Compare Mortgage Refinance Rates Today

February mortgage refinance rates currently average 6.46% for 30-year fixed loans and 6.03% for 15-year fixed loans.

Current refinance mortgage rates

Loan product | Interest rate

Current average rates are calculated using all conditional loan offers presented to consumers nationwide by LendingTree’s network partners over the past seven days for each combination of loan type, loan program, and loan term. Rates and other loan terms are subject to lender approval and not guaranteed. Not all consumers may qualify. See LendingTree’s Terms of Use for more details.

| APR

Current average rates are calculated using all conditional loan offers presented to consumers nationwide by LendingTree’s network partners over the past seven days for each combination of loan type, loan program, and loan term. Rates and other loan terms are subject to lender approval and not guaranteed. Not all consumers may qualify. See LendingTree’s Terms of Use for more details.

|

|---|---|---|

| 30-year fixed rate refinance | 6.48% | 6.67% |

| 15-year fixed rate refinance | 6.06% | 6.44% |

| 10-year fixed rate refinance | 6.75% | 7.30% |

| FHA 30-year fixed rate refinance | 6.42% | 7.12% |

| 30-year 5/1 ARM refinance | 5.91% | 6.15% |

| VA 30-year fixed rate refinance | 5.78% | 6.06% |

| VA 15-year fixed rate refinance | 5.92% | 6.72% |

Average interest rates disclaimer

Mortgage rate news: Are refinance rates going to drop in February?

According to our expert’s mortgage rate predictions, both purchase and refinance rates will remain elevated compared to where they sat before the pandemic.

Here are the U.S. weekly average rates from the Freddie Mac Primary Mortgage Market Survey, as of February 6, 2026:

- 30-year fixed-rate mortgage: 6.11% (↑ 0.01 from last week)

- 15-year fixed-rate mortgage: 5.50% (↑0.01 from last week)

At their most recent meeting in late January, the Federal Reserve held the federal funds rate steady. The next Fed meeting is scheduled for March 17-18.

Refinance mortgage rates tend to be slightly higher than purchase mortgage rates. However, your quoted rate will depend on your credit score and the refinance type you’re applying for (cash-out vs. rate-and-term).

How to compare refinance rates

It’s essential to comparison shop with three to five refinance lenders. Compare loan offers side-by-side, focusing on mortgage rates and closing costs. Here’s how to start:

- Use a rate-comparison website. Like the stock market, mortgage rates change daily, so you’ll need to gather quotes on the same day to make a true comparison. Rate-comparison sites like LendingTree make applying for refinance offers easier — you only enter your information once to get offers from multiple lenders.

- Reach out to lenders on your own. If you’re most comfortable talking to refinance lenders in person, you can sit down with a loan officer at a bank or credit union. Or, if you’d prefer to stay in your pajamas, you can get quotes from online lenders.

Unsure where to start? Browse our lender reviews below.

The most common mortgage refinance options are offered by conventional lenders, as well as lenders approved by the Federal Housing Administration (FHA), U.S. Department of Veterans Affairs (VA) and U.S. Department of Agriculture (USDA).

- Rate-and-term refinance loans. Most homeowners choose this type of refinance to lower their rate or pay off their loan faster. One major perk: You can roll in your closing costs even if you have little to no home equity.

- Cash-out refinance loans. With a cash-out refinance, you borrow more than you currently owe and pocket the difference between the two loans in cash. One drawback: You can’t borrow more than 80% of your home’s value unless you’re eligible for a VA cash-out refinance.

- Streamline refinance loans. The streamline refinance option is exclusive to homeowners with government-backed loans from the FHA, VA or USDA, and it typically doesn’t require a home appraisal or income documentation. To qualify, you must currently have an FHA, VA or USDA loan and prove that the refinance will benefit you financially.

- Jumbo refinance loans. If your existing mortgage loan exceeds the conforming loan limit, you’ll need a jumbo refinance loan. For 2025, the limit for single-family homes in most parts of the country is $806,500. Jumbo mortgage refinance rates have remained steady since the beginning of the year, and if rate trends continue, are expected to end the year around 6.50%.

