How Does A Construction Loan Work?

A construction loan can help you design and build your dream home. However, new home construction loans function differently from traditional mortgages, and they come with some unique qualifying requirements. If you’re thinking of using this type of financing, here’s what you need to know before signing on the dotted line.

- Construction loans pay out funds in stages as your home is built, and you’re only charged interest on the money you take out until construction finishes.

- You’ll need at least a 620 credit score, 5% to 20% down payment and detailed construction plans with a licensed builder to qualify.

- Construction-to-permanent loans save you money by automatically converting to a regular mortgage, so you only pay closing costs once.

What is a construction loan?

A construction loan is a short-term mortgage that covers the cost of building a residential property from the ground up. This type of financing can cover a wide range of costs associated with the homebuilding process, including:

- Land

- Labor costs

- Material costs

- Permits

- Inspections

In cases where the construction costs go over budget, it’s typically up to the property owner to cover the difference, usually by altering the project scope, finding additional financing or paying out of pocket.

How construction loans work

Before construction begins, you or your housebuilder will need to provide the lender with documentation, like a realistic timeline, a complete construction plan and a budget for the build. You’ll also need to regularly update the lender on your progress.

The funds are disbursed in stages for a home construction loan. At each stage of construction, the lender will likely request that a licensed inspector come look at the work that’s been done. As long as everything looks good, the lender will then disburse more funds (known as a “draw”) to the builder so construction can continue.

Repayment on a construction loan generally lasts up to a year, during which time you’ll complete your construction project. You’ll typically only be responsible for making interest-only payments during the construction period. In addition, you’ll only pay interest on the amount that you’ve borrowed to date.

After the construction phase is complete, it’ll be time to convert your construction loan into a permanent mortgage. There are two types of construction loans, and they handle this differently:

- Construction-only loans must be paid off, which is typically done by refinancing the loan into a more traditional mortgage product.

- Construction-to-permanent loans will automatically convert into permanent mortgages, so you’ll only have to pay one set of closing costs. (More on each of these loan types below.)

Let’s say you’re building a $500,000 house with $100,000 down.

| Construction phase | Monthly payment amount | Percentage of loan amount drawn | Payment type |

|---|---|---|---|

| Draw #1 | $325 | 15% | Interest only on drawn amount |

| Draw #2 | $867 | 40% | Interest only on drawn amount |

| Draw #3 | $1,300 | 60% | Interest only on drawn amount |

| Draw #4 | $1,733 | 80% | Interest only on drawn amount |

| Final draw | $2,167 | 100% | Interest only on drawn amount |

| Permanent loan | $2,528 | 100% | Principal and interest on full amount |

4 types of construction loans: Which is right for you?

Construction-only loan

A construction-only loan just covers the cost of building the home. Once the home is constructed, the whole loan amount will typically become due. Borrowers usually cover the balance by paying cash or taking out a new mortgage. However, these loans may be costlier and more time-consuming, because you’ll have to go through the mortgage process twice and pay two sets of closing costs.

Construction-to-permanent loan

A construction-to-permanent loan transitions from a construction-only loan to a traditional mortgage once the home is built. The loan allows the buyer to complete one round of applications and paperwork and pay one set of closing costs.

Renovation or rehabilitation loan

A renovation loan is a type of construction loan that finances the costs of large improvements to an existing home — like adding rooms, a garage or an in-ground swimming pool. Similarly, a rehabilitation loan also finances major changes to a home, but these changes are focused on making a dilapidated home fit to live in.

Owner-builder construction loan

If you’re a general contractor or professional builder and you want to build your own home, an owner-builder construction loan could finance your project. With this loan type, the homeowner is responsible for acting as the builder and providing the lender with the necessary information to keep the project moving forward.

How to get a construction loan

Here are the basic steps to get a construction loan:

- Confirm your eligibility. If you’re interested in an FHA construction loan or a VA construction loan, check out the eligibility requirements to make sure you qualify..

- Get preapproved. Before you find a builder and design your home, get a mortgage preapproval so you know how much financing you can qualify for.

- Find your land and your builder. Make sure your builder meets any requirements set by your lender. Pay close attention to licensing and insurance.

- Complete paperwork. Finalize the plans with the builder and submit all paperwork to the lender. The lender will likely order an appraisal and inspection.

