Best Companies for Cheap SR-22 Car Insurance

Progressive has the cheapest SR-22 insurance for most drivers with a major violation at $221 a month. State Farm has the cheapest SR-22s for a minor violation.

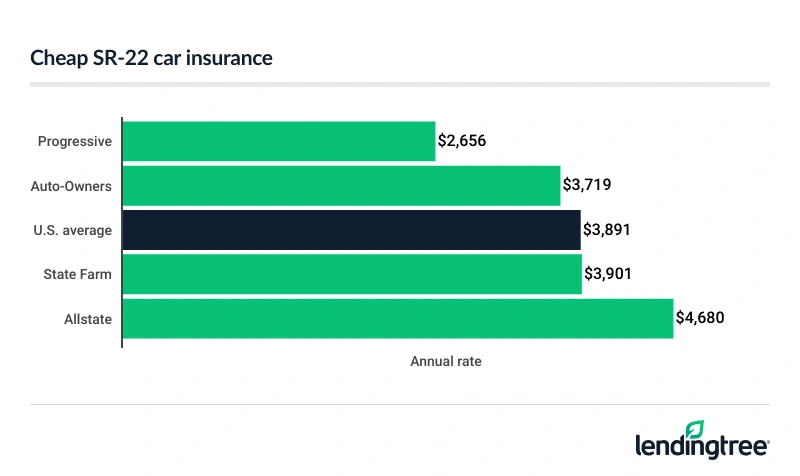

Best cheap SR-22 car insurance rates

Cheapest SR-22 insurance after a major violation

Progressive has the cheapest SR-22 car insurance for most drivers with a major violation like DUI (driving under the influence). Its full coverage

Best SR-22 rates after a major violation

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Progressive | $2,656 | |

| Auto-Owners | $3,719 | |

| State Farm | $3,901 | |

| Allstate | $4,680 | |

| Geico | $5,067 | |

| Farmers | $5,307 | |

| Nationwide | $5,332 | |

| USAA* | $2,576 |

Your actual rate depends largely on the incident that led to your SR-22 insurance requirement. Each company views driving incidents differently, and their rates vary by customer. This makes it good to compare car insurance quotes from a few different companies.

Cheap SR-22 insurance after a minor violation

State Farm has the cheapest SR-22 car insurance for most drivers with a minor violation at $146 a month. This is 7% less than the next-cheapest rate of $157 a month from Auto-Owners.

Auto-Owners has a few more coverage options than State Farm, including gap insurance

Best SR-22 rates after a minor violation

| Company | Annual rate |

|---|---|

| State Farm | $1,755 |

| Auto-Owners | $1,883 |

| Progressive | $2,728 |

| Geico | $2,763 |

| Nationwide | $3,178 |

| Allstate | $3,513 |

| Farmers | $4,589 |

| USAA* | $1,603 |

Best companies for SR-22 insurance

State Farm’s low rates and high satisfaction score from J.D. Power

Auto-Owners is the best regional company for SR-22 insurance. USAA is the best choice if you meet its military eligibility requirements.

Best SR-22 insurance

| Company | Best for | Satisfaction score | LendingTree score |

|---|---|---|---|

| State Farm | Best overall | 657 | |

| Auto-Owners | Regional company | 654 | |

| USAA | Military | 739 |

Best overall: State Farm

State Farm’s Drive Safe and Save program can help you save more money on SR-22 insurance. The program uses a smartphone app to monitor your driving. You get a 10% discount just for signing up. If you drive safely enough, you can save up to 30% each time you renew.

- Cheapest SR-22 insurance after a minor violation

- Discounts for bundling with home or renters insurance

- Safe driving app can lower your rate

- Rates after a major violation are just average

- Doesn’t offer gap insurance

Best regional company: Auto-Owners

Auto-Owners also has a better satisfaction rating than some larger companies, including Progressive and Geico.

It also has easy-to-earn discounts that can make your SR-22 rate more affordable. You can save by getting a quote before your policy’s start date, paying in full and going paperless.

- Cheaper SR-22s than many larger companies

- Excellent rating for customer satisfaction

- Especially cheap for minor violation SR-22s

- Only available in 26 states

- Online quotes not available

Best SR-22 insurance for military: USAA

USAA also offers additional ways to save on SR-22 insurance. Its standard SafePilot app gives you a discount for driving safely. Its pay-per-mile SafePilotMiles app gives you a lower rate if you only drive once in a while.

However, with USAA, you usually end up talking to a different agent each time you call the service center. You can get more personalized service from other companies by regularly working with the same agent.

