What’s the Purpose of a Loan? Common Reasons to Get a Personal Loan

- You can use a loan to pay for almost anything, but some purposes are better than others.

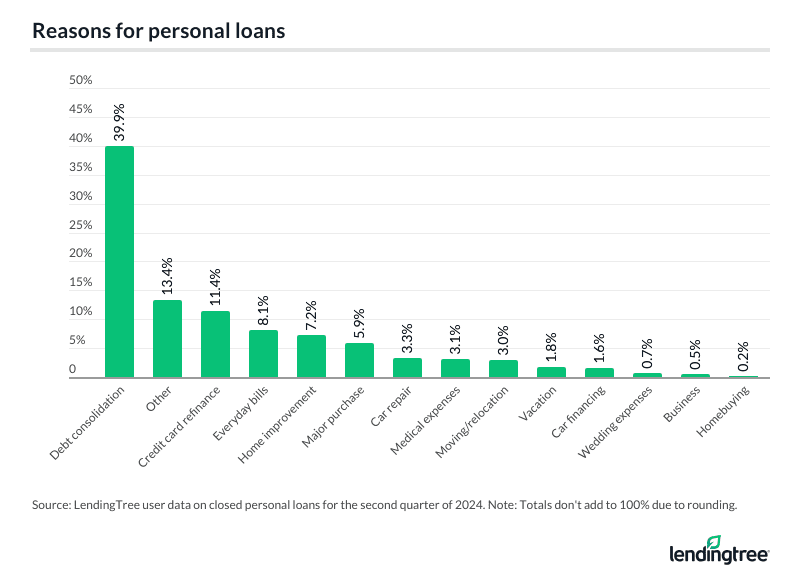

- Most people borrow money to consolidate debt. Bills, home improvement projects and major expenses are other popular reasons to get a loan.

- You should only get a loan for necessary expenses and when you can afford the monthly payments.

Top reasons for personal loans

You can get a personal loan for any purpose — almost. So what are personal loans used for? Here are the most common reasons to get a loan according to a recent LendingTree study:

Most borrowers take out loans to consolidate debt, but loans can also cover a variety of other expenses like bills and home improvement projects. Here’s what you need to know about the most popular loan purposes.

Debt consolidation

The most popular loan purpose is debt consolidation, or using a loan to pay off several smaller debts. Debt consolidation can make good financial sense (or cents) — you can save up to $3,000 by consolidating $10,000 worth of debt.

See how much you can save with a consolidation loan by using our debt consolidation calculator.

Credit card refinancing

Credit card refinancing is just another form of debt consolidation where you use a loan to pay off several credit card debts. You can save money and boost your credit score by more than 80 points by using a loan to refinance your credit card debt.

Learn more about using a loan to pay off your credit cards.

Bills

Rising costs are putting pressure on households — 76% of Americans agree that inflation has made it more difficult to pay the bills. So, it’s no surprise that one of the most common reasons to get a personal loan is to pay off everyday bills. If you’re having trouble making ends meet, read up on how to save money to keep your head above water.

Learn more about prioritizing what bills to pay first.

Home improvement

Home improvement loans can help you bridge the gap between your bank account and your dream home upgrade. The most popular home improvement projects are small upgrades like interior painting, landscaping and upgrading a bathroom, but you can also take out a large fixer-upper loan.

Learn more about eco-friendly home improvements that can lower the cost of your utility bill.

Major purchases

According to our study, 5.9% of borrowers take out a loan to cover a major purchase, but not all large purchases are created equal. Taking out an emergency loan to replace an essential appliance, like a broken fridge, is a better use of your money than borrowing to buy the latest iPhone when yours is still working.

Learn more about using a buy now, pay later app to spread out payments interest-free.

When to consider loans

You qualify for low interest rates

Unless you can manage to borrow money interest-free with a family loan or a 0% APR credit card, it costs money to borrow money. That said, the best personal loans come with rates as low as 5.99%, which can make your monthly payments affordable.

Market rates are low

When the Fed cuts rates, personal loan interest rates tend to follow suit. A percentage point or two can mean the difference between hundreds of dollars in interest payments, so try to time your loan with rate cuts if you can.

Calculate the total cost of borrowing with a personal loan calculator.

You’ve just improved your credit

If you’ve just boosted your credit, it could be a good time to consider getting a loan. It’s no secret that borrowers with excellent credit qualify for lower interest rates, meaning they can save money on the cost of borrowing.

In fact, raising your score from “fair” to “very good” could save you over $22,000 across several forms of debt, including loans, credit cards and mortgages.

Don’t know your score? Check your credit score for free with LendingTree Spring. It won’t impact your score.

When to avoid personal loans

High monthly payments

If the monthly payments are too big for your budget, hold off on taking out a loan if at all possible. If you can’t afford your monthly payments, you’re more likely to skip payments and default on your loan. Your credit will take a hit, and lenders can send your account to collections.

Avoid high interest rates from payday lenders at all costs. These loans trap borrowers in a cycle of debt, meaning they often need to take out a new loan to pay off the old one.

Nonessential purchases

Whenever possible, avoid taking on debt for things you don’t absolutely need. It’s tempting to keep up with the Joneses by buying a new capsule wardrobe or updated gadget, but you could face buyer’s remorse in addition to those monthly payments — 41% of Americans regret spending more than they could afford on new tech.

Small, ongoing expenses

Consider paying small, regular expenses like a utility bill or Netflix subscription with a credit card rather than a personal loan, especially if you can afford to pay them off before your monthly statement is due. If you pay your bill in full every month and avoid carrying a balance, you’re essentially getting an interest-free loan every month — and building your credit in the meantime.

Earn points or cash back with your everyday spending with a rewards credit card.

Tuition and business expenses

Many personal loan companies don’t allow you to use the loan money for your business or education costs. Consider small business loans and student loans to cover the cost of your business expenses or college tuition.

Should I get a personal loan?

You should only get a personal loan if you meet these four criteria:

- You can afford it. Before you sign on the dotted line, make a quick budget to pay off debt. If you can afford the monthly payments, move on to the next step. If not, consider ways to make extra cash. You can even ask for a raise — 82% of full-time workers who asked got one.

- It’s a necessary expense. Ask yourself if the debt is absolutely necessary. You’ll likely be paying off the debt over several years, so make sure that the reason behind your loan is worth it to you.

- It’s the cheapest alternative. Personal loans aren’t the only way to borrow money. Consider loan alternatives before you commit to borrowing from a personal loan lender.

- You’ve shopped around. The rates you qualify for can vary dramatically between lenders, so be sure to compare offers from several lenders before you commit to a loan. You can save over $3,000 just by getting six or more offers. LendingTree makes the process easy — you’ll get offers from up to five of our trusted lending partners by filling out a single form.

Frequently asked questions

Personal loans, otherwise known as installment loans, are a type of debt. You borrow a lump sum of money from a lender that you then pay back in monthly installments. Personal loans can be secured with collateral or unsecured, meaning they’re backed by your promise to pay them back.

Personal loans aren’t always bad. How the loan affects your finances determines if it’s good or bad.

Taking out a loan with monthly payments you can afford in order to cover a necessary expense could be a smart financial move. But it’s rarely a good idea to borrow money for something you don’t need, especially when you can’t afford the monthly payments.

The best reason for a personal loan is debt consolidation, since you’re not putting more strain on your finances by taking on additional debt. Plus, you could save money on interest with debt consolidation, putting you in a better financial position in the long run.

Yes, you need a reason for a personal loan. Lenders typically ask how you plan to use your loan during the loan application process.

Yes. The reason for your personal loan matters because it could determine the loan rates and the amount you can borrow. Some lenders allow you to borrow more (and at lower rates) for certain loan purposes.

Get personal loan offers from up to 5 lenders in minutes