Cheapest Full Coverage Car Insurance Companies (2026)

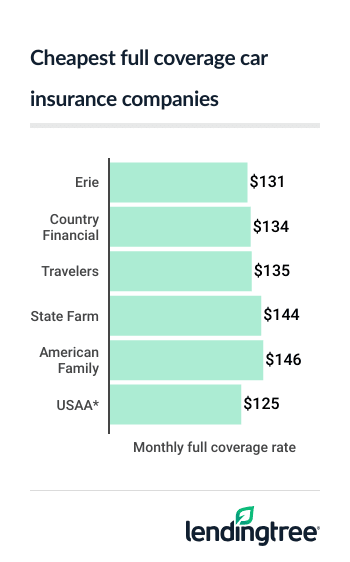

Travelers has the cheapest full coverage car insurance among national companies, with an average rate of $135 a month.

Cheap full coverage car insurance companies

Cheapest companies for full coverage car insurance

Travelers has the cheapest full coverage

Regional companies Erie Insurance and Country Financial are even cheaper, with average rates that are under $135 a month. However, Erie is only available in 12 states

Cheapest full coverage car insurance companies

| Company | Annual rate | Monthly rate | LendingTree score | |

|---|---|---|---|---|

| Nationwide | $840 | $70 | |

| Allstate | $1,094 | $91 | |

| Encompass | $1,143 | $95 | Not rated |

| State Farm | $1,152 | $96 | |

| Cumberland Mutual | $1,290 | $108 | Not rated |

| Travelers | $2,180 | $182 | |

| American Family | $4,204 | $350 | |

USAA offers the cheapest full coverage car insurance rates nationally, at just $125 a month, but it only sells to military personnel, veterans and their families.

Best full coverage car insurance companies

- Best for most drivers: Travelers, $135 a month

- Best midsize company: Erie, $131 a month

- Best for coverages: Amica, $235 a month

- Best for military members and veterans: USAA, $125 a month

Best full coverage car insurance for most drivers: Travelers

Monthly rate: $135

Travelers offers several discounts that make its low full coverage rates even cheaper. These include discounts for homeowners and early shoppers.

It also offers useful add-ons like gap insurance

Travelers’ customer satisfaction rating from J.D. Power

Company highlights

Travelers’ IntelliDrive program can get you a discount of up to 30% if you drive safely using its smartphone app.

PROS

- Rates are 24% less than the national average

- Excellent complaint rating

- Useful add-on coverages

CONS

- Worse-than-average customer satisfaction rating

Best midsize company for full coverage car insurance: Erie Insurance

Monthly rate: $131

Erie Insurance is an excellent option for drivers in certain states because of its cheap rates and great customer service.

Full coverage car insurance from Erie Insurance costs $131 a month, on average. Also, compared to its competitors, Erie has one of the best customer satisfaction ratings from J.D. Power’s 2025 U.S. Auto Insurance Study.

However, Erie’s website experience is lacking compared to its competitors. With Erie, you have to work with an agent to get a policy instead of buying one online.

Company highlights

Offers a rate lock feature, which protects you from future rate increases until you make major changes to your policy, like moving.

PROS

- Offers unique coverage

- Good customer satisfaction ratings

- Cheap car insurance rates

CONS

- Only available in 12 states and the District of Columbia

Best coverage options: Amica

Monthly rate: $235

Although Amica’s full coverage car insurance rates are higher than average at $235 a month, it has a wide range of optional coverages. Amica offers a Platinum Choice auto package, which includes new car replacement if your car is less than a year old or has fewer than 1,500 miles, and prestige rental car coverage that has no daily limit.

Amica also has excellent customer satisfaction reviews. J.D. Power gave Amica a score of 735 out of 1,000 in its 2025 U.S. Auto Claims Satisfaction Study, which ties USAA for best score in the study.

Company highlights

Amica offers dividend and traditional policies. Dividend policies cost more upfront, but they may save you money in the long run.