What factors affect my refinance mortgage rate?

Refinance lenders may calculate your refinance mortgage rate slightly differently, but the same general factors will apply:

Your credit score

Borrowers with a higher credit score tend to receive the lowest refinance rates. However, you can still get approved for a loan with a lower score.

Your LTV ratio

Your loan-to-value (LTV) ratio can also affect your refinance rate. Borrowing less of your home’s value is likely to get you a lower rate, since the lender views it as lower risk.

Your DTI ratio

Your debt-to-income (DTI) ratio measures your gross monthly income against your monthly debt payments. Lenders usually prefer a 35% DTI ratio or lower. A low DTI ratio can help you secure the best mortgage refinance rates.

Repayment term

Longer-term loans, such as 30-year mortgages, typically have higher interest rates than shorter-term home loans.

Explore whether you should refinance into a shorter loan term.

What is a mortgage refinance?

Refinancing your mortgage means replacing an existing home loan with a new one. You’ll follow the same steps you did to apply for your purchase mortgage, except the new loan will pay off your old loan. People commonly refinance to change their loan term or interest rate, both of which can help lower your monthly mortgage payments.

The whole mortgage refinance process usually takes about one to two months. Refinance loans can come with 10-, 15- or 30-year loan terms, and can have fixed or adjustable rates.

Use our refinance calculator to find how much you can save, or use our cash-out refinance calculator to see how much cash you can access from your home.

LendingTree picks for the best refinance lenders

| Lender | User ratings | Best for | |

|---|---|---|---|

|

(1455)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| Overall refinance | |

| User reviews coming soon | Online refinance | |

|

(952)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| Rate transparency | |

|

(55433)

Ratings and reviews are from real consumers who have used the lending partner’s services.

| Loan variety |

Best refinance lender overall: Rate

- Diverse loan options, including hard-to-find specialty loans for physicians or for self-employed borrowers

- Approval in as little as one day

- Brick-and-mortar locations in nearly every state

- Must agree to be contacted in order to get personalized rates

- You may have to attend your closing in-person (only in some states)

Available refinance products:

- Conventional cash-out refinance

- FHA refinance

- USDA refinance

- VA cash-out refinance

- VA IRRRL

- FHA 203(k) renovation refinance

- Fannie Mae HomeStyle and Freddie Mac Renovation refinances

- VA renovation refinance

Additional loan products:

- Jumbo loans

- Interest-only mortgages

- Home equity loans

Founded in 2000, Rate (formerly known as Guaranteed Rate) is a mortgage lender specializing in a digital mortgage experience. Consumers can check out refinance rates online, find information about Rate’s loan products, or read articles about mortgage lending and an easy online application process. Rate offers seven different refinance programs, including a wide variety of fixer-upper refinance programs.

You’ll have the best chance of qualifying for a mortgage refinance with Rate if you have a 62% loan-to-value (LTV) ratio or better, according to nationwide data from 2023. That year, 53% of refinance borrowers had a debt-to-income (DTI) ratio under 40%.

Best online refi experience from a traditional bank: Chase

- On-time closing guarantee

- Relationship discounts for existing customers

- Competitive rates and fees

- Doesn’t disclose income or credit requirements

- Home loan advisors aren’t available in all states

- USDA loans aren’t available

- Conventional mortgage loans

- FHA loans

- VA loans

- Jumbo loans

Founded in 1799, JP Mortgage Chase is one of the oldest financial institutions in the United States. Chase mortgage advisors work with customers in 37 states and the District of Columbia. When it comes to refinancing, Chase provides a combination of online product information, mortgage finance articles and rates updated daily on six different products, earning it the best online mortgage experience award for an institutional bank lender.

You’ll have the best chance of qualifying for a mortgage refinance with Chase if you have a 47% loan-to-value (LTV) ratio or better, according to nationwide data from 2023. That year, about 55% of refinance borrowers had a debt-to-income (DTI) ratio below 40%.