- Cheapest SR-22 car insurance rates

- Highest rated company for customer satisfaction

- Easy-to-use website and smartphone app

- Only available to the military community

- Lack of personalized agent services

Cheapest SR-22 car insurance by state

The cheapest company for SR-22 insurance varies by state. Progressive has the cheapest SR-22 insurance for major violations in 24 states. State Farm is the cheapest company in nine states. In some states, regional companies are cheaper than large national ones.

For example, Mercury has the cheapest SR-22 insurance for a major violation in California. Plymouth Rock is the cheapest SR-22 company for majors in Massachusetts.

Cheapest major violation SR-22s by state

| State | Cheapest company | Annual Rate | Monthly Rate |

|---|---|---|---|

| Alabama | State Farm | $3,048 | $254 |

| Alaska | Geico | $2,617 | $218 |

| Arizona | Progressive | $2,445 | $204 |

| Arkansas | State Farm | $3,033 | $253 |

| California | Mercury | $3,026 | $252 |

| Colorado | Progressive | $3,892 | $324 |

| Connecticut | Progressive | $3,291 | $274 |

| Delaware | Progressive | $3,024 | $252 |

| Florida | Geico | $4,246 | $354 |

| Georgia | Auto-Owners | $3,411 | $284 |

| Hawaii | State Farm | $3,037 | $253 |

| Idaho | State Farm | $2,026 | $169 |

| Illinois | State Farm | $3,414 | $284 |

| Indiana | Progressive | $1,641 | $137 |

| Iowa | Progressive | $1,589 | $132 |

| Kansas | Progressive | $2,143 | $179 |

| Kentucky | Progressive | $3,344 | $279 |

| Louisiana | Allstate | $3,858 | $321 |

| Maine | Progressive | $1,534 | $128 |

| Maryland | Allstate | $4,193 | $349 |

| Massachusetts | Plymouth Rock | $2,003 | $167 |

| Michigan | Progressive | $2,176 | $181 |

| Minnesota | Farmers | $4,730 | $394 |

| Mississippi | Progressive | $2,273 | $189 |

| Missouri | Progressive | $2,096 | $175 |

| Montana | State Farm | $1,921 | $160 |

| Nebraska | American Family | $2,041 | $170 |

| Nevada | Progressive | $4,402 | $367 |

| New Hampshire | Hanover | $994 | $83 |

| New Jersey | Progressive | $2,471 | $206 |

| New Mexico | Progressive | $2,246 | $187 |

| New York | Allstate | $4,702 | $392 |

| North Carolina | Progressive | $3,036 | $253 |

| North Dakota | Progressive | $1,898 | $158 |

| Ohio | Geico | $944 | $79 |

| Oklahoma | Progressive | $2,089 | $174 |

| Oregon | Progressive | $2,036 | $170 |

| Pennsylvania | Allstate | $2,731 | $228 |

| Rhode Island | Progressive | $2,966 | $247 |

| South Carolina | Farm Bureau | $1,827 | $152 |

| South Dakota | State Farm | $2,218 | $185 |

| Tennessee | Erie | $2,248 | $187 |

| Texas | State Farm | $1,422 | $119 |

| Utah | Progressive | $1,983 | $165 |

| Vermont | Progressive | $1,375 | $115 |

| Virginia | Farm Bureau | $1,753 | $146 |

| Washington | American Family | $1,930 | $161 |

| Washington, D.C. | Progressive | $2,389 | $199 |

| West Virginia | Erie | $2,128 | $177 |

| Wisconsin | Progressive | $2,277 | $190 |

| Wyoming | State Farm | $2,270 | $189 |

Cheapest companies for minor violation SR-22 insurance

State Farm has the cheapest SR-22 insurance for minor violations in 34 states, while Geico is the cheapest in six. Auto-Owners and Progressive have the lowest minor violation SR-22 rates in four states each.

Cheap minor violation SR-22 insurance by state

| State | Cheapest company | Annual rate | Monthly rate |

|---|---|---|---|

| Alabama | State Farm | $1,329 | $111 |

| Alaska | State Farm | $1,475 | $123 |

| Arizona | State Farm | $1,759 | $147 |

| Arkansas | State Farm | $1,440 | $120 |

| California | Geico | $2,326 | $194 |

| Colorado | State Farm | $2,086 | $174 |

| Connecticut | State Farm | $1,805 | $150 |

| Delaware | State Farm | $1,960 | $163 |

| Florida | State Farm | $2,114 | $176 |

| Georgia | Auto-Owners | $1,782 | $149 |

| Hawaii | Geico | $829 | $69 |

| Idaho | State Farm | $710 | $59 |

| Illinois | State Farm | $1,545 | $129 |

| Indiana | State Farm | $1,437 | $120 |

| Iowa | State Farm | $1,106 | $92 |

| Kansas | Progressive | $2,439 | $203 |

| Kentucky | Auto-Owners | $2,011 | $168 |

| Louisiana | State Farm | $2,874 | $239 |

| Maine | State Farm | $1,251 | $104 |

| Maryland | State Farm | $1,509 | $126 |

| Massachusetts | Geico | $1,453 | $121 |

| Michigan | Progressive | $2,301 | $192 |

| Minnesota | Geico | $3,765 | $314 |

| Mississippi | State Farm | $1,229 | $102 |

| Missouri | State Farm | $1,773 | $148 |

| Montana | State Farm | $966 | $81 |

| Nebraska | State Farm | $1,484 | $124 |

| Nevada | State Farm | $2,503 | $209 |

| New Hampshire | Hanover | $859 | $72 |

| New Jersey | State Farm | $2,656 | $221 |

| New Mexico | State Farm | $1,563 | $130 |

| New York | State Farm | $2,700 | $225 |

| North Carolina | Progressive | $1,085 | $90 |

| North Dakota | State Farm | $1,411 | $118 |

| Ohio | Geico | $832 | $69 |

| Oklahoma | State Farm | $1,616 | $135 |

| Oregon | State Farm | $1,395 | $116 |

| Pennsylvania | State Farm | $1,610 | $134 |

| Rhode Island | Amica | $2,970 | $248 |

| South Carolina | Auto-Owners | $1,460 | $122 |

| South Dakota | State Farm | $1,351 | $113 |

| Tennessee | Erie | $1,497 | $125 |

| Texas | Texas Farm Bureau | $1,036 | $86 |

| Utah | Auto-Owners | $1,697 | $141 |

| Vermont | State Farm | $758 | $63 |

| Virginia | State Farm | $1,491 | $124 |

| Washington | State Farm | $1,282 | $107 |

| Washington, D.C. | Erie | $2,273 | $189 |

| West Virginia | Westfield | $1,481 | $123 |

| Wisconsin | State Farm | $1,524 | $127 |

| Wyoming | State Farm | $1,294 | $108 |

How to get SR-22 insurance

Most car insurance companies offer SR-22 insurance, but some don’t. It’s good to let the companies you contact for quotes know about your SR-22 requirement up front. This can spare you the time of having to fill out insurance questionnaires for companies that don’t have it.

- Most companies add a small SR-22 filing fee of about $25 to your rate.

- Your insurance company usually files your SR-22 certificate with your state’s DMV when you buy your policy. Make sure to confirm this with the company you choose.

-

You can often get non-owners SR-22 insurance if you don’t own a car. A non-owners SR-22 policy lets you legally drive cars that you borrow

or rent.If you regularly borrow the same car, its owner may need to add you to their policy. You can check with their insurance company to find out.

SR-22 car insurance coverage requirements

You usually only need to meet your state’s minimum auto insurance requirements to get an SR-22. Most states require liability insurance. A few also make you get uninsured motorist

You usually need to add collision

How to save money on SR-22 car insurance

You can often save money on SR-22 insurance by shopping around, adjusting your coverage and using car insurance discounts.

SR-22 car insurance shopping tips

The average cost of car insurance goes up by 85% after a major violation like a DUI to $324 a month. However, some companies raise their rates by smaller amounts. Getting quotes from multiple companies helps you find the best rate for your situation.

- Some companies, including State Farm and Allstate, work with exclusive agents. You have to contact these companies separately for quotes.

- Other companies, including Auto-Owners and Progressive, work with independent agents. An independent agent can get you quotes from multiple companies at once.

It’s good to ask the insurance agents who give you quotes which companies they represent. This helps you make sure you get quotes from all the companies you want to contact. It also helps you avoid having multiple agents give you quotes from the same companies.

Money-saving SR-22 coverage tips

You can also save money on SR-22 insurance by choosing high deductibles or dropping full coverage.

Since your deductibles come out of your pocket, you don’t want them to be too high. However, just raising them from $500 to $1,000 usually provides noticeable savings.

You may be better off without full coverage if your vehicle’s value is less than a few thousand dollars. Insurance only covers your car at its depreciated value, minus your deductible.

If you have a $1,000 deductible for a $3,000 car, insurance only pays $2,000 if it’s totaled or stolen. For comparison, dropping collision and comp can knock about $1,000 off your annual insurance rate.

Best discounts for SR-22 insurance

Bundling your car insurance with a home or renters policy usually gets you a big discount. You can add to your savings by using your insurance company’s safe driving app, if it has one. Ask about these other discounts when you get your quotes.

Methodology

LendingTree gets rates from Quadrant Information Services using publicly sourced insurance company filings. Rates are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit who drives a 2015 Honda Civic EX.

Full coverage policies include:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

—

Our team of insurance experts also rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the NAIC and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military and their spouses and children. If you’re already a USAA member, your spouse and children may also be eligible.