Do You Need a Good Credit Score to Buy a House?

You’ll generally need a 620 credit score to buy a house. Some loan programs allow you to qualify for a mortgage with a credit score as low as 500, but you’ll need to pay a higher interest rate and make a larger down payment. Knowing what credit score is needed to buy a house — as well as how your score affects your rate and payment — can help you decide whether you should buy a home or wait.

- The credit score you’ll need to qualify for a mortgage depends on the loan type and lender.

- 620 is generally the minimum credit score required by conventional loan lenders.

- You’ll need a credit score in the high 700s to qualify for the best mortgage rates.

What is a good credit score to buy a house?

Most lenders set a 620 minimum benchmark for you to buy a house, though that’s not necessarily a “good” score to get a mortgage. There are a couple of reasons the minimum score isn’t ideal for buying a house:

- Borrowers with lower credit scores receive higher rates, which means higher monthly payments.

- A higher monthly payment means a higher debt-to-income (DTI) ratio, which can reduce the mortgage amount for which you qualify.

Conventional lenders require a 780 credit score or higher to qualify for the lowest mortgage interest rates, so anything above 780 is considered an excellent score to buy a house. Armed with this score, you can secure a more affordable monthly payment and have more buying power when making purchase offers.

Just because 780 is the ideal score to get the best rates, that doesn’t mean you can’t get a mortgage with a score below 780. Most home loan programs require you to meet minimum credit score requirements, which range from 500 to 620. Explore the credit score needed for common loan types.

Don’t know your credit score? Get your free score on LendingTree Spring today.

There are several types of credit scoring formulas, but most lenders use the FICO scoring system. The FICO credit score ranges are as follows:

- 300 – 579 (Poor)

- 580 – 669 (Fair)

- 670 – 739 (Good)

- 740 – 799 (Very good)

- 800+ (Exceptional)

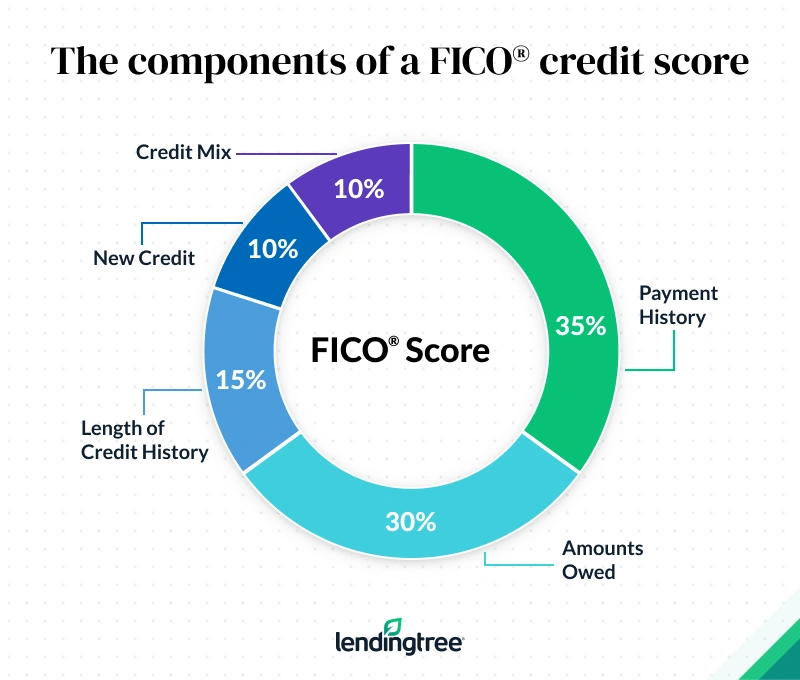

The FICO Score is calculated using an algorithm based on your payment history, how you manage credit and the mix of different accounts you have. Learn more about what affects your credit score.

How a good credit score helps you buy a house

Besides a lower interest rate and monthly payment, there are some added benefits to buying a home with a high credit score, including:

You can get approved with more total debt

- Although most lending programs cap your DTI at 45%, a high credit score may allow exceptions up to 50%. This means you could get approved for a mortgage even with a larger amount of debt.

You can reduce mortgage insurance costs

- If you can’t quite swing a 20% down payment, you can at least minimize your monthly private mortgage insurance (PMI) costs (on a conventional loan) with a high credit score. PMI is usually part of your monthly payment.

You can afford a more expensive home

- Your credit score affects both your interest rate and mortgage payment, so it has an impact on how much house you can afford. Try our home affordability calculator to see the difference a few percentage points can make on the home price you can qualify to purchase.

The example in the table below shows these numbers in action as we compare the interest rate, monthly payment and maximum home price you can afford with a higher and lower conventional credit score. The example also assumes you earn $85,000 per year and have $750 per month in non-mortgage debt.

| Credit score | Interest rate | Monthly payment | Maximum home price |

|---|---|---|---|

| 780 | 6.75% | $2,295* | $335,689 |

| 620 | 7.63% | $2,295* | $316,232 |

A low credit score reduces your homebuying power by $19,457 in this example.

Minimum credit score to buy a house by loan type

FHA loans and VA loans backed by the Federal Housing Administration (FHA) and U.S. Department of Veterans Affairs (VA), respectively, cater to borrowers with credit scores as low as 500. Still, most homebuyers choose conventional loans to purchase homes, despite the stringent qualifying rules set by Fannie Mae and Freddie Mac, which require a minimum 620 score.

