.

Top credit cards with no foreign transaction fee

| Credit Cards | Our Ratings | Annual Fee | Welcome Offer | Rewards Rate | |

|---|---|---|---|---|---|

Capital One Venture X Rewards Credit Card

|

$395 | 75,000 miles

Earn 75,000 Miles when you spend $4,000 on purchases in the first 3 months from account opening

| 2X - 10X miles

| ||

Chase Sapphire Preferred® Card

|

$95 | 75,000 points

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

| 1X - 5X points

| ||

Chase Sapphire Reserve®*

|

$795 | 125,000 points

Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

| 1X - 8X points

| ||

Capital One Venture Rewards Credit Card

|

$95 | 1,000 dollars

Earn up to $1,000 towards travel once you spend $4,000 on purchases within the first 3 months of account opening

| 2X - 5X Miles

| ||

Capital One Savor Cash Rewards Credit Card

|

$0 | $200 Cash Back

Earn $200 Cash Back after you spend $500 on purchases within 3 months from account opening

| 1% - 8% cash back

| ||

Capital One Venture X Business

|

$395 | 150,000 miles

Earn 150,000 Miles once you spend $30,000 in the first 3 months from account opening

| 2X - 10X Miles

|

Foreign transaction fees by credit card issuer

Foreign transaction fees vary by card issuer, and can even vary between different card products from the same issuer. While every major bank offers at least one card with no foreign transaction fees, Capital One and Discover are unique in that they don’t charge foreign transaction fees on any of their card products. For other issuers, the typical foreign transaction fee is around 3%.

| Issuer | Typical Foreign Transaction Fee | No-Foreign-Transaction-Fee Credit Cards examples |

|---|---|---|

| 2.70% |

|

| 3% | |

| 3% |

|

| 0% | All Cards |

| 3% | |

| 3% |

|

| 0% | All cards |

| 3% |

|

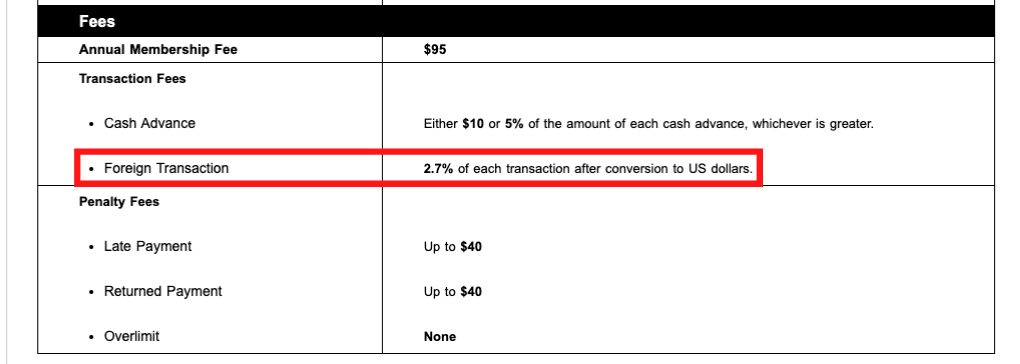

How to spot a credit card foreign transaction fee

Issuers typically don’t advertise the fact that their cards charge foreign transaction fees, unless a product explicitly lacks these fees. If you don’t see “no foreign transaction fees” advertised as a benefit for a card product, it’s likely the card will charge an FX fee. To be certain, check the terms and conditions (sometimes called “Pricing and Terms” or “Rates and Fees”) for your particular card. The foreign transaction fee will be listed under the “Fees” section, alongside the card’s annual fee and other fees, such as cash advance and penalty fees.

When are foreign transaction fees charged?

Credit card networks flag transactions as “foreign” if, at any point, the transactions pass through a foreign bank. You don’t necessarily have to be located outside the U.S. at the time of purchase. Some purchases, such as online purchases from foreign merchants in foreign currency, will incur foreign transaction fees. Even if your transaction is executed in USD, it may include an FX fee if it’s routed through a foreign bank.

You could be charged a foreign transaction fee if:

- A purchase occurs from a merchant located outside the U.S.

- A purchase is in a foreign currency

- A purchase is routed through a foreign bank (sometimes even when it’s charged in U.S. dollars)

How to avoid foreign transaction fees

- Get a credit card that doesn’t have a foreign transaction fee.

If you’re a frequent traveler, this is a savvy investment. If you invest in a travel card with an annual fee, then you likely won’t have to deal with foreign transaction fees. But there are some no-annual-fee cards with no FX fees, too, like the Bank of America® Travel Rewards credit card and Wells Fargo Autograph® Card. - Get a debit card that doesn’t charge foreign transaction fees, either.

You can use your debit card for getting money in a different currency at an ATM. However, like credit cards, they too can come with extra foreign fees. If you use a bank that doesn’t have foreign transaction fees, you’ll only have to pay the required exchange rate. - Use an ATM card that reimburses ATM fees.

It’s usually wise to have local cash on hand when traveling in a foreign country. However, you can incur both an international transaction fee and out-of-network ATM fee when withdrawing cash outside the U.S. Make sure that you use an ATM card that reimburses ATM fees. Some ATMs also try to hit you with DCC (dynamic currency conversion), so avoid that as well. This ensures you’ll receive the wholesale currency exchange rate that day. Tip: You can also exchange cash before leaving the U.S. to avoid foreign transaction fees. Banks and currency exchange stores will exchange cash for most major currencies. For example, Chase offers foreign currency exchange services. - Shop online with international merchants that accept U.S. currency.