Best for online refi rate transparency: Zillow Home Loans

- A wide selection of purchase and refinance mortgage loans

- Offers online mortgage prequalification with no impact to your credit score

- Available in most states

- Limited rate and fee information on Zillow’s website

- Online loan applications still require speaking with a loan officer

- Not available in New York

- No home equity loans or HELOCs

- Conventional mortgage loans

- FHA loans

- VA loans

- Jumbo loans

Zillow is probably best known for its home shopping platform, but the company also launched Zillow Home Loans in 2019 to give aspiring homeowners a place to go mortgage shopping as well. Zillow offers a solid menu of refinance types but especially shines when it comes to the amount of online mortgage rate information it offers. Consumers can track rates for conventional, FHA and VA fixed-rate loans and even peruse a number of adjustable-rate mortgage (ARM) rates with initial rates that are fixed for three, five or seven years.

You’ll have the best chance of qualifying for a mortgage refinance with Zillow if you have a 62% loan-to-value (LTV) ratio or better, according to nationwide data from 2023. That year, about 56% of refinance borrowers had a debt-to-income (DTI) ratio below 40%.

Best for variety of refi products: Fairway Independent Mortgage

- More loan options than other lenders, including renovation loans and super-jumbo loans

- Brick-and-mortar locations in most states

- Low application denial rates

- Doesn’t publish rates or fees online

- Higher fees than many competitors

- Doesn’t offer HELOCs

Available refinance products:

- Conventional mortgage loans

- FHA loans

- VA loans

- Jumbo loans

- USDA loans

- Fixer-upper loans (including the FHA 203(k) program, Fannie Mae HomeStyle® Renovation loans and VA and USDA renovation loans)

Additional loan products:

- Home equity line of credit (HELOC)

- Interest-only mortgages

- Reverse mortgages

- Physician home loans

Fairway Independent Mortgage Corp. has more than 25 years of experience originating loans and currently offers home loans in all 50 states. In addition to most of the standard conventional and government-backed refinance home loans, it also offers refinance loans for borrowers with mortgages currently backed by the U.S. Department of Agriculture (USDA). It also has the widest array of renovation loans of the lenders we reviewed, including a USDA renovation refinance product.

You’ll have the best chance of qualifying for a mortgage refinance with Fairway if you have a 62% loan-to-value (LTV) ratio or better, according to nationwide data from 2023. That year, about 48% of refinance borrowers had a debt-to-income (DTI) ratio under 40%.

Read more about how we chose our picks for the best refinance lenders.

Pros and cons of a mortgage refinance

Pros

-

Lower rates

Refinance rates tend to be lower than second mortgage rates. -

Less interest

You can save thousands in lifetime interest charges by reducing your interest rate. -

Lower monthly payment

You’ll also pay less per month when your interest rate drops (assuming you didn’t increase your outstanding loan amount). -

Potential savings

If you can get rid of mortgage insurance, you stand to save thousands of dollars over the life of your loan. -

Flexibility

You can use equity tapped during a refinance to pay off debt, make home improvements or take action on whatever your highest priority is right now.

Cons

-

Closing costs

You’ll pay 2% to 6% of the loan amount in closing costs. -

Lost equity

You’ll lose equity if you increase your loan amount to cover closing costs or take out cash. -

Longer time frame

You might not break even on costs if you sell too soon, so be prepared to stay in the home past your break-even point. -

Depends on appraised value

Your house may not appraise for what you think it’s worth, which could reduce your borrowing power. -

Higher monthly payments

Your payment may become unaffordable if you shorten your loan term, since you’ll have less time to pay off the same amount.

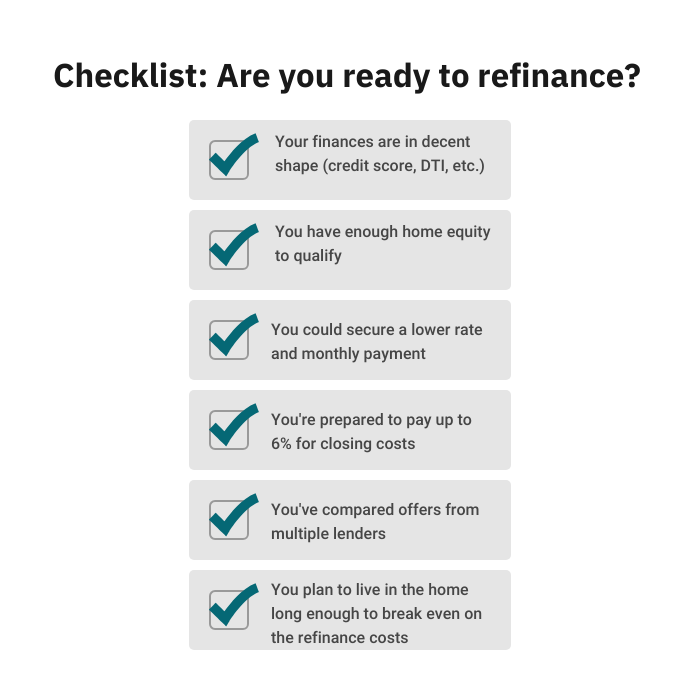

When should you refinance your mortgage?

Unless your current mortgage rate is near or above 6.46%, refinancing may not make sense right now. There are a few exceptions that may be worth considering, though:

-

You need to switch to a longer loan term.

If you took out a short-term loan (like a 15-year mortgage) and the payments are squeezing your budget, refinancing to a 30-year mortgage could give you some breathing room. -

You want to access cash.

It’s common to use a refinance to access a large amount of cash. To do this, you’d choose a cash-out refinance, borrow more than you need to pay off your current mortgage, and pocket the extra cash. If you’ve racked up debt, a cash-out refinance could help you pay off high-interest-rate loans or credit cards. -

Your home needs repairs or renovations.

Cash-out refinance rates are usually much cheaper than financing your fixer-upper projects with a credit card or personal loan. -

You want to get rid of mortgage insurance.

Home values continue to rise despite higher mortgage rates, which may give you enough equity to ditch monthly mortgage insurance payments. American households are sitting on $34.5 trillion of home equity, according to a LendingTree analysis. You’ll need at least 20% to cancel your private mortgage insurance on a conventional loan.

If you bought your home a couple of years ago when rates were at their recent peak, it’s possible that today’s rates are low enough to make refinancing worth it. Shopping around and comparing lenders’ rates is key.

How to get the best refinance mortgage rates

-

Spruce up your credit

Dispute errors on your credit report, reduce credit card balances, avoid opening new credit accounts and pay everything on time to optimize your score. -

Budget some extra cash to pay for points

A mortgage point costs 1% of your loan amount, and every point you purchase typically “buys down” (lowers) your rate by up to 0.25 percentage points. Just make sure you’ll break even on the extra costs if you plan to sell your home in the near future. (Your break-even point is a measure of how long it takes to recoup your refinance closing costs.) -

Shop and haggle with lenders

Sure, you could just refinance with your current lender — but LendingTree data show that comparison shopping with multiple lenders can save you about $80,000 in interest costs over the life of your loan. Don’t be afraid to negotiate or walk away if you don’t think you’re getting the best deal. -

Compare APRs and interest rates

Lenders must disclose your annual percentage rate (APR) and your interest rate. A low rate may sound good at first, but if it comes with high fees, it may not actually offer you the best value. The APR reflects the full cost of a loan, including fees, rather than just the interest you’ll pay. -

Avoid second mortgages if you can

Lenders charge higher rates if your loan is a second mortgage, like a home equity loan or home equity line of credit (HELOC). As long as you can lower your interest rate when replacing your current mortgage, using a cash-out refinance is a cheaper way to access a large amount of cash than using a home equity loan or HELOC.

Learn more about how to improve your credit score.

How to refinance a mortgage in 6 steps

It’s easy to get overwhelmed by all of the details involved in the mortgage refinance process, but following these six steps will get you on your way:

-

Know your credit score

The lowest refinance rates go to borrowers with the highest credit scores. A 780 FICO Score is the benchmark for the best conventional refi rates, but some government-backed refinance programs allow scores as low as 500. -

Make sure you’ll break even after costs and fees

Expect to pay between 2% and 6% of your loan amount toward refinance closing costs. Calculate your break-even point by dividing your total costs by your monthly savings — the result is how many months it’ll take to recoup your refi fees. As long as you plan to stay in your home that long, the refinance makes sense. -

Estimate your home’s value

Try a home value estimator or contact your real estate agent to help pinpoint your home’s value. The more equity you have, the lower your rate will typically be. If you have little or no equity, ask your loan officer if you’re eligible for an FHA streamline refinance or VA interest rate reduction refinance loan (IRRRL) — these options don’t require appraisals. -

Shop around

Pick three to five refinance lenders and fill out applications with each. Try to complete the applications within a 14-day time frame to minimize the impact to your credit scores. -

Lock in your refinance rate

Once you’ve committed to a lender, get a mortgage rate lock to secure your quoted interest rate. -

Close on your refinance

Work with your lender to finalize your refinance, submit any outstanding paperwork and schedule your closing date.

A typical refinance will cost between 2% and 6% of your loan amount, but there are different ways to pay the costs.

- Ask for a no-closing-cost option. You’ll trade a lower closing cost bill for a higher interest rate if your lender offers a no-closing-cost refinance. The catch: You’ll spend more on interest charges over the life of your mortgage.

- Add the costs to your loan amount. If you have enough home equity, you can borrow more and use the extra money to pay your costs. This is referred to as “rolling your costs” into your loan amount.

Read more about mortgage refinance closing costs and what to expect.

Frequently asked questions

APR stands for annual percentage rate, and it’s a measure of your total refinance loan costs, including interest and origination fees. Your mortgage interest rate is the percentage you’ll pay as a fee for borrowing the money. The higher your APR is compared to your interest rate, the more you’re paying in total closing costs.

A good rule of thumb is to wait until you can reduce your current rate by at least 50 basis points. That said, if you need to refinance for other reasons — like removing someone’s name from a mortgage or switching to a fixed-rate mortgage — it can still be worth considering. If you need guidance, reach out to a loan officer or housing counselor.

Refinance rates are usually higher than purchase mortgage rates because lenders view refinancing as a higher risk, especially for cash-out refinances that increase the loan amount.

The table below gives you a quick glance at the refinance requirements for credit score, DTI ratio and LTV ratio for common refinance loan types.

| Loan program | Refinance purpose | Credit score | LTV ratio | DTI ratio |

|---|---|---|---|---|

| Conventional | Rate and term | 620 | 97% | 45% to 50% |

| Cash out | 620 | 80% | 45% to 50% | |

| FHA | Rate and term | 500 to 580 | 97.75% | 43% |

| Cash out | 500 | 80% | 43% | |

| Streamline | N/A | N/A | N/A | |

| VA | Rate and term | No minimum, but lenders typically require 620 | 100% | 41% |

| Cash out | No minimum | 90% | 41% | |

| Streamline | No minimum | N/A | N/A | |

| USDA | Streamline | N/A | N/A | N/A |

Common reasons borrowers are disqualified from refinancing include having a low credit score, unstable income or insufficient home equity.

Getting a cash-out refinance on your primary residence provides you with a cash lump sum you can use for various purposes, including buying a vacation home or investment property.

How we chose our picks for the best refinance lenders

To determine the best refinance lenders, we reviewed data from more than 30 LendingTree lender reviews and evaluated the lenders’ refinance loan programs and services.

Each lender review gives a rating between zero and five stars based on several features including digital application processes, available loan products and the accessibility of product and lending information. To evaluate refinance-specific factors, we awarded extra points to lenders that publish a wide variety of refinance rates online, offer the most conventional and government-backed refinance loan types and offer renovation refinance loans for homeowners that want to fix up their homes and roll the costs into one loan.

Our editorial team brought together the star ratings, as well as the scores awarded for refinance-specific characteristics, to find the lenders with a product mix, information and guidelines that best serve the needs of refinance borrowers. To be included in the “best of” roundup, lenders must offer mortgages in at least 35 states.