Can You Get a 40-Year Mortgage in 2025?

Yes, you can get a 40-year mortgage in 2025 but your options are limited. A 40-year mortgage extends your repayment term 10 years beyond a traditional 30-year loan, which gives you lower monthly payments and means you’ll pay significantly more interest over time.

While 40-year mortgages can make homeownership more affordable in today’s expensive housing market, most lenders don’t offer them for new purchases. Instead, you’re more likely to encounter them as loan modifications designed to help struggling homeowners avoid foreclosure by reducing their monthly payments.

Can you get a 40-year mortgage?

Yes, it’s possible to get a 40-year mortgage but it’s not as simple as getting a more traditional 15- or 30-year loan.

A 40-year mortgage isn’t usually an option for borrowers in good financial standing who are simply looking for a longer loan term on a new purchase. Instead, lenders typically use 40-year loans as a loan modification option. Extending a struggling homeowner’s existing loan term can significantly lower their monthly payments and help pull them back from the brink of mortgage default or foreclosure.

Where can I get a 40-year mortgage?

If you are shopping for a 40-year purchase loan, rather than a loan modification, you’ll have to search outside of large national lenders like Rocket Mortgage, Chase or Wells Fargo. That’s because 40-year mortgages are rare — they’re riskier for lenders than other loans because they can’t be backed by the government or purchased by Fannie Mae and Freddie Mac.

Jump to our list of 40-year mortgage lenders now.

What would be my monthly payment on a 40-year mortgage?

The average monthly payment on a 40-year mortgage, using current rates and median home prices, is about $2,172. To calculate how much your monthly payment would be, make sure you know what interest rate and down payment amount you’re targeting and use a mortgage calculator.

| Date | Mar '26 | Apr '26 | May '26 | Jun '26 | Jul '26 | Aug '26 | Sep '26 | Oct '26 | Nov '26 | Dec '26 | Jan '27 | Feb '27 | Mar '27 | Apr '27 | May '27 | Jun '27 | Jul '27 | Aug '27 | Sep '27 | Oct '27 | Nov '27 | Dec '27 | Jan '28 | Feb '28 | Mar '28 | Apr '28 | May '28 | Jun '28 | Jul '28 | Aug '28 | Sep '28 | Oct '28 | Nov '28 | Dec '28 | Jan '29 | Feb '29 | Mar '29 | Apr '29 | May '29 | Jun '29 | Jul '29 | Aug '29 | Sep '29 | Oct '29 | Nov '29 | Dec '29 | Jan '30 | Feb '30 | Mar '30 | Apr '30 | May '30 | Jun '30 | Jul '30 | Aug '30 | Sep '30 | Oct '30 | Nov '30 | Dec '30 | Jan '31 | Feb '31 | Mar '31 | Apr '31 | May '31 | Jun '31 | Jul '31 | Aug '31 | Sep '31 | Oct '31 | Nov '31 | Dec '31 | Jan '32 | Feb '32 | Mar '32 | Apr '32 | May '32 | Jun '32 | Jul '32 | Aug '32 | Sep '32 | Oct '32 | Nov '32 | Dec '32 | Jan '33 | Feb '33 | Mar '33 | Apr '33 | May '33 | Jun '33 | Jul '33 | Aug '33 | Sep '33 | Oct '33 | Nov '33 | Dec '33 | Jan '34 | Feb '34 | Mar '34 | Apr '34 | May '34 | Jun '34 | Jul '34 | Aug '34 | Sep '34 | Oct '34 | Nov '34 | Dec '34 | Jan '35 | Feb '35 | Mar '35 | Apr '35 | May '35 | Jun '35 | Jul '35 | Aug '35 | Sep '35 | Oct '35 | Nov '35 | Dec '35 | Jan '36 | Feb '36 | Mar '36 | Apr '36 | May '36 | Jun '36 | Jul '36 | Aug '36 | Sep '36 | Oct '36 | Nov '36 | Dec '36 | Jan '37 | Feb '37 | Mar '37 | Apr '37 | May '37 | Jun '37 | Jul '37 | Aug '37 | Sep '37 | Oct '37 | Nov '37 | Dec '37 | Jan '38 | Feb '38 | Mar '38 | Apr '38 | May '38 | Jun '38 | Jul '38 | Aug '38 | Sep '38 | Oct '38 | Nov '38 | Dec '38 | Jan '39 | Feb '39 | Mar '39 | Apr '39 | May '39 | Jun '39 | Jul '39 | Aug '39 | Sep '39 | Oct '39 | Nov '39 | Dec '39 | Jan '40 | Feb '40 | Mar '40 | Apr '40 | May '40 | Jun '40 | Jul '40 | Aug '40 | Sep '40 | Oct '40 | Nov '40 | Dec '40 | Jan '41 | Feb '41 | Mar '41 | Apr '41 | May '41 | Jun '41 | Jul '41 | Aug '41 | Sep '41 | Oct '41 | Nov '41 | Dec '41 | Jan '42 | Feb '42 | Mar '42 | Apr '42 | May '42 | Jun '42 | Jul '42 | Aug '42 | Sep '42 | Oct '42 | Nov '42 | Dec '42 | Jan '43 | Feb '43 | Mar '43 | Apr '43 | May '43 | Jun '43 | Jul '43 | Aug '43 | Sep '43 | Oct '43 | Nov '43 | Dec '43 | Jan '44 | Feb '44 | Mar '44 | Apr '44 | May '44 | Jun '44 | Jul '44 | Aug '44 | Sep '44 | Oct '44 | Nov '44 | Dec '44 | Jan '45 | Feb '45 | Mar '45 | Apr '45 | May '45 | Jun '45 | Jul '45 | Aug '45 | Sep '45 | Oct '45 | Nov '45 | Dec '45 | Jan '46 | Feb '46 | Mar '46 | Apr '46 | May '46 | Jun '46 | Jul '46 | Aug '46 | Sep '46 | Oct '46 | Nov '46 | Dec '46 | Jan '47 | Feb '47 | Mar '47 | Apr '47 | May '47 | Jun '47 | Jul '47 | Aug '47 | Sep '47 | Oct '47 | Nov '47 | Dec '47 | Jan '48 | Feb '48 | Mar '48 | Apr '48 | May '48 | Jun '48 | Jul '48 | Aug '48 | Sep '48 | Oct '48 | Nov '48 | Dec '48 | Jan '49 | Feb '49 | Mar '49 | Apr '49 | May '49 | Jun '49 | Jul '49 | Aug '49 | Sep '49 | Oct '49 | Nov '49 | Dec '49 | Jan '50 | Feb '50 | Mar '50 | Apr '50 | May '50 | Jun '50 | Jul '50 | Aug '50 | Sep '50 | Oct '50 | Nov '50 | Dec '50 | Jan '51 | Feb '51 | Mar '51 | Apr '51 | May '51 | Jun '51 | Jul '51 | Aug '51 | Sep '51 | Oct '51 | Nov '51 | Dec '51 | Jan '52 | Feb '52 | Mar '52 | Apr '52 | May '52 | Jun '52 | Jul '52 | Aug '52 | Sep '52 | Oct '52 | Nov '52 | Dec '52 | Jan '53 | Feb '53 | Mar '53 | Apr '53 | May '53 | Jun '53 | Jul '53 | Aug '53 | Sep '53 | Oct '53 | Nov '53 | Dec '53 | Jan '54 | Feb '54 | Mar '54 | Apr '54 | May '54 | Jun '54 | Jul '54 | Aug '54 | Sep '54 | Oct '54 | Nov '54 | Dec '54 | Jan '55 | Feb '55 | Mar '55 | Apr '55 | May '55 | Jun '55 | Jul '55 | Aug '55 | Sep '55 | Oct '55 | Nov '55 | Dec '55 | Jan '56 | Feb '56 |

