LendingTree Mortgage Offers Report — June 2021

Wondering how much you might save by shopping around for a mortgage? Here’s the latest data from LendingTree.

June 2021 highlights

- The average annual percentage rate (APR) for 30-year, fixed-rate refinance loans offered to borrowers with the best credit scores in June 2021 was 3.13%. For purchase loans, borrowers with the best credit scores were offered an average APR of 3.03%. LendingTree considers the most creditworthy consumers to have credit scores of 800 or higher. People with credit scores at or above 800 receive the best mortgage offers through the LendingTree marketplace, which allows users to compare offers from multiple mortgage lenders. Mortgage rates vary depending on borrowing parameters, including credit score, loan-to-value (LTV) ratio, income and property type.

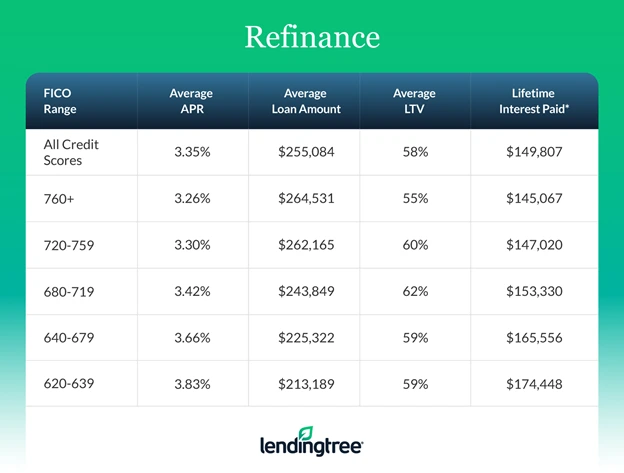

- For all consumers, regardless of credit score, the average APR for conforming, 30-year, fixed-rate refinance loans was 3.35% in June, up 7 basis points from May. Consumers with excellent credit scores (760 or higher) received an average APR of 3.26% in June, compared with 3.42% for consumers with scores of 680 to 719 for purchase loans. The APR spread of 16 basis points represents $8,263 in additional costs for borrowers with scores of 680 to 719 over the span of 30 years.

- For all consumers, the average APR for conforming, 30-year, fixed-rate purchase loans offered on LendingTree’s platform was 3.27% in June, the same as May. Consumers with excellent credit scores (760 or higher) received an average APR of 3.15% in June, compared with 3.39% for consumers with scores of 680 to 719 for purchase loans. The APR spread of 24 basis points represents $12,955 in additional costs for borrowers with scores of 680 to 719 over the span of 30 years.

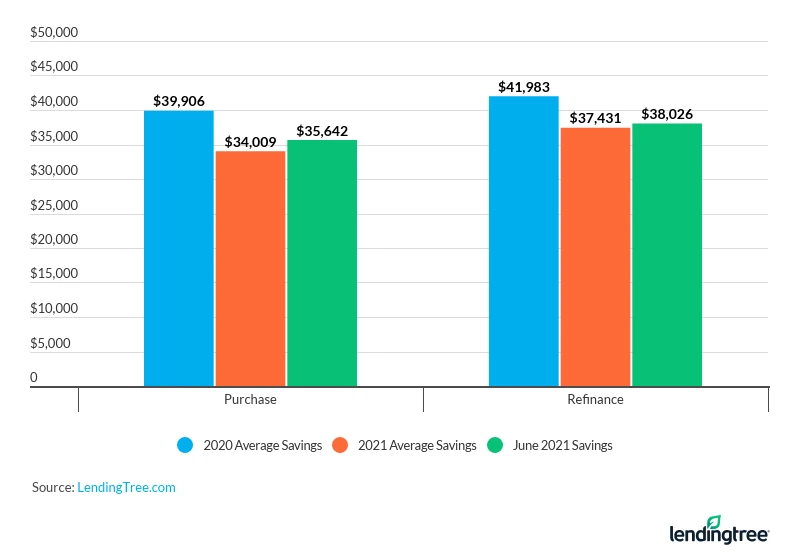

- Aside from highlighting savings by credit score, each month LendingTree also looks at how much money consumers might save by comparing mortgage rates during the loan-shopping process. LendingTree does this by using the Mortgage Rate Competition Index, which represents the median spread between the lowest and highest APRs offered by lenders in our marketplace. For the month of June, the index was 0.8 for refinance borrowers and 0.5 for purchase borrowers. This translates to $38,026 and $35,642, respectively, in lifetime interest savings on a 30-year, fixed-rate loan of $300,000 for all borrowers.

- For 30-year, fixed-rate mortgages, 22.02% of refinance borrowers received offers below 3%, while 41.41% of purchase borrowers received offers below 3%. A year ago, 3.20% of refinance borrowers and 13.01% of purchase borrowers received rate offers below 3%.

Historical Mortgage Rate Competition Index

Mortgage Savings Tracker

Purchase mortgage APR offers by credit score

*We calculated the lifetime interest paid based on the overall average loan amount to enable comparison. Lifetime interest paid may include additional costs like lender fees.

Refinance mortgage APR offers by credit score

*We calculated the lifetime interest paid based on the overall average loan amount to enable comparison. Lifetime interest paid may include additional costs like lender fees.

May 2021 report summary

- The average (APR) for 30-year, fixed-rate refinance loans offered to borrowers with the best credit scores in May 2021 was 3.10%. For purchase loans, borrowers with the best credit scores were offered an average APR of 3.04%.

- For all consumers, regardless of credit score, the average APR for conforming, 30-year, fixed-rate refinance loans was 3.28% in May, down 7 basis points from April. Consumers with excellent credit scores (760 or higher) received an average APR of 3.21% in May, compared with 3.28% for consumers with scores of 680 to 719 for purchase loans. The APR spread of 7 basis points represents $3,752 in additional costs for borrowers with scores of 680 to 719 over the span of 30 years.

- For all consumers, the average APR for conforming, 30-year, fixed-rate purchase loans offered on LendingTree’s platform was 3.27% in May, down 6 basis points from April. Consumers with excellent credit scores (760 or higher) received an average APR of 3.14% in May, compared with 3.42% for consumers with scores of 680 to 719 for purchase loans. The APR spread of 28 basis points represents $14,701 in additional costs for borrowers with scores of 680 to 719 over the span of 30 years.

About the Monthly Mortgage Offers report

The LendingTree Monthly Mortgage Offers Report contains data from actual loan terms offered to borrowers by lenders on LendingTree.com. LendingTree believes it’s an important addition to standard industry surveys and reports on mortgage rates. Most quoted industry rates are for a hypothetical borrower with prime credit who makes a 20% down payment. However, most borrowers don’t fit this profile.

LendingTree’s report includes the average quoted APR by credit score, together with the average down payment and other metrics described below. LendingTree stratifies by credit score, so borrowers have additional information on how their credit profile affects their loan prospects. The report covers conforming, 30-year, fixed-rate loans for both purchase and refinance transactions.

- APR: Actual annual percentage rate (APR) offers to borrowers on the LendingTree platform.

- Down payment: Though analogous to the loan-to-value (LTV) ratio, LendingTree finds that borrowers identify more closely with the down payment amount. Academic studies have also found that the down payment is the primary concern for homebuyers and is one of the main barriers to entering the homebuying market.

- Loan amount: The average loan amount borrowers are offered.

- LTV ratio: Actual LTV ratio offered to borrowers on our platform. The LTV ratio is a formula that divides the loan amount by the home’s value to assess a borrower’s lending risk.

- Lifetime interest paid: This is the total cost a borrower incurs for the loan, inclusive of the interest rate and loan fees.

About the Mortgage Rate Competition Index

The LendingTree Mortgage Rate Competition Index is a proprietary measure of the dispersion in mortgage pricing. It measures the APR spread of the best offers available on LendingTree, relative to the least competitive (i.e., the highest) rates on 30-year, fixed-rate mortgages. LendingTree’s research shows that mortgage rate competition varies with the financial and operational measures of activity in the mortgage markets. More details on the index are available in a LendingTree white paper.

How the index is formulated

A mortgage shopper enters their information on LendingTree.com. They input loan variables, including the proposed amount and down payment, and property variables, including property type and location. Using LendingTree’s proprietary algorithm, borrowers are matched with lenders based on the criteria they provide. Interested lenders return a rate and fee offer. For this index, LendingTree combines the interest rate and loan fees into the APR and calculates the spread as follows:

The spread is the difference between the highest and lowest offers, in this example, 4.62 – 4.21 = 0.41. LendingTree repeats this calculation across 30-year, fixed-rate mortgage offers for that month and then finds the median of the individual spread, which is the index value for that month. This is done separately for purchase and refinance loan requests.

View mortgage loan offers from up to 5 lenders in minutes