You may also incur a foreign transaction fee when shopping online with an international retailer, even if you’re in the U.S. To avoid this, make sure that the merchant accepts U.S. dollars as a payment option.

Do FX fees count when earning credit card rewards?

Sadly, foreign transaction fees usually don’t earn rewards. In the previous example, cash back would only be earned on the $100, not on the $3 foreign transaction fee. Furthermore, rewards for general-purpose credit cards tend to hover around the 1.5% to 2% level, so the 3% FX fee would likely erase any rewards earned with the card.

Conversion charges: Charges in USD vs. local currency

Sometimes when you’re traveling abroad, a merchant may give you the option to convert your charges to USD instead of the local currency, in a process called dynamic currency conversion (DCC). We advise against choosing DCC, as you’ll almost always end up paying more. The merchant sets the rate, which can be as high as 12% — or possibly even higher. Moreover, picking an unfavorable rate pads the merchant’s profits, as well as those of the third-party DCC service provider.

To avoid being overcharged, choose to pay in the local currency instead. The currency conversion will be handled automatically by your credit card network using their exchange rate. Make sure the total on your receipt shows the charge in local currency.

You could still face a foreign exchange fee even if the transaction is in USD through dynamic currency conversion, as long as it passes through a foreign bank. Card issuers often outline this in their terms, specifying whether fees apply to transactions in U.S. dollars or local currency.

If your card issuer only specifies local currency fees, this means they don’t charge for transactions in USD. Due to the Truth in Lending Act, credit issuers in the U.S. are required to disclose all fees in the terms and conditions.

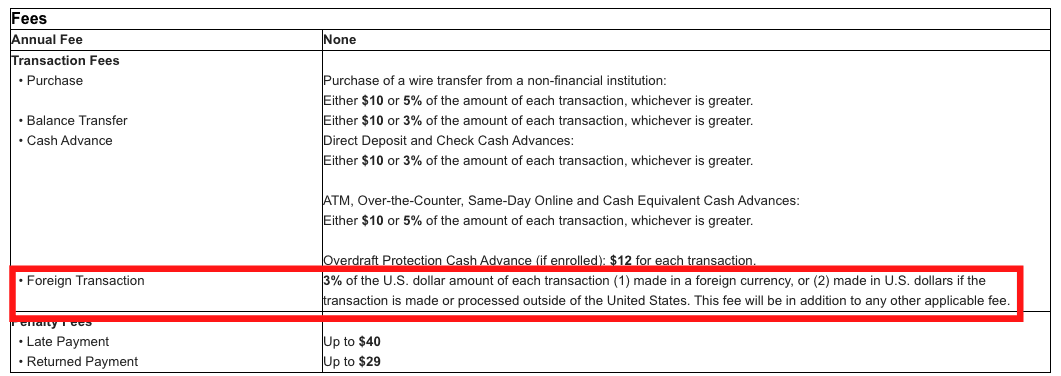

Some cardholders are getting foreign transaction fees waived

While travel cards are often free of foreign transaction fees, other cards, like cash back cards, may still charge these fees. However, some cardholders are asking if they can have the fee waived. In fact, a LendingTree survey found that nearly two-thirds (64%) of those who’ve requested to have an FX fee waived or reduced have been successful.

Frequently asked questions

Foreign transaction fees vary by credit card issuer, but they’re typically around 3%.

Like any other fee, banks charge foreign transaction fees to make money off of credit card usage by consumers.

Foreign transaction fees are issued by the lender and can be deducted like any other credit card fee as a business expense, as long as the purchase itself was made for business purposes.

Yes, foreign transaction fees can apply to online purchases in a foreign currency or where a transaction is routed through a foreign bank.

You’ll need to check your card agreement to determine whether your card charges a foreign transaction fee. Find the agreement provided with your card, if you have it filed somewhere. Alternatively, you can find your card online and check the fees section under “Pricing and Terms” or “Rates and Fees”.

The best credit card for foreign transactions is the Capital One Venture X Rewards Credit Card — it has no foreign transaction fees, offers the chance to earn a large sign-up bonus and comes with an excellent rewards rate on travel purchases. Plus, you’ll get extra travel benefits, including up to $120 Global Entry/TSA PreCheck® credit, a $300 annual travel credit through Capital One’s travel portal and airport lounge access.

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

- American Express Platinum Card®

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Platinum American Express Card

- Hilton Honors American Express Surpass® Card

- Marriott Bonvoy Brilliant® American Express® Card

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Chase Sapphire Reserve®, Hilton Honors Aspire Card from American Express, AtmosTM Rewards Ascent Visa Signature® credit card, Hawaiian Airlines® Business MasterCard®, AAdvantage® Aviator® Red World Elite Mastercard®, JetBlue Business Card, The New United℠ Explorer Card, The New United Club℠ Card, British Airways Visa Signature® Card, Southwest Rapid Rewards® Premier Credit Card, IHG One Rewards Premier Credit Card, World of Hyatt Credit Card, Marriott Bonvoy Boundless® Credit Card, Citi® / AAdvantage® Executive World Elite Mastercard®, Costco Anywhere Visa® Card by Citi, U.S. Bank Altitude® Connect Visa Signature® Card and Wells Fargo Autograph® Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.