Compare Home Loan Offers and Rates From Multiple Lenders

Compare home loan rates from 500+ lenders in minutes

Looking for a home loan? LendingTree makes it easy to compare home loan offers from multiple lenders at once.

Instead of applying with just one lender, LendingTree lets you shop and compare personalized home loan offers side by side. Whether you’re a first-time homebuyer, looking to refinance or browsing different mortgage programs, you can explore your options below. View loan types, rates and terms — all without impacting your credit score.

Compare home loan types

How LT works

How to get banks to compete for your business with LendingTree

Shopping for a home equity loan shouldn’t mean filling out tons of applications. With one form, compare rates from our network of vetted home equity lenders — when banks compete, you win.

1. Tell us what you need

Take two minutes to tell us about yourself, your home and whether you want to tap your home equity.

2. Shop your offers

If you qualify, we’ll send you offers from up to five lenders from the nation’s largest lender network.

3. Finalize your application

You’ll choose the lender that fits your budget and needs and send in a formal application.

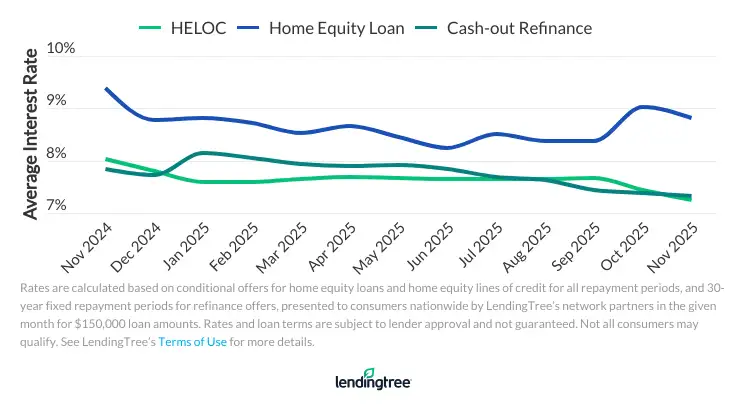

Current home loan rates

Curious where mortgage rates might be headed? Read our mortgage rates forecast.

Home loan options for tapping equity

If you’re looking for ways to access cash, the following mortgages allow you to trade some of your home equity for funds that can be spent on anything you choose. Common uses for these loans include home repairs, college tuition or even a down payment on an investment property.

Home equity loans

Home equity loans let you borrow against your home in a single lump sum. Also known as “second mortgages,” they can be taken out alongside your primary home loan, provided you have enough equity in your property.

Home equity lines of credit (HELOCs)

Similar to home equity loans, HELOCs also let you borrow against your home equity. However, instead of a lump sum, you’ll draw from and pay back the funds on a revolving basis, similar to a credit card.

Cash-out refinances

Cash-out refinances allow you to take a loan out for more than you owe on your current mortgage. You can pocket the difference in cash, and make a single payment each month that covers the full amount.

Current home equity rates

How to get the best home loan for you

1. Strengthen the factors lenders care about most

- Credit profile: Higher credit scores typically qualify you for lower mortgage rates.

- Down payment: A larger down payment can lower your monthly mortgage payments and may help you avoid mortgage insurance.

- Debt level: Applying for a home loan with less debt can help you snag a better rate, which in turn increases your borrowing power.

2. Choose a loan term that fits your budget

- Longer loan terms like the 30-year mortgage often have lower monthly payments and are popular with first-time homebuyers.

- Shorter loan terms usually come with higher payments but can help you save money on interest in the long run.

3. Compare home loan offers, not just lenders

- Home loan rates and fees can vary widely between lenders. With LendingTree, you can fill out one form and receive personalized home loan offers from multiple lenders.

- Shopping around — that is, comparing multiple offers — helps you find your best mortgage option by identifying who’s offering you the lowest rates and fees. When lenders compete for your business, you’re more likely to get a better deal.

4. Look at the full cost of the loan

The loan offer with the lowest rate isn’t always the best home loan. Understanding the total loan cost helps you choose wisely. Make sure to compare:

| Loan type | Minimum score |

|---|---|

| Conventional | Typically 620 |

| FHA | 500 (with 10% down) or 580 (with 3.5% down) |

| VA | No minimum, but lenders commonly require 620 |

| USDA | No minimum, but lenders commonly require 640 |

Don’t know your credit score? Get your free score on LendingTree Spring today.

You can improve your credit score by reducing your outstanding debts, paying off credit cards and staying up-to-date on monthly payments. It’s also helpful to avoid making any new credit applications or taking out any new debt while you give your credit score a chance to bounce back.

Credit repair is a long-term commitment and can take months (or even years), depending on your financial situation. However, the benefits of a high credit score are immense.

Compare home loan lenders

Comparison shopping with three to five lenders can save you more than $80,000, according to a LendingTree study. But if you’re unsure which lenders to start with, a great place to begin is our list of the best mortgage lenders of 2026. You can also find our mortgage lender reviews by entering a lender’s name and “LendingTree” into your favorite search engine.

LendingTree’s picks: The best home loan lenders of 2026

| Lender | Best for | User ratings | Min. credit score | Avg. total loan costs

Average total loan costs include orginiation fees and are based on 2023 data from the Federal Financial Institutions Examination Council (FFIEC).

| |

|---|---|---|---|---|---|

Best mortgage lender for FHA loans |

(625)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| 580 | $8,512 | ||

Best mortgage lender for VA loans |

(2620)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| 580 to 680 | $8,122 | ||

Best lender for online mortgage experience |

(952)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| 500 to 620 | $7,959 | ||

Best mortgage lender for refinance loans |

(1455)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| 620 | $7,794 | ||

Best mortgage lender for jumbo loans |

(428)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| 700 | $7,068 | ||

Best lender for home equity loans | User reviews coming soon | 580 to 620 | $5,092 | ||

Best lender for overall mortgage loan variety |

(55433)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| 580 to 620 | $8,170 |

Read more about how we chose these lenders.

Tools and resources for home loan shopping

Why you can trust LendingTree

25+ years in business. 110+ million Americans served. $260+ billion in funded loans.

Security

Instead of sharing information with multiple lenders, fill out one simple, secure form in five minutes or less.

Savings

We’ll match you with up to five lenders from our network of 300+ lenders who will call to compete for your business.

Support

We provide ongoing support with free credit monitoring, budgeting insights and personalized recommendations to help you save.

Frequently asked questions

When you take out a home loan, a lender provides you with a lump sum to purchase a property. You’ll repay the money — typically over 15 to 30 years — through monthly payments that include both principal (the original loan amount) and interest. Over time, as you pay down the loan, you build equity in the home. You can leverage this equity to take out future loans, even if your home isn’t fully paid off yet.

The amount you can borrow typically depends on your debt-to-income (DTI) ratio, with most lenders allowing you to spend up to 41% to 45% of your gross monthly income on housing costs.

As a general rule, financial planners recommend that your monthly mortgage payment not exceed 28% of your gross monthly income (front-end DTI ratio), and your total monthly debt payments not exceed 36% of your gross monthly income (back-end DTI ratio). These guidelines help ensure you can comfortably afford your home while managing other financial obligations.