The table below breaks down the minimum credit scores for each loan program.

| Loan program | Minimum FICO Score |

|---|---|

| Conventional | 620 |

| FHA | 580 with a 3.5% down payment, 500 with a 10% down payment |

| VA | No minimum requirement, though most lenders set their minimum between 580 and 620 |

| USDA | No minimum, though 640 is standard |

| Jumbo | 700 or higher |

- Conventional loan. This popular loan program is a good fit if you have a credit score of at least 620 and can make a 20% down payment. If you’re making a lower down payment, pay close attention to your PMI premium: The lower your credit score, the higher your mortgage insurance premium and monthly payment will be.

- FHA loan. A loan backed by the Federal Housing Administration (FHA) is often the only choice for borrowers with a credit score between 500 and 619. You’ll pay for FHA mortgage insurance that includes an upfront premium of 1.75% of your loan amount and annual mortgage insurance premiums ranging between 0.15% and 0.75%. However, unlike PMI, the premium percentage is the same regardless of your credit score.

- VA loan. This loan type is available only to eligible veterans, active-duty service members, reservists, and surviving spouses. Lenders don’t require mortgage insurance or a down payment. Although the VA has no minimum score requirement, most lenders set their minimum between 580 and 620.

- USDA loan. The U.S. Department of Agriculture (USDA) backs this loan type to help low- and moderate-income buyers finance rural homes. No down payment is required, but you’ll pay upfront and annual guarantee fees that work like FHA mortgage insurance. The USDA doesn’t set a minimum credit score, but most lenders require at least 640.

- Jumbo loan. This is your only choice if you’re borrowing above the conforming loan limits, and these loans are more common in expensive cities throughout the country. Most jumbo loan programs require a credit score of at least 700, although there may be programs with lower score limits if you can afford a higher interest rate and payment.

To calculate your score, mortgage lenders typically pull your credit history from all three of the main credit reporting bureaus — Equifax, Experian and TransUnion. Then, they use the middle score to quote you a rate and approve your loan. You can get a free credit report from each credit reporting agency once a year. However, a mortgage credit report, obtained when applying with a lender, will give you a better idea of where you stand as a potential homebuyer.

What affects your credit score?

The image below shows the components of your credit score. As you can see, payment history and amounts owed have the biggest impact, followed by length of credit history, new credit and the mix of credit accounts you have.

Learn more about the factors that make up your credit score.

What other factors do mortgage lenders consider?

- DTI ratio. DTI measures your monthly debt payments compared to your income. The less debt you have compared to your income, the less risky you look to lenders. DTI requirements vary by loan type and lender, but most loans require your monthly debts to be no more than 45% of your income.

- Loan-to-value (LTV) ratio. Lenders will also consider your LTV ratio, which measures the mortgage amount compared to the home’s value. High-LTV loans are considered riskier to lenders since you’re borrowing a larger amount of the home’s value. Making a larger down payment can lower your LTV ratio.

- Income. Mortgage lenders will want to see that you have sufficient income and a stable employment history. You’ll likely need to fork over pay stubs, tax returns, W-2s and any other documents the lender requests.

- Mortgage reserves. In some cases, you may need to provide proof that you have a certain number of months’ worth of mortgage payments available in a liquid account. This is more common when buying a multi-family property.

How to increase your credit score before house hunting

If your eyes are set on homebuying, here are some things you can do now to boost your credit score:

- Shrink your credit card balances. As a general rule, avoid using more than 30% of your total available credit to maximize your score. For the best credit score, limit your monthly spending to less than 10% of your total available credit.

- Pay your bills on time. Even one recent late payment on a credit card or loan can drastically drop your score.

- Avoid authorized user cards. You’re responsible for charges as a primary cardholder. If an authorized user racks up a large amount of debt on the card and can’t pay it off, your credit score will suffer.

- Don’t cosign on debt. Whether it’s a student loan or a car lease, your credit score could take a hit if a cosigned account is paid late, even if you’re not the primary borrower.

- Don’t open up new credit cards or take on new loans. Limit new credit applications within a year of applying for a mortgage to maximize your credit score and avoid extra scrutiny from your lender.

- Fix errors if you find them. Your credit report may have errors, such as incorrect late payments, that you can fix by filing a dispute with the credit bureaus.

How to buy a house with bad credit

There are some steps that may help improve your odds of buying a house with a low credit score.

Make a larger down payment

Lenders may be more willing to consider a loan application from a buyer with a poor credit score if you’re making more than the minimum down payment. Consider asking a relative for a gift, and stockpile those tax refunds and bonuses to build your down payment fund.

Pay down your debt

Another way to offset low credit scores is to get rid of as much debt as possible. Mortgage underwriters may look more favorably on an application with a very low DTI ratio, even if your credit history has some bumps in it.

Consider non-QM mortgages

Non-qualified mortgages, more commonly known as non-QM loans, don’t have to meet the stringent federal standards tied to common loan programs. Some non-QM loans even allow you to get a loan one day after completing a bankruptcy or foreclosure, as long as you have a large down payment and can afford a higher interest rate.

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles