What Is Mortgage Insurance? Types, Costs and Money-Saving Strategies

Mortgage insurance protects your lender if you default on your loan, which is why it’s typically required when your down payment is less than 20%. But here’s what many homebuyers don’t know: there are proven strategies to avoid it entirely, reduce the cost or eliminate it faster.

Understanding your mortgage insurance options can save you thousands of dollars over the life of your mortgage, and we’ll show you how.

- You can avoid paying for mortgage insurance on a conventional loan by making at least a 20% down payment, or by taking out a piggyback loan.

- You can’t avoid paying for mortgage insurance on FHA loans, but they’re still competitive options compared to conventional loans, especially for anyone with a credit score below 760.

- With conventional loans, you can reduce your mortgage insurance costs by improving your credit score or paying off debt. FHA loans don’t factor in these variables.

How does mortgage insurance work?

Mortgage insurance will pay your lender a certain amount of money if you’re unable to repay your mortgage loan. This reduces financial risk for lenders, which allows them to offer mortgages with more relaxed requirements.

Different types of mortgage insurance can work slightly differently. For instance, some are paid upfront while others are added to your monthly mortgage payments.

Types of mortgage insurance

| Loan program | Mortgage insurance type | Description |

|---|---|---|

| Conventional loans | Private mortgage insurance (PMI) | Required if you make less than a 20% down payment |

| FHA loans | Upfront mortgage insurance premium (UFMIP) | Charged as a lump sum and typically financed into your loan balance, but can be paid in cash |

| Annual mortgage insurance premium (MIP) | Charged yearly, divided by 12 and added to your monthly payments |

Do I need mortgage insurance?

Here’s a quick guide to when mortgage insurance is required:

-

Conventional loans:

- 20% down payment or more: no mortgage insurance needed

- Less than 20% down: PMI required (monthly payments)

-

FHA loans:

- Any down payment amount: FHA mortgage insurance required

- You’ll pay two types: UFMIP (upfront) and MIP (monthly)

-

Other loan types:

- VA loans: No mortgage insurance (funding fee instead)

- USDA loans: No mortgage insurance (guarantee fee instead)

How much does mortgage insurance cost?

The cost of mortgage insurance ranges from $48 to $267 per month for a typical home purchase.

- For conventional loans you’ll pay an average of $30 to $70 per month in PMI premiums for every $100,000 you borrow. For a median-priced home in today’s market, that could come to around $114 to $267 per month.

- For FHA loans you’ll generally pay 1.75% of your loan amount for upfront FHA mortgage insurance. The annual MIP ranges between 0.15% and 0.75% of your loan amount. The premium is divided by 12 and added to your monthly payment. At today’s median home price, that could mean paying around $6,866 upfront and $48 to $239 in monthly premiums.

Get a quick estimate of PMI premiums by using LendingTree’s mortgage calculator. Just be sure to check the “include PMI” box under “advanced options.”

| Home loan program | Type of mortgage insurance | Factors that affect your premium |

|---|---|---|

| Conventional | Private mortgage insurance (PMI) |

|

| FHA | Upfront mortgage insurance premium (UFMIP) |

|

| FHA | Annual mortgage insurance premium (MIP) |

|

- Pay it monthly. Borrower paid mortgage insurance (BPMI) is the most popular option, because you can divide up the cost and add it to your monthly payments. You can do this through an escrow account or finance the cost by rolling it into your mortgage.

- Pay it upfront. You can pay your entire premium in a lump sum when you take out your loan, which allows you to avoid paying it monthly. In cases where a seller offers to pay a percentage of your closing costs, you can use the credit to pay the single premium insurance.

- Split it. PMI companies may offer “mix-and-match” choices that allow you to pay part of the PMI premium in a lump sum at closing and pay the other portion monthly.

- Let the lender pay it. Your lender may offer to pay mortgage insurance on your behalf, if you’re willing to accept a higher mortgage rate for the life of the loan.

Payment options for FHA loans

There are two ways to pay for the upfront portion of your FHA mortgage insurance:

Finance it into your loan amount. This is the most common way to pay the upfront FHA mortgage insurance premium.

Pay it in cash. You can either pay it from your own funds, get a gift for the cost or ask the seller to cover it.

However, annual FHA mortgage insurance must be paid as part of your monthly mortgage payments.

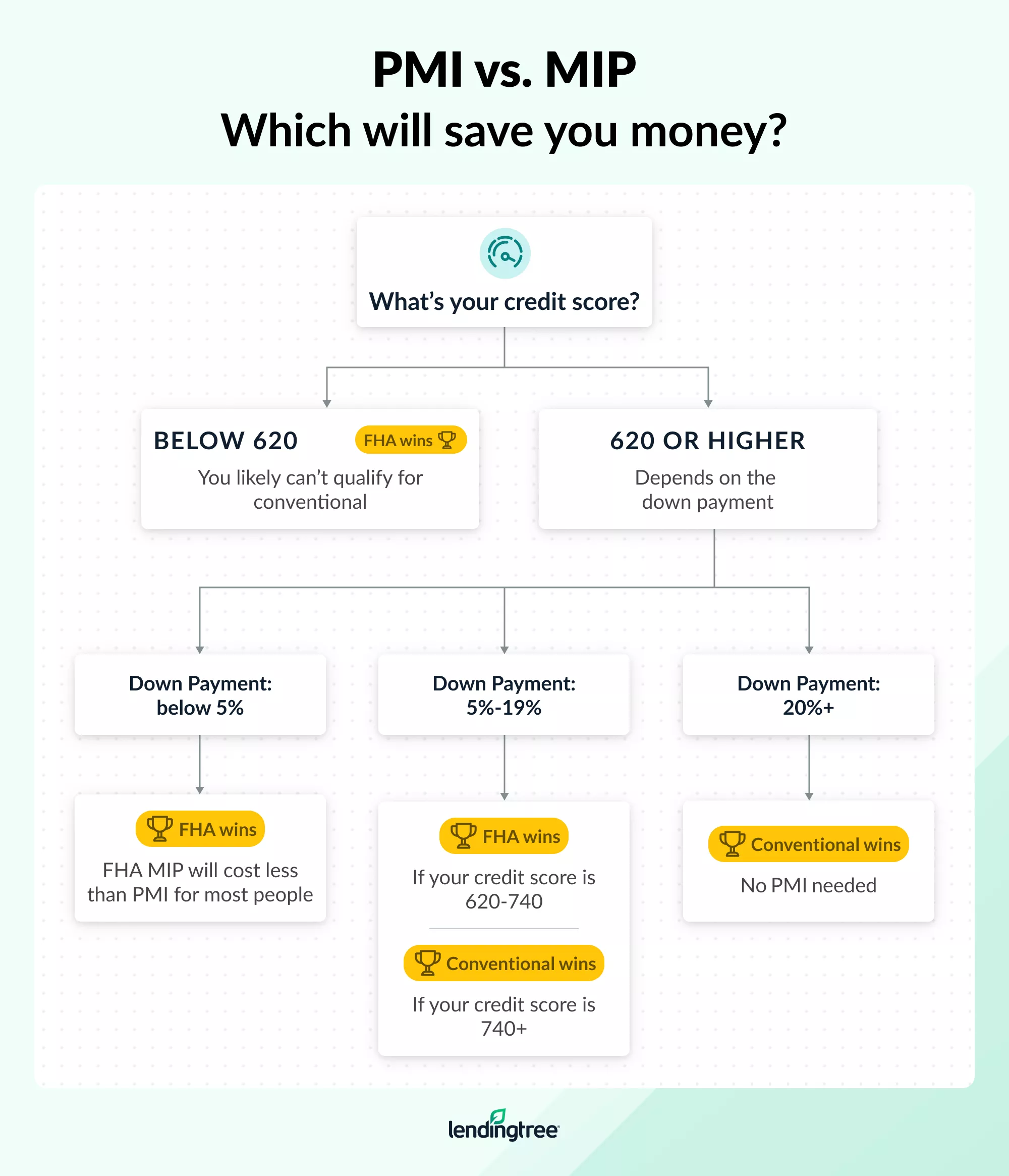

PMI vs. MIP: Which will save you money?

Although PMI and MIP essentially do the same thing — reimburse the lender for financial losses if they have to foreclose on your home — different factors determine how much each one will cost. Choosing the right loan type could save you hundreds or even thousands of dollars annually.

Money-saving decision guidelines

| Your situation | Best choice | Why you save money |

|---|---|---|

| Credit score under 620 | FHA | Conventional loans aren’t an option for credit scores below 620 |

| Credit score under 620 to 740 with a down payment under 5% | FHA | Fixed MIP usually costs less than variable PMI at these lower credit bands |

| Credit score 740+ with a down payment under 5% | Conventional | Low PMI rates plus the ability to cancel it once you reach 20% equity |

| Credit score 620 to 739 with a down payment of 5% to 19% | Compare both, but likely: FHA | You’re not in the credit band (740+) where PMI is cheapest, so you’ll likely pay more |

| Credit score 740+ with a down payment of 5% to 19% | Conventional | Significantly lower PMI rates |

| Credit score of at least 620 and 20%+ down | Conventional | No mortgage insurance required |

The cost difference can be substantial. Click through the expandable sections below to see more detail on how each factor in your financial profile can affect your mortgage insurance premiums.

PMI companies are on the hook to pay claims if you default on a loan, and they consider your credit score when estimating how likely you are to default. A low credit score and down payment will result in a much higher PMI premium.

However, credit score doesn’t play into the cost of either type of FHA mortgage insurance, making FHA loans a more cost-effective choice for homebuyers with rocky credit histories.

You’ll pay a higher PMI premium on a conventional loan if your debt-to-income (DTI) ratio is above 45%. There’s no markup for FHA loans based on your DTI ratio.

Conventional PMI is more expensive if you’re buying a manufactured home or multifamily home, but won’t affect FHA mortgage insurance premiums.

You’ll pay slightly lower PMI premiums if two (or more) people are on the loan, while FHA mortgage insurance premiums are the same no matter how many people apply.

Lenders divide your loan balance by your home price to determine your loan-to-value (LTV) ratio — the higher it is, the more mortgage insurance you pay. With a 20% down payment or more, you won’t pay any PMI. FHA mortgage insurance is required regardless of your down payment or LTV ratio.

PMI vs. MIP example: How to find the best option for you

Let’s imagine a borrower with a credit score below 740 who wants to put 3.5% down on a $300,000 home. That borrower will have a slightly lower monthly payment if they go with an FHA loan instead of a conventional loan. But, if that same borrower can get their credit score above 760, they’ll save money by going with a conventional loan instead.

Note: For each credit score range listed below, the cheaper monthly payment is in green, while the more expensive option is in red.

| Credit score range | Monthly payment | Monthly savings via optimal loan program choice | Annual savings via optimal loan choice | |

|---|---|---|---|---|

| FHA | Conventional | |||

| 620-639 | $1,999 | $2,249 | $250 | $3,000 |

| 640-659 | $1,999 | $2,203 | $205 | $2,460 |

| 660-679 | $1,999 | $2,184 | $185 | $2,220 |

| 680-699 | $1,999 | $2,124 | $125 | $1,500 |

| 700-719 | $1,999 | $2,078 | $79 | $948 |

| 720-739 | $1,999 | $2,056 | $57 | $684 |

| 740-759 | $1,999 | $2,027 | $28 | $336 |

| 760 + | $1,999 | $1,998 | $1 | $12 |

As the table shows, the lower a borrower’s credit score, the more they stand to save with an FHA loan — but only for borrowers with scores below 760.

Those with a 760 credit score or higher will technically save money by going with a conventional loan (but the savings isn’t significant, amounting annually to the cost of a single fast-food meal).

Mortgage insurance premiums vs. guarantee fees

There is no mortgage insurance for VA loans backed by the U.S. Department of Veterans Affairs or USDA loans guaranteed by the U.S. Department of Agriculture — and, despite that fact, you may still be eligible for a no-down-payment mortgage. But there’s a catch: These government-backed programs require guarantee fees instead.

A guarantee is a promise to pay the lender a specific amount if you default on a VA or USDA loan. And, just like with mortgage insurance, you’re required to pay a premium that makes protecting the lenders possible. In the case of VA and USDA loans, the guarantee fees also protect taxpayers from losses in the event of mortgage default.

How much do guarantee fees cost?

| Loan program | Fee name | Cost | Factors that affect the fee amount |

|---|---|---|---|

| VA | Funding fee | 0.50% to 3.30% of the loan amount |

|

| USDA | Guarantee fee |

| None (these are flat-rate fees) |

VA funding fee

Most VA borrowers must pay a funding fee that ranges from 0.50% to 3.30% of their loan amount and is charged to offset the taxpayer burden related to VA loans.

How it’s paid

The fee is typically financed into the loan amount, but you can pay the fee in cash from your own funds or ask the home seller to cover it.

USDA guarantee fee

USDA loans require two types of guarantee fees:

- A lump-sum upfront guarantee fee based on a percentage of your loan amount, which is usually rolled into your loan amount.

- An annual guarantee fee that’s divided by 12 and added to your monthly mortgage payment.

How to avoid mortgage insurance

Private mortgage insurance

- Make at least a 20% down payment. You can get a conventional mortgage without PMI by putting down 20% or more.

- Take out a piggyback loan. Rather than paying for mortgage insurance, you can take out a home equity loan or home equity line of credit (HELOC) and use the funds to push your down payment above 20%. You’ll need enough cash to cover a 10% down payment, the home equity loan or HELOC will cover another 10% and you’ll finance the remaining 80%. This strategy is called using a piggyback loan.

FHA mortgage insurance

- The only way to avoid FHA MIP and UFMIP is to choose a different loan program. It’s possible to stop paying FHA mortgage insurance premiums after 11 years, but only if you made at least a 10% down payment at closing.

VA funding fee

- Apply for a VA disability waiver. Military veterans with a service-related disability may be eligible for a funding fee exemption. Find out if you’re exempt by obtaining your VA certificate of eligibility.

USDA guarantee fee

- The only way to avoid USDA guarantee fees is to choose a different loan program — there’s no way to reduce the fee.

Tips for how to save on mortgage insurance

Conventional PMI

- Boost your credit scores. Your credit score plays a big role in your PMI costs; keeping low credit card balances and paying bills on time could mean big savings.

- Keep your DTI ratio low. A DTI ratio higher than 45% usually comes with a higher PMI premium.

- Ask the seller to pay a lump-sum PMI premium. Consider using a seller concession to make a lump-sum PMI payment. You might end up needing cash for your other costs, but you’d have a lower monthly mortgage payment.

- Avoid lender-paid mortgage insurance. Taking a higher interest rate so your lender pays your mortgage insurance upfront may keep your out-of-pocket costs low at the closing table. However, you’re stuck with the higher rate for the life of the loan.

- Check your home equity regularly. You can ask to cancel PMI once you’ve reached 20% home equity. You might have to pay for a home appraisal, but it’s worth it if home prices are booming in your neighborhood.

Curious how much money you might get with a home equity loan or HELOC? Try LendingTree’s home equity loan and HELOC calculator now.

FHA mortgage insurance

- Make at least a 5% down payment. The annual MIP is slightly lower when you make at least a 5% down payment. On a $300,000 loan, that could save you $150/year or $12.50/month.

- Choose a shorter loan term. If you can afford the payments of a 15-year mortgage term, you can reduce your monthly MIP premium by quite a bit.

- Refinance to a conventional loan as soon as you can. If you chose an FHA loan because your credit scores were low, refinance your FHA loan to a conventional mortgage as soon as your credit is in better shape.

- Ask the seller to pay the UFMIP. The FHA permits sellers to pay up to 6% of your sales price to cover FHA closing costs, including your UFMIP.

- Do an FHA streamline refinance. If you currently have an FHA loan, the FHA streamline refinance allows you to refi with reduced MIP costs.

VA funding fees

- Make a bigger down payment. A 5% to 10% down payment may save you thousands of dollars on the funding fee.

- Ask the seller to pay the funding fee. VA guidelines allow sellers to pay up to 4% of the sales price toward the buyer’s VA closing costs.

- Save your VA benefits for your dream home. In most cases the VA funding fee is 2.15% of your loan amount the first time you use it, compared to 3.30% for every use thereafter. On a $350,000 loan, that could mean savings of around $4,025 for a first-time user.

Frequently asked questions

There are three major differences between mortgage insurance and homeowners insurance:

- Mortgage insurance only protects the lender, not you.

- Mortgage insurance isn’t required if you have 20% home equity and borrow a conventional mortgage.

- Mortgage insurance is chosen by your lender or loan program — you can’t shop for it.

You’ll pay PMI until your loan is paid down to 78% of your home’s original value. However, you may be able to remove PMI sooner if you can prove you’ve built up 20% equity since purchasing your home.

Yes, if you’re buying a home with less than a 20% down payment. However, you can avoid it with a piggyback loan.

Yes. The premium can be added to your interest rate if you choose “lender-paid mortgage insurance” (LPMI). The lender pays PMI on your behalf and in exchange you accept a higher interest rate.

No. Title insurance only protects you from claims against your home — like tax liens or judgments — from prior owners. Most lenders require you to purchase a “lender’s title policy” if you’re getting a mortgage.

More commonly called mortgage life insurance, some companies may offer this type of policy that pays off your mortgage if you unexpectedly die before you can pay it in full. It’s an optional insurance product and mortgage lenders never require it.

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles