How To Read a Mortgage Loan Estimate: Where To Find 11 Essential Items

A loan estimate is a standardized, three-page form that contains all of the important information about any mortgage loan you apply for. These are the same details you’ll need to compare offers from different lenders. Shopping around with multiple lenders can save you thousands of dollars over the life of your loan because interest rates, fees and other terms can vary significantly between offers. However, if you’re not sure how to read a loan estimate, you could end up overpaying for your mortgage.

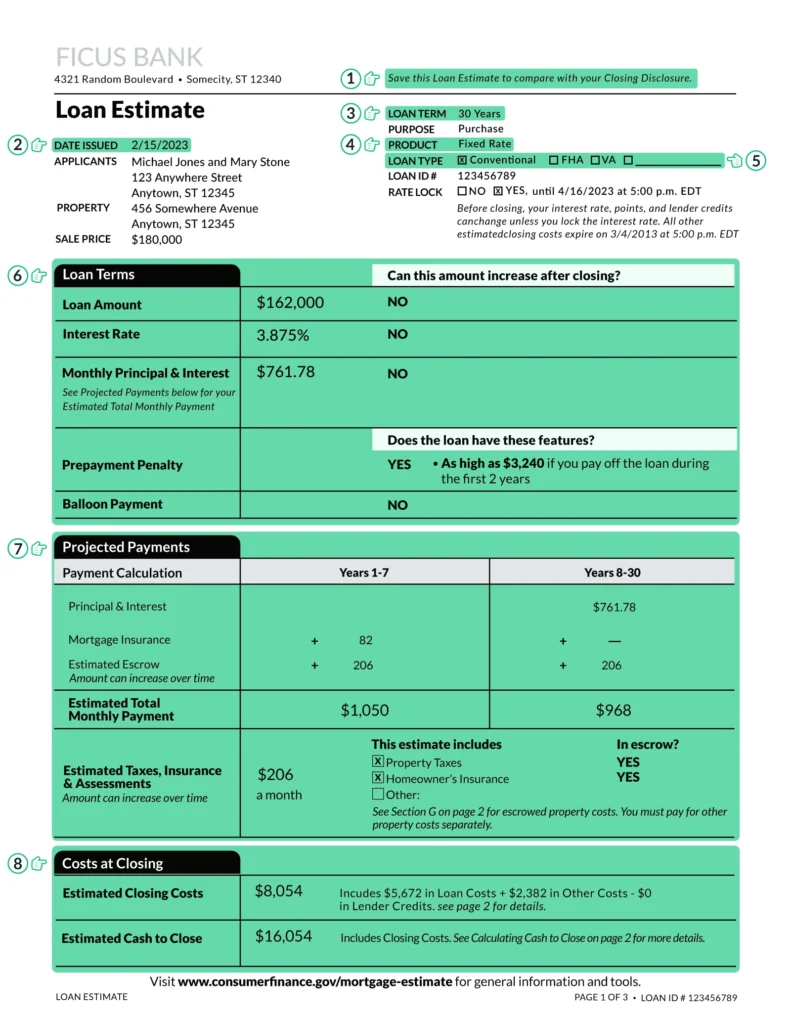

Below, we’ll walk through a loan estimate example, showing you page-by-page where to find the essential information.

- A loan estimate lists important features of a mortgage you’ve applied for, like your interest rate and estimated closing costs.

- Lenders must provide this standardized three-page form to you within three business days of receiving your mortgage application.

- A loan estimate is only binding on the date it’s issued, so you must lock in your mortgage rate on the day you receive your loan estimate to guarantee those exact terms.

What is a loan estimate?

A loan estimate form lists the important features of a mortgage you’ve applied for, like your interest rate and estimated closing costs. The Consumer Financial Protection Bureau (CFPB) requires all lenders to use a standardized form to present this information, making it easier for consumers to compare the details of each loan offer they’re received.

To view a sample loan estimate, keep reading. We’ll map out the anatomy of this important document and make it easy to find what you need.

Already have a loan estimate? Get a walkthrough of your offer and see if LendingTree can get you a better mortgage rate. If not, we’ll give you $250.

Loan estimate example: What items appear on a loan estimate?

The loan estimate contains three pages of information about your loan. Below is a loan estimate example highlighting the 11 most important details to review.

Page 1 of the loan estimate

1. “Save this loan estimate to compare to your closing disclosure.”

This is an important reminder that lenders are legally required to honor the interest rate offer that’s quoted in a binding loan estimate (more on that below).

Make sure the fees cited in your loan estimate match the final fees listed on the closing disclosure you receive right before finalizing your loan.

2. Date issued

Your lender must send you a loan estimate within three business days of receiving your loan application.

Because mortgage rates change daily, you should apply for loan estimates from each lender on the same day to make the best comparison among several loan options.

3. Loan term

If you see a loan offer with a very low rate, make sure to check the loan term. Mortgages with shorter terms generally come with lower rates, but their payments are likely higher because there’s a shorter repayment period. On the flip side, you can get more affordable payments with a longer loan term, but expect to see a higher interest rate.

If you’re considering a refinance to change your loan term, use a mortgage refinance calculator to determine whether a 15- or 30-year loan is right for you.

4. Product

The two most common loan products are fixed-rate and adjustable-rate mortgages (ARMs). Some lenders like to highlight ARMs because they offer lower rates than fixed-rate loans. However, that rate is only for a temporary period — typically three, five or seven years. After that, an ARM’s rate will fluctuate based on broader economic factors.

Be sure you’re not comparing rate quotes for loans that have different terms and repayment structures.

5. Loan type

Lenders should discuss which loan types you can qualify for before issuing a loan estimate. Conventional loans are popular if you have good credit and stable income, while loans backed by government agencies like the Federal Housing Administration (FHA) allow for lower credit scores and can be easier to qualify for.

Stuck choosing between loan types? Read our full comparison of conventional versus FHA loans.

6. Loan terms

Your loan amount and interest rate, two of the most important components of your mortgage loan, can be found here. The principal and interest payment is also listed here, but you’ll have to consult an amortization schedule for a breakdown of exactly how your payments will apply to your principal balance over time.

Use LendingTree’s mortgage payment calculator to generate an amortization schedule tailored to you.

7. Projected payments

This section adds property taxes and insurance to your principal and interest payment amount, giving you a more realistic idea of what your total PITI payment could look like.

8. Costs at closing

This section gives you an initial look at the total closing costs you’ll need to pay, which usually range from 2% to 6% of your loan amount.

Before deciding which lender is giving you the best deal, review the more detailed breakdown of closing costs on Page 2. If your lender is giving you a “lender credit,” it will appear here. A lender credit is when a lender opts to cover your closing costs in exchange for a higher interest rate.

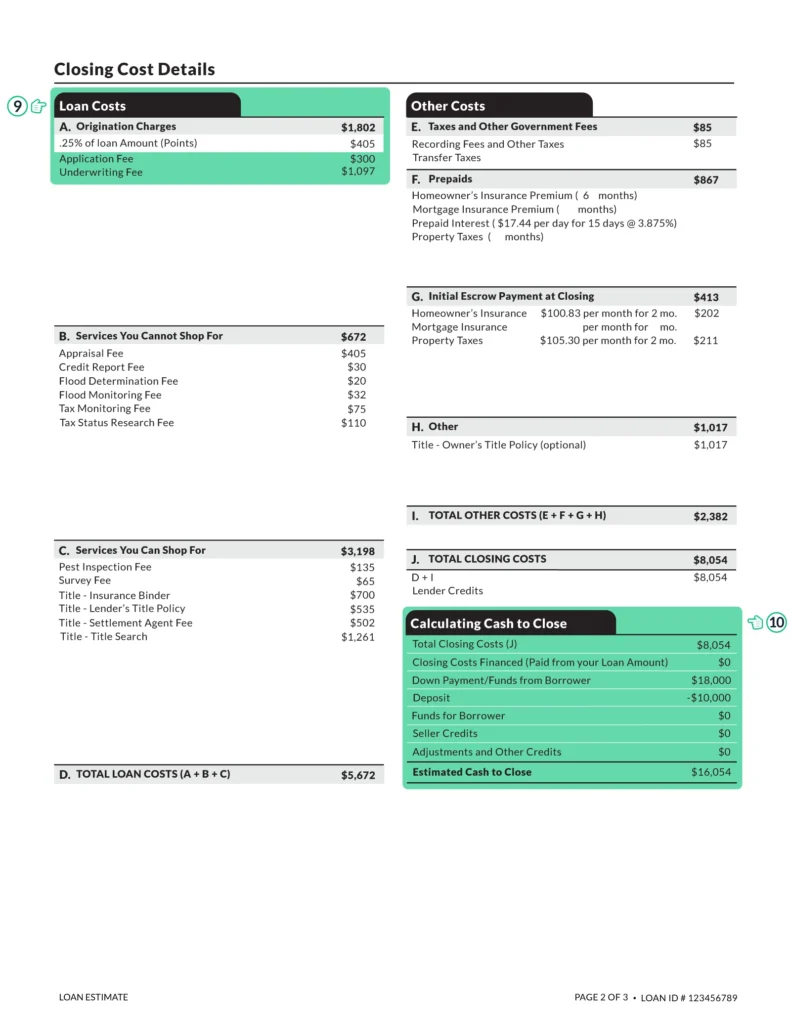

Page 2 of the loan estimate

9. Loan costs

The loan costs you see here are some of the most important to consider when comparison shopping for mortgages. Lenders must disclose how much they plan to charge you in origination fees and “services you cannot shop for” (Section B). If they don’t honor this quote, they’ll have to pay the difference between the quoted cost and the updated cost. You may also see mortgage points in this section if you’re paying extra for a lower rate.