PROS

- Many discount options

- Upgrade package offers better coverage

- Excellent customer satisfaction

CONS

- Higher-than-average car insurance rates

Best full coverage auto insurance for military families: USAA

Monthly rate: $125

USAA offers cheap car insurance rates along with excellent customer satisfaction. However, it’s only available for military members and veterans, as well as their spouses and children.

USAA had the best customer satisfaction scores in all U.S. regions, according to J.D. Power’s 2025 U.S. Auto Insurance Study.

USAA also offers military-specific discounts. If you’re deployed and just storing your insured car, for example, you could get up to 60% off of your policy.

Company highlights

Offers car replacement assistance, which will give you 20% more than the current value of your vehicle if it gets totaled or stolen

PROS

- Excellent customer satisfaction

- Discounts aimed at military members

- Easy online quotes

CONS

- Only available for military members, veterans and their families

- No local agents

Cheap full coverage car insurance near me

Full coverage car insurance rates can vary by state. Crime rates, accident rates, population density and severe weather in your area impact how much you pay for car insurance.

State Farm and Travelers have the cheapest full coverage rates in 12 states each. You may find cheaper rates from local or midsize car insurance companies depending on where you live.

| State | Cheapest company | Cheapest rate |

|---|---|---|

| Alabama | Travelers | $103 |

| Alaska | Geico | $116 |

| Arizona | State Farm | $144 |

| Arkansas | State Farm | $125 |

| California | Geico | $127 |

| Colorado | Geico | $182 |

| Connecticut | Travelers | $112 |

| Delaware | Farmers | $147 |

| Florida | State Farm | $158 |

| Georgia | Farm Bureau | $119 |

| Hawaii | Geico | $69 |

| Idaho | State Farm | $61 |

| Illinois | Travelers | $93 |

| Indiana | Travelers | $97 |

| Iowa | Progressive | $89 |

| Kansas | Travelers | $124 |

| Kentucky | Travelers | $131 |

| Louisiana | Allstate | $212 |

| Maine | Travelers | $66 |

| Maryland | State Farm | $129 |

| Massachusetts | Geico | $113 |

| Michigan | Progressive | $134 |

| Minnesota | Travelers | $106 |

| Mississippi | State Farm | $107 |

| Missouri | Travelers | $115 |

| Montana | State Farm | $95 |

| Nebraska | Farmers Mutual of Nebraska | $99 |

| Nevada | Travelers | $161 |

| New Hampshire | Safety | $86 |

| New Jersey | Geico | $132 |

| New Mexico | State Farm | $133 |

| New York | Progressive | $104 |

| North Carolina | Progressive | $70 |

| North Dakota | State Farm | $100 |

| Ohio | Geico | $97 |

| Oklahoma | Progressive | $99 |

| Oregon | State Farm | $88 |

| Pennsylvania | Erie | $120 |

| Rhode Island | Progressive | $163 |

| South Carolina | Auto-Owners | $128 |

| South Dakota | Farmers Mutual of Nebraska | $91 |

| Tennessee | Travelers | $107 |

| Texas | State Farm | $101 |

| Utah | Progressive | $142 |

| Vermont | State Farm | $65 |

| Virginia | Travelers | $86 |

| Washington | Mutual of Enumclaw | $107 |

| Washington, D.C. | Geico | $179 |

| West Virginia | Westfield | $116 |

| Wisconsin | American Family | $112 |

| Wyoming | American National | $65 |

Cheapest full coverage car insurance with a ticket

Erie, USAA and State Farm are the cheapest companies for full coverage car insurance after a speeding ticket, with all three offering average rates under $160 a month.

Insurance companies raise your rates by 22% after a ticket, on average. Auto-Owners raises full coverage rates by just 6%.

| Company | Monthly rate after a ticket | % increase from a clean record |

|---|---|---|

| Erie | $143 | 9% |

| State Farm | $156 | 8% |

| Auto-Owners | $164 | 6% |

| Country Financial | $169 | 26% |

| American Family | $173 | 18% |

| Travelers | $181 | 34% |

| Progressive | $213 | 33% |

| Farm Bureau | $222 | 14% |

| Geico | $233 | 35% |

| Nationwide | $244 | 28% |

| Amica | $252 | 7% |

| AAA | $284 | 45% |

| Allstate | $295 | 19% |

| Farmers | $338 | 31% |

| USAA* | $153 | 22% |

Cheap rates for full coverage car insurance with an accident

At $163 a month, State Farm has the cheapest full coverage car insurance rates if you’ve been in an accident.