- Close on the loan. The mortgage closing process ends with your signature on the dotted line. After everything is signed and the funds are released, your builder can begin.

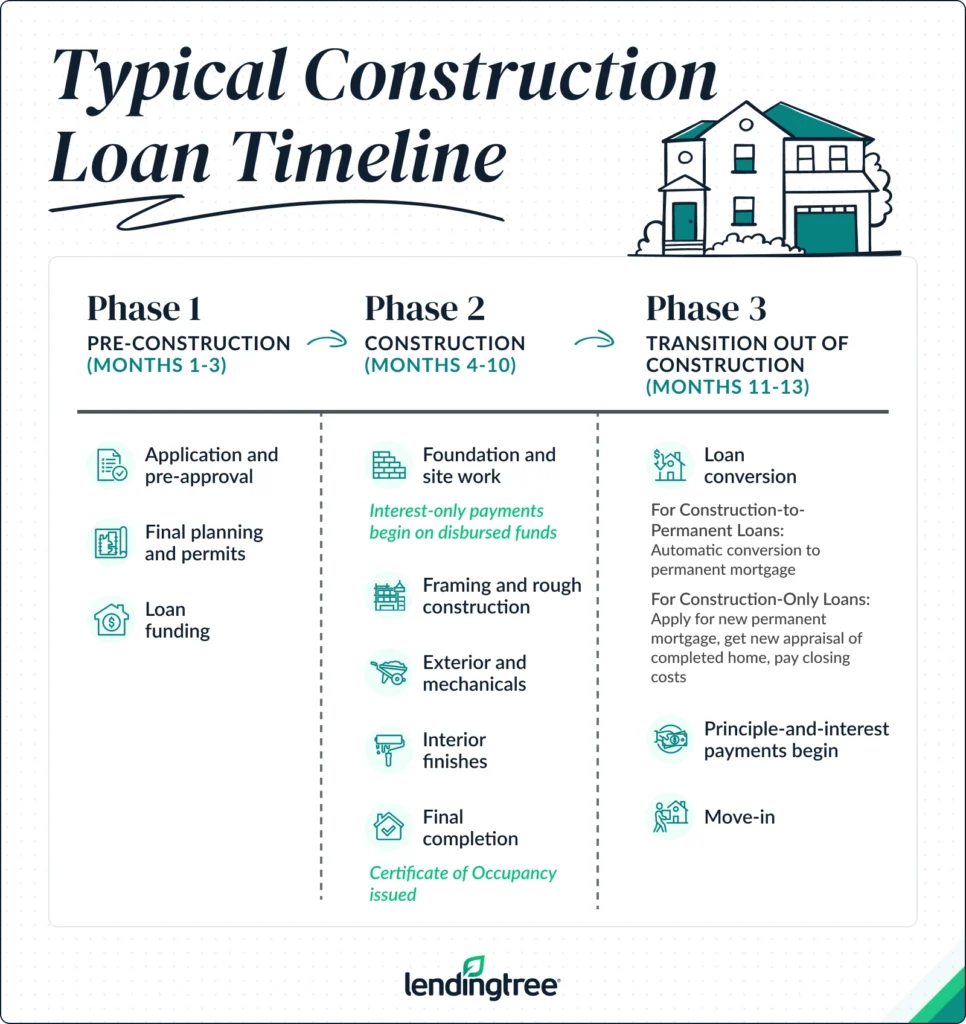

What to expect: A typical construction loan timeline

While your exact timeline will differ based on your project’s needs, a typical construction loan timeline might look like this. Click through the sections below to see more detail about each phase of construction.

Phase 1: Pre-construction (months 1-3)

Key Activities:

Submit construction loan application

Provide financial documentation (income, assets, credit)

Receive preapproval

Submit construction plans and blueprints

Provide detailed project budget

Submit builder contracts

Milestone: Loan pre-approval issued

Final planning and permits

Key Activities:

Finalize architectural plans

Apply for building permits

Obtain homeowners insurance quote

Schedule appraisal of future value

Review and sign final construction contract

Milestone: Building permits obtained

Finalizing construction loan

Key Activities:

Final underwriting review

Review and sign closing documents

Pay closing costs

Transfer down payment funds

Obtain title insurance

Milestone: Construction loan funded

Note: Interest-only payments begin on disbursed funds

Phase 2: Construction (months 4-10)

