Best Homeowners Insurance Companies

Top-rated home insurance companies

Best companies for homeowners insurance

Amica is the top home insurance company in the U.S. It offers low rates and treats its customers well. J.D. Power gave Amica a top score for customer satisfaction, and it has a great complaint rating from the National Association of Insurance Commissioners (NAIC).

State Farm, North Star Mutual, Erie, Chubb and USAA each stand out for their own reasons.

Best home insurance companies at a glance

| Company | Annual rate | Satisfaction rating** | Complaint rating*** | LendingTree score |

|---|---|---|---|---|

| Best company overall: Amica | $1,830 | 679 | 0.37 | |

| Best large company: State Farm | $2,427 | 643 | 1.22 | |

| Best regional company: North Star Mutual | $2,159 | Not rated | 0.18 | |

| Best coverages: Erie | $2,055 | 674 | 0.44 | |

| Best for luxury homes: Chubb | $2,606 | 688 | 0.08 | |

| Best for military: USAA | $2,507 | 737 | 0.37 | |

| Best for discounts: Farmers | $3,801 | 609 | 0.91 | |

| Best for seniors: Allstate | $2,560 | 631 | 1.75 |

Best overall home insurance company: Amica

Annual rate: $1,830

At $1,830 a year, Amica’s average home insurance rate is 35% cheaper than the national average of $2,801. This makes Amica one of the cheapest home insurance companies in the U.S.

Amica is an especially good choice in Connecticut, New Hampshire and Rhode Island. Its rates are well below the average in those states. But in Massachusetts, Amica charges 35% more than the state average.

Amica has a low complaint rating of 0.33. This means customers file far fewer complaints against Amica than other companies. Its satisfaction rating is also better than most other companies.

With Amica, you can choose a regular policy or a dividend policy. A dividend policy gives you back about 5% to 20% of your premium when it ends. The policy may cost more upfront, but it can still save you money.

If you want more than standard home insurance, Amica offers the Platinum Choice package. It includes:

-

30% more for your dwelling replacement cost

Replacement cost is the estimated cost of rebuilding a home after a total loss. You usually need to insure your home for this amount, which is typically lower than a home’s market value.

- Personal property coverage at replacement cost

- Protection for water pump and sump pump overflows

- Credit card fraud protection

PROS

- Affordable rates in many states

- Excellent customer service ratings

- Flexible coverage options

- Dividend policy that can save you money over time

CONS

- Expensive in some states

- You can only buy a policy by phone

- Few physical office locations

Best large home insurance company: State Farm

Annual rate: $2,427

State Farm is the largest home insurance company in the U.S. It offers benefits that many smaller companies don’t, like 24/7 customer service and lots of coverage options. You can get online quotes or visit one of its many local offices. State Farm has offices in most communities across the country.

State Farm is also one of the cheapest home insurance companies. Its average annual rate is $2,427. That’s 13% lower than the national average.

You can lower your cost with State Farm if you qualify for some of its many discounts. One of the best is the home and auto bundling discount. It can save you up to $1,356 when you combine your car and home insurance.

For customer ratings, State Farm’s scores from J.D. Power and the NAIC are just average.

PROS

- Cheapest large home insurance company

- Generous bundling discount

- Wide range of discounts

- Easy-to-use website

CONS

- Customer satisfaction score is average

- Complaint rating is worse than average

Best regional home insurance company: North Star Mutual

Annual rate: $2,159

North Star Mutual is a solid home insurance choice in the eight states

North Star Mutual’s average annual rate is $2,159, which is 23% lower than the national average.

The company also offers flexible coverage options, such as:

- Coverage for refrigerated food that spoils during a power outage

- Liability coverage for RVs and watercraft

Another positive for North Star Mutual is its 0.83 complaint rating, which means it gets fewer complaints than the average company.

PROS

- Cheaper rates than average

- Fewer complaints than most companies

- More optional coverages than many insurers

- Add-on liability coverage for RVs and watercraft

CONS

- Only available in eight states

- Few discounts compared to bigger companies

Best home insurance coverage options: Erie

Annual rate: $2,055

Erie is the 11th-largest home insurance company in the country, but it competes well with bigger insurers. Its rates are often cheaper than larger competitors. Erie’s average annual rate is $2,055, which is 27% lower than the national average. The company also holds an A+ Financial Strength Rating from AM Best, beating some of the larger insurers.

The ErieSecure package includes guaranteed replacement coverage

- Flooding in a basement or other rooms

- Sewer and drainage backups

- Home improvements that reduce future flood risks

PROS

- Cheaper rates than larger companies

- Guaranteed replacement cost coverage for your home

- Optional protection for water damage

- Fewer complaints than most companies

CONS

- Only available in 12 states and the District of Columbia

- Few discounts compared to other insurers

-

Only sells policies through independent agents

Independent insurance agents work with several insurers to offer clients a wide range of policy options.

Best for luxury homes: Chubb

Annual rate: $2,606

Chubb’s Masterpiece home insurance package includes features that many other companies charge extra for. These include:

-

Extended replacement cost coverage

for your homeChubb’s extended replacement covers rebuild costs that go over your policy’s dwelling limit. This includes costs of meeting codes enacted after it was originally built.

-

Replacement cost coverage

for your belongingsReplacement cost pays to replace stolen or damaged items with comparable new ones, without depreciation.

- A cash settlement option if you decide to relocate after a major disaster

The package also comes with Chubb’s HomeScan service. A consultant visits your home to look for moisture and fire hazards before they turn into costly claims.

Chubb’s ratings are excellent. J.D. Power gives it the second-highest score for customer satisfaction, just behind USAA. Its complaint rating is also outstanding, with about one-tenth as many complaints as average.

Although Chubb isn’t the cheapest insurer, it’s still affordable. Its average annual rate is $2,606, which is 7% lower than the national average.

PROS

- Great customer satisfaction rating

- Guaranteed replacement cost for your home

- Belongings covered at replacement value

- Excellent add-on coverages

- Cash settlement option

- HomeScan service can spot hazards before they cause damage

- Far fewer complaints than average

CONS

- Only available for high-value homes

- Only sells policies through independent agents

Best insurance for military homeowners: USAA

Annual rate: $2,507

USAA serves the military community with reliable home insurance at low rates. It helps active-duty members by covering uniforms and military gear. These features and more help USAA earn the highest satisfaction rating of any home insurance company.

A USAA policy covers your belongings and some building materials at replacement cost. This means your payouts won’t decrease because of age or wear and tear.

USAA also makes it easy to manage your policy online or with its app. But it only sells insurance to military members and their families.

PROS

- Rates are 10% lower than the U.S. average

- Special coverage for active-duty military

- Highest-rated company for customer satisfaction Pays personal property claims at replacement cost

CONS

- Only available to the military community

- You may talk with a different agent each time you call Few discounts compared to other insurers

Best homeowners insurance discounts: Farmers

Annual rate: $3,801

Farmers offers more ways to save on home insurance than most top companies. You can get a discount from Farmers if you:

- Bundle your home and auto insurance

- Pay your premium in one or two installments

- Go paperless

- Pay your bill on time

- Own a home with approved eco-friendly updates

- Own a home less than 14 years old

- Avoid filing a claim for three years in a row

Farmers also offers other ways to save. You earn a $50 credit on your deductible every year your policy stays active. If you go five years without filing a claim, your next claim won’t raise your premium.

The average cost of a Farmers home insurance policy is $3,801 a year. That’s 36% higher than the national average.

PROS

- Wide range of discounts

- Deductible credits each year your policy stays active

- Claim forgiveness after five claim-free years

CONS

- Rates are higher than the national average

- Customer satisfaction is worse than many competitors

- Discounts not available in all states

Best for seniors: Allstate

Annual rate: $2,560

Allstate gives seniors a 20% discount on home insurance. And you can save 25% when you get both home and auto policies from Allstate.

Allstate also offers useful add-on coverages, such as:

- Identity theft protection: Helps cover costs for stolen identity

- Scheduled personal property coverage: Covers valuables like jewelry or art for their full value

The downside is that Allstate’s customer satisfaction and complaint ratings are worse than average.

Allstate’s average home insurance rate is $2,560 a year. That’s 9% cheaper than the national average.

PROS

- Average rates 9% cheaper than the national average

- Good discount for seniors

- Extra savings with its bundling discount Several useful add-on coverages

CONS

- More customer complaints than average

- Poor customer satisfaction rating

Best-rated home insurance companies by state

State Farm has the best insurance company ratings in 32 states and in the District of Columbia. Erie holds the top spot in eight states. Country Financial leads in four states.

Best-rated company by state

| State | State annual rate | Best-rated company | Company annual rate |

|---|---|---|---|

| Alabama | $3,217 | Country Financial | $2,627 |

| Alaska | $1,475 | Country Financial | $1,355 |

| Arizona | $2,623 | State Farm | $1,737 |

| Arkansas | $3,722 | State Farm | $4,336 |

| California | $1,260 | State Farm | $1,304 |

| Colorado | $4,489 | Country Financial | $5,268 |

| Connecticut | $2,618 | Amica | $2,020 |

| Delaware | $1,764 | State Farm | $1,497 |

| District of Columbia | $1,701 | State Farm | $1,152 |

| Florida | $3,889 | State Farm | $5,180 |

| Georgia | $2,689 | Country Financial | $2,798 |

| Hawaii | $632 | State Farm | $746 |

| Idaho | $2,178 | State Farm | $2,669 |

| Illinois | $2,743 | Country Financial | $2,378 |

| Indiana | $2,643 | State Farm | $2,338 |

| Iowa | $2,697 | State Farm | $2,679 |

| Kansas | $5,412 | State Farm | $4,626 |

| Kentucky | $4,671 | State Farm | $2,661 |

| Louisiana | $4,033 | State Farm | $1,274 |

| Maine | $1,863 | State Farm | $1,124 |

| Maryland | $1,810 | State Farm | $1,448 |

| Massachusetts | $1,906 | Amica | $2,578 |

| Michigan | $2,467 | State Farm | $2,259 |

| Minnesota | $3,642 | North Star Mutual | $2,001 |

| Mississippi | $4,201 | State Farm | $3,288 |

| Missouri | $3,387 | State Farm | $3,321 |

| Montana | $3,068 | State Farm | $3,630 |

| Nebraska | $5,912 | State Farm | $5,150 |

| Nevada | $1,626 | Country Financial | $1,925 |

| New Hampshire | $1,760 | Amica | $1,114 |

| New Jersey | $1,744 | State Farm | $1,211 |

| New Mexico | $3,354 | State Farm | $2,183 |

| New York | $1,897 | State Farm | $1,809 |

| North Carolina | $3,378 | State Farm | $1,475 |

| North Dakota | $2,911 | North Star Mutual | $1,947 |

| Ohio | $2,207 | State Farm | $1,871 |

| Oklahoma | $6,133 | State Farm | $5,078 |

| Oregon | $1,885 | Country Financial | $2,322 |

| Pennsylvania | $1,928 | State Farm | $1,515 |

| Rhode Island | $2,240 | Amica | $1,609 |

| South Carolina | $3,335 | State Farm | $2,712 |

| South Dakota | $3,605 | North Star Mutual | $2,530 |

| Tennessee | $2,857 | State Farm | $2,473 |

| Texas | $5,180 | State Farm | $5,674 |

| Utah | $1,507 | State Farm | $1,248 |

| Vermont | $1,339 | State Farm | $1,371 |

| Virginia | $2,499 | State Farm | $1,483 |

| Washington | $1,600 | Country Financial | $2,543 |

| West Virginia | $2,511 | State Farm | $1,862 |

| Wisconsin | $2,159 | State Farm | $1,813 |

| Wyoming | $2,323 | State Farm | $2,046 |

Tips for finding the best insurance

As you shop around, consider smaller local or regional insurers, as well as the bigger names. And don’t just compare prices, but also look at customer service reviews and coverage options.

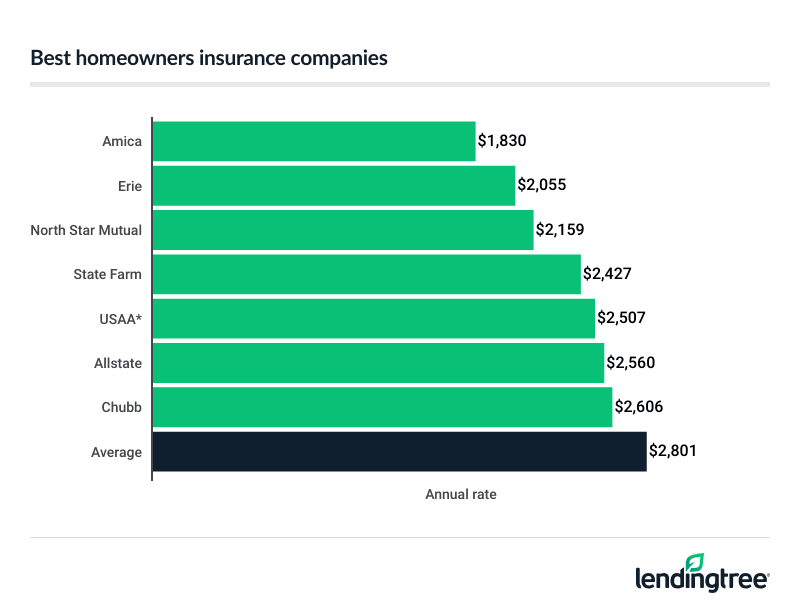

Best cheap homeowners insurance companies

Amica has the best average homeowners insurance rate of $1,830 a year. That’s 35% less than the national average cost of homeowners insurance of $2,801.

Other affordable companies include:

- Erie at $2,055 a year

- North Star Mutual at $2,159 a year

- State Farm at $2,427 a year, making it the cheapest large company

Home insurance rates by company

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Amica | $1,830 | |

| Erie | $2,055 | |

| North Star Mutual | $2,159 | |

| State Farm | $2,427 | |

| USAA* | $2,507 | |

| Allstate | $2,560 | |

| Chubb | $2,606 | |

| Progressive | $2,648 | |

| Country Financial | $2,827 | |

| Nationwide | $3,055 | |

| American Family | $3,072 | |

| Travelers | $3,149 | |

| Farmers | $3,801 | |

*USAA is only available to current and former service members and their families.

How to find the best home insurance company

To find the best homeowners insurance company, you should:

- Look at your coverage limits.

- Calculate the value of your belongings.

- Compare quotes from several companies.

Choose dwelling coverage and liability limits

You should have enough dwelling coverage to pay for a full rebuild of your home if needed. The cost of your policy will change based on how much dwelling coverage you choose.

Rate by coverage amount

| Coverage amount | Annual rate |

|---|---|

| $350,000 | $2,498 |

| $400,000 | $2,801 |

| $450,000 | $3,111 |

Your liability coverage limit also affects your premium. Most home insurance companies set the default limit at $100,000. That may sound like a lot, but a long court case or a serious injury could cost much more.

If legal or medical costs go over your limit, you have to pay the rest out of your own pocket. That’s why it helps to raise your liability limit to at least $300,000 if you can afford it.

Calculate personal property

The best way to figure out what your belongings are worth is to make a home inventory. This helps you avoid being overinsured or underinsured

Most home insurance companies set separate coverage limits on valuables like jewelry and art. They usually offer endorsements you can buy for extra protection. Make sure you know what your policy covers, and what it doesn’t, before you sign.

Compare quotes

To find the best company for your needs, compare home insurance quotes from several insurers. Pay attention to coverage differences that can affect the price. For example, a quote with water backup coverage may cost more, but it could still be the better deal.

Check customer satisfaction ratings as well. Cost and coverage matter, but so does how a company handles claims. J.D. Power and the NAIC are good places to look for this information.

Pick your best company

After you finish your research and compare quotes, choose the home insurance company that best fits your needs. Many companies let you get quotes and sign up online. You can also reach most companies by phone.

Frequently asked questions

Home insurance often covers six main areas:

- Dwelling: Covers damage to your home’s structure, like walls and roof.

- Other structures: Protects detached buildings, such as a garage or shed.

- Personal property: Covers belongings like clothes, furniture and electronics.

- Liability: Helps if you’re responsible for injuries or property damage.

- Loss of use: Pays extra living costs if you can’t stay in your home during repairs.

- Medical payments: Covers guest medical bills, no matter who’s at fault.

Some of the most common optional coverage types for home insurance are:

- Umbrella insurance: Provides extra liability protection beyond your standard policy limits.

- Equipment breakdown: Covers repairs or replacement of damaged equipment. It also covers lost income and spoiled food.

- Loss assessment: Helps pay your share of a claim under your condo or HOA’s master policy.

- Windstorm coverage: Protects against damage from wind, hail and similar events.

Hazard insurance is part of a home insurance policy. It covers the structure of your house. Mortgage companies require it as part of the loan agreement.

You should have enough dwelling coverage to pay for a full rebuild of your home. This includes attached structures, like a garage or deck. You should also have enough personal property coverage to replace your belongings.

Homeowners insurance is a type of coverage that protects you from loss and damage to your home. It also covers your belongings and liability if accidents happen on your property.

Homeowners insurance is not required by law. But if you take out a mortgage, your lender will require it to protect its financial interest in your home. Even if you own your home outright, insurance is still a smart way to protect your investment.

Homeowners insurance usually does not cover pest damage. Insurance companies consider problems like termite damage a home maintenance issue, not accidental damage.

“HO-3” is the technical name of the most common form of homeowners insurance. Many companies also offer HO-5s, which provide more coverage than an HO-3. HO-4s are for renters. HO-6 policies cover unit owners in a condo or co-op.

Methodology

The rates shown in this article are based on nonbinding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in all 50 states. The following coverages and deductibles were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss-of-use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

—

For LendingTree ratings, our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings, and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.