10. Calculating cash to close

This is where all of the money you need to close your loan is itemized and mapped out for you. As you comparison shop, you only need to focus on the lender fees (Section A). The “other costs” (listed in Sections E through H) are the same regardless of the lender you choose. These include:

- Taxes and government fees

- Prepaid expenses

- Your initial escrow payment

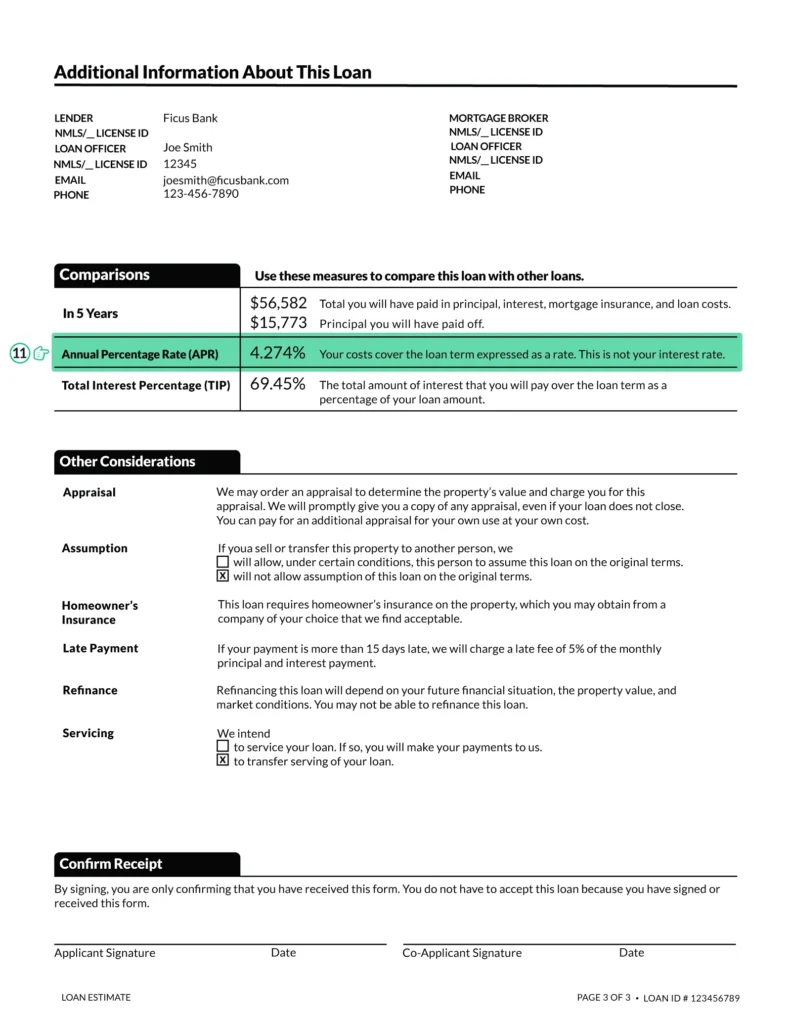

Page 3 of the loan estimate

11. Comparisons: Annual Percentage Rate (APR)

Your mortgage APR is a measure of the total costs of taking out a mortgage, including your interest rate and all associated fees. Typically, you’ll want to focus on the items in Section A and the mortgage insurance cost listed in Section F. These fees may not be the same from lender to lender, so you’ll want to review the itemized list on Page 2 of your loan estimate to see how these fees are contributing to your APR. You can try negotiating some of them down to get the best deal.

You may notice a big difference in the APR and interest rate of an FHA loan or other government-backed mortgage as compared to a conventional loan. This is primarily due to the higher cost of mortgage insurance, which can push up a loan’s APR even if it has a reasonably low interest rate. FHA loans require two types of FHA mortgage insurance, while conventional loans typically require only private mortgage insurance (PMI) for low-down-payment borrowers.

How to compare loan estimates

When evaluating loan estimates to determine the best deal, you’ll want to focus on the details of the loan that can vary from one lender to another and that directly affect the loan’s cost. Place your forms alongside each other and compare the following:

- Interest rates. This is your base borrowing cost — but don’t just pick the lowest rate automatically. Compare rates for the same loan term and product type (e.g. fixed versus variable rate), and check if the lender is offering the same number of mortgage points across estimates. Ensuring that these aspects match allows you to make a meaningful comparison between the loans in front of you.

- APRs. The APR includes your interest rate plus most loan fees, giving you a more complete picture of your total borrowing costs. A loan with a slightly higher interest rate might actually cost less overall if the APR is lower, for example, due to lower lender fees.

- Origination fees and other costs you can’t shop around for. These appear in Sections A and B of Page 2 and include application fees, underwriting fees and appraisal costs. Since you can’t negotiate these with third parties, focus on lenders with lower charges in these categories.

- Mortgage points. Compare whether lenders are quoting rates with the same number of points, and calculate whether paying points makes sense based on how long you plan to stay in the home.

- Estimated monthly payments. Look at the total monthly payment including principal, interest, taxes, insurance and mortgage insurance (if applicable). Even small differences of $50 to $100 per month add up to thousands over the life of your loan.

- Estimated cash to close. This is the total amount you’ll need at closing, including your down payment and all closing costs. Some lenders may offer lower rates but require more cash upfront, so factor this into your planning.

- Third-party fees. Check Section C on Page 2 for services you can shop for, like title insurance and surveys. Also look for fees that appear on one estimate but not others — some lenders choose not to charge certain fees.

- Loan amounts. Make sure each lender is quoting the same loan amount. Some lenders might suggest a higher loan amount to cover closing costs, which affects your monthly payment and total interest paid over time.

Frequently asked questions

All lenders must provide a loan estimate within three days of receiving a completed loan application. Lenders who don’t follow this requirement can be subject to regulatory action and fines. A form submitted to a lender will qualify as a loan application, according to the CFPB, if it includes all six of the following pieces of information:

- Your name

- Your income

- Your Social Security number

- The address of the home you’re financing

- The value of the property you’re financing

- The loan amount you’re requesting

If you’re still shopping around for a house and can’t provide property-specific information, you won’t trigger the requirement to provide a loan estimate. However, you can request a nonbinding preapproval loan estimate from lenders you’re interested in working with. This may help you determine how much home you can afford and feel out your loan options. You can always comparison shop again later, once you’ve accepted a contract.

A loan estimate is only binding on the date it’s issued. The lender has to give you the loan with the exact terms listed in the loan estimate if on that day you take steps to accept the loan and lock in your mortgage rate. Like stock prices, interest rates change daily — so if you don’t lock in your rate that day, there’s no guarantee your lender will be willing to offer you that same rate in the future.

Once your loan is locked, there are still some scenarios that could result in a difference between your initial and final loan estimates. Common situations where you might be subject to a “change of circumstance” adjustment to the terms of your home loan include:

- You decide to change loan programs

- You decide to make a lower down payment

- Your home appraisal comes back with a value significantly higher or lower than you expected

- Your credit score drops when a credit report is pulled before closing

- You included income on your loan application that couldn’t be documented or that wasn’t used to qualify you for the loan

If any of these scenarios occur, your interest rate or closing costs could change. If they do, the lender will send you a revised loan estimate.

Certain fees on your loan estimate are allowed to change after they’ve been disclosed, but there are rules limiting exactly how. Here’s a breakdown:

Group 1: These fees should not change at all after they’re disclosed. If the fees do change, the lender must pay the difference.

- Origination fees

- Processing fees

- Underwriting fees

- Transfer taxes

Group 2: If the total amount of fees disclosed in this category are 10% higher than the initial quote, the lender must pay the difference. Anything less than 10% is the responsibility of the buyer.

- Settlement services (if selected by lender)

- Title services (if selected by lender)

- Title insurance (if selected by lender)

- Government recording fees

Group 3: These costs can change without any restrictions.

- Title services (if selected by buyer)

- Title insurance (if selected by buyer)

- Homeowners insurance

A closing disclosure is another key form you’ll encounter as you go through the homebuying process. It’s very similar to a loan estimate in that it breaks down your interest rate, closing costs and other loan terms. But a closing disclosure isn’t an estimate — it’s final. Specifically, it’s a legal document that spells out the terms of the mortgage you’re about to take out.

The closing disclosure also comes with its own three-day rule: You must receive a copy at least three business days before your closing date.

Don’t forget: When it comes to mortgage fees, your lender is obligated to keep its promises. Mortgage rates, however, can change if you don’t lock them in on the day you receive your loan estimate. Compare the terms listed in your closing disclosure to what you were quoted in your loan estimate.

View mortgage loan offers from up to 5 lenders in minutes