Lender schedules inspection

Inspector verifies completed work

Builder requests draw #1

Funds released to builder (usually within 7-10 days)

Milestone: Foundation complete and inspected

Duration: 30-60 days

Your payment: Interest only on disbursed amount ($325 per month in our example)

Draw #2: Framing and rough construction and roofing

Builder requests draw #2

Lender inspection of framing and mechanical, plumbing and electrical (MPE) rough-ins

Approval and fund disbursement

Municipal framing inspection may be required

Milestone: The home has been “dried-in” (made weather-tight) and MPE systems have been inspected.

Duration: 30-45 days

Your payment: Interest only on total disbursed ($867 per month in our example)

Draw #3: Exterior completion

Builder requests draw #3

Lender inspection of completed exterior

Funds released

Milestone: Exterior complete

Duration: 30-60 days

Your payment: Interest only on total disbursed ($1,300 per month in our example)

Draw #4: Interior finishes

Builder requests draw #4

Lender inspection of interior finishes

Verification of quality and completion

Fund disbursement

Milestone: Interior substantially complete

Duration: 30-60 days

Your payment: Interest only on total disbursed ($1,733 per month in our example)

Final draw: Project completion

Builder requests final draw

Comprehensive final inspection by lender

Final inspection and certificate of occupancy

All lien waivers collected from subcontractors

Final funds disbursed

Milestone: Certificate of Occupancy issued

Duration: 7-14 days

Your payment: Interest only on full loan amount ($2,167 per month in our example)

Phase 3: Transition out of construction (months 11-13)

For construction-to-permanent (single close) loans:

Automatic conversion to a permanent mortgage

Interest rate locked at initial closing

Principal and interest payments begin

No additional closing costs

No new loan application required

For construction-only (double-close) loans:

Apply for a new permanent mortgage

Submit updated financial documentation

New appraisal of completed home

New underwriting process

Second closing; which means a second round of closing costs (2% to 6% of loan amount)

Pay off construction loan with new mortgage

Milestone: Permanent financing in place

New Payment: Principal and interest ($2,528 per month in our example)

Final step: Move-in

Key activities:

Final walkthrough with builder

Receive all warranties and manuals

Receive garage door openers, keys and access codes

Schedule utility transfers

Milestone: Move-in!

Ongoing:

Make monthly mortgage payments (P&I)

Builder warranty period begins (typically 1 year)

Maintain homeowner’s insurance

Begin building equity

Construction loan rates

Construction loan rates tend to be higher than you’d pay to purchase an existing home. In the third quarter of 2025, it was 1.35 percentage points more expensive to borrow money for a construction loan than a traditional 30-year mortgage. And compared to 15-year mortgages, construction loans were 2.21 percentage points more expensive during that same period.

That said, purchasers of new construction may be able to secure more favorable interest rates via discounts and promotions, which builders have begun to offer more frequently.

In fact, it can be cheaper to build a house than to buy one in the current market. According to the National Association of Home Builders, newly constructed homes have recently become more affordable than existing homes for the first time in over three decades. Data from Realtor.com’s third quarter 2025 analysis shows that new homes carry a median price that’s $41,670 less than existing properties.

Construction loan requirements

Due to the tight timeframe, construction loans often come with more — and more strict — requirements than traditional mortgage loans. Unless you get a home construction loan through a government agency, like the Federal Housing Administration (FHA) or the U.S. Department of Veterans Affairs (VA), you’ll typically need to meet conventional mortgage requirements:

- 620 minimum credit score: You’ll generally need a 620 credit score or higher to qualify for a construction loan.

- 45% maximum debt-to-income ratio: Your debt-to-income (DTI) ratio measures the percentage of your total income that goes toward paying your existing debts. It tells the lender how easily you’ll be able to manage paying another loan. Conventional lenders typically look for a DTI ratio below 45%.

- 5%-20% down payment: Construction loans may require a bigger down payment than most traditional mortgages. In some cases, you may be required to put down up to 20%.

- Builder contract: In addition to all the requirements for a traditional mortgage loan, you’ll also need to show a contract from a licensed builder or contractor.

- Construction documents: Your lender will need to approve your construction plans, schedule and project budget.