| Initial Balance | $400,000.00 | $399,672.12 | $399,342.33 | $399,010.62 | $398,676.97 | $398,341.38 | $398,003.83 | $397,664.31 | $397,322.80 | $396,979.31 | $396,633.81 | $396,286.30 | $395,936.76 | $395,585.18 | $395,231.55 | $394,875.86 | $394,518.09 | $394,158.24 | $393,796.28 | $393,432.22 | $393,066.03 | $392,697.71 | $392,327.23 | $391,954.60 | $391,579.79 | $391,202.79 | $390,823.60 | $390,442.20 | $390,058.57 | $389,672.70 | $389,284.58 | $388,894.19 | $388,501.53 | $388,106.58 | $387,709.33 | $387,309.76 | $386,907.85 | $386,503.60 | $386,097.00 | $385,688.02 | $385,276.66 | $384,862.90 | $384,446.72 | $384,028.12 | $383,607.07 | $383,183.57 | $382,757.59 | $382,329.14 | $381,898.18 | $381,464.71 | $381,028.71 | $380,590.17 | $380,149.07 | $379,705.39 | $379,259.13 | $378,810.27 | $378,358.78 | $377,904.67 | $377,447.90 | $376,988.47 | $376,526.36 | $376,061.55 | $375,594.04 | $375,123.79 | $374,650.80 | $374,175.06 | $373,696.53 | $373,215.22 | $372,731.10 | $372,244.15 | $371,754.37 | $371,261.73 | $370,766.21 | $370,267.80 | $369,766.49 | $369,262.25 | $368,755.07 | $368,244.93 | $367,731.81 | $367,215.71 | $366,696.59 | $366,174.44 | $365,649.25 | $365,120.99 | $364,589.66 | $364,055.22 | $363,517.66 | $362,976.97 | $362,433.13 | $361,886.11 | $361,335.91 | $360,782.49 | $360,225.84 | $359,665.95 | $359,102.79 | $358,536.35 | $357,966.60 | $357,393.53 | $356,817.11 | $356,237.34 | $355,654.18 | $355,067.62 | $354,477.64 | $353,884.21 | $353,287.33 | $352,686.96 | $352,083.09 | $351,475.70 | $350,864.76 | $350,250.26 | $349,632.18 | $349,010.49 | $348,385.18 | $347,756.21 | $347,123.58 | $346,487.26 | $345,847.22 | $345,203.46 | $344,555.93 | $343,904.63 | $343,249.53 | $342,590.61 | $341,927.85 | $341,261.22 | $340,590.70 | $339,916.27 | $339,237.90 | $338,555.58 | $337,869.28 | $337,178.97 | $336,484.64 | $335,786.26 | $335,083.80 | $334,377.24 | $333,666.57 | $332,951.75 | $332,232.75 | $331,509.57 | $330,782.17 | $330,050.52 | $329,314.60 | $328,574.39 | $327,829.87 | $327,081.00 | $326,327.76 | $325,570.13 | $324,808.08 | $324,041.58 | $323,270.62 | $322,495.15 | $321,715.16 | $320,930.62 | $320,141.51 | $319,347.79 | $318,549.44 | $317,746.44 | $316,938.75 | $316,126.35 | $315,309.21 | $314,487.30 | $313,660.60 | $312,829.08 | $311,992.71 | $311,151.45 | $310,305.29 | $309,454.20 | $308,598.14 | $307,737.08 | $306,871.01 | $305,999.88 | $305,123.67 | $304,242.34 | $303,355.88 | $302,464.25 | $301,567.41 | $300,665.35 | $299,758.02 | $298,845.40 | $297,927.45 | $297,004.15 | $296,075.46 | $295,141.36 | $294,201.81 | $293,256.78 | $292,306.23 | $291,350.14 | $290,388.47 | $289,421.20 | $288,448.28 | $287,469.68 | $286,485.38 | $285,495.33 | $284,499.51 | $283,497.88 | $282,490.41 | $281,477.06 | $280,457.80 | $279,432.59 | $278,401.41 | $277,364.21 | $276,320.95 | $275,271.62 | $274,216.16 | $273,154.54 | $272,086.73 | $271,012.70 | $269,932.39 | $268,845.79 | $267,752.85 | $266,653.53 | $265,547.80 | $264,435.62 | $263,316.95 | $262,191.75 | $261,059.99 | $259,921.63 | $258,776.63 | $257,624.95 | $256,466.56 | $255,301.40 | $254,129.45 | $252,950.66 | $251,765.00 | $250,572.42 | $249,372.88 | $248,166.34 | $246,952.77 | $245,732.12 | $244,504.35 | $243,269.41 | $242,027.27 | $240,777.89 | $239,521.22 | $238,257.21 | $236,985.84 | $235,707.04 | $234,420.79 | $233,127.04 | $231,825.73 | $230,516.84 | $229,200.31 | $227,876.11 | $226,544.17 | $225,204.47 | $223,856.95 | $222,501.58 | $221,138.29 | $219,767.05 | $218,387.82 | $217,000.54 | $215,605.16 | $214,201.65 | $212,789.95 | $211,370.02 | $209,941.80 | $208,505.25 | $207,060.32 | $205,606.96 | $204,145.12 | $202,674.76 | $201,195.82 | $199,708.25 | $198,212.01 | $196,707.03 | $195,193.28 | $193,670.70 | $192,139.24 | $190,598.84 | $189,049.45 | $187,491.03 | $185,923.52 | $184,346.86 | $182,761.01 | $181,165.91 | $179,561.50 | $177,947.73 | $176,324.55 | $174,691.90 | $173,049.72 | $171,397.97 | $169,736.58 | $168,065.50 | $166,384.67 | $164,694.04 | $162,993.55 | $161,283.13 | $159,562.74 | $157,832.31 | $156,091.79 | $154,341.12 | $152,580.23 | $150,809.07 | $149,027.58 | $147,235.70 | $145,433.36 | $143,620.52 | $141,797.09 | $139,963.03 | $138,118.27 | $136,262.75 | $134,396.41 | $132,519.18 | $130,631.00 | $128,731.80 | $126,821.53 | $124,900.11 | $122,967.48 | $121,023.58 | $119,068.34 | $117,101.70 | $115,123.58 | $113,133.93 | $111,132.66 | $109,119.73 | $107,095.05 | $105,058.56 | $103,010.19 | $100,949.88 | $98,877.54 | $96,793.12 | $94,696.53 | $92,587.72 | $90,466.60 | $88,333.12 | $86,187.18 | $84,028.73 | $81,857.69 | $79,673.98 | $77,477.54 | $75,268.28 | $73,046.13 | $70,811.03 | $68,562.88 | $66,301.62 | $64,027.17 | $61,739.45 | $59,438.39 | $57,123.90 | $54,795.92 | $52,454.35 | $50,099.12 | $47,730.16 | $45,347.37 | $42,950.69 | $40,540.03 | $38,115.30 | $35,676.43 | $33,223.33 | $30,755.92 | $28,274.12 | $25,777.85 | $23,267.01 | $20,741.52 | $18,201.30 | $15,646.27 | $13,076.33 | $10,491.40 | $7,891.39 | $5,276.21 | $2,645.78 |

