How to Get the Cheapest Homeowners Insurance

Best cheap home insurance

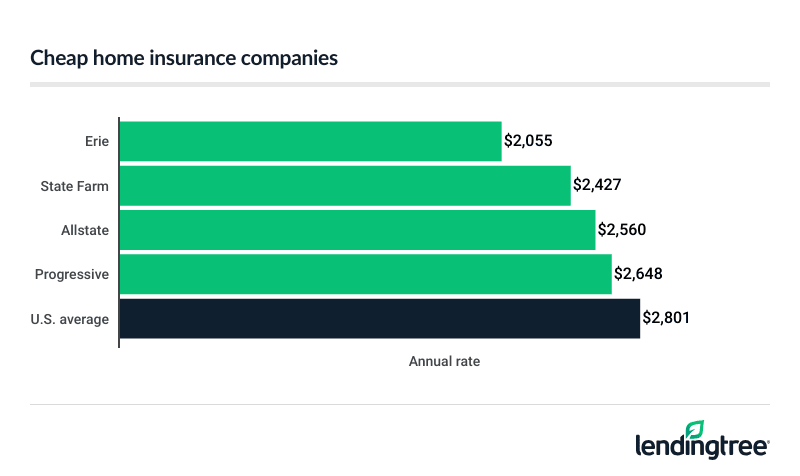

Cheapest companies for homeowners insurance

State Farm has the cheapest homeowners insurance for most customers at $2,427 a year. Erie is cheaper and has a better satisfaction rating from J.D. Power

Home insurance rates by company

| Company | Annual rate | Monthly rate | LendingTree score | |

|---|---|---|---|---|

| Erie | $2,055 | $171 | |

| State Farm | $2,427 | $202 | |

| USAA* | $2,507 | $209 | |

| Allstate | $2,560 | $213 | |

| Chubb | $2,606 | $217 | |

| Progressive | $2,648 | $221 | |

| Country Financial | $2,827 | $236 | |

| Nationwide | $3,055 | $255 | |

| American Family | $3,072 | $256 | |

| Travelers | $3,149 | $262 | |

The average cost of homeowners insurance is $2,801 a year before discounts, or $233 a month.

Your actual rate depends on factors like your location, home and, in most states, your credit. Each company treats these factors differently, and their rates vary by customer. This makes it good to compare home insurance quotes from a few different companies.

Low-cost home insurance comparison

| Company | Good for | Annual rate | Satisfaction rating

Source: J.D. Power 2024 U.S. Home Insurance Study. Higher is better; 640 is average.

|

|---|---|---|---|

| State Farm | Bundling | $2,427 | 643 |

| Erie | Regional shoppers | $2,055 | 674 |

| Allstate | Coverage options | $2,560 | 631 |

| Chubb | Luxury homes | $2,606 | 688 |

| USAA* | Military | $2,507 | 737 |

Cheap home insurance for bundlers: State Farm

Along with cheap home insurance, State Farm’s car insurance rates are 24% less than the national average. The discount State Farm gives you for bundling your home and auto insurance makes these rates even cheaper.

State Farm offers all the normal home insurance coverages

PROS

- Cheap home and auto insurance for bundlers

- Better-than-average customer satisfaction

- Personalized service from local agents

CONS

- Few optional coverages

- Customer satisfaction is only slightly better than average

Cheapest regional insurance company: Erie

Erie backs up its cheap rates with a higher customer satisfaction rating than most large companies. This means customers generally like Erie’s prices, coverage options and service.

Erie’s guaranteed replacement cost coverage takes some of the anxiety out of home insurance. This covers most rebuild costs that go over your policy’s dwelling limit. This protection often costs extra from other companies.

PROS

- Cheaper rates than most other companies

- Excellent customer satisfaction rating

- Guaranteed replacement coverage for your home

CONS

- Not available in every state

- Does not offer homeowners quotes online

Cheap for custom coverage: Allstate

Allstate offers a few more coverage options than some of its low-priced competitors. Its add-on for water backups can save you money and stress if your sewer or drainage line backs up. It also offers enhanced protections for valuables ranging from jewelry to ski gear.

You can get a lower rate from Allstate by only insuring your belongings at their actual cash value, after age and wear. Or you can pay a little more to have Allstate replace stolen or damaged items with comparable new ones.

PROS

- Home insurance rates are 9% less than the U.S. average

- Flexible coverage options

- Personalized service from agents in most communities

CONS

- Not as cheap as Erie or State Farm

- Lower than average for customer satisfaction

Cheapest for luxury homes: Chubb

Chubb specializes in high-value homes, or those with a replacement value

The white glove treatment begins when you buy your policy. Chubb offers complimentary appraisals to make sure you have accurate coverage limits. It also offers home inspections to identify and reduce your home’s potential fire and security risks.

PROS

- Coverage available for high value homes

- Standard policies include guaranteed replacement of your home

- Higher satisfaction score than most other companies

CONS

- Usually not available for homes with typical values

- Online quotes not available

Cheap for military households: USAA

USAA’s excellent rates and satisfaction rating make it a good choice. Its car insurance rates are cheaper than State Farm in many parts of the country. This often gets you a very low combined rate when you bundle your home and auto policies.

The company makes it easy to shop and manage your policy online and by phone. However, you usually get a different agent each time you call in for help. USAA’s high satisfaction rating suggests that its customers don’t mind this arrangement.

PROS

- Cheap home and auto rates for bundling

- Higher home satisfaction rating than every other company

- Easy-to-use website and smartphone app

CONS

- Only available to current and former military members and their families

- You usually get a different agent each time you call in for help

Cheapest homeowners insurance by state

The cheapest homeowners insurance company near you depends on where you live. Allstate has the cheapest home insurance rates in 10 states, including Alabama and Washington state. State Farm is the cheapest in eight states, including Arizona and North Carolina.

It’s good to compare quotes from your state’s cheapest company to other companies’ rates.

Cheapest home insurance by state

| State | State | Cheapest company | Annual rate |

|---|---|---|---|

| Alabama | Alabama | Allstate | $2,228 |

| Alaska | Alaska | Umialik | $1,235 |

| Arizona | Arizona | State Farm | $1,737 |

| Arkansas | Arkansas | Allstate | $3,473 |

| California | California | USAA* | $799 |

| Colorado | Colorado | Chubb | $2,614 |

| Connecticut | Connecticut | Allstate | $1,737 |

| Delaware | Delaware | Nationwide | $840 |

| Florida | Florida | Chubb | $2,294 |

| Georgia | Georgia | Progressive | $2,061 |

| Hawaii | Hawaii | Allstate | $514 |

| Idaho | Idaho | Nationwide | $1,325 |

| Illinois | Illinois | Nationwide | $1,545 |

| Indiana | Indiana | Erie | $1,453 |

| Iowa | Iowa | Farmers | $1,830 |

| Kansas | Kansas | Travelers | $4,416 |

| Kentucky | Kentucky | Allstate | $2,240 |

| Louisiana | Louisiana | State Farm | $1,274 |

| Maine | Maine | State Farm | $1,124 |

| Maryland | Maryland | Travelers | $1,384 |

| Massachusetts | Massachusetts | Travelers | $1,536 |

| Michigan | Michigan | USAA* | $2,156 |

| Minnesota | Minnesota | American Family | $2,774 |

| Mississippi | Mississippi | Farm Bureau | $3,249 |

| Missouri | Missouri | Allstate | $2,356 |

| Montana | Montana | Farmers | $1,660 |

| Nebraska | Nebraska | American Family | $3,834 |

| Nevada | Nevada | Nationwide | $1,065 |

| New Hampshire | New Hampshire | State Farm | $1,250 |

| New Jersey | New Jersey | Allstate | $1,028 |

| New Mexico | New Mexico | State Farm | $2,183 |

| New York | New York | Nationwide | $1,332 |

| North Carolina | North Carolina | State Farm | $1,475 |

| North Dakota | North Dakota | Country Financial | $2,617 |

| Ohio | Ohio | Erie | $1,242 |

| Oklahoma | Oklahoma | Farm Bureau | $4,994 |

| Oregon | Oregon | Nationwide | $1,156 |

| Pennsylvania | Pennsylvania | Erie | $1,311 |

| Rhode Island | Rhode Island | State Farm | $1,027 |

| South Carolina | South Carolina | Allstate | $1,274 |

| South Dakota | South Dakota | USAA* | $3,176 |

| Tennessee | Tennessee | Erie | $2,332 |

| Texas | Texas | Farm Bureau | $3,474 |

| Utah | Utah | Farm Bureau | $1,230 |

| Vermont | Vermont | Allstate | $768 |

| Virginia | Virginia | State Farm | $1,483 |

| Washington | Washington | Allstate | $1,061 |

| Washington, D.C. | Washington, D.C. | Nationwide | $1,409 |

| West Virginia | West Virginia | USAA* | $1,197 |

| Wisconsin | Wisconsin | Erie | $1,222 |

| Wyoming | Wyoming | Nationwide | $1,408 |

Cheapest home insurance by city

Travelers’ rate of $662 a year in San Jose, California, is the cheapest among the nation’s 25 largest cities. This is barely cheaper than Norfolk and Dedham’s rate of $677 a year in Boston.

Allstate also has the cheapest rate in Oklahoma City at $4,592 a year. This is 25% less than Oklahoma’s state average of $6,133 a year.

Cheapest home insurance for big cities

| City | Cheapest company | Cheapest premium |

|---|---|---|

| Austin | Chubb | $2,024 |

| Boston | Norfolk & Dedham Mutual | $677 |

| Charlotte | State Farm | $848 |

| Chicago | Erie | $1,984 |

| Columbus | Erie | $1,305 |

| Dallas | Chubb | $2,952 |

| Denver | Chubb | $3,267 |

| El Paso | Chubb | $1,337 |

| Fort Worth | Chubb | $3,199 |

| Houston | Nationwide | $1,774 |

| Indianapolis | Erie | $1,661 |

| Jacksonville | UPC | $1,302 |

| Las Vegas | Nationwide | $1,245 |

| Los Angeles | Allstate | $857 |

| Nashville | Erie | $2,070 |

| New York City | New York Central Mutual | $785 |

| Oklahoma City | Allstate | $4,592 |

| Philadelphia | Westfield | $1,276 |

| Phoenix | State Farm | $1,866 |

| San Antonio | Chubb | $2,306 |

| San Diego | Travelers | $796 |

| San Francisco | Travelers | $836 |

| San Jose | Travelers | $662 |

| Seattle | Mutual of Enumclaw | $831 |

| Washington, D.C. | Nationwide | $1,409 |

How to get cheaper home insurance

Shopping around and using discounts are good ways to get cheap home insurance. Choosing high deductibles and avoiding claims for minor expenses helps keep your rates affordable.

Why shop around for cheap insurance

There are a few reasons why it pays to shop around for cheap home insurance.

- Each company uses a different system to set rates. Some companies may charge you less than others based on your credit, location or other factors.

- Insurance companies often adjust their rates. A company that gave you an expensive quote in the past may be a cheaper option now.

- Your own rate factors can change. You may get cheaper rates than before if your credit has recently improved or a recent claim has come off your record.

Best discounts for cheap home insurance

A 2% home insurance discount here and a 3% discount there may not sound like much, but the savings can add up. It’s good to ask the companies you contact for quotes about their discounts. Some good ones to keep an eye out for include:

- Bundling: Most companies give you a big discount for bundling a homeowners policy with your car insurance. You can usually save more by adding insurance for a boat, motorcycle or other needs to your bundle.

- Home safety and security: Smoke detectors and deadbolt locks usually get you a small home insurance discount. Monitored security and WiFi-connected home monitoring devices usually help you save more.

- Home renovations: Replacing an old heating, plumbing or electrical system with modern equipment may get you an insurance discount. Let insurance companies know about any recent upgrades to your home’s major systems.

How high deductibles lower your rate

Choosing a high deductible

You’ll save more with a higher deductible. Just make sure you have funds available to cover it if a disaster strikes.

Avoiding claims for cheap rates

Insurance companies usually raise your homeowners rates after a claim of any size. If you file too many claims within two to three years, your insurance company may drop you. These are two good reasons to avoid seeking insurance money for minor repairs or losses.

Having to pay for a broken window or stolen bicycle out of your own pocket is a pain. However, doing so may save you money in the long run.

Frequently asked questions

Erie has the cheapest home insurance at $2,055 a year for a typical home. However, Erie is only available in 12 states and the District of Columbia. State Farm has the next-cheapest rate at $2,427 a year. It’s also available just about everywhere.

Homeowners insurance is not required by law. However, most lenders require it for a mortgage. Some homeowners associations also require it. The financial protection home insurance provides usually makes it worth it when it’s optional.

Yes, but each type of home has its own type of insurance. Condo unit owners typically need HO-6 insurance. Mobile home owners usually need an HO-7 policy. Both are forms of home insurance modified for each of these types of home.

Methodology

The rates shown in this article are based on nonbinding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in all 50 states. The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighed these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.