- Home appraisal: Once your home is fully built, it will serve as collateral for your mortgage loan. Lenders will generally require a home appraisal that estimates the completed home’s value so they can be sure they’re making a sensible investment.

Construction loan requirements vs traditional mortgage requirements

| Down payment | 5%-20% | 0%-3.5% |

| Credit score minimum | 620 | 580 to 620, depending on loan type |

| DTI ratio maximum | 45% | 41-45% depending on program |

| Documentation required | Plans, budget, timeline, builder contracts, extensive | Standard income and asset documentation |

| Mortgage reserves | 0-12 months worth of loan payments | Not usually required |

| Inspections | Multiple (at each draw stage and once construction is complete) | A single pre-closing inspection |

Overview: Construction loans vs. traditional mortgages

Construction loans usually have shorter terms, lower payments during construction, higher credit and documentation requirements and higher interest than traditional mortgage rates.

| Feature | Construction loan | Traditional mortgage |

|---|---|---|

| Loan duration | 12-18 months (construction phase), then converts or refinances | 15 to 30 years |

| Payout type | Staged draws (4 to 6 payouts as construction progresses) | One lump sum at closing |

| Payment type | Interest-only during construction | Typically principal and interest from day one |

| Interest rates (2025) | 7.90% (9-month) | 5.69% (15-year) 6.55% (30-year) |

| Closing costs | $12,000-$24,000 (one or two closings) | $10,000-$15,000 (single closing) |

| Property collateral | Unfinished home and the land it sits on | Completed home and the land it sits on |

| Timeline to closing | 30-60 days | 30-45 days |

| Best For | Building custom homes from scratch | Purchasing existing or completed homes |

Pros and cons of construction loans

Pros

- Customization. You’ll have a lot of flexibility to design your dream home.

- Structured process. The construction loan process comes with staged draws and inspections. This can help keep things on track in a way that might not happen with a home equity line of credit (HELOC) or other loan product.

- Low payments. During construction, you’ll usually make interest-only payments. These are typically lower than the monthly payment on a traditional mortgage.

- Potential for single closing. If you choose a single-close construction loan, you can fund the purchase of land, build a home and live in the home all with a single loan.

Cons

- Higher risk. Construction delays and the possibility of going over budget mean that it can be hard to know exactly how much you’ll end up spending.

- Less predictable monthly payments. During construction you’ll only pay interest on the money you’ve drawn, but that amount is likely to change each month as your project progresses.

- Additional costs. Some construction loans require you to go through a second closing, which means you’ll pay closing costs twice.

- Higher cost. Building a new home is more expensive on average (37.5% more) than buying an existing home, though this can vary by state

Alternatives to a construction loan

| Loan type | Description | Best if… |

|---|---|---|

| HELOC | A revolving credit line secured by the equity in your existing home. You can draw funds as needed during construction and only pay interest on what you borrow. | You already own property with substantial equity and your renovation or construction project is on the smaller side. |

| Home equity loan | A lump-sum loan secured by your home’s equity with a fixed interest rate. | You know exactly how much your construction project will cost and prefer predictable monthly payments. |

| Cash-out refinance | Refinance your existing mortgage for more than you owe and receive the difference in cash. | You have significant equity and want to consolidate your construction financing and current home loan into one loan. |

| Renovation (fixer-upper) loan | A single mortgage that combines the home purchase price and renovation costs into one loan. The funds will be released as work is completed. | You want to buy a fixer-upper but avoid managing multiple loans. |

| Land loan | A loan specifically for purchasing raw land or a lot where you plan to build. Usually requires a larger down payment (15-35%) and has higher interest rates than home mortgages. | You want to secure and pay for the lot first, then arrange construction financing separately later. Good if you found the perfect location but aren’t ready to build immediately. |

| Home improvement (personal) loan | An unsecured loan based on your creditworthiness with no collateral required. Fixed monthly payments over a set term (typically 2-5 years). | You want to complete a small project (under around $50,000) and don’t want to use your home as collateral. |

| Buy an existing home instead | Purchase a move-in-ready home rather than building from scratch. Uses a standard mortgage with established processes and timelines. | You want to avoid construction risks, delays and cost overruns. Ideal if you need to move in relatively quickly. |

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles