Cash-Out Refinance: How It Works and When To Do It

A cash-out refinance allows you to swap your current mortgage for a new one and convert some of your home equity to cash at the same time.

It’s normal to feel cautious about borrowing against your home equity — after all, your home is likely one of your biggest assets. When used wisely, a cash-out refinance can be a smart way to make progress toward your financial goals, such as consolidating high-interest debt or remodeling your kitchen.

- A cash-out refinance involves borrowing more than you currently owe on your existing mortgage.

- Cash-out refinance requirements are stricter than for a traditional mortgage refinance and often come with higher monthly payments.

- In most cases, you’ll need at least 20% home equity to qualify.

- A cash-out refi can be a better option than a personal loan, since it often has a lower interest rate and doesn’t require an additional monthly payment.

How does a cash-out refinance work?

For the most part, a cash-out refinance works like any other home loan. You shop for a mortgage lender, fill out a loan application and qualify based on your credit score, income and assets. You can use a cash-out refinance payout for whatever you want, including renovating your home, paying off debt and covering higher education costs. However, there are a few extra considerations:

- You must qualify for a higher loan amount. Because you’re taking out a new loan for more than you currently owe, your lender will need to verify your ability to afford the larger loan amount and higher monthly payment.

- You’ll pay for a home appraisal. Until you complete a refinance home appraisal, your cash-out refi loan amount is just an estimate. If your appraisal comes back lower than expected, you may not qualify to borrow as much home equity as you’d hoped.

- Your lender finalizes your cash-out refinance loan amount. Once your appraisal comes back, the lender calculates your cash-out amount by subtracting your current loan balance from the final loan amount.

- Your old loan is paid off and you receive the rest of the money in cash. Once you review your closing disclosure to confirm the final figures and sign your closing paperwork, your lender will fund your loan. Your old mortgage is paid off, the new mortgage is secured by your home and a wire or check is sent to you.

How much can you borrow with a cash-out refinance?

The amount you can get from a cash-out refinance depends on various factors — most importantly, your home equity. Lenders calculate your home equity by subtracting your loan balance from your home’s appraised value. They also limit how much you can cash out by setting loan-to-value (LTV) ratio requirements. Most lenders set an 80% LTV limit, meaning you can borrow up to 80% of your home’s value — minus your outstanding mortgage balance.

Use LendingTree’s cash-out refinance calculator to estimate your monthly payments and the amount of cash you could walk away with. Follow these steps to get started:

- Enter your home value. A home value estimator can help you get a rough idea of how much your home is worth.

- Put in your current mortgage balance. You can find this on your most recent mortgage statement.

- Add the amount of cash you’d like to take out. If you enter too large an amount, the calculator will let you know.

Let’s say your home is worth $450,000 and you owe $300,000 on your existing mortgage. This means you have $150,000 in home equity. Here’s how to determine your cash-out refinance payout:

- Multiply your home’s value by the 80% LTV ratio limit: $450,000 x 0.80 is $360,000. This is your maximum loan amount.

- Subtract your current mortgage balance: $360,000 – $300,000 is $60,000.

- You could pocket up to $60,000 with a cash-out refinance.

Taking this a step further, let’s say you take the $60,000 and pay off your credit card debt, which has a 24.19% APR. This move could save you about $1,100 a month if you can secure a cash-out refinance loan with a 6.70% interest rate and 3% in closing costs.

However, since you’re restarting a 30-year loan and adding new closing costs, your total lifetime cost would increase by roughly $108,000. The bottom line: A cash-out refinance can be a lifeline for cash-strapped homeowners — but it’s most beneficial when paired with a plan to pay down the new balance early due to the increased long-term costs.

Cash-out refinance rates

Cash-out refinance mortgage rates are generally higher than those on regular refinances. Turning equity into debt increases the odds you could lose your home to foreclosure, and lenders pass this risk on to you in the form of higher interest rates.

How to get the best cash-out refi rates

Here are four steps you can take to get the best refinance rate:

1. Raise your credit score

Your credit score has a major impact on cash-out refinance rates. A score of 780 or higher can get you the lowest rates on a conventional cash-out refinance. Although the minimum requirements are lower for FHA loans, your credit score still affects the rate you’ll receive.

Paying off credit card balances and avoiding new credit accounts can help you improve your credit score. The extra effort could save you thousands of dollars in interest charges over a 30-year loan term.

Need help finding or understanding your score? Get help and see your free credit score on LendingTree Spring.

2. Borrow less money

Your LTV ratio, which measures how much you’re borrowing compared to your home’s value, is another factor that impacts your cash-out refinance rate. The higher your LTV ratio, the higher your rate will be. One way to borrow less money is by paying down your mortgage principal with a lump sum before refinancing. This can also help make your mortgage payments more affordable.

Read more about how much you should put down on a house.

3. Make home improvements

The right home improvements could increase your home’s value, lower your LTV ratio and lead to a lower cash-out refinance rate. Check the Journal of Light Construction’s most recent Cost vs. Value Report to learn which improvements give you the best return on every dollar you invest.

4. Shop around for lender offers

You can save serious money by comparing multiple refinance offers before making your final decision. On average, borrowers can save about $80,000 over the course of a 30-year, fixed-rate mortgage by shopping around, according to LendingTree data. Collect loan estimates from three to five lenders or use an online comparison site and compare the annual percentage rates (APRs) and interest rates to find your best offer. The best cash-out refinance lenders will offer competitive rates, transparent fee structures and streamlined application processes.

Check out our list of the best refinance lenders.

Cash-out refinance requirements

| Conventional | FHA | VA | |

|---|---|---|---|

| Maximum LTV ratio | 80% | 80% | 90% |

| Minimum credit score | 640 | 500 | No minimum (but many lenders require 620) |

| Maximum DTI ratio | 45% to 50% | 43% | 41% |

Maximum 80% LTV ratio

A maximum 80% LTV ratio is the standard for both FHA and conventional mortgages. However, there is one major exception: Eligible military homeowners can typically borrow up to 90% of their home’s value with a VA cash-out refinance.

Minimum 640 credit score

Conventional cash-out refinance guidelines require a minimum credit score of 640. Meanwhile, the VA doesn’t set a minimum score, but many lenders set their own at 620. FHA loans are the exception, and borrowers may qualify with scores as low as 500.

Learn more about FHA cash-out refinances.

Maximum 50% DTI ratio

Lenders divide your total monthly debt by your income to determine your debt-to-income (DTI) ratio. Conventional lenders prefer a DTI ratio of 45%, but you may get approved with a DTI up to 50%. The maximum DTI ratios for FHA and VA loans are a bit lower, at 43% and 41%, respectively.

Occupancy

You can take out an FHA or VA cash-out refinance loan only for a home you will live in as your primary residence. Conventional loans allow you to borrow against equity in a second home or investment property refinance, if you’re willing to borrow less and pay higher rates.

Number of units and property type

You’ll get the most cash out of a single-family home. Lenders apply lower LTV ratio limits to multifamily homes with two to four units. Lenders may also charge extra fees or higher rates to borrow equity from a condo or manufactured home refinance. Some may even restrict the cash-out LTV ratio on these property types.

Waiting period

If you recently purchased your home, you’ll generally need to adhere to the following waiting periods before you can do a cash-out refinance:

- Conventional: 12 months

- FHA: 12 months

- VA: 210 days (about seven months)

Loan limits

Your cash-out refinance loan is subject to conforming loan limits and FHA loan limits, which are based on median home prices and change annually. Loan limits don’t apply to most VA loans, though lenders may set their own maximums.

The 2025 loan limits for single-family homes are $806,500 for conventional loans and $524,225 for FHA loans.

Refinance closing costs typically range from 2% to 6% of your loan amount. You’ll pay the same types of fees for a cash-out refinance as for a purchase mortgage, including origination, title, appraisal and credit report costs. You can pay cash-out refinance closing costs out of pocket or request the lender deduct them from your payout. Some companies offer no-closing-cost refinance options if you accept a higher interest rate in exchange for having your lender pay your costs.

- Conventional cash-out refinances don’t require private mortgage insurance (PMI).

- FHA cash-out refinances come with FHA mortgage insurance regardless of your LTV ratio.

- VA cash-out refinances don’t require mortgage insurance, but you’ll have to pay the VA funding fee of 0.50% to 3.30% of the loan amount.

Cash-out refinance pros and cons

Pros

- Flexibility. You can use the funds for any purpose, including consolidating debt, investing in real estate or starting a business.

- Low interest rates. Mortgages typically have lower interest rates than credit cards, personal loans and home equity loans.

- One monthly payment. Since a cash-out refinance replaces your current mortgage, you won’t have to worry about extra monthly payments like you would with a second mortgage, such as a home equity loan.

Cons

- Minimum 20% equity required. If home values have tumbled in your area or you bought your home with a small down payment, a cash-out refinance may not be possible, at least not right now.

- Loss of equity. Borrowing against your home equity now may mean a smaller profit when you sell your home later.

- Higher payments. In most cases, a higher loan amount will mean a higher monthly mortgage payment for as long as you own your home.

- Closing costs. You’ll need to pay various closing costs to get a cash-out refinance loan, including origination and appraisal fees.

Alternatives to a cash-out refi

HELOC or home equity loan

A home equity line of credit (HELOC) is an alternative way to access cash that’s secured by your home. HELOCs work a lot like a credit card: You use the funds up to a set limit and pay off those charges as you go. One advantage of HELOCs is that most HELOC lenders allow you to borrow up to 85% of your home’s value. Some HELOC lenders will even lend up to 100% — much more than the 80% cap on most cash-out refinances.

See current HELOC rates today.

Another equity-tapping option is a home equity loan, which provides access to funds secured against a portion of your home’s equity. You’ll receive all the funds at once and repay the loan on a fixed payment schedule. Terms often range from five to 30 years. Like HELOCs, home equity lenders may set LTV ratios at up to 100%, though most keep the maximum at 85%.

See current home equity loan rates today.

| A cash-out refinance makes sense if: | A HELOC makes sense if: | A home equity loan makes sense if: |

|---|---|---|

|

|

|

Learn more about choosing between a cash-out refi vs. a home equity loan or HELOC.

Our home equity loan and HELOC calculator can help you estimate how much money you can qualify for based on your home’s value and your outstanding mortgage balance.

Compare rates for a cash-out refinance vs. home equity products

Is a cash-out refinance a good idea?

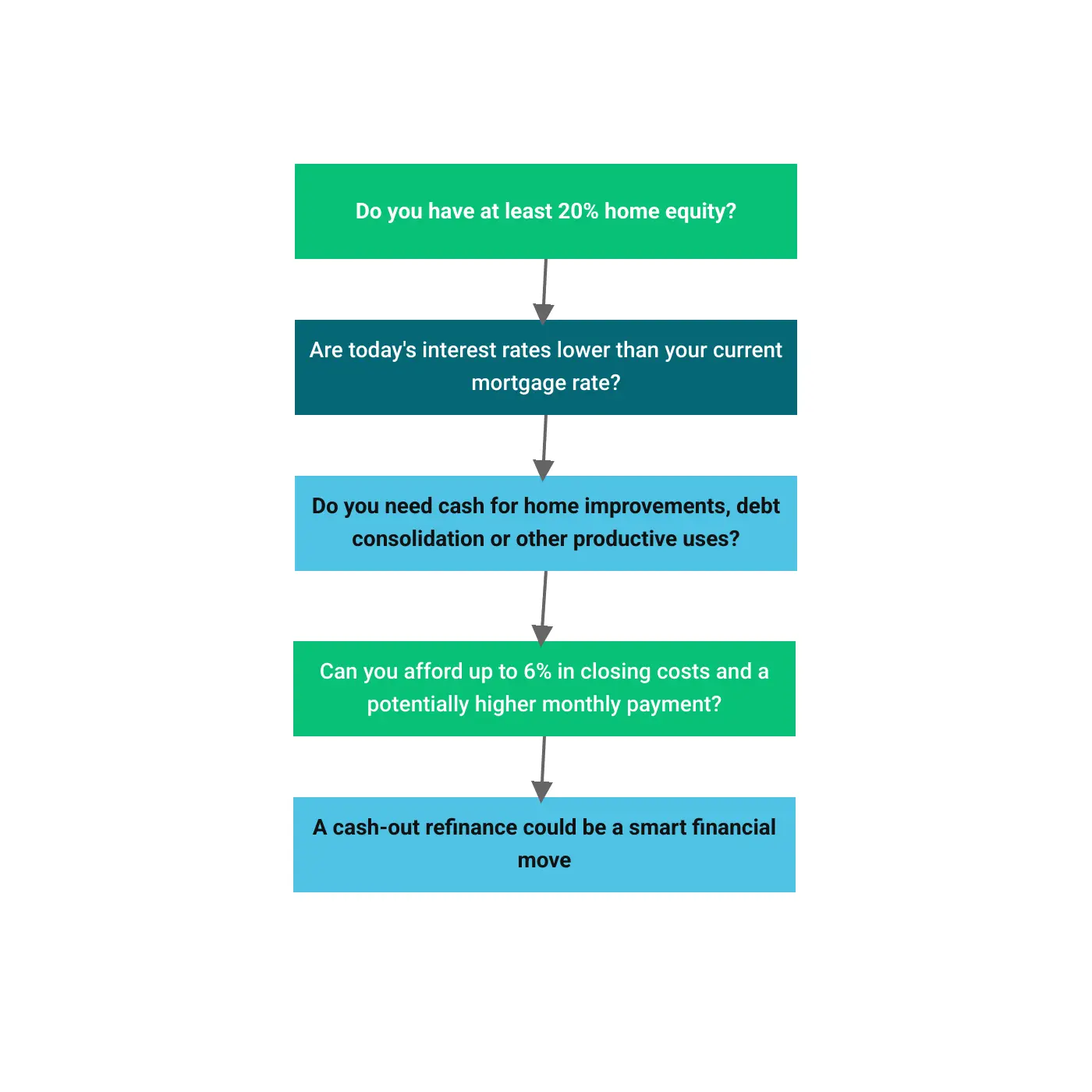

Whether a cash-out refinance is a good option depends on your financial situation and how you plan to use the funds. Use the flowchart below to find out if a cash-out refi could be the right choice for you.

I took out a cash-out refinance in 2021 to build a fence around my property, buy a shed and make general home improvements. For me, a cash-out refinance was a win-win. I got easy access to the cash I needed and qualified for a lower rate on my mortgage.

Frequently asked questions

How soon you can refinance after buying a house depends on your loan type. While some loans allow you to refinance at any time, others enforce waiting periods, and the waiting periods are often longer for cash-out refinances. For example, you can do a rate-and-term refinance with a conventional loan at any time, while a cash-out refinance requires a six-month waiting period.

The IRS doesn’t consider cash from a cash-out refinance taxable income. This is because it’s considered a loan, not income.

Yes, if you qualify, you can get a cash-out refinance on an investment property. However, you’ll be limited to a lower LTV ratio and should expect a higher interest rate. Lenders limit the LTV ratio for cash-out refinances on investment properties to 75%, meaning you’ll need at least 25% equity after closing.

Cash-out refinance rates are typically higher than traditional refinance rates. This is because lenders consider cash-out refinances to be a riskier mortgage product. However, your specific rate will depend on various factors, including your financial situation and market conditions.

Cash-out refinance closing costs and fees are typically 2% to 6% of your loan amount. That means if you take out a $300,000 loan, you could pay up to $18,000 in fees alone.

The amount of cash you can borrow in a cash-out refinance depends on your chosen loan program’s maximum LTV ratio. For example, you can borrow up to 80% of your home’s value with a conventional cash-out refinance.

Yes, FHA cash-out refinances are legitimate loan products insured by the Federal Housing Administration (FHA).

While you can get a cash-out refinance with a lower credit score, it’s typically more challenging and comes with higher costs. It’s likely easier for borrowers with bad credit to qualify for government-backed cash-out refinance loans, such as FHA or VA loans, versus conventional loans.