| Loan Payment | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 | $2,661.21 |

| Principal | $327.88 | $329.79 | $331.71 | $333.65 | $335.59 | $337.55 | $339.52 | $341.50 | $343.49 | $345.50 | $347.51 | $349.54 | $351.58 | $353.63 | $355.69 | $357.77 | $359.85 | $361.95 | $364.06 | $366.19 | $368.32 | $370.47 | $372.63 | $374.81 | $376.99 | $379.19 | $381.41 | $383.63 | $385.87 | $388.12 | $390.38 | $392.66 | $394.95 | $397.25 | $399.57 | $401.90 | $404.25 | $406.61 | $408.98 | $411.36 | $413.76 | $416.18 | $418.60 | $421.05 | $423.50 | $425.97 | $428.46 | $430.96 | $433.47 | $436.00 | $438.54 | $441.10 | $443.67 | $446.26 | $448.87 | $451.48 | $454.12 | $456.77 | $459.43 | $462.11 | $464.81 | $467.52 | $470.24 | $472.99 | $475.75 | $478.52 | $481.31 | $484.12 | $486.95 | $489.79 | $492.64 | $495.52 | $498.41 | $501.31 | $504.24 | $507.18 | $510.14 | $513.11 | $516.11 | $519.12 | $522.15 | $525.19 | $528.26 | $531.34 | $534.44 | $537.55 | $540.69 | $543.84 | $547.02 | $550.21 | $553.42 | $556.65 | $559.89 | $563.16 | $566.44 | $569.75 | $573.07 | $576.41 | $579.78 | $583.16 | $586.56 | $589.98 | $593.42 | $596.89 | $600.37 | $603.87 | $607.39 | $610.94 | $614.50 | $618.08 | $621.69 | $625.32 | $628.96 | $632.63 | $636.32 | $640.03 | $643.77 | $647.52 | $651.30 | $655.10 | $658.92 | $662.76 | $666.63 | $670.52 | $674.43 | $678.37 | $682.32 | $686.30 | $690.31 | $694.33 | $698.38 | $702.46 | $706.55 | $710.68 | $714.82 | $718.99 | $723.19 | $727.40 | $731.65 | $735.92 | $740.21 | $744.53 | $748.87 | $753.24 | $757.63 | $762.05 | $766.50 | $770.97 | $775.46 | $779.99 | $784.54 | $789.11 | $793.72 | $798.35 | $803.00 | $807.69 | $812.40 | $817.14 | $821.91 | $826.70 | $831.52 | $836.37 | $841.25 | $846.16 | $851.10 | $856.06 | $861.05 | $866.08 | $871.13 | $876.21 | $881.32 | $886.46 | $891.63 | $896.84 | $902.07 | $907.33 | $912.62 | $917.95 | $923.30 | $928.69 | $934.10 | $939.55 | $945.03 | $950.55 | $956.09 | $961.67 | $967.28 | $972.92 | $978.60 | $984.30 | $990.05 | $995.82 | $1,001.63 | $1,007.47 | $1,013.35 | $1,019.26 | $1,025.21 | $1,031.19 | $1,037.20 | $1,043.25 | $1,049.34 | $1,055.46 | $1,061.62 | $1,067.81 | $1,074.04 | $1,080.30 | $1,086.60 | $1,092.94 | $1,099.32 | $1,105.73 | $1,112.18 | $1,118.67 | $1,125.19 | $1,131.76 | $1,138.36 | $1,145.00 | $1,151.68 | $1,158.40 | $1,165.16 | $1,171.95 | $1,178.79 | $1,185.66 | $1,192.58 | $1,199.54 | $1,206.53 | $1,213.57 | $1,220.65 | $1,227.77 | $1,234.93 | $1,242.14 | $1,249.38 | $1,256.67 | $1,264.00 | $1,271.38 | $1,278.79 | $1,286.25 | $1,293.76 | $1,301.30 | $1,308.89 | $1,316.53 | $1,324.21 | $1,331.93 | $1,339.70 | $1,347.52 | $1,355.38 | $1,363.28 | $1,371.24 | $1,379.24 | $1,387.28 | $1,395.37 | $1,403.51 | $1,411.70 | $1,419.94 | $1,428.22 | $1,436.55 | $1,444.93 | $1,453.36 | $1,461.84 | $1,470.36 | $1,478.94 | $1,487.57 | $1,496.25 | $1,504.97 | $1,513.75 | $1,522.58 | $1,531.46 | $1,540.40 | $1,549.38 | $1,558.42 | $1,567.51 | $1,576.66 | $1,585.85 | $1,595.10 | $1,604.41 | $1,613.77 | $1,623.18 | $1,632.65 | $1,642.17 | $1,651.75 | $1,661.39 | $1,671.08 | $1,680.83 | $1,690.63 | $1,700.49 | $1,710.41 | $1,720.39 | $1,730.43 | $1,740.52 | $1,750.67 | $1,760.89 | $1,771.16 | $1,781.49 | $1,791.88 | $1,802.34 | $1,812.85 | $1,823.42 | $1,834.06 | $1,844.76 | $1,855.52 | $1,866.34 | $1,877.23 | $1,888.18 | $1,899.20 | $1,910.27 | $1,921.42 | $1,932.63 | $1,943.90 | $1,955.24 | $1,966.64 | $1,978.12 | $1,989.66 | $2,001.26 | $2,012.94 | $2,024.68 | $2,036.49 | $2,048.37 | $2,060.32 | $2,072.34 | $2,084.42 | $2,096.58 | $2,108.81 | $2,121.11 | $2,133.49 | $2,145.93 | $2,158.45 | $2,171.04 | $2,183.71 | $2,196.45 | $2,209.26 | $2,222.15 | $2,235.11 | $2,248.15 | $2,261.26 | $2,274.45 | $2,287.72 | $2,301.06 | $2,314.49 | $2,327.99 | $2,341.57 | $2,355.23 | $2,368.97 | $2,382.78 | $2,396.68 | $2,410.66 | $2,424.73 | $2,438.87 | $2,453.10 | $2,467.41 | $2,481.80 | $2,496.28 | $2,510.84 | $2,525.49 | $2,540.22 | $2,555.04 | $2,569.94 | $2,584.93 | $2,600.01 | $2,615.18 | $2,630.43 | $2,645.78 |

| Interest | $2,333.33 | $2,331.42 | $2,329.50 | $2,327.56 | $2,325.62 | $2,323.66 | $2,321.69 | $2,319.71 | $2,317.72 | $2,315.71 | $2,313.70 | $2,311.67 | $2,309.63 | $2,307.58 | $2,305.52 | $2,303.44 | $2,301.36 | $2,299.26 | $2,297.14 | $2,295.02 | $2,292.89 | $2,290.74 | $2,288.58 | $2,286.40 | $2,284.22 | $2,282.02 | $2,279.80 | $2,277.58 | $2,275.34 | $2,273.09 | $2,270.83 | $2,268.55 | $2,266.26 | $2,263.96 | $2,261.64 | $2,259.31 | $2,256.96 | $2,254.60 | $2,252.23 | $2,249.85 | $2,247.45 | $2,245.03 | $2,242.61 | $2,240.16 | $2,237.71 | $2,235.24 | $2,232.75 | $2,230.25 | $2,227.74 | $2,225.21 | $2,222.67 | $2,220.11 | $2,217.54 | $2,214.95 | $2,212.34 | $2,209.73 | $2,207.09 | $2,204.44 | $2,201.78 | $2,199.10 | $2,196.40 | $2,193.69 | $2,190.97 | $2,188.22 | $2,185.46 | $2,182.69 | $2,179.90 | $2,177.09 | $2,174.26 | $2,171.42 | $2,168.57 | $2,165.69 | $2,162.80 | $2,159.90 | $2,156.97 | $2,154.03 | $2,151.07 | $2,148.10 | $2,145.10 | $2,142.09 | $2,139.06 | $2,136.02 | $2,132.95 | $2,129.87 | $2,126.77 | $2,123.66 | $2,120.52 | $2,117.37 | $2,114.19 | $2,111.00 | $2,107.79 | $2,104.56 | $2,101.32 | $2,098.05 | $2,094.77 | $2,091.46 | $2,088.14 | $2,084.80 | $2,081.43 | $2,078.05 | $2,074.65 | $2,071.23 | $2,067.79 | $2,064.32 | $2,060.84 | $2,057.34 | $2,053.82 | $2,050.27 | $2,046.71 | $2,043.13 | $2,039.52 | $2,035.89 | $2,032.25 | $2,028.58 | $2,024.89 | $2,021.18 | $2,017.44 | $2,013.69 | $2,009.91 | $2,006.11 | $2,002.29 | $1,998.45 | $1,994.58 | $1,990.69 | $1,986.78 | $1,982.84 | $1,978.89 | $1,974.91 | $1,970.90 | $1,966.88 | $1,962.83 | $1,958.75 | $1,954.66 | $1,950.53 | $1,946.39 | $1,942.22 | $1,938.02 | $1,933.81 | $1,929.56 | $1,925.29 | $1,921.00 | $1,916.68 | $1,912.34 | $1,907.97 | $1,903.58 | $1,899.16 | $1,894.71 | $1,890.24 | $1,885.75 | $1,881.22 | $1,876.67 | $1,872.10 | $1,867.49 | $1,862.86 | $1,858.21 | $1,853.52 | $1,848.81 | $1,844.07 | $1,839.30 | $1,834.51 | $1,829.69 | $1,824.84 | $1,819.96 | $1,815.05 | $1,810.11 | $1,805.15 | $1,800.16 | $1,795.13 | $1,790.08 | $1,785.00 | $1,779.89 | $1,774.75 | $1,769.58 | $1,764.37 | $1,759.14 | $1,753.88 | $1,748.59 | $1,743.26 | $1,737.91 | $1,732.52 | $1,727.11 | $1,721.66 | $1,716.18 | $1,710.66 | $1,705.12 | $1,699.54 | $1,693.93 | $1,688.29 | $1,682.61 | $1,676.91 | $1,671.16 | $1,665.39 | $1,659.58 | $1,653.74 | $1,647.86 | $1,641.95 | $1,636.00 | $1,630.02 | $1,624.01 | $1,617.96 | $1,611.87 | $1,605.75 | $1,599.59 | $1,593.40 | $1,587.17 | $1,580.91 | $1,574.61 | $1,568.27 | $1,561.89 | $1,555.48 | $1,549.03 | $1,542.54 | $1,536.02 | $1,529.45 | $1,522.85 | $1,516.21 | $1,509.53 | $1,502.81 | $1,496.05 | $1,489.26 | $1,482.42 | $1,475.55 | $1,468.63 | $1,461.67 | $1,454.68 | $1,447.64 | $1,440.56 | $1,433.44 | $1,426.28 | $1,419.07 | $1,411.83 | $1,404.54 | $1,397.21 | $1,389.83 | $1,382.42 | $1,374.96 | $1,367.45 | $1,359.91 | $1,352.32 | $1,344.68 | $1,337.00 | $1,329.28 | $1,321.51 | $1,313.69 | $1,305.83 | $1,297.93 | $1,289.97 | $1,281.97 | $1,273.93 | $1,265.84 | $1,257.70 | $1,249.51 | $1,241.27 | $1,232.99 | $1,224.66 | $1,216.28 | $1,207.85 | $1,199.37 | $1,190.85 | $1,182.27 | $1,173.64 | $1,164.96 | $1,156.24 | $1,147.46 | $1,138.63 | $1,129.75 | $1,120.81 | $1,111.83 | $1,102.79 | $1,093.70 | $1,084.55 | $1,075.36 | $1,066.11 | $1,056.80 | $1,047.44 | $1,038.03 | $1,028.56 | $1,019.04 | $1,009.46 | $999.82 | $990.13 | $980.38 | $970.58 | $960.72 | $950.80 | $940.82 | $930.78 | $920.69 | $910.54 | $900.32 | $890.05 | $879.72 | $869.33 | $858.87 | $848.36 | $837.79 | $827.15 | $816.45 | $805.69 | $794.87 | $783.98 | $773.03 | $762.01 | $750.94 | $739.79 | $728.58 | $717.31 | $705.97 | $694.57 | $683.09 | $671.55 | $659.95 | $648.27 | $636.53 | $624.72 | $612.84 | $600.89 | $588.87 | $576.79 | $564.63 | $552.40 | $540.10 | $527.72 | $515.28 | $502.76 | $490.17 | $477.50 | $464.76 | $451.95 | $439.06 | $426.10 | $413.06 | $399.95 | $386.76 | $373.49 | $360.15 | $346.72 | $333.22 | $319.64 | $305.98 | $292.24 | $278.43 | $264.53 | $250.55 | $236.48 | $222.34 | $208.11 | $193.80 | $179.41 | $164.93 | $150.37 | $135.72 | $120.99 | $106.17 | $91.27 | $76.28 | $61.20 | $46.03 | $30.78 | $15.43 |

| Extra Payment | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| End Balance | $399,672.12 | $399,342.33 | $399,010.62 | $398,676.97 | $398,341.38 | $398,003.83 | $397,664.31 | $397,322.80 | $396,979.31 | $396,633.81 | $396,286.30 | $395,936.76 | $395,585.18 | $395,231.55 | $394,875.86 | $394,518.09 | $394,158.24 | $393,796.28 | $393,432.22 | $393,066.03 | $392,697.71 | $392,327.23 | $391,954.60 | $391,579.79 | $391,202.79 | $390,823.60 | $390,442.20 | $390,058.57 | $389,672.70 | $389,284.58 | $388,894.19 | $388,501.53 | $388,106.58 | $387,709.33 | $387,309.76 | $386,907.85 | $386,503.60 | $386,097.00 | $385,688.02 | $385,276.66 | $384,862.90 | $384,446.72 | $384,028.12 | $383,607.07 | $383,183.57 | $382,757.59 | $382,329.14 | $381,898.18 | $381,464.71 | $381,028.71 | $380,590.17 | $380,149.07 | $379,705.39 | $379,259.13 | $378,810.27 | $378,358.78 | $377,904.67 | $377,447.90 | $376,988.47 | $376,526.36 | $376,061.55 | $375,594.04 | $375,123.79 | $374,650.80 | $374,175.06 | $373,696.53 | $373,215.22 | $372,731.10 | $372,244.15 | $371,754.37 | $371,261.73 | $370,766.21 | $370,267.80 | $369,766.49 | $369,262.25 | $368,755.07 | $368,244.93 | $367,731.81 | $367,215.71 | $366,696.59 | $366,174.44 | $365,649.25 | $365,120.99 | $364,589.66 | $364,055.22 | $363,517.66 | $362,976.97 | $362,433.13 | $361,886.11 | $361,335.91 | $360,782.49 | $360,225.84 | $359,665.95 | $359,102.79 | $358,536.35 | $357,966.60 | $357,393.53 | $356,817.11 | $356,237.34 | $355,654.18 | $355,067.62 | $354,477.64 | $353,884.21 | $353,287.33 | $352,686.96 | $352,083.09 | $351,475.70 | $350,864.76 | $350,250.26 | $349,632.18 | $349,010.49 | $348,385.18 | $347,756.21 | $347,123.58 | $346,487.26 | $345,847.22 | $345,203.46 | $344,555.93 | $343,904.63 | $343,249.53 | $342,590.61 | $341,927.85 | $341,261.22 | $340,590.70 | $339,916.27 | $339,237.90 | $338,555.58 | $337,869.28 | $337,178.97 | $336,484.64 | $335,786.26 | $335,083.80 | $334,377.24 | $333,666.57 | $332,951.75 | $332,232.75 | $331,509.57 | $330,782.17 | $330,050.52 | $329,314.60 | $328,574.39 | $327,829.87 | $327,081.00 | $326,327.76 | $325,570.13 | $324,808.08 | $324,041.58 | $323,270.62 | $322,495.15 | $321,715.16 | $320,930.62 | $320,141.51 | $319,347.79 | $318,549.44 | $317,746.44 | $316,938.75 | $316,126.35 | $315,309.21 | $314,487.30 | $313,660.60 | $312,829.08 | $311,992.71 | $311,151.45 | $310,305.29 | $309,454.20 | $308,598.14 | $307,737.08 | $306,871.01 | $305,999.88 | $305,123.67 | $304,242.34 | $303,355.88 | $302,464.25 | $301,567.41 | $300,665.35 | $299,758.02 | $298,845.40 | $297,927.45 | $297,004.15 | $296,075.46 | $295,141.36 | $294,201.81 | $293,256.78 | $292,306.23 | $291,350.14 | $290,388.47 | $289,421.20 | $288,448.28 | $287,469.68 | $286,485.38 | $285,495.33 | $284,499.51 | $283,497.88 | $282,490.41 | $281,477.06 | $280,457.80 | $279,432.59 | $278,401.41 | $277,364.21 | $276,320.95 | $275,271.62 | $274,216.16 | $273,154.54 | $272,086.73 | $271,012.70 | $269,932.39 | $268,845.79 | $267,752.85 | $266,653.53 | $265,547.80 | $264,435.62 | $263,316.95 | $262,191.75 | $261,059.99 | $259,921.63 | $258,776.63 | $257,624.95 | $256,466.56 | $255,301.40 | $254,129.45 | $252,950.66 | $251,765.00 | $250,572.42 | $249,372.88 | $248,166.34 | $246,952.77 | $245,732.12 | $244,504.35 | $243,269.41 | $242,027.27 | $240,777.89 | $239,521.22 | $238,257.21 | $236,985.84 | $235,707.04 | $234,420.79 | $233,127.04 | $231,825.73 | $230,516.84 | $229,200.31 | $227,876.11 | $226,544.17 | $225,204.47 | $223,856.95 | $222,501.58 | $221,138.29 | $219,767.05 | $218,387.82 | $217,000.54 | $215,605.16 | $214,201.65 | $212,789.95 | $211,370.02 | $209,941.80 | $208,505.25 | $207,060.32 | $205,606.96 | $204,145.12 | $202,674.76 | $201,195.82 | $199,708.25 | $198,212.01 | $196,707.03 | $195,193.28 | $193,670.70 | $192,139.24 | $190,598.84 | $189,049.45 | $187,491.03 | $185,923.52 | $184,346.86 | $182,761.01 | $181,165.91 | $179,561.50 | $177,947.73 | $176,324.55 | $174,691.90 | $173,049.72 | $171,397.97 | $169,736.58 | $168,065.50 | $166,384.67 | $164,694.04 | $162,993.55 | $161,283.13 | $159,562.74 | $157,832.31 | $156,091.79 | $154,341.12 | $152,580.23 | $150,809.07 | $149,027.58 | $147,235.70 | $145,433.36 | $143,620.52 | $141,797.09 | $139,963.03 | $138,118.27 | $136,262.75 | $134,396.41 | $132,519.18 | $130,631.00 | $128,731.80 | $126,821.53 | $124,900.11 | $122,967.48 | $121,023.58 | $119,068.34 | $117,101.70 | $115,123.58 | $113,133.93 | $111,132.66 | $109,119.73 | $107,095.05 | $105,058.56 | $103,010.19 | $100,949.88 | $98,877.54 | $96,793.12 | $94,696.53 | $92,587.72 | $90,466.60 | $88,333.12 | $86,187.18 | $84,028.73 | $81,857.69 | $79,673.98 | $77,477.54 | $75,268.28 | $73,046.13 | $70,811.03 | $68,562.88 | $66,301.62 | $64,027.17 | $61,739.45 | $59,438.39 | $57,123.90 | $54,795.92 | $52,454.35 | $50,099.12 | $47,730.16 | $45,347.37 | $42,950.69 | $40,540.03 | $38,115.30 | $35,676.43 | $33,223.33 | $30,755.92 | $28,274.12 | $25,777.85 | $23,267.01 | $20,741.52 | $18,201.30 | $15,646.27 | $13,076.33 | $10,491.40 | $7,891.39 | $5,276.21 | $2,645.78 | $0.00 |

Most major banks don’t offer 40-year mortgages because they aren’t qualified mortgages, meaning they don’t follow a set of rules created by the Consumer Financial Protection Bureau (CFPB). They also aren’t conforming loans, which means that they don’t follow Fannie Mae and Freddie Mac’s rules for conventional loans.

How a 40-year mortgage works

The monthly payments on a 40-year mortgage are typically lower than shorter-term loans. However, you’ll end up paying more in interest because you’re making payments over a longer period. In addition, 40-year fixed mortgage interest rates are likely to be higher than those on 15- and 30-year loans.

Similar to home loans with more common payment terms, the structure of a 40-year mortgage can vary by lender and loan program. Here are a few ways a 40-year loan could work:

- A 40-year fixed-rate mortgage, This option is pretty straightforward. With a fixed-rate mortgage, the monthly principal and interest payments remain the same for the entire loan term. A 40-year mortgage extends the mortgage term by 10 years when compared with a traditional 30-year mortgage.

- A 40-year variable-rate mortgage, Borrowers can get an adjustable-rate mortgage (ARM) with a 40-year term. An ARM has a fixed rate for a set time (for example, five, seven or 10 years) and then adjusts periodically for the remaining loan term. Check current ARM rates.

- A 40-year interest-only mortgage, With an interest-only loan, mortgage payments are very low in the beginning because they’re only covering the interest. But, after a specific amount of time, they convert to principal and interest payments.

- A 40-year mortgage with a balloon payment, With a balloon mortgage, you benefit from lower payments during much of the loan term. However, you’ll have to make a large, lump-sum payment when the mortgage comes due.

Pros and cons of a 40-year mortgage

Pros

- Lower monthly payments. The payment on a 40-year mortgage is more affordable than a 30-year mortgage with the same loan amount.

- Increased buying power. The extended payment term and lower monthly payments of a 40-year mortgage may allow some buyers to purchase more expensive homes.

- More flexibility. Loans with an initial period in which you only pay interest can allow a little more flexibility at the beginning of your loan term. This can be a nice feature if you find yourself grappling with the high costs of moving into, furnishing or fixing up a new home.

Cons

- Higher interest rates. Mortgages with longer terms can have higher interest rates than loans with shorter terms.

- Harder to find. Not all lenders offer 40-year home loans because they’re not a mainstream mortgage product.

- Can be risky. If the 40-year loan has unusual components, such as an interest-only period, negative amortization or a balloon payment, you could be taking on significant risk.

- Can negatively affect credit. A mortgage modification can affect your credit.

- Equity builds slowly. With a 40-year mortgage you’ll build equity at a slower pace because the loan term is drawn out.

- Higher total loan costs. A 40-year mortgage will have a higher total cost than shorter-term mortgages.

How to get a 40-year mortgage

How to get a 40-year purchase loan

The process to get a 40-year mortgage at the time of purchase (not as a loan modification) is very similar to what you’d do to get a 30- or 15-year loan. But there are a few differences to keep in mind:

- The minimum requirements to qualify vary. Nonqualified mortgages (Non-QM) don’t have the same minimum mortgage requirements as traditional loans and they can vary from lender to lender. Non-QM lenders have wide leeway to decide what minimum credit scores, loan-to-value (LTV) ratios and debt-to-income (DTI) ratios they will accept.

- There are limited lenders you can choose from. Because 40-year purchase loans aren’t widely available, you may need to do some extra research or go through a mortgage broker to find a lender. But before settling on one, make sure you’re working with a reputable lender. Most legitimate lenders are listed in the NMLS loan originator database.

Read more about how to apply for a home loan.

40-year mortgage lenders

Most of the big, “household name” lenders don’t offer 40-year purchase loans to borrowers who aren’t in need of a loan modification. But here are some lenders that do offer a 40-year option:

| Lender | Available loan features | LendingTree rating | |

|---|---|---|---|

| Jumbo | |||

| Fixed rate | |||

| Interest-only period | |||

| ARM | No rating available | No review available |

It’s also worth asking a bank or lender you already have a relationship with if they’ll offer a 40-year loan. If they don’t, there are multiple places you can look:

- Mortgage brokers. Some mortgage brokers work with lenders that specialize in 40-year loans and other nonqualifying mortgages.

- Online and local lenders. You may have success finding an online lender — or a small local or regional bank — that offers 40-year mortgages.

- Credit unions. Some credit unions have more flexible lending terms and may offer 40-year mortgages.

- Housing counselors. Your state or local HUD office can point you to a housing counselor and other resources. Additionally, the CFPB has a database of housing counselors.

Read our list of the best mortgage lenders.

How to get a 40-year loan modification

If you’re struggling to make your mortgage payments and hoping a 40-year mortgage could help ease the financial strain, the first thing you should do is contact your lender. If you’re in mortgage default, your lender is required by law to work with you to find a solution.

If you want to pursue a mortgage loan modification, here’s what you need to know:

- You have to apply. You’ll need to put in an application with your lender and show documentation of your financial hardship. You may also need to write a “hardship letter,” which explains your situation to the lender in your own words.

- You may have to miss a mortgage payment. In many cases, you can’t qualify for a loan modification unless you’ve missed at least one payment. Just one late payment will harm your credit and a missed payment will stay on your credit report for several years. It’s worthwhile to consider whether the price of entry to a loan modification program is more damaging than the benefits it offers you.

- You could have a trial period. Some lenders require you to make on-time trial payments for several months before they’ll approve you for a permanent loan modification.

40-year mortgage loan modification options

If you’re looking for a loan modification, you have it a bit easier: You can get a loan modification on any of the following loan types:

- A conventional loan. Fannie Mae and Freddie Mac’s Flex Modification programs are popular options that could reduce your monthly payments by 20%. To qualify you have to be at least 60 days behind on your payments or be able to show that you will be within the next 90 days.

- FHA loan. Homeowners with a loan backed by the Federal Housing Administration (FHA) could be eligible for a 40-year loan modification, as long as their loan is at least 90 days delinquent.

- USDA loan. If your current loan is backed by the U.S. Department of Agriculture (USDA), you may be able to get a 40-year loan modification, but your lender is required to try other options before it can offer you a 40-year loan.

How does a 40-year mortgage compare to a 30-year mortgage?

A 40-year mortgage can lower your monthly payments, but it’ll also greatly increase how much you’ll pay in interest.

To see what this could look like in the real world, choose the example below that applies to your situation. If you’re only interested in how a longer loan term can affect your ability to build home equity, head to the final example.

