Compare Florida (FL) Mortgage and Refinance Rates Today

Mortgage interest rates currently average 6.10% for 30-year fixed loans and 5.14% for 15-year fixed loans.

Current refinance rates in Florida

| Interest rate | APR | |

|---|---|---|

| 30-year fixed-rate refinance | 6.48% | 6.67% |

| 15-year fixed-rate refinance | 6.06% | 6.44% |

| 10-year fixed-rate refinance | 6.75% | 7.30% |

| FHA 30-year fixed-rate refinance | 6.42% | 7.12% |

| 30-year 5/1 ARM refinance | 5.91% | 6.15% |

| VA 30-year fixed-rate refinance | 5.78% | 6.06% |

| VA 15-year fixed-rate refinance | 5.92% | 6.72% |

Average interest rates disclaimer

You’ll find that adjustable-rate mortgages (ARMs), 15-year refinance loans and VA loans often have lower rates than a conventional refinance loan. This can vary, however, based on your financial profile so it’s a good idea to evaluate which program is best for you before refinancing.

Learn more about the different refinance loan programs available to you.

When deciding if you should refinance, consider the purpose and goal of your decision:

- Are you hoping to lower your monthly mortgage payment by getting a better interest rate?

- Do you want to pay off your mortgage faster by shortening the loan term?

- Do you want to consolidate debt or pay renovation costs with a cash-out refinance?

Recent refinance trends

Mortgage refinance loans became more affordable for borrowers in the past year. On LendingTree in 2024, Florida refinance borrowers were offered:

- Lower rates: The annual percentage rates (APRs) on offers fell by 1.59 percentage points when compared to 2023.

- Lower monthly payments: The average monthly payment on offered refinance loans decreased by $100, even though average loan amounts increased by $22,800.

Does refinancing make sense for you? Find out using our mortgage refinance calculator.

LendingTree experts predict that rates will remain around 6% in early 2026, potentially falling to 5.9% as the year continues.

While many Americans are worried about an imminent housing market crash, experts believe it’s very unlikely to happen. In part, that’s because signs of real trouble, like high mortgage delinquency rates and foreclosure rates, just aren’t there — and that’s a great thing.

Even Florida’s notably high home prices and vacancy rates don’t indicate a market in distress. These conditions are normal for desirable coastal areas that attract both tourists and seasonal residents. In Miami, for instance, roughly 13% of homes typically remain empty at any given time, largely because vacation rentals and homes often aren’t used in the off-season.

What are current mortgage predictions in Florida?

If national mortgage rates and home prices remain high, as expected, Florida home sales will likely not skyrocket as they usually would in the spring homebuying season.

Home affordability is currently low in Florida, due to both high home prices and elevated interest rates. Wealthy buyers moving to Florida from out of state continue to push up prices. For example, in 2024, new homeowners in Miami-Dade County enjoyed average incomes 79% higher than the incomes of existing households in the county, according to the Miami Association of Realtors.

Average Florida mortgage interest rates by county

According to LendingTree data, Jefferson County had the highest average interest rate (7.76%) in Florida, while Martin County had the lowest average mortgage rate (6.30%).

Top 5 Florida mortgage lenders

Below are the top five mortgage lenders for 30-year conventional loan offers in Florida in 2024. United Wholesale Mortgage made the most offers to Florida borrowers, but Lennar Mortgage offered the lowest average interest rate and DHI Mortgage had the lowest total average loan costs.

Common types of mortgage loans in Florida

30-year fixed-rate mortgage loans are the most common type of loan homebuyers seek because they often offer the lowest monthly payment. The most common loan programs include conventional, FHA, and VA, and are all good options depending on your qualifications.

30-year fixed-rate mortgages are home loans with an interest rate that never changes and are repaid over 30 years. They’re the most popular mortgage type since they offer the lowest monthly payments, which averaged $2,206 in Florida over roughly the last year.

15-year fixed-rate mortgages have a rate that never changes and are paid over 15 years. You save thousands on total interest charges by cutting the 30-year loan term in half, but you’ll pay more each month. Monthly payments on 15-year loans averaged $3,046 in Florida over roughly the last year.

Not sure what loan term to choose? Read our guide to 15- versus 30-year mortgages.

Adjustable-rate mortgages (ARMs) usually offer lower interest rates than a comparable fixed-rate mortgage — but only for a set number of years. Then, the rate can move up or down, causing your monthly payments to change.

Conventional loans have requirements set by Fannie Mae and Freddie Mac and are the most common type of home loan. They’re usually a great choice for borrowers with a good credit score and sufficient down payment funds. Conventional loans typically require 3% down, and the average first-time homebuyer puts down 9%.

FHA loans, insured by the Federal Housing Administration (FHA), have more lenient requirements than conventional loans. In exchange, you’ll have to pay monthly mortgage insurance premiums. FHA loans only require a 500 credit score if you can make a 10% down payment, or a 580 score with 3.5% down. FHA loan monthly payments on 30-year loans averaged $1,784 in Florida over roughly the last year.

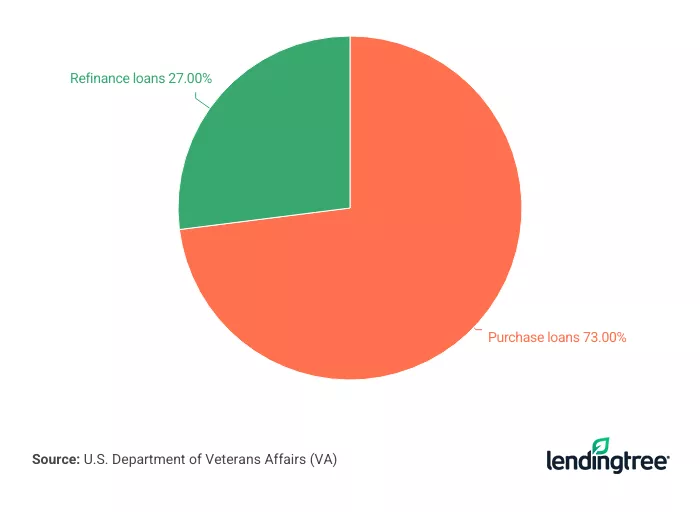

VA loans, guaranteed by the U.S. Department of Veterans Affairs, are very popular in Florida due to the large military population. They offer very competitive interest rates with no minimum credit score requirement, no mortgage insurance and no down payment in most cases. VA loan monthly payments on 30-year mortgages averaged $2,463 in Florida over roughly the last year.

Florida VA loan statistics (2024)

Floridians took out more VA loans in 2024 than any other state’s residents except Texas. Florida is home to a large community of active-duty service members spread across 19 military bases, as well as more than 1.5 million veterans.

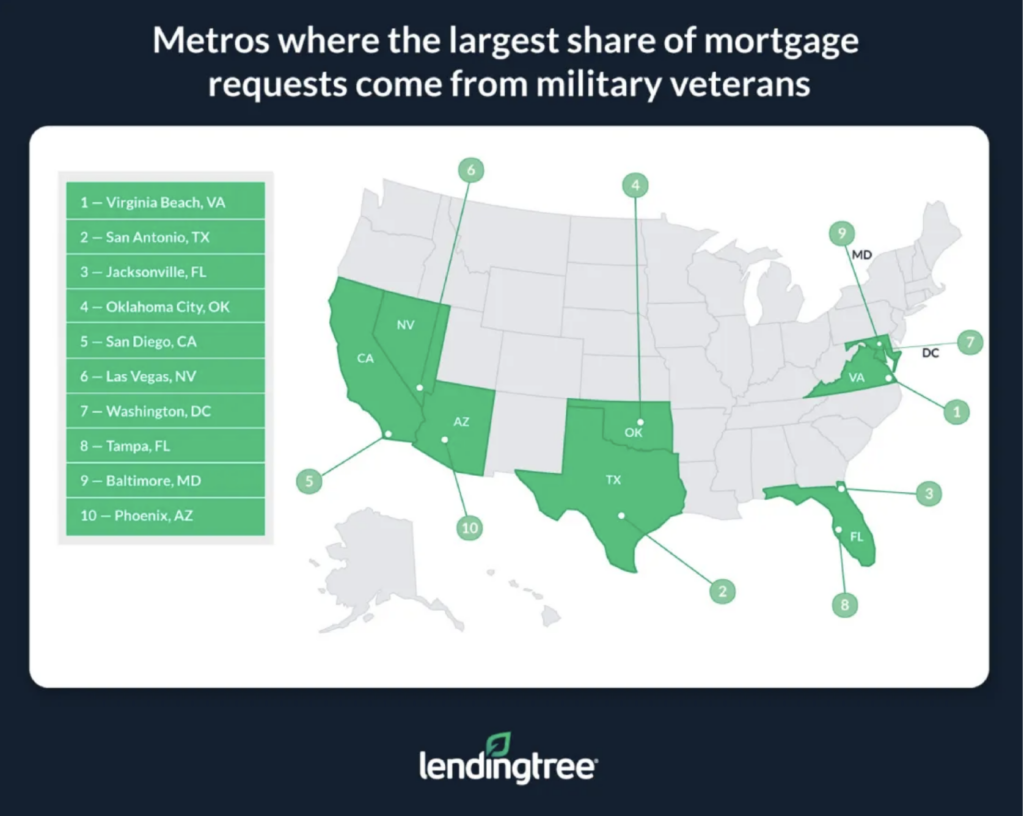

Jacksonville, Fla., has the third-highest rate of veterans applying for mortgages of all U.S. metro areas, according to a LendingTree analysis.

Source: Most Popular Metros for Military Veteran Homebuyers

Homebuyer trends: What you need to get a home loan in Florida

- 660+ credit score: Floridians need at least a 660 credit score to get a better rate than the national average. Buyers with low credit scores are often given rates up to 0.71 percentage points higher than the national average.

- $150,00 to $300,000 home price budget: The median home price ranges from $150,000 and $300,000 in 55% of Florida’s counties. If you’re looking for a home closer to common tourist locations, the median home price is likely to jump up significantly.

- Homeowners insurance: Floridians pay the most expensive home insurance premiums in the nation — around $361 per month on average.

Don’t know your credit score? See it for free on LendingTree Spring today.

| Credit score | Conventional loan rate | Difference from national average |

|---|---|---|

| 800+ | 6.74% | +0.13% |

| 780-799 | 6.67% | +0.05% |

| 760-779 | 6.96% | +0.31% |

| 740-759 | 6.81% | +0.09% |

| 720-739 | 7.16% | +0.34% |

| 700-719 | 7.07% | +0.11% |

| 680-699 | 7.38% | +0.25% |

| 660-679 | 7.12% | -0.16% |

| 640-659 | 7.59% | +0.40% |

| 620-639 | 7.97% | +0.71% |

The median home price in the state of Florida was $320,750 in Q1 2025, while the median monthly payment was $1,890 — a drop of $35 since 2024. The table below lets you see how home prices and monthly payments in your county, and get a feel for how monthly payment affordability has changed in the past year.

| State | County Name | Median Home Price Q1 2025 |

|---|---|---|

| Florida | Alachua County | $341840 |

| Florida | Baker County | $236100 |

| Florida | Bay County | $334200 |

| Florida | Bradford County | $198160 |

| Florida | Brevard County | $369190 |

| Florida | Broward County | $514560 |

| Florida | Calhoun County | $147270 |

| Florida | Charlotte County | $357390 |

| Florida | Citrus County | $306420 |

| Florida | Clay County | $354680 |

| Florida | Collier County | $613730 |

| Florida | Columbia County | $253110 |

| Florida | DeSoto County | $166510 |

| Florida | Dixie County | $106500 |

| Florida | Duval County | $337260 |

| Florida | Escambia County | $304430 |

| Florida | Franklin County | $279490 |

| Florida | Gadsden County | $165670 |

| Florida | Gilchrist County | $212680 |

| Florida | Glades County | $126170 |

| Florida | Gulf County | $259050 |

| Florida | Hamilton County | $121340 |

| Florida | Hardee County | $142220 |

| Florida | Hendry County | $208490 |

| Florida | Hernando County | $327480 |

| Florida | Highlands County | $229590 |

| Florida | Hillsborough County | $425260 |

| Florida | Holmes County | $111450 |

| Florida | Indian River County | $396240 |

| Florida | Jackson County | $125180 |

| Florida | Jefferson County | $212900 |

| Florida | Lafayette County | $144640 |

| Florida | Lake County | $354410 |

| Florida | Lee County | $375980 |

| Florida | Leon County | $333910 |

| Florida | Levy County | $188380 |

| Florida | Liberty County | $129250 |

| Florida | Madison County | $116390 |

| Florida | Manatee County | $417370 |

| Florida | Marion County | $293010 |

| Florida | Martin County | $464880 |

| Florida | Miami-Dade County | $572570 |

| Florida | Monroe County | $885960 |

| Florida | Nassau County | $431810 |

| Florida | Okaloosa County | $377900 |

| Florida | Okeechobee County | $196730 |

| Florida | Orange County | $446950 |

| Florida | Osceola County | $411250 |

| Florida | Palm Beach County | $575960 |

| Florida | Pasco County | $362470 |

| Florida | Pinellas County | $410440 |

| Florida | Polk County | $314020 |

| Florida | Putnam County | $176070 |

| Florida | St. Johns County | $560980 |

| Florida | St. Lucie County | $393470 |

| Florida | Santa Rosa County | $362880 |

| Florida | Sarasota County | $443250 |

| Florida | Seminole County | $445180 |

| Florida | Sumter County | $451720 |

| Florida | Suwannee County | $176840 |

| Florida | Taylor County | $110130 |

| Florida | Union County | $176290 |

| Florida | Volusia County | $353050 |

| Florida | Wakulla County | $231640 |

| Florida | Walton County | $481390 |

| Florida | Washington County | $171450 |

Home insurance in Florida costs $361 per month ($4,329 per year) on average, according to LendingTree data, making it the most expensive in the nation. This is because of factors like:

- Natural disasters: Hurricanes and tropical storms lead to strong winds and flooding, which can cause expensive damage to homes, so insurance companies require your insurance to include these extra protections.

-

Florida laws: Laws allow homeowners to sue their insurance company for more money, so insurers pass these increased costs on to customers.

About 20% of Florida homeowners opted out of home insurance in 2024, according to ValuePenguin, our sister site. Insurance costs can be stressful, so it’s no surprise that Florida made it into the top three in LendingTree’s list of states where people feel pressured to move.

Chubb is the cheapest insurer in Florida, according to LendingTree data, costing just $191 a month ($2,294 per year).

Average loan-to-value (LTV) ratio (nationwide)

| Purchase loans | Refinance loans | |

|---|---|---|

| Conventional | 76% | 48% |

| FHA | 94% | 74% |

| VA | 95% | 87% |

Average debt-to-income (DTI) ratio (nationwide)

| Purchase loans | Refinance loans | |

|---|---|---|

| Conventional | 37% | 37% |

| FHA | 45% | 44% |

| VA | 44% | 43% |

Average credit scores (nationwide)

| Purchase loans | Refinance loans | |

|---|---|---|

| Conventional | 754 | 737 |

| FHA | 691 | 654 |

| VA | 725 | 675 |

Additional home loan resources

How can I get the best mortgage rate for my Florida home loan?

-

Improve your credit score.

The higher your credit score, the better your mortgage rate will be. Buyers with a 780+ credit score get the best rates, but Floridians with a credit score above 660 can still get a better rate than the national average. The average credit score of Florida homebuyers was 715 in 2024, according to LendingTree data. -

Choose the right down payment amount.

Increasing your down payment amount often lowers your monthly payment and, in most cases, your interest rate. A 20% down payment is recommended to avoid a monthly private mortgage insurance bill on a conventional loan, but if it makes more sense for you to pay this than to dig into your savings, a smaller down payment can be a good move. The median down payment in Florida was $41,250 over roughly the last year — only 13% of the median purchase price. -

Lower your DTI ratio.

Your debt-to-income (DTI) ratio represents how much of your income is paid toward debt each month, and helps lenders understand how likely you are to default on a loan. Most conventional lenders limit you to a 50% DTI, but you can earn a lower interest rate and save on closing costs by keeping it below 40%. Floridians pay an average of $1,683 toward their debts each month, according to a LendingTree analysis. Using our DTI calculator and the average annual income of $75,630 in Florida, this amounts to a 27% DTI ratio. -

Compare offers from multiple lenders.

Shopping with three to five lenders can save you a great deal of money. Florida buyers in particular could save $214 every month (and $77,072 over a 30-year loan term), according to LendingTree data, by comparing and negotiating rate quotes from multiple lenders.

But there are other factors to weigh when choosing a mortgage lender. Your financial situation and life plans — like needing an in-person office or fast closing — should influence your decision. A lender with a slightly higher rate might still be the better choice if they offer other perks that matter more to you.

You should request a mortgage rate lock from your lender once you’ve applied for a home loan and chosen an offer. This ensures that your interest rate won’t increase before you close on your new home. Since some lenders charge for rate locks, ask about any fees when you first apply.

Florida first-time homebuyer programs

| Program | Does it need to be repaid? | Best for |

|---|---|---|

| Florida Homeownership Loan Program | Yes, it comes with monthly payments of $53. The remaining balance doesn’t have to be repaid until you completely pay off the home’s first mortgage, refinance, sell or move out of the house. | Homebuyers who can afford a second mortgage payment and don’t qualify for a deferred or forgivable loan. |

| Hometown Heroes | No, unless you sell the home, refinance your first mortgage, pay off your main mortgage or transfer the deed. | Frontline workers and veterans who need significant help with a down payment and closing costs. |

| Florida Assist | Yes. You won’t have monthly payments, but the loan must be repaid when you sell, refinance, move or completely pay off your first mortgage. | Borrowers who need extra funds but don’t want to take on a second mortgage payment. |

| HFA Advantage Plus Second Mortgage | No, as long as you remain in the home for five years. | Those planning to remain in the home for at least five years, and who want to access down payment or closing cost assistance without taking on another monthly payment. |

Looking for more detail on any of these programs? Visit our Florida first-time homebuyer programs and loans page.

First-time homebuyers are people who have:

- Never owned a home

- Not owned real-estate in the last three years