Country Financial offers the next-cheapest rate for most drivers at $182 a month. State Farm’s full coverage rates go up by just 13% after an accident, on average. Overall, car insurance rates go up around 49% after an accident.

| Company | Monthly rate after an accident | % increase from a clean record |

|---|---|---|

| State Farm | $163 | 13% |

| Country Financial | $182 | 36% |

| Erie | $186 | 42% |

| Travelers | $195 | 44% |

| Auto-Owners | $209 | 36% |

| American Family | $237 | 62% |

| Progressive | $238 | 49% |

| Farm Bureau | $266 | 36% |

| Geico | $296 | 71% |

| Nationwide | $299 | 57% |

| AAA | $338 | 72% |

| Amica | $365 | 55% |

| Farmers | $400 | 55% |

| Allstate | $406 | 64% |

| USAA* | $174 | 39% |

If you’re at fault in an accident, it will usually affect your car insurance rates for three to five years.

Cheapest full coverage car insurance for young drivers

Country Financial offers the cheapest full coverage policies to teen drivers, with rates that average $250 a month. Young drivers pay nearly three times more for car insurance than older drivers do.

To save money on car insurance as a young driver, see if your insurance company offers a good-student discount or an away-at-school discount.

Some insurance companies also offer a discount to teen drivers if they’ve completed an approved driver education course.

| Company | Monthly rate |

|---|---|

| Country Financial | $250 |

| Erie | $290 |

| Auto-Owners | $393 |

| State Farm | $396 |

| Travelers | $441 |

| Geico | $444 |

| Farm Bureau | $448 |

| AAA | $499 |

| American Family | $569 |

| Progressive | $601 |

| Nationwide | $602 |

| Allstate | $679 |

| Farmers | $827 |

| Amica | $842 |

| USAA* | $307 |

Affordable full coverage car insurance with bad credit

Country Financial, USAA and American Family are the cheapest companies for a full coverage policy if you have bad credit. On average, these drivers with a Country Financial policy pay $195 a month.

Drivers with bad credit pay nearly twice as much for car insurance than drivers with good credit.

If you live in California, Hawaii, Massachusetts or Michigan, your credit score won’t impact your car insurance rate.

| Company | Monthly rate |

|---|---|

| Country Financial | $195 |

| American Family | $241 |

| Travelers | $249 |

| Progressive | $271 |

| Nationwide | $279 |

| Geico | $282 |

| Erie | $288 |

| Farm Bureau | $346 |

| Allstate | $402 |

| Auto-Owners | $428 |

| Farmers | $473 |

| AAA | $481 |

| Amica | $518 |

| State Farm | $593 |

| USAA* | $227 |

If you’re looking for ways to improve your credit, you can pay your bills on time, pay down debt or improve your credit utilization.

How do I get affordable full coverage insurance?

To get the cheapest full coverage car insurance, it’s a good idea to compare quotes from multiple companies. Raising your deductible and asking about discounts you might qualify for can also help keep your rates affordable.

- Compare quotes from many car insurance companies. Start by getting full coverage insurance quotes from several different insurance companies. Use the same limits and deductible amounts for each insurer to make the best comparison. Check each company’s customer satisfaction ratings from J.D. Power and the NAIC Complaint Index as well.

- Increase your deductible. The higher your deductible, the lower your car insurance rate. This can be a good step if you have a clean driving record. Don’t choose a deductible amount you can’t afford to pay if you need to file a claim, though.

- Look for discounts. Most auto insurance companies offer a range of discounts to stay competitive. Ask an agent which discounts could drive your rate down.

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: where required by law

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.