Below, we compare two hypothetical loan options for a $430,000 home with a 13% down payment. As a best-case scenario, we’ll give both loans the same interest rate.

| Loan amount | Interest rate | Monthly payment | Total cost | |

|---|---|---|---|---|

| 30-year mortgage | $374,100.00 | 7.79% | $2,690.45 | $968,560.64 |

| 40-year mortgage | $3,74,100.00 | 7.79% | $2,542.39 | $1,220,346.21 |

Takeaways: While you’d save $148.06 per month on your mortgage payments by going with a 40-year loan, you would end up spending nearly $251,800 more for the privilege of doing so.

Here we look at both 30- and 40-year loan options for a home with $300,000 still owed to the lender. In our example, there is no difference in the interest rate because a loan modification doesn’t alter the interest rate of the existing loan. The monthly payment amounts reflect principal and interest only.

| Loan amount | Interest rate | Monthly payment | Total cost | |

|---|---|---|---|---|

| 30-year mortgage | $300,000.00 | 6.27% | $1,851.06 | $666,380.04 |

| 40-year mortgage | $300,000.00 | 6.27% | $1,707.45 | $819,576.04 |

Takeaways: In this example, you would have paid $153,196 more in interest by choosing to modify your loan. But, on the other hand, if this was the only way to prevent foreclosure, it may very well have been worth it.

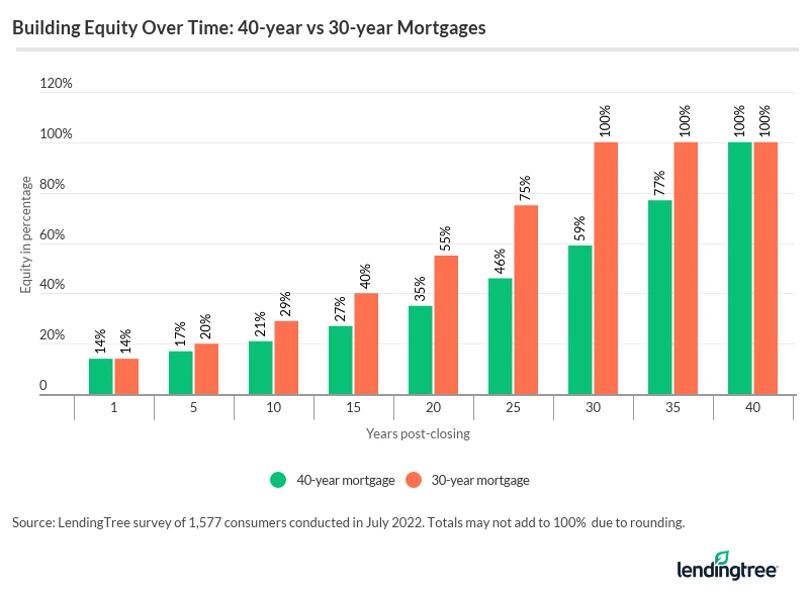

It’s worth taking a look at how much more slowly you’ll build equity with a 40-year loan, because it can affect your ability to get other loans or sell your home in the future. The chart below compares the equity-building timelines for 30- and 40-year mortgages.

As you can see, with a 30-year loan, you would build 20% equity in just five years, but with a 40-year loan, you’d have to wait nearly nine years to build that much equity. And depending on other terms of the loan (e.g., an interest-only period), it could take even longer to build equity.

Alternatives to a 40-year mortgage

Before committing to a 40-year mortgage, be sure you’re familiar with your other options:

- Mortgage points. If your primary goal is to have smaller monthly payments, prepaying interest by purchasing points could have the same effect.

- A 30-year conventional loan. Depending on the loan amount and interest rate, the payment on a 30-year conventional loan may not be much higher than a 40-year mortgage. You can also increase the affordability of a 30-year mortgage by buying a slightly less expensive house.

- FHA loan. FHA loans have low interest rates, low down payment requirements and lenient credit requirements.

- USDA loans. Mortgages guaranteed by the U.S. Department of Agriculture (USDA) may also provide affordable payments. USDA loans have low interest rates and no down payment requirements but are only available to low- and moderate-income borrowers in designated rural areas.

- VA loans. Eligible veterans, military personnel and qualified spouses may find a loan backed by the VA to be an affordable option. VA loans have no down payment or mortgage insurance requirements.

- ARMs. If you’re able to sell the house before the initial fixed-rate period ends, an ARM may be a good option for you.

Alternatives to a 40-year loan modification

- Refinancing. If you’re having trouble keeping up with your mortgage payments, you don’t necessarily have to alter the loan term. You may be able to refinance to get a lower interest rate instead, which can bring your monthly payments down even if you retain the same repayment term.

- Forbearance. If you’re having temporary financial problems, forbearance can help you hit the “pause” button on repaying your mortgage while you get back on your feet. It’s an agreement in which your lender allows you to make reduced payments or stop making payments altogether — but you will have to pay all the money back eventually by making extra payments, higher payments or a lump sum payment.

- Deed-in-lieu. A deed-in-lieu of foreclosure is when you voluntarily give your house to your lender; in return, you get to avoid going through the foreclosure process. You may also get additional help with costs related to losing your home.

- Short sale. A short sale is when you sell your home for less than you owe on your mortgage. You give the lender the proceeds from the sale, but you typically won’t have to pay any amount you owed that isn’t covered by the sale.

Don’t forget: A HUD-approved housing counselor can evaluate your situation and help you understand all of the options

Frequently asked questions

A 40-year mortgage can be a good idea, depending on your situation. Since the loan term spans 40 years, the payments can be more affordable than loans with shorter terms. However, because of the higher interest rate and extended repayment period, 40-year home loans typically have higher total loan costs.

Some lenders’ 40-year mortgage rates may be just a fraction of a percentage point higher than the rate on 30-year loans, while other lenders may impose a significantly higher rate. The exact rate depends on multiple factors, including the loan structure, your credit score and your down payment.

You might be able to refinance to a 40-year mortgage, but it may take some searching — most lenders don’t offer 40-year loan terms. If you already have a 40-year mortgage, you can refinance to a 30-year mortgage later if your finances improve.

View mortgage loan offers from up to 5 lenders in minutes